Key Skills (21 years of banking experience)

advertisement

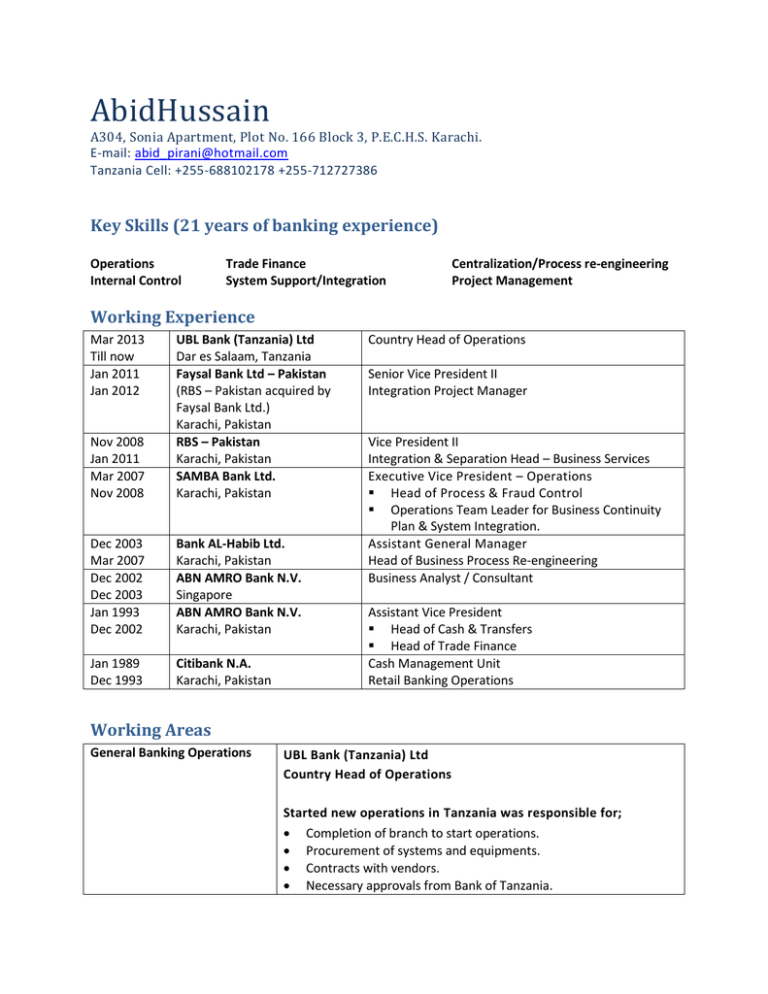

AbidHussain A304, Sonia Apartment, Plot No. 166 Block 3, P.E.C.H.S. Karachi. E-mail: abid_pirani@hotmail.com Tanzania Cell: +255-688102178 +255-712727386 Key Skills (21 years of banking experience) Operations Internal Control Trade Finance System Support/Integration Centralization/Process re-engineering Project Management Working Experience Mar 2013 Till now Jan 2011 Jan 2012 Nov 2008 Jan 2011 Mar 2007 Nov 2008 UBL Bank (Tanzania) Ltd Dar es Salaam, Tanzania Faysal Bank Ltd – Pakistan (RBS – Pakistan acquired by Faysal Bank Ltd.) Karachi, Pakistan RBS – Pakistan Karachi, Pakistan SAMBA Bank Ltd. Karachi, Pakistan Dec 2003 Mar 2007 Dec 2002 Dec 2003 Jan 1993 Dec 2002 Bank AL-Habib Ltd. Karachi, Pakistan ABN AMRO Bank N.V. Singapore ABN AMRO Bank N.V. Karachi, Pakistan Jan 1989 Dec 1993 Citibank N.A. Karachi, Pakistan Country Head of Operations Senior Vice President II Integration Project Manager Vice President II Integration & Separation Head – Business Services Executive Vice President – Operations Head of Process & Fraud Control Operations Team Leader for Business Continuity Plan & System Integration. Assistant General Manager Head of Business Process Re-engineering Business Analyst / Consultant Assistant Vice President Head of Cash & Transfers Head of Trade Finance Cash Management Unit Retail Banking Operations Working Areas General Banking Operations UBL Bank (Tanzania) Ltd Country Head of Operations Started new operations in Tanzania was responsible for; Completion of branch to start operations. Procurement of systems and equipments. Contracts with vendors. Necessary approvals from Bank of Tanzania. Hiring staff. Writing policies and procedures. Target achieved and operations started in May 2013. ABN AMRO Bank N.V. Cash & Transfer Department Dec 1993 – Joined as Head of Cash & Transfer. Responsible for managing Cash, Remittances, Clearing, Collections etc. Project assigned to convert all manual processes into automated / computerised environment. Appointed System Co-ordinator for Operations – automated all functions i.e. cash handling, clearing & collection, remittances & transfers, account opening & closing and miscellaneous accounting entries. Goal Achieved in May 1994. Next task given – to write / update all operational procedures. Main objective was to compile and standardise all processes while incorporating Bank Policies, Head Office requirements and local Central Bank regulations. Goal Achieved in Aug 1994. Completely involved in opening of new branch in Lahore and did review of procedures after opening. Trade Finance Citibank N.A. Karachi – Pakistan Cash Management Unit Started as an Assistant. Worked in Cash Management Unit: Major functions being processing of Retail Banking products. In 1992 was promoted to Supervisor and made responsible for all inward / outward remittances, local clearing & collection, local and foreign currency term deposits, complete customer desk maintenance. In addition, was responsible for Shares Subscription Desk – this included receiving, scrutinizing and processing of all shares subscription applications. ABN AMRO Bank N.V. Assistant Vice President Trade Finance Department Jan 2000 – (Unit Head Imports, Guarantees & Forward Cover) Promoted as Assistant Vice President. Responsible for smooth processing of transactions of all Pakistan Branches, update process flows by applying re-engineering concepts, improve service quality, enhance system capabilities, improve staff productivity, automate manual process in Microsoft Excel/Access environment, closely monitor the issues between all branches and provide solutions, understand customer’s needs and provide solutions, prepare various reporting for Region Office and Central Bank etc. Jan 1999 – Completely involved for Trade Centralisation in Karachi Centralization/Process reengineering Internal Control for all Pakistan Branches. Major responsibilities were to suggest modifications required in T.A.S.K. systems and to design process flow in centralised environment. Target achieved in Mar 99. Jan 1997 – Promoted as Manager and transferred to Import Department as Unit Head. Made major enhancement into the inhouse developed system “T.A.S.K.” Jan 1996 – Transferred to Trade Finance. Here I was given the responsibility of updating the in-house system for Trade Finance (related to Exports) and co-ordinate with Islamabad and Lahore Branches to implement “T.A.S.K.” changes. In addition, headed the Exports Department. Goal achieved in Dec 1996. Bank AL-Habib Ltd. Assistant General Manager Head of Business Process Re-engineering. Assigned responsibility to centralized Account Opening, Cheque Book Issuance, Remittances, and Trade Finance for all Pakistan Branches. Target achieved successfully. Simultaneously is responsible to apply re-engineering methodology on different banking products. The process includes review of product, suggest changes and implement. SAMBA Bank Ltd. Executive Vice President Head of Process & Fraud Control Operations Team Leader for Business Continuity Plan & System Integration. Process Control Unit Fraud Control Unit Business Process Re-engineering Unit Reconciliation Unit Responsible for the overview of the operations and technology areas. Also responsible for the design and implementation of new procedures and the review of existing ones to ensure compliance with Bank’s Policy including AML/SBP/Prudential regulations as stipulated by Central Bank. Responsible for identification of issues with business processes and/or coordinating and monitoring corrective action. Coordinating responses and tracking relevant Audit points. Defining Operations control policies and ensuring policy adherence. Management of relationship with other control departments such as Finance and Audit. Perform role of Business Representative for Operations within Business Continuity Programme. Assist with analysis of operations procedures, processes, and problems and thereby identify areas for automation or improved workflow. Review workflow to evaluate effectiveness and propose system changes to improve productivity, and interact with staff in analysing existing operational procedures and interpreting how client needs can be better met. RBS Pakistan Transition Risk – Business Services. Responsible for identifying potential risks during transition phase for entire Business Services (i.e. Operations & Technology), suggest mitigations/actions, monitor and track closures. Branch Spot Review – Special Branch review project for all 79 branches during transition, lead the review team, prepared smart review checklist, identifying high risk areas, suggest resolution and track for closure. System Support/Enhancement ABN AMRO Bank N.V. Business Analyst / Consultant Working for ABN AMRO Bank N.V., Singapore & Chennai for implementation of BankTrad (Global Trade Finance System) throughout Asia region. Responsible to review Products/Procedures and identify gaps. Suggest workaround/changes as per country’s specific requirement; prepare Business Document and Business Test Cases. Compile issues/gaps raised during testing. Suggest solutions and escalate changes/enhancements if required. Additionally responsible to review Business Test Cases for Middle East and Far East region. Identify unique scenarios needs to be tested other then the standard test cases. Other System Projects Shares Floatation, Citibank N.A., Karachi – Involved to develop a system based on FoxPro & DBASE to assist the floatation of shares and its subsequent processing and administration work. Staff Loan, Citibank N.A., Karachi – Involved in developing a system for loans granted by multinational companies to their employees. This system was also based on FoxPro. T.C.S.S. (Teller Client Services System), ABN AMRO Karachi – Operations co-ordinator for designing, testing and training to staff. T.A.S.K. (Trade Application System Kernel), ABN AMRO Karachi – Operations co-ordinator for enhancing existing applications and testing. T.C.S.S., ABN AMRO Nairobi, Kenya – Visited Nairobi office to carry out an analysis for customising the existing system to meet their requirements. T.A.S.K., ABN AMRO Bahrain – Visited Bahrain office for demonstration of system and to workout the changes / enhancement according to their requirements. SMOOTH PC, ABN AMRO HongKong – Visited HongKong office to analyse and prepare report to adopt SMOOTH PC System (Trade Project Management Finance Package in electronic environment). S.W.I.F.T. Interface – Completely involved in creating interface between T.C.S.S. and S.W.I.F.T. S.W.I.F.T. Interface – Completely involved in designing forms to create interface between T.A.S.K. and S.W.I.F.T. Bank Contract Module (For processing Import transactions without opening of Letter of Credit) in T.A.S.K. – Prepared (BRD) Business Requirements Document, completely involved in testing, training and implementation. Faysal Bank Ltd Symbols upgrade and TCSS migration project. RBS Pakistan SCORE Replacement Project –The project is to migrate from CORE Banking Application (SCORE) and develop the same functionality in inhouse developed system (TCSS). Responsible for managing the entire project i.e. development, UAT, Parallel Run and GO LIVE. Branch Spot Review – Special Branch review project for all 79 branches during transition, lead the review team, prepared smart review checklist, identifying high risk areas, suggest resolution and track for closure. SAMBA Bank Ltd Core Banking system replacement Project. Bank Al-Habib Ltd. Archiving Data and Electronic File Management Project. ABN AMRO Bank N.V. S.W.I.F.T. Implementation Project Course/Workshop attended Fundamentals of Life and Health Insurance, August 1989 – Life Office Management Association (LOMA). CitiSelling by Phone, June 1993 – Citibank N.A., Karachi. Basic Service Skills, Sept 1995 – ABN AMRO Bank, Karachi. Presentation Skills, Aug 1997 – Training 2000, Karachi. Payments, Collection & Documentary Credits, June 1997 – S.W.I.F.T. Bahrain. Documentary Credits, Nov 1997 – ABN AMRO Academy, Amsterdam, Holland. Service ServiceService, Sep 98 – ABN AMRO Bank, Karachi. Individual Recognition Workshop, July 99 – ABN AMRO Bank, Karachi. Workshop on Re-engineering, Nov 99 – Pakistan Institute of Management. Introduction to Computer Programming, Dec 99 – FCCS, Karachi. Trade Finance Structuring & Solutions, August 2000 – ABN AMRO Bank, Karachi. Leadership Excellence, September 2000 – ABN AMRO Bank, Karachi. Executive Training on Microsoft Access, November 2000 – APIIT (Asia Pacific Institute of Information Technology), Karachi. Time Management Workshop, December 2000 – ABN AMRO Bank, Karachi. Workshop on Professional Empowerment – March 2001 – KZR, Karachi. Workshop on Motivation, Coaching and Delegation – August 2001 – KZR, Karachi. Date of Birth 13-Aug-1963 Education Commerce Graduate from University of Karachi.