AGENDA - The American Logistics Association

advertisement

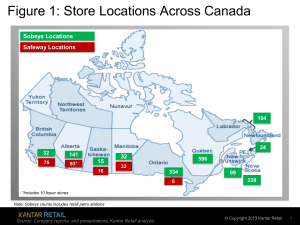

Winning Productive Trips: Shoppers, Retailers and the Road Ahead Presented by: Bryan Gildenberg, Chief Knowledge Officer May 1, 2014 AGENDA • The Trip Environment –“A Polarizing World” –“Outlet Consolidation” –“Share Of Samers” –“Transparent, Personal, Contextual” • Some Thoughts On Responses –Clear –Digital –Fast –Effective © Copyright 2014 Kantar Retail 2 Yes, Weather Is Often to Blame … But only exacerbated underlying trends, as many turned online Weather forecast map for weekend before Christmas Source: http://www.accuweather.com/en/weather-news/severe-storms-saturday-texas-to-tenn/21119943 © Copyright 2014 Kantar Retail 3 Convenience Is King as Shoppers Aim to Simplify Ability to one-stop shop sees resurgence in importance Share of Shoppers Rating Ability to Get All/Most Shopping Done in One Place as One of Top Important Shopping Factors Source: Kantar Retail ShopperScape®, January 2012, 2013, and 2014 © Copyright 2014 Kantar Retail 4 KEY MACRO/SHOPPER INSIGHT: Less “Polar” Vortex And More Polar… Income: Generations: Haves vs. Have Nots Older Americans don’t enjoy shopping as much as younger ones Source: Kantar Retail analysis Ethnicity: Geography: 45% of under 30 America is nonCaucasian America becoming less rural, and urban areas drive smaller more targeted stores © Copyright 2014 Kantar Retail 5 One Less Stop … Store set contracts, again, in 2013 Average Number of Retailers Shopped in Past Four Weeks* (among all primary household shoppers) 12.4 12.4 2007 2008 Average retailers shoppers/month (Jan–Sept) 11.1 2009 11.1 11.2 11.2 2010 2011 2012 10.7 2013 *Inclusive of visits to stores and websites; averages are for Q1–Q3 of each year. Source: Kantar Retail ShopperScape®, January 2007–October 2013 © Copyright 2014 Kantar Retail 6 Trend Is Part of a Continuing Story… Amazon growth vs. shopper base contracts at key competitors Past 4-Week Shoppers, by Retailers* (among all primary household shoppers) * Inclusive of visits to stores/websites and use of catalogs Source: Kantar Retail ShopperScape®, August 2007–December 2013 © Copyright 2014 Kantar Retail 7 Spending Intentions Signal Willingness to Spend >50% = Same; fewer shoppers actively looking to curtail spending Retail Spending Intentions in Coming Month Compared with Same Period Last Year (three-month moving average) Spend about the Same Spend Much/ Somewhat Less Spend Much/ Somewhat More Source: Kantar Retail ShopperScape®. June 2008–December 2013 © Copyright 2014 Kantar Retail 8 Shoppers Signaling More “Limiting” in 2014 Plus online shopping more likely to be in the mix Planned Changes in Shopping Behavior: 2014 vs. 2013 • 2013 2014 49% 47% – Buying fewer things 34% 38% – Shopping less often 29% 31% – Postponing more purchases 19% 21% 13% 15% Deal Seeking … Still at top of the list, but participation dips vs. last year Growing participation vs. last year • Limiting Behaviors • Shopping Online – Shop online more often Note: Shading indicates significant difference vs. October 2012 (95% confidence level) Source: Kantar Retail ShopperScape®, October 2012 and October 2013 © Copyright 2014 Kantar Retail 9 Long-Term Inflation Key to Polarized Outlook Inflation focus in food/fuel aggravates Have/Have Not split Inflation Impact on U.S. Household Income * Nominal Compound Annual Growth Rate Income Growth By: High School/Some College* All Households 4-Year College Degree** Food & Fuel Prices 1980-1990 1990-2000 2000-2010 2010-2020F * Yellow bars are average inflation rate Underlying bars are average income growth for households * High school education or only some college is indicator of “Have Not” households **4-year degree or more is indicator of “Have” households Source: U.S. Department of Commerce, and Kantar Retail analysis © Copyright 2014 Kantar Retail 10 As a Result… Retailer’s are adapting & changing price position Of the top 70 supermarket retailers in the KR database, there are roughly as many characterized as Value (19), Premium (23), and Mainstream (27)* But projected dollar growth 2012E-2017E is: “Haves” “Have-Nots” Source: Kantar Retail analysis; company reports Premium 24.7% (CAGR 4.0%) Mainstream 7.4% (CAGR 1.3%) Value 67.9% (CAGR 6.4%) © Copyright 2014 Kantar Retail 11 Think of Portable, Real-Time Information as Climate Change is one key symptom of that change — the ability for shoppers to know retail — a better product obviously reduces that comparability! So, what are the responses? the ability for retailers to know shoppers the ability for retailers to dynamically be the right retailer at the right time for the shopper Source: Kantar Retail analysis © Copyright 2014 Kantar Retail 12 Using Loyalty Data to Offer Personalized Pricing Language all centered around the user, showing the personalization Recommended deals are designed to convert the shopper to purchase in other categories Source: Kantar Retail store visits & analysis © Copyright 2014 Kantar Retail 13 Personalizers Data-driven individualized targeters • Kroger and CVS in brick and mortar world • Amazon is the ultimate personalized targeter • Kingfisher’s view of dynamic pricing • Non-transaction based personalized targeting Will need to get more fluent at this type of communication to help these winning retailers continue to win (this is the practical example of how “Big data” comes to life in retail) Source: Kantar Retail analysis © Copyright 2014 Kantar Retail 14 Contextualizers Framers of a brand beyond shopping — targeting, but targeting a group based on affinity & lifestyle need rather than transactions • Whole Foods, lululemon, fashion, Dollar General • Who will play a broader role? Watching category players starting to step up – Blurring of media and retail – pronounced in entertainment and in online advertising – Interesting model – Netflix, which started as a “retailer” but has turned into much more than that (content provider and producer, data source – in essence have replaced a broadcast network with a personalized and contextualized alternative) Source: Kantar Retail analysis © Copyright 2014 Kantar Retail 15 APPAREL SPECIALTY = CONTEXT This changing context might be a bigger risk to apparel retailers than Amazon… © Copyright 2014 Kantar Retail 16 CONCLUSIONS • A polarizing world means value proposition needs to get markedly better defined and articulated • Outlet consolidation means I have to nail categories that shoppers buy most often, and leverage them effectively – Rx and HBA for Target are trip drivers, not basket builders • Share of samer shoppers are less enticed by hot deals and premiumization – they are trying to responsibly manage their expense line • Personalization and context are how we win the war against price transparency…how will Target use categories and partners here? © Copyright 2014 Kantar Retail 17 KEY WORDS • Clear • Digital • Fast • Effective © Copyright 2014 Kantar Retail 18 Response from the PBORs Demystification of high spend categories (what we sell) Focus: Healthcare • Better: “the aid” – a walking stick, GPS and emergency help system (“an iPhone on a stick” – J Rand) • Personal: service (dieticians, pharmacists, etc) • Context: access to healthcare and these better products • What else gets demystified? – Technology (Best Buy) – Home Improvement (Home Depot) – Fashion (J. Crew) – Beauty (Ulta/Sephora) Source: Kantar Retail analysis © Copyright 2014 Kantar Retail 19 Health & Wellness Across the Box Assortment: Solutions Rx & OTC Fitness H&W Food Home & HBA USD 25K competition and chance to partner with Target to find the best ideas to 1) help people make positive lifestyle and prevention choices, and 2) help people live well with a chronic condition Source: Kantar Retail analysis © Copyright 2014 Kantar Retail 20 DEMYSTIFYING FOOD AND BEAUTY • ShopRite Dieticians a key part of “demystifying” good nutrition and healthy living – best in class food retailers will own food expertise • Publix Aprons runs 10 cooking schools, a YouTube channel and in-store displays for meal solutions • HEB has beauty advisors in over 170 stores! Giant Eagle among many to revamp ISV in Beauty.. © Copyright 2014 Kantar Retail 21 Strong Service Complements the Presentation And facilitates sales growth Sq. Ft. per Employee Sales per Sq. Ft Personalized Interaction: • Employees in aisle • Live announcements • Handwritten signage Data as of 5/24/13 Source: Kantar Retail analysis; Facebook © Copyright 2014 Kantar Retail 22 CLEAR: BEST PRACTICE • Assortment management – science and discipline to help simplify an overcomplicated shelf –Has to be non-self directed and holistic economically • Signage – creative skill required to develop something the shopper wants too! • Digital –use digital touchpoints to help shopper navigation in and before the shopping moment © Copyright 2014 Kantar Retail 23 KEY WORDS • Clear • “Digital” • Fast • Effective © Copyright 2014 Kantar Retail 24 Digital Impact: 100% Even if you don’t sell much online (today), the impact extends well beyond eCommerce Source: Kantar Retail analysis © Copyright 2014 Kantar Retail 25 Shoppers Leverage Digital Along Path Regardless of product or source, multiple planning activities User Satisfaction Navigate Store/Site Select & Buy Choose Trusted Source Advocate Community Choose Channel Create Demand KEY: Shoppers Are In Charge!! Source: Kantar Retail analysis © Copyright 2014 Kantar Retail 26 Use of Retailer Apps on Mobile Growing Have Accessed Retailer Apps in Past Six Months (among all shoppers) 2014 17% 2012: 7% Source: Kantar Retail ShopperScape®, January 2013 and 2014 © Copyright 2014 Kantar Retail 27 Prime Penetration Now Nearly 1 in 5 Households Trial to habit to loyalty – significant impact on overall shopping Penetration of Amazon Prime Membership (among all U.S, primary household shoppers) 21.5M 15.6M 11.2M Source: Kantar Retail ShopperScape®, December 2011, 2012, 2013, Kantar Retail estimates © Copyright 2014 Kantar Retail 28 29 Source: Company reports © Copyright 2014 Kantar Retail © Kantar Retail 2014 Advising Decisions via Social Feedback Featuring top-selling accessories on center display, aiding back-toschool item selection through popular vote Staff offer hand-written recommendations of items, helping the store feel more personable and aiding selection Source: Kantar Retail analysis, store visits (Canada, Germany, USA) Calling out top-pinned items on the shelf, highlighting for shoppers what’s trendy through shopper feedback © Copyright 2014 Kantar Retail 30 Making the Revolutionary, Routine Digital removes friction, disrupts habit, and creates more “chutes” Personalized Pricing Digital Shelf (content, images, reviews, etc.) Must build more ladders & flexibility into our processes Source: Kantar Retail analysis, photos © Copyright 2014 Kantar Retail 31 KEY WORDS • Clear • “Digital” • Fast • Effectiveness © Copyright 2014 Kantar Retail 32 Food is Laggard; Online Arrived in Other Categories Already over 10% of retail sales, headed to 20% Combined Goods Categories (Ex-Auto, Food & Drug) vs. Food, Drug & HBC Online Impact of Food, Drugs, & HBC Food, Drugs/HBC Source: U.S. Department of Commerce, Kantar Retail analysis © Copyright 2014 Kantar Retail 33 Amazon Fresh Drives Overall Online Grocery Competitive dynamics will accelerate response Online Share of Food, Drugs, HBA 36% CAGR Source: US Dept. of Commerce, Kantar Retail analysis, photo cred: splendidmarket © Copyright 2014 Kantar Retail 34 THIS IS FUN… It’s Like Sharper Image Built An “End Of The World” Stick • https://www.youtube.com/watch?v=aFYs9zqYpdM © Copyright 2014 Kantar Retail 35 Express Is Breaking Out Walmart Express details: • 10,000sq ft -15,000 sq ft, 11,000 – 13,000 SKUs • Designed for urban & rural locations, net 20 open to date, with expansion plans ramping up in FY2015 “We are very, very pleased with the topline.” – Bill Simon, April 2014 Source: Company presentations, Kantar Retail analysis © Copyright 2014 Kantar Retail 36 In Rural Locations, Strong Results “We have the best results in rural and the likes of suburban with pharmacy and with gas, and that’s exciting for us, a very nice model there.” –Bill Simon, March 2014 Richfield, NC Dunn, NC Source: Company presentation, Kantar Retail store visits, analysis Gentry, Ark. © Copyright 2014 Kantar Retail 37 The Store in the Larger Context Manufacturer Warehouse Source: Kantar Retail analysis, store visits Stores Home © Copyright 2014 Kantar Retail 38 FAST: BEST PRACTICE • Small store expertise - developing skills in limited assortment, small case pack and pack and logistics required to win • Home delivery – leaning in with Amazon on deciphering its next phase of logistics development • Store navigation – thinking hard on helping shoppers find the category/store – proximity-based marketing © Copyright 2014 Kantar Retail 39 KEY WORDS • Demystify • Rotate • “Speed Is Life” = “Life Is Speed” • Effectiveness © Copyright 2014 Kantar Retail 40 EFFICIENCY: Is Contextual, Not Absolute • Lowest unit cost is a nice outcome where the world wants one thing • When it doesn’t, it’s a hindrance • Analogy here is digital marketing – today we are all finding the efficiencies in something that seemed fragmented and unfamiliar • Online selling will be critical to your existing customers not just “new” ones • When retail and media collide we’ll all be back here again! © Copyright 2014 Kantar Retail 41 10 COMMANDMENTS: 1 The USA is a, polarized, old and young, increasingly urban, mobile enabled multicultural, omnichannel place – are we ready? 2 Keyword 1: “SPECIFIC” – fact-based trading area level understanding critical to winning in a complex, polarized world 3 Keyword 2: “MOBILE” Think 10:50:100 Digital Impact in small screens 4 Keyword 3: “SHOPPER” - Shopper Marketing = “Point of Decision Marketing” – Conventional Brand Marketing Becomes More Shopper-Centric 5 Keyword 4: “POST-MASS” - Context and Personalization Win © Copyright 2014 Kantar Retail 10 COMMANDMENTS PART 2: GET CLEVER 6 Keyword 5: “CONVENIENCE” – in retail, speed is life no matter what format you run 7 Keyword 6: “LOYALTY” – transaction cards + attitudinal understanding 8 Keyword 7: “EXPERIENCE” - great stores do something, not just look great 9 Keyword 8: “VALUE” – pricing’s going to get weird 10 Keyword 9/10: “EXECUTION/ROI” – getting things done is the difference between a business plan and a daydream © Copyright 2014 Kantar Retail