Minerals and Materials (FCX, BHP, Rio Tinto)

advertisement

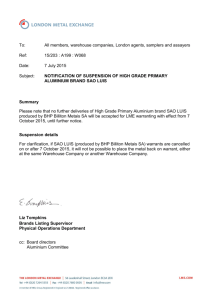

GROUP 2 PRESENTATION: MINERAL AND MATERIALS Prepared by: Haili Yin Li Regan Sun Fai Yi He AGENDA • Introduction to Industry: • Copper • Petroleum • Aluminium • Companies: • Freeport-McMoRan • BHP Billiton • Rio Tinto COPPER • Conductor of heat and electricity, a building material, and a constituent of metal alloys • International traded commodity • Prices of copper: • Reflect the worldwide balance of copper supply and demand • Volatile • Cyclical COPPER • Prices are determined by the major metals exchanges: • London Metal Exchange (LME) • New York Mercantile Exchange (NYMEX) • Shanghai Futures Exchange COPPER PRICES • Spot price ranged from a low of $2.86 per pound to a high of $3.38 per pound • $2.88 per pound at December 31,2014 COPPER DEMAND • By end-use market: • Construction (30%) • Consumer products (28%) • Electrical applications (19%) • Transportation (12%) • Industry machinery (11%) COPPER PRODUCTION • Key point: Copper usage increased 12% in 2014 while mine production increased just 3% POTENTIAL RISKS • Operating Risks: • Laws and Regulations • Equipment shortage • Environmental condition • Technology • Market Risks: – Copper price – Interest rate – Foreign exchange risk – Substitutes – Economic and political issue POTENTIAL HEDGING ACTIVITIES • Energy Prices • Copper Prices • Exchange Rates • Interest Rates PETROLEUM • Comes from Latin: “petra” (meaning “rock”) and “oleum” (meaning “oil”). • Colour: from yellow to black • Formed by a large number of dead organisms, compressed in intense heat and pressure PETROLEUM • It consists of hydrocarbons of different molecular weights, but they all contain element C! • Uses fluid catalytic cracking to change complex molecules into simpler ones • Used in the modern day era as fuel during combustion PETROLEUM PRICES PETROLEUM DEMAND PETROLEUM SUPPLY • OPEC is a major factor in supply and price (Organization of the Petroleum Exporting Countries) PETROLEUM--RISK AND UNCERTAINTIES • Business Risks: • Failure to discover new resources • Increased cost and schedule delay • External Risks: • Change in demand in major markets • Changes in currency exchange rates • Laws and regulations (for byproduct as well!) PETROLEUM--POTENTIAL HEDGING STRATEGIES • Possible methods: • Contracts • Interest Rate Swaps • Cross Currency Rate swaps ALUMINUM • Final product of a three-stage production process • Bauxite: natural ore • Alumina: refining process • Aluminum • Light, strong, flexible, corrosion-resistant and infinitely recyclable • One of the most widely-used metals • Transportation • Machinery • Construction ALUMINUM • An Internationally traded commodity • New York Commodities Exchange • London Metal Exchange • Worldwide Production • China is the largest aluminum producer and has the highest growth rate • Prices • Contango • Cyclical • Price affected by demand and supply ALUMINUM PRICE ALUMINUM DEMAND • Factors affecting demand • Global Economic Conditions • Instability Decreases Demand (US. and Europe) • Industrialization • Changes in demand transportation vehicles • Changes in the construction market • Changes in containers and packaging • Energy Costs GLOBAL ALUMINUM DEMAND - INDUSTRIES GLOBAL ALUMINUM SUPPLY GLOBAL ALUMINUM DEMAND AND SUPPLY FREEPORT-MCMORAN COMPANY BACKGROUND One of the world’s largest producers of copper and gold Headquarters in Phoenix, Arizona Operating location: North America, South America, Indonesia, Africa Traded as NYSE:FCX and S&P 500 Component LOCATIONS OF OPERATING MINES OWNERSHIP INTEREST OF FCX PRODUCTS AND SALES • Sales of copper (60%): • Copper concentrate (44%) • Copper cathode (31%) • Continuous cast copper rod (25%) • • • • Sales of oil (20%) Sales of gold (7%) Sales of molybdenum (6%) Others (7%) RISK FACTORS • Financial risks • Market prices of copper, gold and/or oil • Debt and other financial commitments may limit the financial and operating flexibility • Mine closure and reclamation regulations impose substantial costs on operations • Financial assurance is required to support their obligations (e.g. Bonds) RISK FACTORS • International risks • International operations are subject to political, social and geographic risks • The company’s business may be adversely affected by political, economic and social uncertainties in Indonesia • Tenke minerals district may be adversely affected by security risks and political, economic and social instability in the DRC RISK FACTORS • Operational risks • Mining and oil and gas operations are subject to operational risks • Labor unrest and activism could disrupt the operations • The mining production depends on the availability of sufficient water supplies • Indonesia and Africa mining operations involve additional risks because of the difficult location • Development projects are inherently risky and may require more capital than anticipated • Others RISK FACTORS • Environmental risks • Subject to complex and evolving environmental laws, such as CERCLA • Remediation of environmental conditions on mining properties that have not been operated in many years • Unexpected environmental impacts from Indonesia mining operations could incur increased costs • Regulation of greenhouse gas emissions and climate change issues may adversely affect the company’s operations RISK FACTORS • Other risks • Holding company structure may impact the ability to service debt and stockholders’ ability to receive dividends • Anti-takeover provisions in the company’s charter documents and Delaware law may make an acquisition of the company more difficult DISCLOSURES ABOUT MARKET RISKS • Commodity Price Risk • Foreign Currency Exchange Risk • Interest Rate Risk COPPER PRICE VS. FCX STOCK PRICE INCOME STATEMENT CASH FLOW STATEMENT CASH FLOW STATEMENT CONT’D BALANCE SHEET BALANCE SHEET CONT’D RISK MANAGEMENT PHILOSOPHY “FCX does not purchase, hold or sell derivative financial instruments unless there is an existing asset or obligation, or it anticipates a future activity that is likely to occur and will result in exposure to market risks, which FCX intends to offset or mitigate. FCX does not enter into any derivative financial instruments for speculative purposes, but has entered into derivative financial instruments in limited instances to achieve specific objectives. ” FINANCIAL INSTRUMENTS • Commodity Contracts: • Forward, futures and swap contracts • A variety of crude oil and natural gas commodity derivatives, such as swaps, collars, puts, calls and various combinations of these instruments • Derivatives do not contain credit risk-related contingent provisions • As of December 31,2013 and 2012, FCX had no price protection contracts relating to mine production FAIR VALUE HEDGES • Using Copper Futures and Swap Contracts • FCX receive the COMEX average price in the month of shipment • The customers pay the fixed price they requested • Three steps to follow: • Determine the fair value of both hedged item and hedging instrument at reporting date • Recognize any change in fair value on the hedging instrument in profit or loss • Recognize the hedging gain or loss on the hedged item in its carrying amount FAIR VALUE HEDGE TRANSACTIONS Realized gains (losses) & Unrealized gains (losses) FINANCIAL INSTRUMENTS • Derivatives not designated as hedging instruments • Embedded Derivatives • Crude Oil and Natural Gas Contracts • Copper Forward Contracts EMBEDDED DERIVATIVES • A provision in a contract that modifies the cash flow of a contract by making it dependent on some underlying measurement • Incorporated into a host contract • Accounted for separately form the host contract when it is not closely related to the host contract • Provides price certainty EMBEDDED DERIVATIVES Summary of FCX’s embedded derivatives at December 31,2014 Crude Oil and Natural Gas Contracts • FCX has crude oil options, crude oil and natural gas swaps as a result of the acquisition of PXP • Not designated as hedging instruments • In order to limit the effects of crude oil price decreases • Composed of crude oil put spreads consisting of put options with a floor limit CRUDE OIL AND NATURAL GAS CONTRACTS The outstanding crude oil option contracts at December 31,2014 • The deferred option premiums and accrued interest associated with the crude oil option contracts totaled $210 million COPPER FORWARD CONTRACTS • Entered by Atlantic Copper, FCX’s wholly owned smelting and refining unit in Spain • Designed to hedge its copper price risk whenever its physical purchases and sales pricing periods do not match • Hedge against changes in copper prices • Market-to-market hedging gains or losses recorded in cost of sales • Net forward copper purchase contracts for 13 million pounds at average contract price of $2.9 per pound SUMMARY OF (LOSSES) GAINS Recognized in income before income taxes UNSETTLED DERIVATIVE FINANCIAL INSTRUMENTS CREDIT RISK • Exposed to credit loss when financial institutions with which FCX has entered into derivative transactions are unable to pay • FCX uses counterparties that meet certain credit requirements • Review the creditworthiness of these counterparties • The maximum amount of credit exposure associated with derivative transactions was $379 million at December 31, 2014 BHP BILLITON BHP BILLITON • Multinational mining, metals and petroleum company (top producers in major commodity) • Headquarter: Melbourne, Australia • Was Created in 2001, by merging of Australian Broken Hill Proprietary Company Limited (BHP) and the Angelo-Dutch Billiton plc. (dual-listed company in London and Melbourne) • As of 30 June 2014, the market capitalization of BHP Billiton reached US $179 billion. • Around 123,800 employees and contractors in 21 countries (130 locations around the world. • Products include: Iron Ore, coal, manganese, gold, petroleum, aluminium, silver, copper, etc. BHP BILLITON REVENUE AND EBIT BHP BILLITON INCOME STATEMENT BHP BILLITON BALANCE SHEET BHP BILLITON CASH FLOW STATEMENT BHP BILLITON RISK FACTORS • External risks: • Fluctuations in commodity prices and ongoing global economic volatility • Currency exchange rate fluctuations • Reduction in Chinese demand • Business risks: • Failure to discover/acquire new resources, maintain them or develop new operations • Potential change to their portfolio of assets through acquisitions and divestments BHP BILLITON RISK FACTORS CONTINUED • Financial risks: • If the liquidity and cash flow available to the company severely decreases, then major capital programs cannot be properly funded. • May not recover their investments in mining, oil and gas assets due to change in industry structure or price of commodities. • Operational risks: • Cost pressures and reduced productivity • Sustainability risks: • Safety, health, environmental and community issues, along with incidents/accidents and regulations may also affect the company’s people, operations and reputation, etc. BHP BILLITON FINANCIAL RISK MANAGEMENT BHP BILLITON STATEMENTS • “The natural diversification in our portfolio of commodities, geographies, currencies, assets and liabilities is a key element in our risk management approach.” BHP BILLITON RISK EXPOSURES • Market risk: movements of • interest rates • foreign currencies • commodity prices • Liquidity risk • Credit risk BHP BILLITON MARKET RISK MANAGEMENT BHP BILLITON MARKET RISK: INTEREST RATE RISK AND FOREIGN CURRENCY RISK • The risk in which the value of investment may change due to altering the future cash flow • Methods used by BHP: • Interest rate swaps • Cross currency interest rate swaps BHP BILLITON MARKET RISK: INTEREST RATE RISK AND FOREIGN CURRENCY RISK BHP BILLITON MARKET RISK: INTEREST RATE RISK AND FOREIGN CURRENCY RISK • However, the company is still subject to translational exposure, which is the foreign exchange gains and losses on foreign currency denominated provisions for closure and rehabilitation at operating sites, capitalized in property, plant and equipment. BHP BILLITON MARKET RISK: COMMODITY PRICE RISK BHP BILLITON MARKET RISK: COMMODITY PRICE RISK BHP BILLITON LIQUIDITY RISK • Liquidity risk: Risk of not being able to settle obligations when they are due. BHP BILLITON CREDIT RISK • Credit risk: non-performance of the counterparties’ contract BHP BILLITON FAIR VALUES BHP BILLITON FAIR VALUES BHP BILLITON SENSITIVITY ANALYSIS COMPANY OVERVIEW • British-Australian multinational corporation with headquarters in London, UK, and a management office in Melbourne, Australia • A leading global mining and metals company • Focus on finding, mining and processing the Earth’s mineral resources in order to maximize value for shareholders • Dual-listed company traded on the London Stock Exchange and the Australian Securities Exchange EXECUTIVES Chairman: Jan du Plessis • Director of Rio Tinto since 2008, he was appointed chairman in 2009 • Chairman of British American Tobacco plc. between 2004-2009 • From 1998 to 2001, President and CEO of Ford Motor Company CEO: Sam Walsh AO (Melbourne) • Director of Rio Tinto since 2009, he was appointed chief executive in 2013 • Joined Rio Tinto in 1991, following 20 years in the automotive industry at General Motors and Nissan Australia OPERATION • Operating in 5 major businesses • • • • • Aluminum product group Copper product group Diamonds & Minerals product group Energy product group Iron ore product group OPERATION LOCATIONS GENERAL PERFORMANCE GENERAL PERFORMANCE CONSOLIDATED INCOME STATEMENT FINANCE INCOME AND FINANCE COSTS CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME CONSOLIDATED BALANCE SHEET - ASSETS OTHER FINANCIAL ASSETS CONSOLIDATED BALANCE SHEET- LIABILITIES AND EQUITY CONSOLIDATED CASH FLOW CONSOLIDATED CASH FLOW RISK MANAGEMENT FRAMEWORK • Managing risk effectively is an integral part of how we create value, and fundamental to our business success • “Three lines of defense” model • Ownership of risk by the operations • Control of risk by Group functions and management committees • Assurance of our systems by Group Audit & Assurance FINANCIAL RISK MANAGEMENT • Funding and exposure management • Fundamental part of long-term strategy of the Group • • Treasury operations Treasury policy FINANCIAL RISK FACTORS • • • • • Foreign exchange rate risk Interest rate risk Commodity price risk Credit risk Liquidity and capital risk management FOREIGN EXCHANGE RISK • Geographic diversity of sales and operations • Important currencies • US dollars • Australian dollars • Canadian dollars • Cross currency interest rate swaps FOREIGN EXCHANGE RISK • Net debt of the Group FOREIGN EXCHANGE RISK • Hedging strategy • • • • Not believe in active currency hedging Review its exposure on a regular basis Reserves the right to enter into hedges Monthly treasury report INTEREST RATE RISK • Risk that the value of a financial instrument or cash flows associated with the instrument will fluctuate due to changes in market interest rates • Borrow and invest at floating interest rate • Based on historical correlation between interest rates and commodity prices INTEREST RATE RISK • Hedging strategy • Interest rate derivatives • Hedging result COMMODITY PRICE RISK • Normal policy is to sell products at prevailing market prices • Products sold under contracts and spot market • Copper, aluminum • Products that are “ provisionally priced” • Copper concentrate CREDIT RISK • The risk that a counterparty will not meet its obligations, leading to financial losses • Exposed to credit risks • Operating activities • Financing activities CREDIT RISK • Maximum credit risk exposure of financial assets LIQUIDITY AND CAPITAL RISK MANAGEMENT • Objective is to safeguard the business as a going concern whilst maximizing returns of shareholders • Provide the Group a high degree of financial flexibility at a low cost of capital • Maintain an “A-” credit rating SENSITIVITIES ANALYSIS • Foreign exchange risk SENSITIVITIES ANALYSIS • Interest rate risk • Commodity price risk