Accounting for Merchandise Operations

advertisement

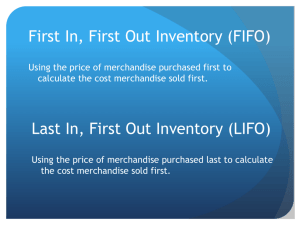

Accounting for Merchandise Operations Chapter 4 Income Statement Accounts Sales Revenue account Sales discounts Amounts deducted from sales price if customer meets certain payment terms 2/10, n/30 – 2% discount if paid within 10 days, or entire amount due within 30 days EOM – end of month Sales returns and allowances Amounts returned by customer, or price reductions given for various reasons Income Statement Accounts Presentation of net sales on the income statement Sales Less: Sales discounts Sales returns and allowances Net sales $ 500,000 $ 4,000 12,000 16,000 $ 484,000 Income Statement Accounts Purchases Purchase discounts Inventory purchased from suppliers Discounts received from supplier for prompt payment Purchase returns and allowances Amounts returned to supplier, or price reductions granted by supplier for various reasons Income Statement Accounts Freight-in Amount paid to have merchandise shipped from the supplier Additional cost of the merchandise inventory Delivery expense Amount paid to deliver merchandise to the customer Income Statement Accounts Calculation of the cost of merchandise sold Beginning merchandise inventory Purchases Less: Purchase discounts $ Purchase returns and allowances Net purchases Add: Transportation-in Cost of goods purchased Goods available for sale Less: Ending merchandise inventory Cost of merchandise sold $ 46,000 $ 286,000 1,900 8,700 10,600 $ 275,400 2,400 277,800 $ 323,800 41,000 $ 282,800 Inventory Methods Periodic Inventory account does not change during the year Purchases, purchase discounts, purchase returns and allowances are recorded in their respective accounts No entry is made to record the cost of merchandise sold Inventory is counted at year-end and records are adjusted at that time Inventory Methods Perpetual Any transaction affecting inventory is recorded in the inventory account Purchases, purchase discounts, purchase returns and allowances, transportation-in accounts are not used Cost of merchandise sold is recorded at the time of the sale Provides “real-time” information on inventory levels and cost of merchandise sold Accounting for Merchandise Transactions Sales Increase revenue (retained earnings) and increase cash or accounts receivable Sales discounts Sale is recorded at the gross amount If customer pays within the discount period Increase cash by the amount received Decrease accounts receivable by the gross amount Record the sales discount (decrease in retained earnings) Accounting for Merchandise Transactions Sales returns and allowances If the sale was for cash If the sale was on credit Decrease cash Record the sales return (decrease retained earnings) Decrease accounts receivable Record the sales return (decrease retained earnings) Record the return of the merchandise Increase inventory Reduce the cost of merchandise sold (increase retained earnings) Accounting for Merchandise Transactions Purchases of merchandise from supplier Periodic method Record the purchase (decrease retained earnings) Increase accounts payable or decrease cash Perpetual method Increase inventory Increase accounts payable or decrease cash Accounting for Merchandise Transactions Purchase discounts Periodic method Decrease accounts payable by the gross amount Decrease cash by the amount paid Record the purchase discount (increase retained earnings) Perpetual method Decrease accounts payable by the gross amount Decrease cash by the amount paid Decrease inventory by the amount of the discount Accounting for Merchandise Transactions Purchase returns and allowances Periodic method Record the amount of the return or allowance (increase retained earnings) Decrease accounts payable or increase cash Perpetual method Decrease inventory Decrease accounts payable or increase cash Accounting for Merchandise Transactions Transportation-in Periodic method Record transportation-in (decrease retained earnings) Decrease cash or increase accounts payable Perpetual method Increase inventory Decrease cash or increase accounts payable Statement of Cash Flows Indirect Method Cash flows from operating activities may be calculated indirectly by starting with net income and adjusting for various items Add depreciation and other non-cash expenses Add (subtract) decreases (increases) in all current asset accounts except cash Add (subtract) increases (decreases) in all current liability accounts Statement of Cash Flows Indirect Method Dr. B’s easy rule for the indirect method If it sounds good, treat it as something bad Did a current asset increase? That sounds good, so treat it as something bad (subtract the increase from net income) Did a current liability increase? That sounds bad, so treat it as something good (add the increase to net income)