Tonći Lazibat, Ph.D. University of Zagreb Faculty of Economic and

Tonći Lazibat, Ph.D.

University of Zagreb

Faculty of Economic and Business

J.F. Kennedy 6, 10000 Zagreb

Phone: +38512383152 Fax: +38512335633

E-mail address: tlazibat@efzg.hr

Ivana Štulec, M.A.

University of Zagreb

Faculty of Economic and Business

J.F. Kennedy 6, 10000 Zagreb

Phone: +38512383384 Fax: +38512335633

E-mail address: istulec@efzg.hr

RESEARCH ON WEATHER RISK MANAGEMENT

AMONG LARGE CROATIAN COMPANIES

ABSTRACT

Weather determines what shall we eat and wear, where shall we spent our holiday, how shall we travel, even what shall we do every single day.

Therefore, it does not come as a surprise that researches show that 80% of global economy is, directly or indirectly, influenced by weather. And while weather may be the oldest risk businesses face with, it gained much needed attention only recently, as impacts of climate change became more obvious.

Uncertainty in future weather conditions translates into uncertainty in future cash flows, which consequently leads to higher cost of borrowing capital.

Regardless of the risk type, there are four basic management strategies – avoidance, acceptance, reduction and transfer – named in the order of their effectiveness. In the past, companies have simply ignored the weather risk, but today principles of weather risk management have become inevitable due to the heavy competition, worldwide economic crisis and climate change.

Currently, weather derivatives present the most effective instrument of weather risk protection. For the purpose of this paper a research was conducted among large Croatian enterprises in order to assess their level of weather risk awareness, to determine which strategies they use to protect themselves from adverse weather and to determine to what extent are researched companies familiar with weather derivatives, as one of the newest and fastest growing derivatives market in the world. Findings imply that

many companies acknowledge weather as a source of risk while only few of them try to actively protect themselves from financial exposure to weather.

Key words: weather risk, weather risk management, weather derivatives, survey research, large Croatian companies

1. INTRODUCTION

Research shows that 80% of world economy is, directly or indirectly, sensitive to weather (Auer, 2003, 1). Furthermore, according to the study on weather sensitivity that Weatherbill, Inc. (2008, 28) conducted among 68 countries worldwide, 34% of Croatian economy is directly influenced by the weather. Given such percentages, it can be concluded that adverse weather can result in unexpected expenses and foregone revenues in almost every economic activity. And even though the weather may be the oldest risk businesses face with, it gained much needed attention only recently as effects of climate change became more obvious and omnipresent economic crisis forced companies to strengthen their expenses control. Therefore, the impact of weather on business and ways in which companies try to protect their business against adverse weather forced themselves as underexplored subjects of research.

The paper gives an overview of literature on weather risk and weather risk management (WRM) strategies and presents results of research conducted among large Croatian companies. The purpose of the research was to assess level of weather risk awareness among large Croatian companies, to determine which strategies they use to protect their business from adverse weather, to examine the association between company characteristics and

WRM practice and to determine to what extent are researched companies familiar with weather derivatives, as one of the newest and fastest growing derivatives market in the world. Research findings are expected to be useful to all participants of the weather protection instruments market, both on the supply and demand side.

2. WEATHER RISK

In order to define the risk of adverse weather conditions (hereafter: weather risk), it is necessary to point out the differences between terms climate and weather, as well as catastrophic and non catastrophic weather. Climate is traditionally being defined as averaged meteorological conditions (e.g.

temperature, humidity, rainfall, snowfall etc.) over an area during some longer period of time, most commonly 25 to 30 years. On the other hand, weather refers to the present condition of the same meteorological elements.

That being said, it follows that relationship between climate and economy is significantly different than the one between weather and economy. The impact of long term climate change on economy will be determined by the climate type currently present in a given area (Mendelsohn et al., 2000). For example, it can be expected that countries with cooler climate will benefit from global warming, which cannot be said for countries with warmer climate. On the other hand, changes in weather have a greater impact on individual businesses rather than the economy as a whole.

Furthermore, weather can be divided into two groups (catastrophic and non catastrophic) regarding the extent of its impact. Catastrophic weather events include floods, hurricanes, tornadoes, windstorms etc. They have a low probability of occurrence and if they occur they cause massive financial damages. On the other hand, non catastrophic weather relates to the minor deviations from “normal” or usual weather, such as wormer than usual winter or cooler than usual summer. In addition to temperature variations, non catastrophic weather includes deviations from normal rainfall and snowfall, wind speed, number of sunshine hours, days in which frost or fog were recorded etc. Non catastrophic weather can be summed into those weather events that affect company's income and/or cost but do not threaten lives and property (Liu, 2006, 24). Having explained the basic terms, the definition of weather risk can be given. Brockett, Wang and Yang (2005, 128) define weather risk as the uncertainty in future cash flows as a result of non catastrophic weather.

As a source of risk, weather is specific because it primarily affects the quantity of production and demand for a certain good, and not the price at which the good is being sold ( adjusted according to Edrich, 2003, 165). In other words, the weather poses a risk of adverse quantity change (volumetric risk) and not price change (price risk). As an example of unfavourable weather impact on demand, the literature often mentions the reduced consumption of heating energy during the unusually warm winters. Using the same analogy, it can be concluded that cooler summers result in lower hotel capacity occupancy. In addition to demand, weather also affects the supply, i.e. the quantity produced. The construction industry, for example, is largely dependent on weather in a way that low temperatures and heavy rainfall can cause delays and interruptions in the construction work and, consequently, the payment of penalties. Weather conditions also significantly affect the

quantity and quality of yields in agriculture. These are just some of many industries whose operating results are affected by weather.

Furthermore, weather risk is unique because weather is not a physical good.

It is impossible to store a sunny day of July till December or to transport a mountain rainfall to farmland in the valley. However, even though the weather cannot be physically exchanged, it is possible to exchange i.e. trade financial exposure to weather, through the use of appropriate financial derivatives. In addition, weather risk is highly geographically localized, meaning that weather varies significantly even when it comes to the small spatial distances.

3. WEATHER RISK MANAGEMENT

In the past, many companies had completely avoided weather risk or were simply trying to cope with the consequences of adverse weather as good as they could. Today, principles of WRM are needed as never before. Dorfman

(2007) divides available risk management strategies into four basic groups, regardless of the risk type:

Avoidance . This strategy entails avoidance of all activities associated with risk. When speaking of weather risk, the company using this strategy would simply decide not to sell their products and services in areas with historically unfavourable weather. Although being the strategy with the simplest application, strategy of avoidance has a major disadvantage - without undertaking risky activities, the company misses an opportunity to gain profit.

Acceptance . This strategy entails acceptance of losses incurred as a result of adverse events. Mainly is about small risk that is hard to cover with insurance because premium cost would most likely exceed overall risk exposure. Weather risk is often managed in this way - the company simply takes into consideration possible risk when projecting volume of production and sales.

Reduction . This strategy entails reduction of actual risk exposure and mitigation of consequences of adverse events. The most common examples of weather risk reduction are geographic and product diversification, which will be further explained later in the paper.

Transfer . This strategy entails the risk transferring process to another party and as such represents the most successful i.e. effective strategy of risk management. A classic example of risk transfer is an insurance contract. Companies exposed to weather risk can also be protected by

transferring the risk through contractual contingencies and commodity futures, while even more effective protection can be provided by weather derivatives.

The aforementioned risk management strategies Lazibat and Županić (2010,

96) divided into active and passive in a way that passive include avoidance and acceptance, and active reduction and transfer. Currently, weather derivatives provide the most effective protection against weather risk.

However, until their emersion in 1997, weather risk was extremely hard to manage. Companies could choose from four basic management solutions available to them (diversification, contract contingencies, weather insurance and commodity futures), each of which has certain disadvantages (Myers,

2008, 20). Basic WRM solutions, as well as their disadvantages compared to weather derivatives, are explained next.

3.1. Diversification

Companies heavily reliant on one type of weather, e.g. snow in the winter, can reduce their weather dependency by diversifying their present product line or by expanding their operations onto new geographical areas. In other words, companies can mitigate the impact of weather on their revenues and/or costs using product and geographical diversification. Product diversification can be defined as product line expansion with those products and services of which sale is enhanced by different weather events.

Geographical diversification entails establishing new premises in geographically distant locations with opposite weather characteristics, i.e. negatively correlated meteorological elements, so as to reduce overall effect of weather on company profits. For companies that have diversified their sales across regions, products and services, one can say that are protected by the nature of their business i.e. that are naturally hedged.

An example of natural hedge achieved by product diversification is energy company that owns both hydroelectric plant and solar power plant. Such diversification is effective under the assumption that rain is negatively correlated with sunshine hours. Natural hedge is much more difficult to achieve through geographical diversification because the feature of negative correlation between meteorological elements in different locations is often not the case in the market size of a single country or even a region.

The advantage of natural hedge is that company does not need to pay for it.

However, the disadvantage is that weather risk is not eliminated, merely

reduced. Moreover, company continues to bear all the consequences of adverse weather because risk is not being transferred onto the party better suited to manage it. Nevertheless, many authors (Scott, 2003; Ray, 2005;

Myers, 2008) allege that geographical and product diversification is basic

WRM strategy that companies apply worldwide.

3.2. Contract contingencies

Some companies, in order to protect themselves from weather risk, incorporate specific contingencies into the contracts according to which financial implications of adverse weather shall be borne by the other party in the contract. This kind of weather protection is common in the construction sector and has proven effective in the time of prosperity. But in the time of slower economic growth when competition intensifies, contractual contingencies do not provide effective protection (Connors, 2003, 21).

Contract contingencies effectively transfer the risk of weather related delays from the contractor to the owner, but do not provide compensation for losses incurred. In other words, even though the risk is transferred, one party to the contract still retains the risk and weather related losses are not compensated.

On the other hand, weather derivatives in the case of adverse weather, beside risk transfer, provide a payment that can be used to pay consequential penalties, cover the cost of special equipment needed to continue constructional work during winter months or reimburse the loss caused by interruption of work.

3.3. Weather insurance

Weather insurance is similar to weather derivatives in a way that both involve payment of amounts that are contingent upon a weather event whose occurrence is uncertain. However, differences exist and should be properly addressed.

One of several differences between conventional insurance and weather derivatives is that weather derivatives cover the events of low risk and high probability of occurrence, while insurance typically covers high-risk events with small likelihood of occurrence (Ali, 2004, 75). Weather derivatives, unlike insurance, base on the fact that deviation of only few temperature degrees can affect revenues.

The advantage of weather derivatives over insurance is that weather derivatives minimize the problems of adverse selection and moral hazard which are inevitable when it comes to weather insurance. Weather derivatives minimize the problem of adverse selection because underlying weather index is tied to measurable weather data and premiums are equal for all market participants. The problem of moral hazard is completely eliminated, because all measurements of weather data are conducted by an independent third party and holder of a weather derivative cannot affect them (Turvey, 2001,

334). Consequently, the holder cannot manipulate the payment and any possibility of fraud is virtually eliminated.

Another difference between weather derivatives and insurance is that payment under weather derivatives depends on whether the underlying weather index has fell below or rose above the predetermined benchmark

(strike). On the other hand, in traditional insurance contracts, indemnities are paid only after actual damages are quantified and not simply upon the occurrence of the specific state of nature. Traditional insurance contracts require demonstration of a loss and that is why field inspection and resultant administrative costs are inevitable. Without massive government support in the form of subsidy on crop insurance premium it would be extremely difficult to sustain traditional insurance approach. In comparison, weather derivatives constitute an economical and sustainable system of WRM

(Sharma & Vashishtha, 2007, 117).

In recent years, in order to establish more market-sustainable protection instruments, a number of innovative and sophisticated insurance programs were developed. Relevant to the current discussion are the so-called weatherbased index insurance contracts that achieve economic impact equal to that of weather derivatives (Stoppa & Hess, 2003, 2). In other words, payoffs by the index insurance contracts are not based on demonstrated financial loss, but on the value of index that is comparable to the weather index underlying the weather derivatives.

However, weather-based index insurance, as well as traditional insurance contracts, assume that holder of an insurance contract has an interest in the subject matter of the contract beyond the amount that may, or may not be, paid to him (Ali, 2004, 77). As such do not recognize the possibility of speculations which make up a large part of transactions on financial derivatives market and provide much needed liquidity. Speculators often, in their attempt to make profit on price changes, give simultaneous orders to buy and sell weather contracts, thus ensuring market liquidity.

3.4. Commodity futures

Commodity futures and forward contracts have proven to be effective instruments of protection against adverse price changes. However, when it comes to quantity changes due to adverse weather events, these instruments have limited applicability. Myers (2008, 20) alleges that commodity futures and forward contracts could offer some protection against adverse weather conditions for energy and agriculture companies. For example, a farmer could lock in a future selling price for his wheat, so that if yields were strong across the industry due to the good weather, he could still realize a fair price for his crop. But even so, this would provide no protection if his own harvest was somehow compromised by weather events unique to his farm.

There are two more limitations of commodity futures as hedging instruments against weather risk. First is that weather has an indirect effect on the price of commodities and services, through the effect on quantity of goods sold.

However, although the price of hotel room or some other good can change as a response to unusually high or low demand, price adjustments do not necessarily need to compensate for lost revenues. In other words, although there is an obvious relation between the price and meteorological elements, the correlation is not as strong as the one between quantity and meteorological elements

1

, creating thus a possibility that payoff under futures contract may not be substantial to cover incurred financial loss. For that reason, it was needed to develop a new futures market instrument – weather derivatives. Yet another limitation of commodity futures as hedging instruments against weather is that they are not applicable to all businesses.

For example, an ice cream manufacturer cannot protect his revenues in a case of a colder summer by selling commodity futures contracts on the ice cream since such contracts do not exist. On the other hand, he can sell a weather derivative that will provide him a payment if accumulated level of temperature degrees during summer months fall below predetermined threshold.

Given the fact that company revenue is subjected to both price risk and quantity risk, weather derivatives are most effective when used in combination with commodity futures. Such hedging strategy is known as cross hedging.

1

Paoletti (2001) analyzed the movements of electricity price and temperature and found a correlation coefficient of about 0.5. Afterwards the relation between electricity consumption and temperature was analyzed and respective correlation coefficient was determined to be over 0.95.

3.5. Weather derivatives

The momentum for creating weather derivatives was deregulation of the energy and utility industries in U.S.A. in mid-1990s (Cao, Li, Wei, 2004, 27) and extremely worm El Nino winter 1997/1998 in U.S.A. (Jones, 2007, 53).

With deregulation, monopolies began to be replaced with competitive market structures and many energy and utility companies learned that while they could hedge away price risk with futures and options on energy itself, they had no way to hedge away weather risk that could dramatically alter the demand for their products. It was in this environment that weather derivatives made public debut in 1997 with an over-the-counter transaction between

Koch Industries Inc. and Enron Corp.

The Risk Limited Glossary (n/a) gives a broad definition of weather derivatives as derivative instruments whose payoffs are based on a specified weather event and are used to hedge the financial impact of weather fluctuations. More detailed definition is the one of Lazibat, Županić and

Baković (2009, 61) according to whom weather derivatives are defined as financial derivative instruments (futures and options) with synthetic weather index as underlying. The weather index is computed by quantifying the deviation of meteorological elements (temperature, rainfall, snowfall, wind speed, frost, etc.) from the selected reference level. The deviation is calculated based on observations of actual weather conditions in the specified climatologic stations. Then, to each degree of deviation, a certain monetary value is given, and the futures contracts become valuable when the level of selected meteorological element falls below or rises above the predetermined threshold, depending on the futures position taken. In this way, weather has been converted into a tradable good.

One example of how a weather derivative can operate is the transaction between Enron Corp. and the London-based bar and restaurant operator

Corney & Barrow (C&B) in 2000. C&B, aware that its revenue increased when there was sunny weather on Thursdays and Fridays, bought a temperature put option from Enron that would provide a payment if the temperature in London fell below 24°C on a Thursday or a Friday over the summer. The payment was capped at £100,000, meaning that maximum payment cannot exceed that amount. This payment to some extent covered the loss of trade resulting from clients being discouraged from going to C&B bars by poor weather. C&B paid an option premium to Enron, a sum that gave it the right but not the obligation to exercise the option, meaning that

C&B`s maximum loss is limited to the option premium. If the temperature was above the benchmark, C&B would not exercise the option, meaning it

would not gain the payment under the option, but would benefit from increased revenue due to the increased number of clients (Munden and Lund,

2003, 2).

Štulec (2010, 165-166) states that weather derivatives currently present the most effective instrument of protection against adverse weather because they

(1) transfer the risk to the other party that is able to manage it more effectively (advantage over diversification), (2) provide compensation for losses incurred (advantage over the contract contingencies), (3) offer a payment based on index value and the field inspection is not necessary in order to determine the loss (advantage over traditional insurance contracts),

(4) do not require an insurable interest in the subject of insurance, therefore, allow for speculations that are important to maintain market liquidity

(advantage over the index insurance contracts) and (5) since the weather risk is primarily the quantity risk, the possibility that the payoff under the weather futures contract is insufficient to cover the damage is minimized (advantage over commodity futures contracts).

4. RESEARCH ON WEATHER RISK MANAGEMENT

The purpose of this research was to assess the level of weather risk awareness among large Croatian companies, to determine which strategies they use to protect their business from adverse weather, to examine whether companies` characteristics are associated with their WRM practices and to what extent are researched companies familiar with the concept of weather derivatives, as one of the newest and fastest growing derivatives market in the world.

4.1. Methodology and sample characteristics

Large companies were chosen as target population under the assumption that they have developed a risk management function (Miloš-Sprčić, 2007, 393).

For the purpose of the research, large companies were classified in accordance with the Accounting Act (Narodne novine, No. 109/07), and as a list of population units The Croatian Company Directory of The Croatian

Chamber of Economy was used (N=496). The research was conducted during the summer 2009 using the online questionnaire.

2

During the scheduled period of time the survey was answered by 76 companies (n=76) and given

2

The advantages and disadvantages of collecting data via online questionnaires in relation to questionnaires sent by conventional mail see in McDonald & Adam (2003).

that all population units had a probability to be selected to the sample greater than zero, this was a random sample (Marušić & Vranešević, 1997, 256).

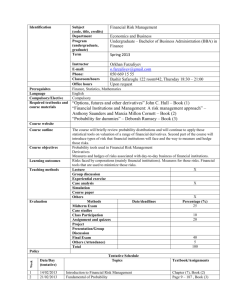

Respondent was in most cases Board member, finance director or sales manager. The following table shows the characteristics of companies in the sample.

Table 1. Characteristics of companies in the sample

1 . Main business activity according to National Classification of

Economic Activities 2002

No. %

1.1. Agriculture, hunting and forestry (A) 6 7.9%

1.2. Mining and quarrying (C)

1.3. Manufacturing (D)

1.4. Electricity, gas and water supply (E)

2

30

3

2.6%

39.5%

3.9%

1.5. Construction (F) 7 9.2%

1.6. Wholesale and retail trade; repair of motor vehicles, motorcycles and personal and household goods (G)

16 21.1%

1.7. Hotels and restaurants (H)

1.8. Transport, storage and communications (I)

1.9. Financial intermediation (J)

1.10. Other community, social and personal service activities (O)

2. Legal constitutional formation

2.1. Public limited company (PLC)

2.2. Limited liability company (LLC)

2.3. Other

3. Ownership form

3.1. Private

3.2. State/Social

3.3. Joint

4. Total revenue in 2008

4.1. Less than 100 million kunas

4.2. From 100 to 500 million kunas

4.3. From 500 million to 1 billion kunas

4.4. More than 1 billion kunas

4.5. No answer

5. Share of senior managers with university degree

5.1. Less than 50%

5.2. From 50 to 80%

5.3. More than 80%

5.4. No answer

5

4

2

1

No.

6

2

30

No.

54

12

10

No.

10

38

10

16

2

No.

35

11

28

2

6.6%

5.3%

2.6%

1.3%

%

7.9%

2.6%

39.5%

%

71.1%

15.8%

13.2%

%

13.2%

50.0%

13.2%

21.0%

2.6%

%

46.0%

14.5%

36.9%

2.6%

In conducting research and results analysis the following methods of scientific research were used: sampling method, descriptive and inferential statistics: graphical and numerical methods, population parameters

(proportions) estimation, parametric statistics (independent-sample t-test, one-way between groups analysis of variance (ANOVA), Levene`s test for homogeneity of variances between groups) and non-parametric statistics

(Chi-square test for independence).

4.2. Research results analysis and discussion

4.2.1. Weather sensitivity

Analyzing the impact of weather on business results among large Croatian companies it was found that 67 out of 76 surveyed companies are sensitive to weather. Given that surveyed sample is large random sample, it is possible to give point and interval estimates about population proportion. Accordingly, point estimate of proportion of large Croatian companies that are affected by weather is 0.8816 or 88.16% and interval estimate with 95% certainty is

(0.81422, 0.94894). That is, with 95% certainty it can be claimed that

weather affects 81.4 to 94.9% of large Croatian companies.

A one-way between groups analysis of variance was conducted to explore whether intensity of weather impact differs among economic activities. Since

National Classification of Economic Activities is too detailed regarding the sample size, companies were divided into four groups (post stratums) regarding economic activities. Group 1 (Primary sector of economy:

Agriculture, hunting and forestry (A)) included 6 sample units. Group 2

(Industry: Mining and quarrying (C), Manufacturing (D), Electricity, gas and water supply (E), Construction (F)) included 42 sample units. Group 3

(Trade, tourism and transport: Wholesale and retail trade; repair of motor vehicles, motorcycles and personal and household goods (G), Transport, storage and communications (I), Hotels and restaurants (H)) included 25 sample units. Group 4 (Other service companies: Financial intermediation (J),

Other community, social and personal service activities (O)) included 3 sample units. Respondents were asked to assess the weather impact on their companies on the scale 1 to 5 (1 being “no impact”, 2 being “slight”, 3 being

“moderate”, 4 being “significant” and 5 being “very significant”). The measurement scale, even though is ordinal, will be treated as interval scale

and weather sensitivity will be measured and compared by mean values.

3

Grade 1 will be disregarded and the remaining grades will be treated as if they were part of an interval scale. Assessments of the weather impact on companies divided into four specified groups of economic activities are given in the chart below.

Chart 1. Assessment of weather sensitivity (measured by the mean) regarding economic activity of companies

ANOVA, being a parametric test, assumes samples are obtained from populations of equal variances. Having that in mind, the Levene's test for homogeneity of variances between groups was conducted. Based on the significance value for Levene's test (p=0.292), which is above cut-off point

0.05, it can be concluded that the assumption of homogeneity of variance was not violated. The output of one-way between groups ANOVA is given in the following table.

Table 2. ANOVA (between groups)

Between Groups

Within Groups

Total

Sum of Squares

19.679

135.479

155.158 df

3

72

75

Mean Square

6.560

1.882

F

3.486

Sig.

0.020

Based on the significance value (p=0.02), it can be concluded that there is statistically significant difference regarding weather impact between specified groups of economic activities.

The actual difference i.e. effect size, measured by eta squared (0.13), is considered large according to Cohen classification (Cohen, 1988, 284-287). Post-hoc comparisons using the Tukey

3

Researchers often in results analysis allow for compromise and treat Likert scale, which is as well ordinal scale, as interval measurement scale in order to be able to calculate the mean

(Marušić & Vranešević, 1997, 241).

HSD test indicated that the mean score for group 1 (M=4.67) was significantly different from group 2 (M=2.93) and group 4 (M=2.00), while differences between other groups did not prove to be significant.

4.2.2. Weather risk management in practice

Further was analyzed which WRM strategies are most widely applied among large Croatian companies. Based on the literature review presented earlier in the paper, seven possible management strategies were listed and respondents were asked to mark the ones their companies use (multiple answers were possible) with the possibility to write down additional strategies if the ones they use are not already listed. The results are shown in the following chart.

Chart 2. Application of WRM strategies among large Croatian companies

It can be seen from the chart that most widely used WRM strategy is simply accepting that company`s earnings are sensitive to weather and planning the production and sales volumes according to weather forecast. 71.1% of large

Croatian companies apply acceptance as WRM strategy, which is a devastating insight knowing that acceptance presents passive risk management strategy, i.e. the company does not transfer the weather risk to another party and is not provided a compensation for foregone revenues or extraordinary expenses. The second most widely used WRM strategy is weather insurance (used by 62.7% of large companies). Product and

geographical diversification is in the third place (56.7% of large companies apply this strategy). Based on the results it can be concluded that there is a gap between the number of companies that are exposed to weather risk and number of those that actively try to manage it.

Chi-square test was conducted in order to examine is there an association between form of ownership and WRM practice under the assumption that larger proportion of private companies apply WRM strategies in comparison to other companies. The percentages are given in the following table.

Table 3. Association between form of ownership and WRM

WRM in practice

Form of ownership Total

Do not apply Apply

Private

State/Social

Joint

22.2%

16.7%

30.0%

22.4%

77.8%

83.3%

70.0%

77.6%

100.0%

100.0%

100.0%

100.0% Total

Chi-square test for independence indicated no significant association between form of ownership and application of WRM strategies ( χ 2 =0.561, pvalue=0.756).

Next, it was examined whether educational structure within company is associated with WRM practice under the assumption that companies with higher proportion of senior managers with university degree apply more often

WRM strategies when compared to other companies. The percentages are given in the following table.

Table 4. Association between educational structure and WRM

Share of senior

WRM in practice managers with university degree

Do not apply Apply

Total

Less than 50%

From 50 to 80%

More than 80%

Total

24.3%

8.3%

25.9%

22.4 %

75.7%

91.7%

74.1%

77.6%

100.0%

100.0%

100.0%

100.0%

Comparing the percentages, such assumption cannot be accepted.

Furthermore, Chi-square test for independence (χ

2

=1.64, p-value=0.441) showed there is no statistically significant association between company's educational structure and application of WRM strategies.

Other company characteristics (legal constitutional formation and revenue) could not been tested for independence because such contingency tables would violate the assumption of Chi-square test, meaning that more than 20% of cells would have expected frequencies less than five.

Further on, respondents were asked to assess their agreement on the scale from 1 to 5 (1 being “strongly disagree”, 5 being “strongly agree”) with several statements regarding their company's attitudes toward weather risk and WRM. Statements and mean assessments are given in the table below.

First two statements are related to weather risk awareness as a prerequisite for WRM and the third one presents an outcome of successful WRM.

Table 5. Attitudes toward WRM

No. Statement Mean

Standard deviation

1. Company`s top management considers weather as a risk source of strategic importance.

2. Weather is nowadays more versatile and harder to predict than ten years ago.

3. Our company is adequately prepared to cope with weather changes.

3.07

3.66

3.61

1.283

1.023

0.937

Based on the mean values, it can be concluded that respondents in a largest extent agree that weather is nowadays more versatile and harder to predict than ten years ago. Furthermore, it was examined how the mean assessments of attitudes vary between the companies regarding their WRM practices.

Independent-sample t-tests were conducted in order to examine are there significant differences in mean assessments between the companies that manage weather risk and the ones that do not. The assumption was that companies who gave higher rank to statements apply WRM strategies.

Following table gives the mean scores for two groups of companies, significance values for Levene's tests and independent-sample t-tests for three attitude statements.

Table 6. T-test for differences in attitudes toward WRM

Mean

No. Statements

Levene's test t-test

Apply

WRM

Do not apply WRM

1. Company`s top management considers weather as a risk source of strategic importance.

2. Weather is nowadays more versatile and harder to predict than ten years ago.

3. Our company is adequately prepared to cope with weather changes.

3.17

3.5

3.71

2.38

3.68

2.88 p=0.358 p=0.101 p=0.780 p=0.648 p=0.279 p=0.017

Based on the Levene's significance levels (column 5), all three statements satisfied the assumption of homogeneity of variances between populations.

Further on, t-test significance values (column 6) show that mean difference between companies that manage weather risk and the ones that do not proved to be statistically significant only for the third statement (p=0.017).

Respective eta squared is 0.085 which is considered moderate effect according to aforementioned Cohen's classification.

4.2.3. Application and degree of familiarity with weather derivatives

Next, it was analysed what type of risk companies face with regarding the severity of its effect: severe weather (40.3%), unusual seasonal variations

(52.2%) and long term climate variations (7.5%).

4

As it has been already said, weather derivatives were primarily developed to reduce the earnings volatility due to unusual seasonal weather variations, but can be effectively used as instruments of protection against financial exposure to climate variations because climate change, among other things, causes greater volatility of weather. Thus, regarding the risk type that companies face with, as potential users of weather derivatives appear 59.7% of large companies in

Croatia. Expressed by confidence interval, with 95% certainty, as potential users of weather derivatives appear between 54.1 and 65.3% of large companies in Croatia .

As it can be seen from the chart 2, weather derivatives are the least applied

WRM strategy among companies, which was expected since weather

4 The division of weather/climate risk into respective three categories was conducted according to Dutton (2002, 1304).

derivatives market is one of the newest derivatives markets in the world and there is no futures market in Croatia. However, it came as a surprise that 2 out of 67 companies that are weather sensitive (3.0%) are already using weather derivatives. With further questioning it has been determined that transactions were conducted over-the-counter in order to hedge companies` revenues and that underlying weather indexes were based on the temperature, rainfall and snowfall.

Next, it was analyzed to what extent are large Croatian companies familiar with the concept of weather derivatives. Respondents were given three categories of answers: not familiar with the concept, had heard of but do not know what are about, had heard of and know how they function. The results are shown on the chart below.

Chart 3. Degree of familiarity with the concept of weather derivatives

The chart shows that most respondents had never heard of weather derivatives (63%), while a smaller percentage had heard of weather derivatives, but does not know how they work (29%). Only six respondents

(8%) know how weather derivatives actually work. Those six respondents were further asked to assess on the scale from 1 to 5 to what extent do seven listed barriers limit further spread of weather derivatives application among

Croatian companies. They were also given the opportunity to add additional barriers if the ones they consider significant were not already listed. The answers were categorized as follows: (1) very insignificant obstacle, (2) insignificant obstacle, (3) moderately significant obstacle, (4) significant obstacle and (5) very significant obstacle. The following chart shows the significance of individual barriers measured by the mean. Explanation of barriers abbreviations is given in a legend below the chart.

Chart 4. The significance of individual barriers to wider application of weather derivatives among Croatian companies

Legend:

B1 General opinion that company cannot be hedged against adverse weather.

B2 Insufficient knowledge of weather derivatives market and instruments.

B3 Costs of weather transactions.

B4 Time necessary to make a transaction.

B5 Reliability and availability of meteorological data.

B6 Insufficient supply by financial institutions.

B7 Insufficient demand by end users.

Based on the nature of the scale used, as factors that significantly impede wider application of weather derivatives among Croatian companies can be classified those barriers of which importance assessment by the mean is equal to or greater than 3.0. Three out of seven listed barriers meet that criterion.

Among them, insufficient demand by end users (B7) is assessed as the most important barrier (M=3.6). As a slightly less important barriers, respondents mentioned general opinion that it is impossible to hedge against adverse weather conditions (B1) and insufficient knowledge of weather derivatives market and instruments (B2); M=3.5.

5. CONCLUSION

The literature review has showed that companies from foreign countries are well aware of weather as a source of risk and are continuously trying to find

new and more effective ways of weather risk protection. The paper gave an overview of basic WRM strategies and stressed out weather derivatives as the most effective instrument of weather risk protection currently available to companies.

Survey research was conducted in order to determine to what extent large

Croatian companies are aware of the weather risk, as well as the importance of WRM. Research findings show, with 95% certainty, that weather affects

81.4 to 94.9% of large Croatian companies. The most widely applied WRM strategy among companies is simple acceptance of weather risk and adjustment of production and sales volume according to weather forecast

(applied by 71.1% of large companies) which is a devastating insight knowing that acceptance presents passive risk management strategy. Weather derivatives are still quite unknown among Croatian companies. Only 8% of respondents know how they actually work, while 3% stated that their company uses them to hedge weather risk. On the other side, findings imply, with 95% certainty, that 54.1 to 65.3% of large companies in Croatia comply with the profile of weather derivatives potential users. As major obstacle in wider application of weather derivatives among Croatian companies, respondents listed insufficient demand by end users which can be explained by insufficient knowledge about weather derivatives market and general opinion that companies cannot be hedged against adverse weather.

Joint conclusion of the research is that there is a gap between number of companies that are affected by weather and those that actively try to manage weather risk, meaning that further education within companies is needed in order to change present mindsets and encourage companies to use instruments of weather risk protection.

REFERENCES

Ali, P.U. (2004): The Legal Characterization of Weather Derivatives , The

Journal of Alternative Investments, Fall, pp. 75-79.

Auer, J. (2003): Weather Derivatives Heading for Sunny Times , Frankfurt

Voice, February, pp. 1-8.

Brockett, P.L., Wang, M., Yang, C. (2005): Weather derivatives and weather risk management , Risk Management and Insurance Review, Vol. 8, No. 1, pp. 127-139.

Cao, M., Li, A., Wei, J. (2004): Watching the Weather Report , Canadian

Investment Review, Vol. 17, No. 2, pp. 27-33.

Cohen, J.W. (1988): Statistical power analysis for the behavioural sciences ,

Lawrence Erlbaum Associates, Hillsdale

Connors, R.B. (2003): Weather Derivatives Allow Construction to Hedge

Weather Risk , Cost Engineering, Vol. 45, No. 3, pp. 21-24.

Dorfman, M.S. (2007): Introduction to Risk Management and Insurance ,

Prentice Hall, Englewood Cliffs

Dutton, J.A. (2002): Opportunities and priorities in a new era for weather and climate services , American Meteorological Society, Vol. 83, No. 9, pp.

1303-1311.

Edrich, C. (2003): Weather risk management , Journal of Financial

Regulation and Compliance, Vol. 11, No. 2, pp. 164-168.

Garcia, A.F., Sturzenegger, F. (2001): Hedging Corporate Revenues with

Weather Derivatives: A Case Study , Master Thesis, Universite de Lausanne,

Ecole des Hautes Etudes Commerciales

Jones, T.L. (2007): Agricultural Applications Of Weather Derivatives,

International Business & Economics Research Journal , Vol. 6, No. 6, pp.

53-60.

Lazibat, T., Županić, I. (2010):

Vremenske izvedenice kao instrument upravljanja vremenskim rizikom , Poslovna izvrsnost, Vol. 4, No. 2, pp. 93-

106.

Lazibat, T., Županić, I., Baković, T. (2009):

Vremenske izvedenice kao instrumenti terminskih tržišta

, Ekonomska misao i praksa, Vol. 18, No. 1, pp. 59-78.

Liu, X. (2006): Weather Derivatives: A Contemporary Review and Its

Application in China , Master Thesis, University of Nottingham

Marušić, M., Vranešević, T. (1997): Istraživanje tržišta

, Adeco, Zagreb

McDonald, H., Adam, S. (2003): A comparison of online and postal dana collection methods in marketing research , Marketing Intelligence &

Planning, Vol. 21, No. 2, pp. 85-95.

Mendelsohn, R., Morrison, W., Schlesinger, M.E., Andronova, N.G.

(2000):

Country-Specific Market Impacts of Climate Change , Climate Change, Vol.

45, No.3-4, pp. 553-569.

Miloš Sprčić, D. (2007):

Izvedenice kao instrumenti upravljanja financijskim rizicima: primjer hrvatskih i slovenskih nefinancijskih poduzeća

, Financijska teorija i praksa, Vol. 31, No. 4, pp. 387-413.

Munden, L., Lund, P. (2003): Weather Derivatives Give European Energy

Utilities a Sunnier outlook , in: Standard & Poor`s Ratingsdirect, pp. 1-3, http://www.wrma.org/wrma/library/file578.pdf, (accessed 15 August 2009)

Myers, R. (2008): What every CFO needs to know about weather risk management , Chicago Mercantile Exchange & Storm Exchange, Inc., pp. 1-

23, http://www.wrma.org/documents/WeatherRisk_What_Every_CFO_Needs_to

_Know_Now.pdf, (accessed 28 August 2010)

Narodne novine (official gazette of the Republic of Croatia) No. 109/07,

Accounting Act

Paoletti, C. (2001): Weather Derivatives; A Beginner`s Guide , in: The

Oxford Princeton programme

–

Press Room, http://www.oxfordprinceton.com/press/ar0103.asp (accessed 3 September

2010)

Ray, C. (2005): Weather Derivatives As A Risk Management Tool For

Beverages Manufacturers and Breweries in the UK , Master Thesis,

Nottingham University Business School

Scott, D. (2003): Climate Change and Tourism in the Mountain Regions of

North America , in: First International Conference on Climate Change and

Tourism, Proceedings, World Tourism Organization, April 9-11, (Djerba)

Tunisia, pp. 1-9.

Sharma, A.K., Vashishtha, A. (2007): Weather derivatives: risk-hedging prospects for agriculture and power sectors in India , The Journal of Risk

Finance, Vol. 8, No. 2, pp. 112-132.

Stoppa, A., Hess, U. (2003): Design and Use of Weather Derivatives in

Agricultural Policies: the Case of Rainfall Index Insurance in Marocco ,

International Conference: Agricultural policy reform and the WTO: where are we heading?, Proceedings, (Capri) Italy, June 23-26, pp. 1-17.

Štulec, I. (2010):

Ispitivanje utjecaja vremenskih prilika na poslovanje poduzeća u Republici Hrvatskoj , Zbornik Ekonomskog fakulteta u Zagrebu,

Vol. 8, No. 2, pp. 163-178.

The Risk Limited Glossary (n/a), http://www.risklimited.com/glossaryw.htm, (accessed 3 September 2010)

Turvey, C.G. (2001): Weather Derivatives for Specific Event Risk in

Agriculture , Review of Agricultural Economics, Vol. 23, No. 2, pp. 333-351.

Weatherbill, Inc. (2008): Global Sensitivity: A Comparative Study , August, pp. 1-43, http://www.weatherbill.com/assets/LandingPageDocs/Global-

Weather-Sensitivity.pdf, (accessed 14 September 2010)