Chapter 21 * Corporate Debt II

advertisement

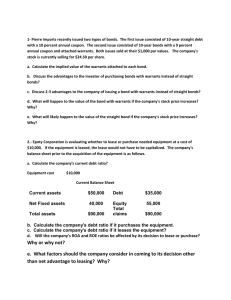

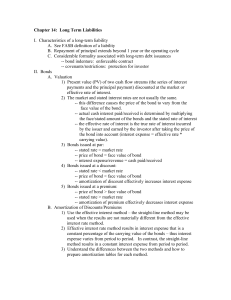

Chapter 20 – Corporate Debt II BA 543 Financial Markets and Institutions Chapter 20 – Corporate Debt II Typical or Standard Bond Interest paid as you go Principal paid at maturity date Yield determined by the market which views Default Potential (Risk of Bond) Inflation and Real Rate Bond Features (Call Options, Collateral, etc.) Ratings by Agencies help assess the information for market yields Table 20-1 Chapter 20 – Corporate Debt II What do the ratings mean? Investment Grade BBB and above Distinctly Speculative B to BB Predominately Speculative Below B Bonds in Default, D “junk bonds” “high-yield bonds” Have missed payment on interest Bond Trustee “filed” on missed payment Fallen Angels Chapter 20 – Corporate Debt II A Look at the High-Yield Bonds Participants (Investment Bankers) Firms – Major Financing of LBOs Drexel, Burnham, & Lambert (Michael Milken) Merrill Lynch, Morgan Stanley, and First Boston John Kluge and Metromedia – 1984 Kolberg, Kravis, Roberts & Co. and Beatrice – 1986 A new market for attracting capital (replacing bank loans) Chapter 20 – Corporate Debt II Leverage Buy-Out (LBO) Using a firms own borrowing capacity to pay for outside management team’s purchase of firm Uses Deferred Interest Bonds Step-up Bonds Payment-in-kind Bonds Management Buy-Out (MBO) Chapter 20 – Corporate Debt II Bond Features Call Option – right of the company to buy back the bond for a pre set price Put Option – right of the bondholder to sell back the bond for a pre set price Conversion feature – right of the bondholder to convert the bond into equity shares Warrants Attached – an additional financial asset that grants the right to buy equity Zero-Coupon Bond – pure discount bond Floating Rate Bond – coupon rate changes Chapter 20 – Corporate Debt II Secondary Market for Bonds Exchange Market (NYSE) – small volume OTC Market used by institutional investors and professional money managers Brokers search Dealers (Dealer Market) Trading Desks – Bond Pits in investment banks The Technology Changes Moving to Web Sites that have prices Remove the extended search process Chapter 20 – Corporate Debt II Other Information Eurobonds Preferred Stock Issued outside of country of company Many different features Dividends preferred (guaranteed?) Convertible to Common in some cases Adjustable rate (floating rate) Financial Engineering of bonds and preferred stock to meet the market demands Chapter 20 – Corporate Debt II Bankruptcy The Bankruptcy Reform Act of 1978 Chapter 7 – Liquidation Rules for liquidation or reorganization Safe Harbor – Time to Think Company sells off remaining assets Pays creditors on a priority basis Chapter 11 – Reorganization Plan approved by Court Plan approved by Claimants via Class