2011-2012 FAFSA Day Presentation Long

advertisement

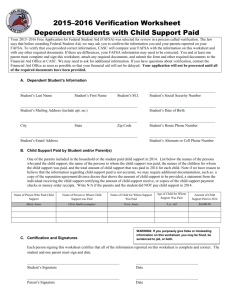

Applying for Financial Aid 2011-2012 1 Sponsors/Partners: Presenter: 2 Types of Financial Aid • Gift Aid - Grants or • • scholarships that do not need to be repaid Work - Money earned by the student as payment for a job on or off campus Loans - Borrowed money to be paid back, usually with interest 3 Sources of Financial Aid • Federal government • State government • • Colleges and universities Private agencies, companies, foundations, and your parents’ employers 4 Types of Applications FAFSA CSS/Financial Aid PROFILE Institutional financial aid application Deadlines and requirements vary by institution 5 FAFSA on the Web • Internet application used by students and parents to complete electronic FAFSA at www.fafsa.gov • Sophisticated on-line edits and skip logic so that errors are less likely to be made • On-line help is available for each question • Student and at least one custodial parent should get a federal PIN at www.pin.ed.gov 6 FAFSA on the Web Password Before starting the on-line FAFSA you will be asked to create a password This allows you to save your application and return to it at a later time 7 Federal PIN • PIN (Personal Identification Number) serves as the electronic signature on ED documents • Both student and at least one custodial parent need PIN to sign the FAFSA electronically • May be used to: • Correct/Update FAFSA • Add additional schools to receive FAFSA data • Needed each year the student completes the FAFSA Apply for student and parent PINs at www.pin.ed.gov 8 Getting Ready • Before starting the FAFSA, gather: • Student driver’s license • Student Alien Registration Card • Student and Parent Social Security cards 2010 W-2 Forms and other records of money earned 2010 federal income tax form (even if not completed) Records of untaxed income Current bank statements Business, farm, and other real estate records Records of stocks, bonds, and other investments Create a file for copies of all financial aid documents submitted 9 FAFSA on the Web Worksheet Used to collect information for the online application Does not include all questions from the FAFSA Do not mail this worksheet 10 The FAFSA on the Web Worksheet A Four Section Form Section 1 – Student information Section 2 – Student dependency status Section 3 – Parent financial information for dependent students Section 4 – Student financial information 11 Section 1 (page 2) STUDENT INFORMATION 12 Section 1 Student Name J O N E S J A N E The online FAFSA will ask for the student’s last name, first name, and middle initial Make sure to report the student’s name exactly as it appears on the student’s Social Security card 13 Section 1 Student Social Security Number 1 2 3 - 4 5 - 6 7 8 9 Double check the student’s Social Security Number when entering it on the FOTW. Both student name and Social Security Number will be compared through a national database match 14 Section 1 Citizenship Status If U.S. citizen, status will be confirmed by Security match Social If eligible noncitizen, status will be confirmed by Department of Homeland Security (DHS) match. This includes: U.S. permanent residents with I-551 Conditional permanent residents with I-551C Eligible noncitizens with I-94 Certification from Department of Health and Human Services with designation of “Victim of human trafficking” If neither a citizen or eligible noncitizen, the student is ineligible for federal/state aid, but might still be eligible for institutional funds 15 Section 1 Alien Registration Number 9 8 7 6 54 3 2 1 If an eligible noncitizen, write in the student’s eight- or nine-digit Alien Registration Number (ARN) Precede an eight-digit ARN with a zero Copy of Permanent Registration Card might be requested by the Financial Aid Office 16 Section 1 Undocumented Students NOTE: if the student is undocumented or under-documented Check with colleges and universities to see if institutional financial aid is available Apply for all private scholarships for which the student may be eligible Watch for changes in federal and state laws regarding the eligibility of undocumented or under-documented students Start inquiring in elementary, middle or high school to see if it is possible for younger students to become permanent residents For more information and a list of scholarships, go to www.maldef.org/pdf/scholarships.pdf www.latinocollegedollars.org www.finaid.org/otheraid/undocumented.phtml 17 Section 1 Student Marital Status The student should check his or her marital status as of the date the FAFSA on the Web is completed If the student is married or remarried, he or she will be asked to provide information about his or her spouse 18 Section 1 Selective Service Registration Male students who are between the ages of 18 and 25 years of age must be registered with Selective Service to receive federal and state aid Answer “Register me” only if the student is male, aged 18-25, and has not yet registered. The student may also register by going to: www.sss.gov 19 Section 1 Student Aid Eligibility Drug Convictions If the student has never attended college since high school, check “Never attended college” If the student has attended college since high school but never received federal student grants, loans or work-study, check “I have never received federal student aid” If the student has received federal student aid and has never had a drug conviction, check “I have never had a drug conviction” 20 Section 1 Student Aid Eligibility Drug Convictions If the student was convicted of the possession or sale of illegal drugs while receiving federal student aid, the student will be asked to complete more questions about the drug offense Simply having a drug conviction does not mean that the student will be ineligible for federal student and/or state student aid 21 Section 1 Parents’ Educational Level Indicate highest level of schooling completed by the student's biological or adoptive parents Use birth parents or adoptive parents - not stepparents or foster parents This definition of parents is unique to these two questions 22 Section 1 Student State of Legal Residence An important question NOT on the Worksheet: Student State of Legal Residence Residency relates to the student’s permanent home state if the student is dependent, the state of legal residence is usually the state in which the custodial parent(s) live State of legal residence is also used to determine eligibility for state grants in the need calculation to determine the appropriate allowance for state and other taxes paid by that state’s residents 23 Section 1 High School Completion Status An important question NOT on the Worksheet: High School Completion Status When the student begins college in the 2011-2012 school year, what will be the student’s high school completion status? High school diploma GED certificate Home schooled None of the above 24 Section 1 High School Completion Status An important question NOT on the Worksheet: If student selects High School diploma they will be required to list the high school they received or will receive diploma from FAFSA on the Web allows students to search for high school by name, city and state 25 Section 1 Grade Level in 2011-2012 An important question NOT on the Worksheet: Grade Level in 2011-2012 When the student begins the 2011-2012 school year, what will be his/her grade level? Never attended college/1st year Attended college before/1st year 2nd year/sophomore 3rd year/junior 4th year/senior 5th year/other undergraduate 1st year graduate/professional Continuing graduate/professional or beyond 26 Section 1 Degree or Certificate Objective An important question NOT on the Worksheet: Degree or Certificate In the 2011-2012 school year, what degree or certificate will you, the student, be working on? Some options are: - 1st bachelor’s degree - Associate degree (occupational or technical program) - Associate degree (general education or transfer program) - Graduate or professional degree 27 Section 1 Interest in Receiving Work-study An important question NOT on the Worksheet: FAFSA on the Web asks If the student is interested in being considered for workstudy Indicating interest does not obligate the student to work nor will it cause the student to lose grants and scholarships Answering “no” may restrict the students opportunity to utilize work-study 28 Section 1 School Selection An important question NOT on the Worksheet: FAFSA on the Web allows the student to list up to 10 colleges/universities that will receive his/her student and parent information list all schools where student is applying for admission If school code is not known you may search by city, state or college name • If the student is applying to more than ten colleges, wait for the processed Student Aid Report (SAR) before deleting/adding additional colleges 29 Section 2 (page 2) STUDENT DEPENDENCY STATUS 30 Section 2 Determination of Student Dependency Status To be considered independent the student must meet one of the following criteria 24 or older Married Graduate Student Serving on active duty in U.S. Armed Forces Veteran of U.S. Armed Forces Have children or dependents who receive more than half of their support In foster care, dependent or ward of the course or parents were deceased any time after age 13 Emancipated minor In legal guardianship Homeless, risk of being homeless, or unaccompanied youth 31 Section 3 (page 3) PARENT INFORMATION 32 Section 3 Who is Considered a Parent See instructions on page 3 of FAFSA on the Web Worksheet Biological or adoptive parent(s) Stepparent (regardless of any prenuptial agreement) In case of divorce or separation, provide information about the parent and/or stepparent the student lived with more in the last 12 months 33 Section 3 Who is Not a Parent Do not provide information on: Foster parents or legal guardians If the student is in foster care or has a legal guardian, he/she is automatically considered an independent student Grandparents or other relatives The student must attempt to get biological parental information Colleges may use Professional Judgment to allow the student to file as independent 34 Section 3 Parents’ Tax Return Filing Status for 2010 The student will be asked to provide information about parent tax filing status for 2010: If his/her parents have completed their 2010 federal income tax return, mark the first box If they have not as yet filed, but plan to file a 2010 federal income tax return, mark the second box If they have not, nor will not, file a 2010 federal income tax return and are not required to do so, mark the third box 35 Section 3 Parent 2010 Adjusted Gross Income If the student’s parents have not yet filed their 2010 federal tax return, use estimated information for this question If the student’s parents have completed their 2010 federal tax return, use actual 2010 tax return information to complete this item. Reminder: If the answer is zero or the question does not apply, enter 0 36 Section 3 Money Earned from Work by Parent(s) in 2010 Use W-2 forms and other records to list all income earned from work in 2010 (including business income earned from self-employment) for father/stepfather and/or mother/stepmother 37 Section 3 Dislocated Worker • The student will be asked to check if the father/stepfather and/or mother/stepmother is a dislocated worker • A person may be considered a dislocated worker if he/she: • is receiving unemployment benefits due to being laid off or losing a job and is unlikely to return to a previous occupation • has been laid off or received a lay-off notice from a job • was self-employed but is now unemployed due to economic conditions or natural disaster • is a displaced homemaker 38 Section 3 Parent 2010 U.S. Income Taxes An important question NOT on the Worksheet: What was the amount parents’ U.S. income tax for 2010? Found on federal tax return Not the amount withheld from parents’ paychecks 39 Section 3 Parents’ 2010 Tax Exemptions An important question NOT on the Worksheet: • Enter the parents’ tax exemptions for 2010 Exemptions can be found on their IRS tax return Be sure to include all persons being claimed on the parents’ 2010 federal tax return, regardless of whether they are included in the parents’ household size question 40 Section 3 IRS Data Retrieval Tool While completing online FAFSA applicant may submit real-time request to IRS for tax data If successful match is made, IRS federal tax information will be displayed Applicant chooses whether or not to transfer tax data to online FAFSA Participation is voluntary Available January 30th Available for FAFSA corrections 41 Section 3 Parents’ Household 2009 or 2010 Benefits Received Indicate if the student, his/her parents, or anyone in the parents’ household received benefits in 2009 or 2010 from any of the federal programs listed Actual amounts received are not reported 42 Section 3 2010 Parent’s Additional Financial Information Check all items received or paid in 2010 FAFSA on the Web will ask for amounts received/paid 43 Section 3 2010 Parent Untaxed Income Check all that apply in 2010 FAFSA on the Web will ask for amounts received 44 Section 3 Parent Assets Parents may be asked to report their assets. If so: List the net value of parents’ assets as of the day the FAFSA is signed If net worth is one million dollars or more, enter $999,999 If net worth is zero, enter 0 $ , 0 NOTE: Some financial aid offices may request supporting documentation for the answers to these questions 45 Section 3 Parent Assets Parents may be asked to report: Current balances of cash, savings and checking accounts Net valued of investments such as real estate, rental properties, money market and mutual funds, stocks, bonds and other securities Net value of businesses and investment farms Note: Do not include the value of your primary residence, the value of life insurance, retirement accounts and small family businesses as described in the FAFSA instructions. 46 Section 3 Parent E-Mail Address An important question NOT on the Worksheet: Provide a parent e-mail address that will be valid at least until the student starts college If a parent provides an e-mail address, the FAFSA processor will let the parent know the student’s FAFSA has been processed 47 Section 3 Parent Household Size An important question NOT on the Worksheet: Parent Number in Household Include in the parents’ household: The student Parent(s) Parents’ other dependent children, if the parents provide more than half their support or the children could answer “no” to every question in Section 2, regardless of where they live Other people, if they now live with the parents and will continue to do so from 7/1/11 through 6/30/12, and if the parents provide more than half their support now, and will continue to provide support from 7/1/11 through 6/30/12 48 Section 3 College Students in the Parent Household An important question NOT on the Worksheet: College Students in the Parent Household Always include the student even if he/she will attend college less than half-time in 2011-2012 Include other household members only if they will attend at least half-time in 2011-2012 in a program that leads to a college degree or certificate Do not include the parents NOTE: Some financial aid offices will require proof that other family members are attending college 49 Section 4 (page 4) STUDENT INFORMATION 50 Section 4 Student Information • Questions in Section 4 are identical to the parent financial questions we covered in Section 3 If the student is single, ignore references to “spouse” If the student is married, report spouse’s income and assets Skip the student’s adjusted gross income question if the student is not required to file taxes 51 Section 4 Student Information There are questions in Section 4 that the student will be asked only if he/she checked at least one response in Section 2 – Student Dependency Status 52 Section 4 Student Benefits Indicate if anyone in the student’s household received benefits in 2009 or 2010 from any of the federal programs listed Actual amounts received are not reported 53 Section 34 Student Household Size An important question NOT on the Worksheet: • Include in the student’s household: • The student and the student’s spouse (if married) • The student’s dependent children, if the student provides more than half their support • Other people, if they now live with the student and will continue to do so from 7/1/11 through 6/30/12, and if the student provides more than half their support now, and will continue to provide support from 7/1/11 through 6/30/12 54 Section 4 Student Number in College An important question NOT on the Worksheet: • Count the student even if he/she will attend college less that half-time in 2011-2012 • Include others only if they will attend at least half-time in 2011-2012 in a program that leads to a college degree or certificate 55 Special Circumstances Contact the Financial Aid Office if there are circumstances which affect a family’s ability to pay for college such as: • • • • • • Loss or reduction in parent or student income or assets Death or serious illness Natural disasters affecting parent income or assets Unusual medical or dental expenses not covered by insurance Reduction in child support or other untaxed benefits Financial responsibility for elderly grandparents Or any other unusual circumstances that affect a family’s ability to contribute to higher education 56 What Happens Next? FAFSA information is sent to colleges listed on the application and Students receive Student Aid Report (SAR) from federal processor Students and families review SAR for important information and accuracy of data Colleges match admission records with financial aid applications and determine aid eligibility Colleges mail notices of financial aid eligibility to admitted students who have completed all required financial aid forms 57 Student Aid Report (SAR) • • • After the student completes the FAFSA on the Web, a SAR will be sent to the student • An electronic SAR Acknowledgment will be sent if student provides an email address • A paper SAR will be mailed if no student e-mail address is provided An electronic copy of the data will be sent to each college or university listed by the student in Section 1 Keep a copy of the SAR with other financial aid documents 58 Summary of the Financial Aid Process • • • • • • Submit all required forms, including the FAFSA, by each college’s published deadlines Keep a copy of all forms submitted Review the electronic Student Aid Report (SAR) Acknowledgement or the paper SAR sent to the student Watch for financial aid award notifications from colleges to which the student has been admitted Be sure to apply for financial aid this year and every year as soon as possible after January 1 to receive the best financial aid award possible ASK QUESTIONS! 59 Questions and Answers 60