week_5_-_term_5_homework

advertisement

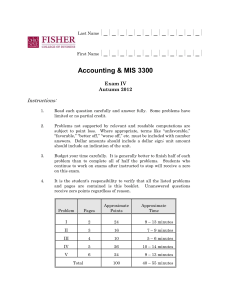

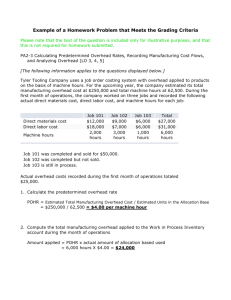

Week 5 – Term 5 Homework 60 Points Due June 10, 2012 1.(6 points) At the beginning of 2010, Zuir Company's accounting department calculated the following estimates for the coming year's production: Estimated overhead Direct labor hours $441,600 9,200 hr During the year, Zuir Company experienced $440,000 in actual overhead costs and actually worked 9,100 direct labor hours. Zuir applies overhead to production using a predetermined overhead rate based on direct labor hours. a. Calculate the predetermined overhead rate Zuir uses to apply overhead. (Show your computations.) b. By what amount was overhead over- or underapplied for 2010? (Show your computations.) c. Assuming the amount of over- or underapplied overhead is not significant, will the Cost of Goods Sold account be increased or decreased to correct the application of overhead? 2.(10 points) Yamishi Production had the following inventories for the first quarter of 20xx: Materials Work in process Finished goods Beginning $606,600 312,100 416,100 Ending $522,100 280,800 540,200 Purchases of materials during the quarter were $427,800. Total direct labor costs were incurred in the amount of $1,482,000. Actual overhead costs were incurred as follows: operating supplies used, $17,100; janitorial and maintenance, $87,300; employee benefits, $26,400; utilities, $162,000; depreciation of factory, $43,200; property taxes, $24,000; factory insurance, $29,000. Net sales for the quarter were $3,562,200. Selling and administrative expenses were $508,000. Income taxes should be computed at 40 percent. Prepare a statement of cost of goods manufactured for the first quarter of 20xx. 3.(6 points) The following information has been made available to you. Assume that overhead is applied on the basis of direct labor hours. Estimated overhead Estimated direct labor hours $1,638,000 390,000 Actual direct labor hours Actual overhead 442,000 $1,862,000 a. Compute the predetermined overhead rate. b. Compute the amount of applied overhead for the year. c. Compute the amount of underapplied or overapplied overhead. 4.(6 points) Job 29 consists of 300 units and has total manufacturing costs of direct materials, $4,500; direct labor, $7,500; and overhead, $3,600. a. What is the unit product cost? b. What are the prime costs per unit? c. What are the conversion costs per unit? 5.(10 points) Cancun Company uses a FIFO process costing system. Cancun Company Equivalent Production November Physical Units Beginning inventory 2,350 Equivalent Units Units started this period 10,120 Direct Materials Units to be accounted for 12,470 Beginning inventory 2,350 Units started and completed 9,120 Ending inventory 1,000 Units accounted for 12,470 The following costs relate to work in process during November: Beginning inventory Direct materials Direct labor Overhead $7,200 380 630 Current month's costs Direct materials $51,612 % Conversion Costs % Direct labor Overhead 21,562 32,342 At the end of the last period, all direct materials had been added, and the units were 40% complete for conversion costs. At the end of this period, all direct materials for the 1,000 units had been added, and 70% of conversion costs had been incurred. Prepare a process report for November, and identify the amount to be transferred. 6.(4 points) Denapasa Manufacturing leases a vacuum cleaning system for a basic monthly fee plus an additional cost per hour used above a given minimum for each month. Given below is the information for the most recent six-month period on the number of machine hours of use and the total cost under this lease. Month 7 8 9 10 11 12 Machine Hours 6,300 4,400 4,700 5,200 5,600 5,000 Total Cost $58,200 49,935 52,390 54,440 56,620 53,800 You are to provide information for planning on the variable and fixed cost elements in this lease. Use the high-low method to (a) determine the variable cost per machine hour and (b) compute the fixed and variable costs for months 7 and 8. 7.(4 points) Ditex is a manufacturer of digital cameras and is preparing production and sales forecasts for the coming fiscal year. The company needs to determine the point at which the projected sales revenue will equal the total of all fixed and variable costs. Fixed costs are estimated to be $314,390, and variable costs are expected to be maintained at $150 per camera. Each camera will sell for $299. Compute (a) the breakeven point in sales units and (b) the breakeven point in sales dollars. 8.(6 points) A new product, an easy to store guitar stand, is being planned, with the following cost estimates: variable cost per unit, $9, and total fixed costs, $58,000. The projected sales price is $13 each. a. Using the contribution margin approach, compute the number of units that must be sold to break even. b. Using the same approach and assuming that fixed costs can be reduced by $8,000, how many units must be sold to produce a profit of $65,000? c. Given the original information and the projection that 50,000 units can be sold, compute the selling price that the producer must use to obtain a profit of $150,000. 9.(8 points) Projected cost information for a new product to be produced by Kolier Manufacturing is as follows: Expected variable unit costs: Direct materials Direct labor Overhead Selling costs $10.90 7.18 1.92 4.00 Annual fixed costs: Taxes on property used Depreciation on building and equipment Advertising Other $ 8,870 18,920 38,840 2,070 The product is to be sold for $49. a. Compute the number of units that must be sold to earn a profit of $80,000. b. Compute the number of units that must be sold if advertising costs rise by $12,000 and a targeted profit of $120,000 is to be obtained. c. Use the original information and sales of 10,000 units to compute the new selling price that the company must use to obtain a profit of $200,000. d. The most in annual sales that could be projected is 20,000 units. Determine the added amount that could be spent on fixed advertising costs if the highest possible selling price that management believes can be charged is $50 and if there is a targeted profit of $225,000.