Economic Stability

1. Describe three characteristics of the

Federal Reserve related to its origin or structure.

What is the main purpose of the Federal

Reserve, and what are the three main tools of monetary policy the Fed possesses to achieve this purpose?

The inflation rate currently sits at 9%.

Describe how you would use the three tools of monetary policy to pursue either an expansionary (easy money) or contractionary (tight money) policy.

Economic instability leads to social and economic problems

Unemployment

Inflation

Stagflation- stagnant growth combined with inflation

The GDP Gap- the difference between actual production and what it could be

We use the production possibilities frontier to illustrate this

The MISERY or DISCOMFORT index

Statistic of inflation and unemployment added together

Measures consumer suffering

Is used over the long term

UNCERTAINTY on the side of the worker

(their job) and employers (decision to expand or not)

The human cost:

›

›

Reduced standard of living

Labor resource is wasted (people can’t find work)

Political instability

Crime

Family values

The government can promote economic growth through demand-side and supply-side policies

Economic stability an be achieved in several ways: aggregate supply, aggregate demand, and monetary policy

The government can manipulate consumer demand through FISCAL

POLICY: taxing and government spending

FISCAL POLICIES are derived from

Keynesian economics, a set of actions designed to lower unemployment by stimulating aggregate demand

GDP=C+I+G+F

C= CONSUMER SPENDING

G=GOVT SPENDING

F=FOREIGN SECTOR SPENDING

I=BUSINESS (INVESTMENT) SECTOR

The MULTIPLIER AND ACCELERATOR (I)

Spend Spend Spend to offset declines in

Business sector (I)

Lower taxes (Laffer curve)

Automatic Stabilizers: Unemployment, transfer payments, progressive income tax

Check the rest on page 450

Policies designed to stimulate output and reduce unemployment through increased production

1970’s 1980’s- very popular

Increase production and reduce unemployment without increasing inflation

EXACT SAME GOAL AS DEMAND SIDE

ECONOMICS

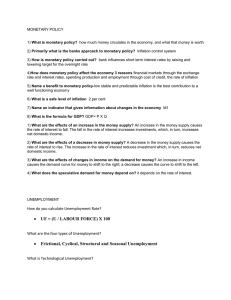

MONETARISM- the role of money and its growth (Equation of Exchange)

Stable and long-term monetary growth will control inflation

Done through controlling interest rates

Takes care of inflation, but not unemployment