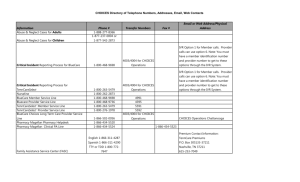

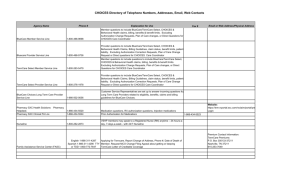

Document - 2015 IM Symposium

advertisement

Provider Quality Portal Biography Emily Bagley Director, Provider Analytics and Partner Solutions BlueCross BlueShield of Tennessee Responsibilities Clinical data exchange with providers Provider Implementation of tools and technology Provider Performance Assessment o Episode Bundles to Support the State of TN Health Care Innovation Initiative (THCII) o Provider Directory Validation and NCCT o Hospital Analytics Tool o Clinician and Facility Dashboards o Efficiency Practice Pattern Analysis (PPA) Provider Measurement Analytics (Provider Incentive Program Overview) Contact Info: Phone: 423-535-7046 Email: emily_bagley@bcbst.com 2 Biography Jyothi Anantha Business Intelligence Applications Lead Responsible for building business intelligence and external facing agile applications to meet business demands. Contact Info: Phone: 423-535-6346 Email: Jyothi_Anantha@bcbst.com 3 Chattanooga, Tennessee 4 BlueCross BlueShield of Tennessee 5 Who We Are 6 BCBST Provider Quality Incentive Programs PCMH (Enterprise-wide initiative) Moving from a chronic model to a Transitions of Care (TOC) model for chronic and non chronic populations Commercial programs Quality Care Partnership Initiative (QCPI) o Fee schedule re-basement program based upon HEDIS quality scores for a group o 8 pilot groups for 2015 o Total cost of care criteria to be added in future QCPI phases Commercial Pay for Gaps (P4G) o 38 groups in 2015 with quality bonus payments for gap closures Provider Transparency (i.e. Physician Quality Measurement Tool) o Association initiative that measures providers 2 times a year and publishes those scores in our Provider Directory tool for members 7 BCBST Provider Quality Incentive Programs BlueCare Programs (Medicaid) BlueCare and BlueCare Plus Pay for Gaps (P4G) o 45 groups in 2015 and quality bonus payments for gap closures Community Mental Health Pay for Gaps (P4G) o Incentivize the mental health facilities to close gaps on members who seek services at mental health facilities versus a PCP BlueCare Pay for Performance (P4P) o Quality and utilization program to incentivize PCPs to see patients that are assigned to their practice BlueCare Provider Practice Patterns Assessments (PPAs) o Quarterly report that measures individual providers across 7 cost/utilization metrics and compares them to their peers Medicare Advantage Programs (STARs) Medicare Advantage Physician Quality (STARs) o Fee Schedule re-basement program that measures groups on 18 STARs measures 8 Business Need for Provider Quality Portal As the market shift towards value-based contracting and a quality emphasis, BCBST felt the need to develop tools and technology to support the providers in this transition. Since the accreditation measures are moving towards outcomes based scoring, BCBST needed to obtain clinical data that is not currently captured on a submitted claim. BCBST developed a portal for providers to access a member’s health information at the point of care that allows for the following: Review and close gaps in care Complete attestations Complete a Provider Assessment Form (PAF) 9 Product Development and Delivery Developed first phase that was available to providers in 3 months Ability to obtain supplemental data through provider attestations Developed in an Agile manner (incremental product delivery) Obtained feedback from providers and further refined product Leveraged platform development for other lines of business (changed measures and financial incentives model) Implemented the portal for all major lines of businesses across the enterprise within a year Utilized the development efforts to also support a Risk/Gain share contracting model to display financial opportunities Automated the incentive payments generated within the portal to disburse payments to providers 10 Project Outcomes-Medicare Advantage Portal Third highest source of gap closures by supplemental data to support HEDIS (EMR data and biometric screenings were first and second, respectively) Primarily impacted Medicare Advantage Significantly impacted the Adult BMI and Colorectal Cancer Screening measures Gap closures via attestations by different lines of business (as of 9/11/15): 37, 962 gaps closed for Medicare Advantage between (Jun 2014 – Dec. 2014) and 42,373 gaps closed YTD 2015 4, 970 gaps closed for BlueCare and BlueCare Plus since an April 2015 portal go live 6, 103 gaps closed for the Commercial line of business since a mid-July 2015 go live Passed (100%) the HEDIS audit for primary source verification 11 Supplemental Data Repository Clinical Data Exchange • Electronic Medical Records • Lab Feeds Quality Care Programs • • • • • Attestations PCMH Data Pay for Quality Data Transparency Data Patient Assessment Forms Immunization Data • Tennessee • North Carolina 12 Provider Performance Module Overview 13 Architecture Source Systems DB2 SQL Sybase Flat File Copy Staging Teradata ETL Integration Clinical Data Warehouse ETL Data Marts Provider Facing Agile Solutions/Applications P4P Clinician FCIR SIMS Empower Business Users 14 15 16 17 18 19 20 21 22 Software Structure SOLID Design Our Software Quality Goals 25 Consolidated Portal – Future State Build a single provider module that aggregates information for a practice/group Aggregates information across the multiple provider incentive programs Includes metrics across the different lines of business Provides interactive capabilities to close gaps Automates reports that are currently static pdf reports Contains a member roster for the different lines of business Allows for a member/provider search across the differing programs Look at performance as compared to state/regional benchmarks Centralized the login process for all provider portals 26 Future State – Example Landing Page 27 28