24 Negotiable Instruments II

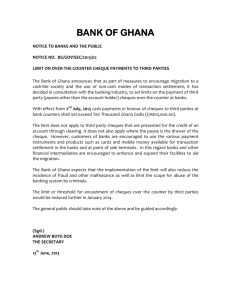

advertisement

Previous Lecture Promissory Note Bill of exchange Negotiable Instruments - 2 Lecture # 24 State Bank of Pakistan According to Article 35.- (1)of the State Bank of Pakistan Act, the Federal Government shall draw, accept, make or issue any Bill of Exchange, Promissory Note State Bank of Pakistan Any person contravening the provision of this Section shall be punishable upon conviction with fine which may extend to double the amount of the Bill, Promissory Note, whereof the offence is committed. Bank A financial institution licensed as a receiver of deposits. There are two types of banks: Commercial/retail banks and Investment banks. In most countries, banks are regulated by the national government or central bank. Bank An establishment to • Accept deposits, • Pay interest, • Clear checks, • Make loans, to its customers. Commercial bank Commercial banks are the most common type of banks. They conduct their business purely on profit motive. The main function of a commercial bank is to accept deposits from those who have surplus funds and lend on interest to those who require funds. Commercial bank The National Bank of Pakistan, the Habib Bank Limited, the Muslim Commercial Bank Limited, the United Bank Limited, are some of the examples of commercial banks in Pakistan. Industrial banks The long-term credit needs of industries Industrial Development Bank of Pakistan was established in 1961 Agricultural banks Agricultural banks provide longterm, medium-term and shortterm finance to agriculture sector. Zarai Taraqiati Bank of Pakistan Exchange banks The exchange banks are those specialized banks which carry on foreign exchange business In Pakistan some of the commercial banks are authorized to conduct foreign exchange business Investment banks Investment banks purchase and sell shares, bonds and securities Investment Corporation of Pakist an and National Investment Trust Ltd. (N.I.T) are serving as investment banks in Pakistan Micro-finance banks The main objectives of microfinance banks is to provide small loans to small traders In Pakistan micro-finance banks and Khush-hali bank are the examples of this type of bank Cheque No…… Branch ….. Date _____ Pay ________________________________ A sum of __________________ Rs._______ abc ABC Distinction Between Bill & Cheque • Bill of exchange – Bill is Drawn on anyone – Bill must be Accepted – 3 days Grace Period sometimes required • Cheque – Cheque is Drawn on Bank – Cheque is not Accepted – No Grace Period required for Cheque Distinction Between Bill & Cheque • Bill of exchange – If not Presented, Payer discharged – Notice of Dishonor is Required – Bill is not Revocable – Bill is not Crossed • Cheque – Till not Presented, Payer Engaged – No Notice of Dishonor Required – Cheque is Revocable – Cheque may be Crossed Payment Instructions • Check Present Time at Bank • Application for FIR at Police When Banker Must Refuse Payment • Customer Instructions • Customer Death • Customer Insolvent When Banker Must Refuse Payment • Customer became Insane • Court Order • Notice of Assignment of Credit Balance When Banker Must Refuse Payment • Title Defective • Closer of Account Next Lecture Company Law - 1