Quiz #5

advertisement

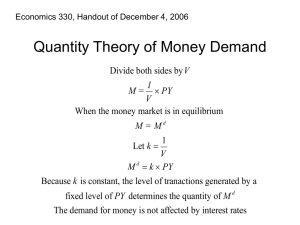

ECO 102 Fall 2013 Quiz 5 1. The “portfolio allocation decision” refers to: a. the decision of how much of one’s money to hold as cash and how much as bank deposits. b. the decision of how much diversification is needed to reduce the risk associated with stocks and other risky assets. c. the decision by a bank whether to make new loans or to hold bank reserves. d. the decision by a person about what forms (or types of assets) to hold his/her wealth in – especially whether to hold money or interest-earning assets. e. the central bank’s decision whether to increase the money supply by open market operations or by lowering the discount rate. 2. In the money supply – money demand diagram, the money demand curve is ____ because: a. upward-sloping interest. b. upward-sloping more money. c. downward-sloping holding money is greater. d. downward-sloping shorter period of time. e. none of the above. at higher interest rates, more money is needed to pay the at higher price levels, any amount of spending will require at higher interest rates, the interest that is not earned by at higher price levels, people will hold onto money for a 3. The reason the aggregate demand curve is downward-sloping is because: a. b. c. d. e. at higher prices, everything becomes more expensive. at higher interest rates, the government borrowing falls. at higher interest rates, net exports rise. at higher prices, people’s holding of money falls in value, making them less wealthy. at higher interest rates, banks lend more money and increase the money supply. 4. If all prices (including wages) can adjust immediately, then the LRAS curve will be: a. flat, with the LRAS showing any output is possible at current prices. b. vertical, with the LRAS curve showing that equilibrium income can be achieved at any interest rate. c. upward-sloping, with the LRAS curve intersecting the AD curve at equilibrium income. d. upward-sloping, with the LRAS curve intersecting the AD curve at the level of potential GDP. e. vertical, with the LRAS curve showing that the potential GDP can be produced at any price level or at any inflation rate. 5. that: The short-run aggregate supply curve is _____-sloping. This depends on the assumption a. downward money becomes less valuable at higher price levels and higher inflation rates. b. upward when prices rise, not all prices adjust completely, with wages being very slow to adjust. c. upward wage rates can adjust immediately to ensure that the labor market is in equilibrium, but other markets are slow to adjust. d. downward non-monetary forms of wealth fall in value when the price level rises. e. downward wealth held as money rises in value when the price level rises. 6. Over the long run, output and income will tend to converge to ____. The force that eventually causes this to happen is: a. potential GDP the central bank’s use of monetary policy to promote fullemployment. b. equilibrium output interest rates adjust to set money supply equal to money demand. c. potential GDP prices and wages rise when there is more-than-usual demand for products and labor, and fall when there is less-than-usual demand for products and labor. d. potential GDP firms increase output when unplanned investment is positive, and decrease output when unplanned investment is negative. e. zero firms decrease output when unplanned investment is positive, and increase output when unplanned investment is negative.