The Bonus & Compensation Seminar

advertisement

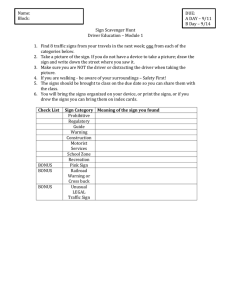

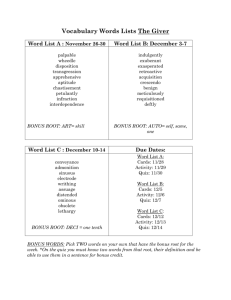

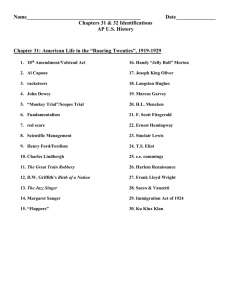

The Bonus & Compensation Seminar 2nd December 2009, Garden Court Chambers, Lincoln’s Inn Fields Bettina Bender, Partner CM Murray LLP CM CMMurray MurrayLLP: LLP:Specialists SpecialistsininEmployment, Employment,Partnership Partnershipand andBusiness BusinessImmigration ImmigrationLaw Law Bonuses • Banking and Financial Services Sector: a different pay structure is typical • Comparatively low base with large bonus • Why is this contentious? • Recent banking crisis – large bonus culture blamed for excessive risk taking CM CMMurray MurrayLLP: LLP:Specialists SpecialistsininEmployment, Employment,Partnership Partnershipand andBusiness BusinessImmigration ImmigrationLaw Law Proposed Controls on Remuneration • Walker Report - (to review the corporate governance of banks) 39 recommendations to improve how banks are run, incl. publishing statistics on number of bankers earning over £1million, half of variable pay to be awarded in shares to vest over five years • Treasury Announcement on 30 November – start of consultation on whether legislation should go further than Walker Review • Financial Services Bill – contracts can be torn up if guaranteed bonuses are payable and • FSA Code on Remuneration – guaranteed bonuses for >1 year non-compliant with excessive risk has been taken – yet to be enacted – query May election? – 2009 bonuses not affected: “bumper year for banks” Code (must be amended by end 2010) • G20 remuneration reforms – up to 60% of bonus payments to be deferred over 3 years, clawback arrangements for failure to perform • Financial Reporting Council – review of corporate governance of UK listed companies published 1 December; possible annual re-election of non-exec as well as chairman; new corporate governance code to take effect June 2010; (looking at the role of shareholders and boards in controlling risk) CM CMMurray MurrayLLP: LLP:Specialists SpecialistsininEmployment, Employment,Partnership Partnershipand andBusiness BusinessImmigration ImmigrationLaw Law Why pay a Bonus? • A Reward for Performance • A Guaranteed Bonus (e.g. Signing on Bonus, Retention Bonus) – on the rise again to attract and retain key performers; often payable irrespective of performance and agreed to compensate employee for leaving deferred incentive arrangement at previous employer; NB no risk management for the bank) CM CMMurray MurrayLLP: LLP:Specialists SpecialistsininEmployment, Employment,Partnership Partnershipand andBusiness BusinessImmigration ImmigrationLaw Law The Performance Bonus • Is it contractual? • Is it discretionary? • N.B. a discretionary bonus can become contractual over time • Is it a hybrid? (there is a contractual entitlement but the amount payable is discretionary) CM CMMurray MurrayLLP: LLP:Specialists SpecialistsininEmployment, Employment,Partnership Partnershipand andBusiness BusinessImmigration ImmigrationLaw Law The Performance Bonus • Is it Cash-based • Is it payable in Deferred Compensation (e.g. shares options, long term incentive plans etc.) • Is it a Combination CM CMMurray MurrayLLP: LLP:Specialists SpecialistsininEmployment, Employment,Partnership Partnershipand andBusiness BusinessImmigration ImmigrationLaw Law Termination of Employment and Bonuses • What happens on termination (with or without cause) or employee resignation • Is the bonus forfeited • Is a pro-rated bonus payable • Is the full bonus payable • Good leaver/Bad leaver • What happens if the employer terminates in order to avoid paying a bonus otherwise due? CM CMMurray MurrayLLP: LLP:Specialists SpecialistsininEmployment, Employment,Partnership Partnershipand andBusiness BusinessImmigration ImmigrationLaw Law Issues to look for • Does a Bonus Plan exist • What does the Contract/Staff Handbook say • What is the Bonus Year • When is the Bonus declared • When is the Bonus payable CM CMMurray MurrayLLP: LLP:Specialists SpecialistsininEmployment, Employment,Partnership Partnershipand andBusiness BusinessImmigration ImmigrationLaw Law Performance • Is it Company Performance • Is it Individual Performance • How is it measured • Who decides? CM CMMurray MurrayLLP: LLP:Specialists SpecialistsininEmployment, Employment,Partnership Partnershipand andBusiness BusinessImmigration ImmigrationLaw Law Bonuses and Exercise of Discretion Case Law to Date – A Recap CM CMMurray MurrayLLP: LLP:Specialists SpecialistsininEmployment, Employment,Partnership Partnershipand andBusiness BusinessImmigration ImmigrationLaw Law Lavarack v Woods of Colchester Ltd [1967] 1 QB 278, [1966] 3 All ER 683, CA Facts: L was employed by W Ltd for a term of 5 years from 1 April 1962 on a basic salary and such bonus (if any) as the directors “shall from time to time determine”. On 27 July 1964 L was dismissed. In 1965 the company revised their salary structure, ending the bonus scheme. L claimed wrongful dismissal claiming damages for loss of salary under the contract and an additional sum representing the salary increase he would have received had he not been terminated. Held (CA): A dismissed employee could not seek compensation for loss of benefits to which he was not contractually entitled and the employee was not entitled to claim the sum he would have received by way of increase in salary in lieu of bonus. CM CMMurray MurrayLLP: LLP:Specialists SpecialistsininEmployment, Employment,Partnership Partnershipand andBusiness BusinessImmigration ImmigrationLaw Law Clark v BET plc [1997] IRLR 348 Facts: C had a contract which provided that he would participate in a a bonus arrangement providing a maximum of 60% of salary in any year. C was dismissed and claimed compensation in respect of salary increases and bonus payments he would have earned during his 3 year notice period. Held (High Court): The Court was prepared to include anticipated salary increases and bonus payments when calculating damages in respect of the notice period. A discretion to award a bonus should not be exercised 'capriciously’. CM CMMurray MurrayLLP: LLP:Specialists SpecialistsininEmployment, Employment,Partnership Partnershipand andBusiness BusinessImmigration ImmigrationLaw Law Clark v Nomura International plc [2000] IRLR 766, QBD Facts: C was employed as senior proprietary trader in equities with a discretionary bonus scheme, based on individual performance. On 13 February 1997, NI dismissed C on 3 months’ notice to be served as garden leave but paid him no bonus on bonus payment date of 25 April. Held (High Court): Whilst the dismissal itself was not wrongful, the discretionary bonus would have been due for payment during the notice period (the employee might have expected to receive £1.35m). There would be a breach of contract in relation to an unfettered and absolute discretion if no reasonable employer would have exercised the discretion in that way. This is the test of irrationality and perversity. CM CMMurray MurrayLLP: LLP:Specialists SpecialistsininEmployment, Employment,Partnership Partnershipand andBusiness BusinessImmigration ImmigrationLaw Law Horkulak v Cantor Fitzgerald International [2004] EWCA Civ 1287, [2004] IRLR 942 Facts: Mr Horkulak was promoted to Senior Managing Director in Aug 1999 on a 3 year fixed term contract with discretionary bonus. He resigned in June 2000 claiming constructive dismissal, on the basis of the bullying behaviour of the President of CF. Held (CA): • A term will be implied into an employment contract that a discretion will be exercised bona fide and rationally. Lord Justice Potter said to do otherwise would to fly in the face of principles of trust and confidence which have been held to underpin the employment relationship. Mr Horkulak was on a 3 year fixed contract. If this contract had been lawfully performed, he would still have been in employment at the time that the bonuses were payable. • Distinguished from Lavarack v Woods as Mr Horkulak was already entitled to a bonus payment under his scheme. CM CMMurray MurrayLLP: LLP:Specialists SpecialistsininEmployment, Employment,Partnership Partnershipand andBusiness BusinessImmigration ImmigrationLaw Law Commerzbank AG v Keen 2007 IRLR 132 Facts: Mr Keen was head of the proprietary trading desk for just under three years and was made redundant June 2005. He participated in a discretionary bonus scheme (with forfeiture provision). His claim was for underpaid bonuses for 2003 and 2004 and non-payment for 2005. Held (CA): Employers do have a wide discretion but this must not be irrationally, perversely or arbitrarily exercised. The burden of establishing that no rational bank would have exercised their discretion in a certain way was a very high one. UCTA 1977, s.3 does not apply to employment contracts at least insofar as they apply to bonuses. CM CMMurray MurrayLLP: LLP:Specialists SpecialistsininEmployment, Employment,Partnership Partnershipand andBusiness BusinessImmigration ImmigrationLaw Law Takacs v Barclays Services Jersey Limited [2006] IRLR 877. Facts: T joined BSJ in Nov 2003 on a contract with a min guaranteed bonus and a further bonus sum payable if credits of £20million were achieved. T was dismissed with 4 weeks’ notice by letter dated 15 November 2004 before the end of the bonus year and before the deal he was working on could be closed. Held (High Court): The employee could pursue a claim that the employer had breached the implied term of trust and confidence by hampering T’s efforts to achieve the sales target and could further pursue the argument that the employer would not to terminate the contract, in order to avoid its bonus obligations, prior to the payment date. The Court decided, at a preliminary hearing, that Mr Takacs had a real prospect of showing that this implied term existed, and that the term could supplement rather than be inconsistent with the employer’s express contractual right to dismiss with notice. This case settled so it will be for another employee to make this argument in the future. CM CMMurray MurrayLLP: LLP:Specialists SpecialistsininEmployment, Employment,Partnership Partnershipand andBusiness BusinessImmigration ImmigrationLaw Law Fish and others v Dresdner Kleinwort Ltd [2009] IRLR 1035 (QBD) Facts: The claimants were part of the senior management team of DK. During 2008 discussions took place regarding the sale of DK to Commerzbank. In a bid to retain key staff they were notified of their bonus payments for 2008. Due to the financial crisis and the falling value of DK and financial difficulties of Commerzbank the purchase price was renegotiated and sale brought forward to Jan 2009 and the employees were to be terminated. The new management decided to substantially reduce the 2008 bonus awards given due to the dire financial outlook. Held (High Court): Where a contractual right to a bonus is established, the employer must pay this, even if it is not in the employer’s best interests to do so. An employer cannot argue that an employee’s express, implied or fiduciary duty to act in the employer’s best interests requires them to forego a sum that is otherwise due under their contract. CM CMMurray MurrayLLP: LLP:Specialists SpecialistsininEmployment, Employment,Partnership Partnershipand andBusiness BusinessImmigration ImmigrationLaw Law Litigating a Bonus Claim • What are the options • Forum • Costs and Time CM CMMurray MurrayLLP: LLP:Specialists SpecialistsininEmployment, Employment,Partnership Partnershipand andBusiness BusinessImmigration ImmigrationLaw Law Deduction of Wages • Section 13(3) of ERA “where the total amount of wages paid on any occasion by an employer to a worker employed by him is less than the total amount of the wages properly payable by him to the worker on that occasion (after deductions), the amount of the deficiency shall be treated for the purposes of this Part as a deduction made by the employer from the worker’s wages on that occasion.” • • • • Wages includes Bonus (Section 27(1) of ERA) Employment Tribunal claim within 3 months of termination of employment or date of deduction The Bonus must be quantifiable (Coors Brewers Ltd v SP Adcock and Ors [2007] EWCA Civ 19 24 January 2007) Awards made under Section 13 of the Employment Rights Act 1996 are not limited by the compensatory award ceiling and a claim for >£25,000 can be brought in the ET CM CMMurray MurrayLLP: LLP:Specialists SpecialistsininEmployment, Employment,Partnership Partnershipand andBusiness BusinessImmigration ImmigrationLaw Law Tradition Securities and Futures S.A. v Mouradian [2009] EWCA Civ 60 Facts: M was a senior broker on the fixed income desk where he managed a team of brokers. In September 2004 he entered into a 4 year fixed term contract. Under the terms of the contract he was to be paid from a bonus pool of 60% of net billed income less appropriate deductions to be divided as he thought appropriate after consultation with the CEO, payable in cash or into a retirement scheme or employee benefit trust. For the period July to December 2007 M had allocated £100,000 bonus to his team, the remainder to be payable to himself. The bank declared a bonus pool of £1,429,00.60 after deductions including a deduction of £154,286 disputed by M. The net shortfall to M was £92,571.60. M brought an unlawful deduction of wages claim in the ET. The issue in question was whether the amount in dispute was a quantifiable sum. Held (CA): The Tribunal were entitled and obliged to make certain findings of fact and in this case determined that M had sole discretion as the both the amount of bonus and the form of his bonus. The claim could accordingly be heard under the deduction of wages provision. CM CMMurray MurrayLLP: LLP:Specialists SpecialistsininEmployment, Employment,Partnership Partnershipand andBusiness BusinessImmigration ImmigrationLaw Law Breach of Contract Claim • Employment Tribunal claim within 3 months of the termination of employment • NB: maximum award is capped at £25,000 CM CMMurray MurrayLLP: LLP:Specialists SpecialistsininEmployment, Employment,Partnership Partnershipand andBusiness BusinessImmigration ImmigrationLaw Law Wrongful Dismissal Claim • County Court or High Court • Can be brought up to 6 years after termination of employment • Damages in the County Court are limited to £50,000 but in the High Court these are unlimited • High Court action: protracted and expensive CM CMMurray MurrayLLP: LLP:Specialists SpecialistsininEmployment, Employment,Partnership Partnershipand andBusiness BusinessImmigration ImmigrationLaw Law Discrimination Complaint • Employment Tribunal claim that a bonus scheme has been operated unlawfully in contravention of discrimination legislation (sex, marital status, pregnancy, race, disability, sexual orientation, gender reassignment, age, and religion and belief or less favourable treatment as part-time worker or fixed term employee) • Can be brought within 3 months of the discriminatory act or 6 months in an equal pay case • Compensation uncapped but loss based CM CMMurray MurrayLLP: LLP:Specialists SpecialistsininEmployment, Employment,Partnership Partnershipand andBusiness BusinessImmigration ImmigrationLaw Law Unfair Dismissal Claim • Employment tribunal claim within 3 months of the dismissal • Compensatory awards are capped (currently £66,200) CM CMMurray MurrayLLP: LLP:Specialists SpecialistsininEmployment, Employment,Partnership Partnershipand andBusiness BusinessImmigration ImmigrationLaw Law Factors the courts will consider:• Is the scheme contractual or discretionary • In a discretionary scheme what has been past practice on payment of bonuses • Are there set pre-conditions the employee is required to meet • How is actual bonus award arrived at – what is the calculation used and what are the award criteria, e.g. performance • If performance is a factor, how is this measured? • What is said to be the rationale behind the bonus – is it to incentivise for the future, for past performance or a combination of the two • Are good leaver/bad leaver provisions operated • Has any commitment been given to the individual during the bonus year? • Are there any published explanatory notes/guidelines? CM CMMurray MurrayLLP: LLP:Specialists SpecialistsininEmployment, Employment,Partnership Partnershipand andBusiness BusinessImmigration ImmigrationLaw Law Maternity Leave and Bonus Payments • • • • • • • If a woman takes maternity leave is she entitled to a bonus otherwise payable? If so, is she entitled to a pro-rated amount of the full bonus level? This area covered by Employment Rights Act 1996, Maternity and Parental Leave Regulations 1999, the Equal Pay Act 1970 and the Sex Discrimination Act and Article 141 of the EC Treaty The general principle is that retroactive pay for work done can be reduced pro-rata to take account of maternity leave absences The two week compulsory maternity leave period must be treated as working time An employee on OML is entitled to benefit from the terms and conditions which would have applied if she had not been absent, excluding remuneration (and employees now enjoy the same rights during AML as during OML). Only sums payable to the employee “by way of wages or salary” are to be treated as remuneration (Reg 9 (3) Maternity and Parental Leave Regulations 1999 (MPL Regs). CM CMMurray MurrayLLP: LLP:Specialists SpecialistsininEmployment, Employment,Partnership Partnershipand andBusiness BusinessImmigration ImmigrationLaw Law Maternity Leave and Bonus Payments Position on Discretionary Loyalty Bonuses is not straightforward • • Gus Home Shopping Ltd v Green and McLaughlin [2001] IRLR 75 The EAT ruled that a discretionary loyalty bonus must be paid in full. • In Hoyland v Asda Stores Limited [2005] IRLR 438 all eligible employees received a bonus less tax and NI and a percentage was paid into the employees’ pension plans with an equivalent contribution from Asda. The EAT held that this was to be treated as “wages or salary” and therefore “remuneration”. Asda was entitled to make a pro-rata deduction to reflect the time the employee was absent on maternity leave. • It remains unclear whether a truly discretionary bonus would qualify as “wages or salary”. CM CMMurray MurrayLLP: LLP:Specialists SpecialistsininEmployment, Employment,Partnership Partnershipand andBusiness BusinessImmigration ImmigrationLaw Law Maternity Leave and Bonus Payments • Bonuses can qualify as pay within the meaning of Article 141 of the EC Treaty which guarantee equal pay between men and women • ECJ law makes clear that the purpose of the bonus, not when it is paid, determines whether a woman should receive it during maternity leave • Where a bonus paid is in relation to past performance and the employee in question was absent on OML and AML for some of that bonus year you can pro-rate the bonus. CM CMMurray MurrayLLP: LLP:Specialists SpecialistsininEmployment, Employment,Partnership Partnershipand andBusiness BusinessImmigration ImmigrationLaw Law Lewen v Denda [2000] IRLR 67 ECJ Facts: L had been employed with D for approx 6 years when she became pregnant. D usually paid a Christmas bonus equivalent to one month’s pay. The bonus was expressed to be a single voluntary benefit which could be revoked and which was repayable if the employee left. In Germany women are not allowed to work 6 weeks before the EWC and 8 weeks after childbirth. German law also provides for 3 years’ parental leave which can be taken by either parent. During parental leave the contract is suspended and no remuneration payable. ECJ held: A Christmas bonus constituted pay. An employer could not simply refuse to pay a bonus to a woman on maternity leave, where it constitutes retroactive pay for work done. However, it can make a pro-rata reduction to take account of the leave, ignoring any time when the employee is prohibited from working, thus making a prorata allocation of bonus. ECJ did however also rule that non-payment of a bonus during maternity leave would not be in breach of Article 141 where the only condition is active service at the time of payment. CM CMMurray MurrayLLP: LLP:Specialists SpecialistsininEmployment, Employment,Partnership Partnershipand andBusiness BusinessImmigration ImmigrationLaw Law Part-time workers • Under the Part-time Workers (Prevention of Less Favourable Treatment) Regulations 2000, part-time workers bonuses should be pro-rated • Different treatment will only be lawful if it can be objectively justified (relying on this will be difficult) CM CMMurray MurrayLLP: LLP:Specialists SpecialistsininEmployment, Employment,Partnership Partnershipand andBusiness BusinessImmigration ImmigrationLaw Law Conclusion • Goldman Sachs boss Lloyd Blankfein recently said that “bankers did God’s work” (Sunday Times 8 November 2009) • Lord Myners, Financial Services Minister reportedly responded to this on 25 Nov 2009 in a speech to investors at Council of Christians & Jews City Seminar (copy on HM Treasury website): "He (Mr Blankfein) seemed to some to be on a different planet to the rest of humanity; ignoring a year of record losses, of dangers and damage. Blankfein appeared to have lost sight of the impact the crisis had on ordinary people and their anger at perceived personal excesses expressed as entitlement by those implicated. (…) Yet the reality is that many people are dismayed by the continuing 'tin ears' of those who seem to operate with a 'heads I win, tails you lose' mentality.” • The Centre for Economics and Business Research recently estimated that £6 billion will be paid in bonuses in the City this year (compared with £4 billion last year). • Banking Bonuses – Business as Usual? CM CMMurray MurrayLLP: LLP:Specialists SpecialistsininEmployment, Employment,Partnership Partnershipand andBusiness BusinessImmigration ImmigrationLaw Law Speaker Details If you have any questions, please do not hesitate to contact: Bettina Bender, Partner CM Murray LLP 37th Floor One Canada Square Canary Wharf London E14 5AA United Kingdom Phone: 00 44 (0)207 718 0090 Email: bettina.bender@cm-murray.com Website: www.cm-murray.com CM CMMurray MurrayLLP: LLP:Specialists SpecialistsininEmployment, Employment,Partnership Partnershipand andBusiness BusinessImmigration ImmigrationLaw Law