BUSINESS DOCUMENTS – PowerPoint

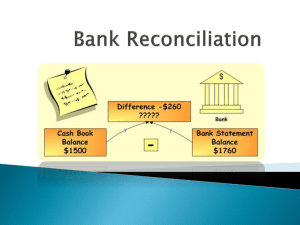

advertisement

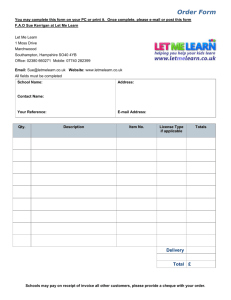

BUSINESS DOCUMENTS Year 9 BUSINESS FINANCIAL DOCUMENTS The documentation prepared when conducting business includes: Purchase orders Tax invoices Delivery notes Adjustment notes Cheques Receipts ERRORS Any errors made in completing such forms should be neatly crossed out, corrected and initialled on manually prepared forms. FLOW OF DOCUMENTS BETWEEN BUYER AND SELLER Buyer sends purchase order Seller sends buyer a receipt Seller Receives purchase order Buyer sends seller a cheque and remittance advice Seller sends delivery note; invoice and goods If goods are damaged, seller sends adjustment note to buyer PURCHASE ORDERS Orders for goods and services can be placed by telephone or by faxing or mailing a written purchase order. Orders should be signed by an authorised person to provide greater stock control and help eliminate the over or under ordering of stock. TAX INVOICE A tax invoice is a bill provided to customers indicating goods / services purchased and the amount owing. The tax invoice accompanies the goods being delivered to the purchaser. Terms Meaning N/7 Net 7 days – the amount owing must be paid within 7 days 2/7 Two per cent discount can be deducted from the total amount owing if received within seven days N/30 Net 30 days – the amount owing must be paid within 30 days 2/7; N/30 Two per cent discount can be deducted from the total amount owing if received within seven days – OTHERWISE the total bill (without discount) must be paid in full with 30 days. DELIVERY NOTE Delivery notes, also known as delivery slips, delivery dockets or packing slips are prepared when goods are ready to be despatched to the purchaser. The supplier requires the purchaser sign the delivery notes to acknowledge that the goods have been received in good condition. The purchaser should carefully check that the order is correct and that the goods are indeed in good condition before formally accepting delivery of items. ADJUSTMENT NOTE There are many reasons businesses seek adjustment notes – damaged product; incorrect size; wrong colour; overcharge. Dissatisfied buyers can either return the goods and be credited for the total amount owing on those items, or retain the goods but seek a reduction in the amount owing to the supplier. In both circumstances, an adjustment note is prepared by the seller. CHEQUES A cheque must be signed by an authorised person, allows money to be transferred from one party to another. It instructs the financial institution to withdraw money from the business’s account to pay a stipulated person / organisation. There are three parties to a cheque: The drawer – the person or business from whose account the money is withdrawn The drawee – the financial institution upon which the cheque is drawn and whose name is preprinted on every cheque The payee – the person or business who is being paid Cheques are usually divided into two sections: the cheque butt and the cheque form. The cheque butt must always be completed first to ensure that correct payment details are recorded and to avoid making errors on the cheque form. The two most common types of cheques are open and crossed. An open cheque instructs the drawee to pay anyone who presents the cheque for payment. Open cheques should only be used to withdraw cash from the business’s account for specific purposes. A crossed cheque offers greater security because once the cheque has been crossed; it must be banked into an account. RECEIPT When a debtor forwards a cheque in payment of the amount owing as per the tax invoice, the creditor will forward a receipt to the debtor if requested. BANK RECONCILIATION Account for differences between the cash book and bank statement balances. When the business receives a bank statement, it checks the CASH book against the items listed on the bank statement. Any discrepancies, such as errors, or omissions, are identified. The aim is for the Cash book to balance with the Bank statement. Differences between records Bank Statement Cash Books ( Cash Receipts Journal; Cash Payments Journal; & Cash at Bank) Interest paid Cheques (un presented – issued by business BUT not yet taken to the bank by the recipient) Bank fees and government charges Cheques banked by the business but declined by the bank (Dishonoured cheques) Deposits paid directly into bank account (Bpay, Internet Banking or merchant settlements) Deposits banked by the business that have not yet appeared on the bank statement (deposits not yet credited) Periodical Payments (loan repayments) Errors made by both parties (incorrect recording of figures) Deposits from sales (EFTPOS) Errors made by both parties (incorrect recording of figures)