IPCC Test_19.10.2015_Ans. Sheet_LI - 23

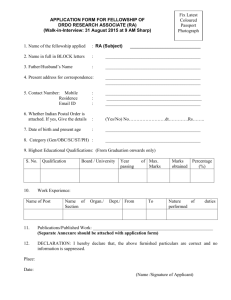

advertisement

MITTAL COMMERCE CLASSES IPCC – MOCK TEST BATCH : LI - 23 DATE: 19.10.2015 MAXIMUM MARKS: 50 TIMING: 3:00 PM to 4:30 PM ADVANCE ACCOUNTING Answer: 1 (12 Marks) Realisation Account Particulars Rs. Particulars Rs. To Building 1,90,000 By Trade creditors 80,000 To Stock 1,30,000 By Bills payable 30,000 To Investment 50,000 By Cash To Debtors 70,000 Building 2,09,000 To Cash-creditors paid (W.N.1) To Cash-expenses To Cash-bills payable 63,650 Stock 1,20,000 8,000 29,500 Investments (W.N.2) Debtors (W.N. 3) 40,000 56,700 4,25,700 (30,000-500) To Partners’ Capital A/cs By R -Debtors-unrecorded P Q R 4,183 4,183 2,789 S 1,395 By R- Investmentsunrecorded 12,550 5,53,700 5,53,700 Cash Account Amount Particulars Rs. Particulars To Balance b/d 30,000 To Realisation – assets realised 63,650 By Realisation-bills payable 29,500 2,09,000 By Realisation-expenses Stock 1,20,000 By Capital account 40,000 Debtors To R’s capital A/c 56,700 4,25,700 7,000 4,62,700 Particulars To Balance b/d To Realisation A/cDebtorsmisappropriation To Realisation A/cInvestmentmisappropriation To R's capital A/c (W.N.4) To Cash A/c Amount Rs. By Realisation-creditors paid Building Investments 7,000 11,000 8,000 P 1,51,132 Q S 1,51,132 59,286 4,62,700 Partners’ Capital Accounts Q R S Particulars P Q R S Rs. Rs. Rs. Rs. Rs. Rs. Rs. 40000 By Balance b/d 150000 150000 – 60000 By General res. 13333 13333 8889 4445 7000 By Realisation profit 4183 4183 2789 1395 By Cash A/c 7000 By P's capital A/c 16384 11000 By Q's capital A/c 16384 By S's capital A/c 6554 16384 16384 6554 151132 151132 59286 167516 167516 58000 65840 167516 167516 58000 65840 P Rs. 1|Page MITTAL COMMERCE CLASSES IPCC – MOCK TEST Working Notes: 1. Amount paid to creditors in cash Rs. Book value 80,000 Less: Creditors taking over investments (13,000) 67,000 Less: Discount @ 5% (3,350) 63,650 2. Amount received from sale of investments Rs. Book value 50,000 Less: Misappropriated by R (8,000) 42,000 Less: Taken over by a creditor (9,000) 33,000 Add: Profit on sale of investments 7,000 Cash received from sale of remaining investment 3. Amount received from debtors 40,000 Rs. Book value 70,000 Less: Unrecorded receipt (7,000) 63,000 Less: Discount @ 10% (6,300) 56,700 4. Deficiency of R Rs. 40,000 7,000 11,000 58,000 31st Balance of capital as on March, 2014 Debtors-misappropriation Investment-misappropriation Less: Realisation Profit (2,789) General reserve (8,889) Contribution from private assets (7,000) Net deficiency of capital 39,322 This deficiency of Rs. 39,322 in R’s capital account will be shared by other partners P, Q and S in their capital ratio of 15 : 15 : 6. Accordingly, P’s share of deficiency = [39,322 x (15/36)] = Rs. 16,384 Q’s share of deficiency = [39,322 x (15/36)] = Rs. 16,384 S’s share of deficiency = [39,322 x (6/36)] = Rs. 6,554 Answer: 2 (8 Marks) When the benefit of firm underwriting is given to individual underwriters (i) Total marked applications: M N 2,50,000 2,00,000 O 2,00,000 P 80,000 = 7,30,000 2|Page MITTAL COMMERCE CLASSES IPCC – MOCK TEST (ii) Shares subscribed excluding firm underwriting Total applications 8,00,000 shares Less : Marked applications (7,30,000) shares Unmarked 70,000 (iii) Statement showing Liability of underwriters M 3,50,000 N 3,00,000 O 2,50,000 P 1,00,000 Total 10,00,000 (2,50,000) (2,00,000) (2,00,000) (80,000) (7,30,000) 1,00,000 (24,500) 1,00,000 (21,000) 50,000 (17,500) 20,000 (7,000) 2,70,000 (70,000) 75,500 79,000 32,500 13,000 2,00,000 (30,000) (50,000) 40,000 (18,500) (1,38,500) 45,500 29,000 (7,500) (5,500) 61,500 7,000 6,000 7,500 5,500 – 38,500 23,000 - - 61,500 Gross liability Less: Marked applications Less: Unmarked (in Gross Ratio) Less: Firm underwriting Less: Surplus of ‘O’ and ‘P’ allotted to M,& N (35:30) Net liability (iv) Statement of underwriters’ liability M N O P Total Firm Others 30,000 38,500 50,000 23,000 40,000 - 18,500 - 1,38,500 61,500 TOTAL 68,500 73,000 40,000 18,500 2,00,000 (v) Amounts due from underwriters M N O P Total Shares to be subscribed as per (iv) above 68,500 73,000 40,000 18,500 2,00,000 Amount due @ Rs. 60 per share 41,10,000 43,80,000 24,00,000 11,10,000 1,20,00,000 Less: Commission due on shares underwritten (10,50,000) (9,00,000) (7,50,000) (3,00,000) (30,00,000) 30,60,000 34,80,000 16,50,000 8,10,000 90,00,000 (vi) Commission payable to underwriters M 10,00,000 X 100 X 35% X 3% = 10,50,000 N 10,00,000 X 100 X 30% X 3% = 9,00,000 O 10,00,000 X 100 X 25% X 3% = 7,50,000 P 10,00,000 X 100 X 10% X 3% = 3,00,000 Journal Entry Rs. 5,70,00,000 Bank A/c Underwriting Commission A/c To Equity share Application A/c Dr. Rs. 30,00,000 6,00,00,000 3|Page MITTAL COMMERCE CLASSES IPCC – MOCK TEST AUDIT Answer: 1 (4 Marks) Self revealing errors Errors the existence of which becomes apparent in the process of compilation of accounts. Examples of self revealing errors are: Examples Revealing in Compilation Wrong totaling of the purchase book. Trial balance will not agree. Omission to post a part of a journal entry to the Trial balance will not agree. ledger. Failure to record in the cash book amounts paid Bank reconciliation statement will show up error. into or withdrawn from the bank. A mistake in recording amount received from X in Statements of account of parties will reveal the account of Y. mistake. Answer: 2 (5 Marks) Areas in which different accounting policies may be encountered Method of depreciation, depletion and amortization – Straight Line Method, Written Down Value method. Treatment of expenditure during construction i.e. write off, capitalization, deferment. Conversion or translation of foreign currency items – average rate, buying rate, selling rate, closing rate etc. Valuation of inventories-FIFO, LIFO, weighted average etc. Treatment of goodwill – write off, retain. Valuation of investment- at cost, market or net realizable value etc. Treatment of retirement benefits-Actuarial, funded through trust, insurance policy etc. Recognition of profit on long term contracts- on full completion or % completion etc. Valuation of fixed assets-historical cost, revaluation price, exchange fluctuation etc. Treatment of contingent liabilities. Answer: 3 (2 Marks Each) (i) Statement is incorrect. As per AS–1 “Disclosure of Accounting Policies” any change in the accounting policies which has a material effect should be disclosed, along with its effect on F.S. to the extent ascertainable. If such change is disclosed appropriately in the Financial Statements, auditor is not required to report in auditor’s report. (ii) Statement is incorrect. Section 129(1) of the Companies Act, 2013 states that every balance sheet of a company shall give a true and fair view of the profit or loss of the company for the financial year. (iii) Statement is incorrect. AS-1 “Disclosure of Accounting Policies” requires that if the fundamental accounting assumptions are followed in Financial Statements, specific disclosure is not required. If any of the fundamental accounting assumption is not followed, then a disclosure is not required. If any of the fundamental accounting assumption is not followed, then a disclosure is required. SM Answer: 1 (5 Marks) Business Process Reengineering (BPR) is an approach to unusual improvement in operating effectiveness through the redesigning of critical business processes and supporting business systems. It is revolutionary redesign of key business processes that involves examination of the basic process itself. It looks at the minute details of the process, such as why the work is done, who does it, where is it done and when it is done. BPR refers to the analysis and 4|Page MITTAL COMMERCE CLASSES IPCC – MOCK TEST redesign of workflows and processes both within the organization and between the organization and the external entities like suppliers, distributors, and service providers. The orientation of redesigning effort is basically radical. In other words, it is a total deconstruction and rethinking of business process in its entirety, unconstrained by its existing structure and pattern. Its objective is to obtain quantum jump in process performance in terms of time, cost, output, quality, and responsiveness to customers. BPR is a revolutionary redesigning of key business processes. BPR involves the following steps: 1. Determining objectives and framework: Objectives are the desired end results of the redesign process which the management and organization attempts to achieve. This will provide the required focus, direction, and motivation for the redesign process. It helps in building a comprehensive foundation for the reengineering process. 2. Identify customers and determine their needs: The designers have to understand customers - their profile, their steps in acquiring, using and disposing a product. The purpose is to redesign business process that clearly provides added value to the customer. 3. Study the existing process: The existing processes will provide an important base for the redesigners. The purpose is to gain an understanding of the 'what', and 'why' of the targeted process. However, some companies go through the reengineering process with clean perspective without laying emphasis on the past processes. 4. Formulate a redesign process plan: The information gained through the earlier steps is translated into an ideal redesign process. Formulation of redesign plan is the real crux of the reengineering efforts. Customer focused redesign concept are identified and formulated. In this step alternative processes are considered and the best is selected. 5. Implement the redesign: It is easier to formulate new process than to implement them. Implementation of the redesigned process and application of other knowledge gained from the previous steps is key to achieve dramatic improvements. It is the joint responsibility of the designers and management to operationalise the new process. Answer: 2 (5 Marks) A strategy manager has many different leadership roles to play: visionary, chief entrepreneur and strategist, chief administrator, culture builder, resource acquirer and allocator, capabilities builder, process integrator, crisis solver, spokesperson, negotiator, motivator, arbitrator, policy maker, policy enforcer, and head cheerleader. Managers have five leadership roles to play in pushing for good strategy execution : 1. Staying on top of what is happening, closely monitoring progress, working through issues and obstacles. 2. Promoting a culture that mobilizes and energizes organizational members to execute strategy and perform at a high level. 3. Keeping the organization responsive to changing conditions, alert for new opportunities and remain ahead of rivals in developing competitively valuable competencies and capabilities. 4. Ethical leadership and insisting that the organization conduct its affairs like a model corporate citizen. 5. Pushing corrective actions to improve strategy execution and overall strategic performance. 5|Page MITTAL COMMERCE CLASSES IPCC – MOCK TEST Answer: 3 (5 Marks) Functional structure is widely used because of its simplicity and low cost. A functional structure groups tasks and activities by business function. The functional structure consists of a chief executive officer or a managing director and limited corporate staff with functional line managers in dominant functions such as product, accounting, marketing, R&D, engineering, and human resources. Disadvantages of a functional structure are that it forces accountability to the top, minimizes career development opportunities, etc. 6|Page