Collateralized Mortgage Obligations (CMOs) History and Application

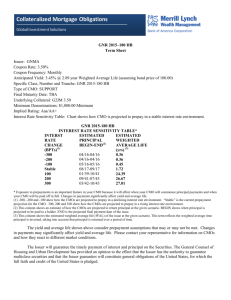

advertisement

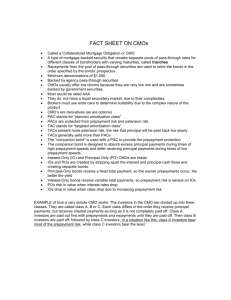

Collateralized Mortgage Obligations (CMOs) History and Application Michael Wallace BA543-1 Agenda What is a CMO? History Risk Example – (Sequential-Pay CMO) Types of CMOs Conclusion What is a CMO? Pools of securitized mortgages whose cash flows have been dedicated to two or more types of bond classes designed to better meet investor needs. Derivative mortgage securities What is a CMO? Loan # 1 Loan # 2 Monthly Cash Flow Interest Scheduled principal payments Prepayments Pass-through: Pooled mortgage loans Interest Scheduled principal payments Prepayments Tranche A Loan # 3 Rule for distribution of cash flow (i.e. Pro rata basis) Tranche B Interest Scheduled principal payments Prepayments Tranche A Loan # 4 Tranche B Interest Scheduled principal payments Prepayments Tranche C Tranche D CMO Tranche C Tranche D Who issues CMOs? Agencies (i.e. Freddie Mac, Ginnie Mae..etc) Non-agency (i.e. Countrywide) Private-label Whole-loan History The first CMO was issued in 1983 by Freddie Mac Sears/Dean Witter, Reynolds attempted CMO issuance in 1984 Volatility of interest rates in previous decade => high prepayment risk IRS ruling made CMOs uncompetitive Tax Reform Act of 1986 Creation of the Real Estate Mortgage Investment Conduit (REMICs) Required accrual-based accounting for investors Characteristics Maturity – Matures when investor receives final principal payment Yield Weighted average maturity (WAM) Assumed prepayment rates Tranches Interest Principal – “active” tranche The Three Relationships •Prices and Rates Interest Rates CMO Prices CMO Prices Interest Rates •Prices and Time CMO Life CMO Life CMO Prices CMO Prices •Prepayments and Time Interest Rates Prepayment Prepayment Interest Rates Risk Why not invest directly in mortgages? Exposure: credit risk, liquidity risk, price risk, prepayment risk Types of Risk Price Risk Return Risk Prepayment (“Call”) Risk Prepayment Risk Contraction Risk-Decline in mortgage rates that effectively shortens the life of a pass-through security Extension Risk-Increase in mortgage rate that effectively lengthen the life of a pass-through security Prepayment Speed Assumptions (PSA) Model Created by the Bond Market Association Based on Constant Prepayment Rate (CPR) Annualized amount of outstanding principal prepaid each month (SMM) Ex. 100% PSA => 0.2%CPR in first month, 0.4% CPR in second month, and increases until rate reaches 6% 200 300 400 100 500 0 600 PSA Example Sequential-Pay CMO Classes of CMOs Sequential-Pay Planned Amortization – PAC & Companion Tranches Type I PAC – 100% to 300% PSA Target Amortization Companion Tranches – Higher yield, greater uncertainty Z-Tranches Principal-Only (PO) Interest-Only (IO) Floating-Rate – tied to interest rate index (i.e. LIBOR) Residuals Conclusion CMO Issuance 20 02 20 00 19 98 19 96 High credit rating (AAA) Low minimum cost to buy into ($1,000) Competitive yield Flexibility to meet investor needs (maturity) Ability to receive monthly cash flow Hedging against prepayment risk Liquidity 19 94 BILLIONS 19 92 Why invest in CMOs? 19 90 900 800 700 600 500 400 300 200 100 0 Questions?