Financial Aid Night Presentation

advertisement

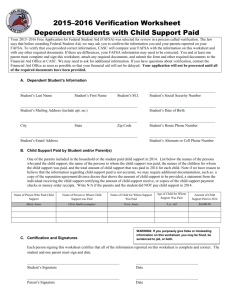

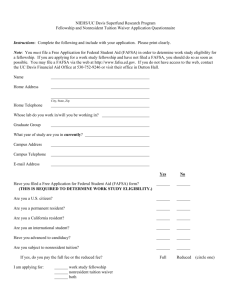

FINANCIAL AID NIGHT PRESENTATION Youngstown State University Office of Financial Aid and Scholarships Topics We Will Discuss Tonight What is financial aid? Cost of attendance (COA) Expected Family Contribution (EFC) What is financial need? Categories, types, and sources of financial aid • Free Application for Federal Student Aid (FAFSA) • Special circumstances • • • • • What is Financial Aid? • Financial aid consists of funds provided to students and families to help pay for postsecondary educational expenses. What is Cost of Attendance (COA)? Direct costs + Indirect costs = COA Costs include • Tuition and fees • Room and board • Transportation • Miscellaneous personal expenses • Expenses related to a disability • Dependent care expenses *Remember! Costs vary widely from school to school. What is Expected Family Contribution? • Amount family can reasonably be expected to contribute based on a formula passed by congress • Stays the same regardless of college • Calculated using data from a federal application form and a federal formula • Two components Parent contribution Student contribution What is Financial Need? Cost of Attendance - Expected Family Contribution = Financial Need Categories of Financial Aid • Need-based • Non need-based Types of Financial Aid • Scholarships • Grants • Loans • Employment Gift Aid Self-Help Options Scholarships • Money that does not have to be paid back • Awarded on the basis of merit, skill, or unique characteristic YSU Scholarships for Excellence • First Opportunity $1000.00 (3.0 GPA, 20 ACT* or 900 SAT**) • Red and White $2000.00 (3.0 GPA, 22 ACT* or 1030 SAT**) • Deans’ $3000.00 (Upper 15% of class, 25 ACT or 1140 SAT) • President’s $4000.00 (Upper 10% of class, 27 ACT or 1220 SAT) • Trustees’ $5000.00 (High School Valedictorian) • University Scholars (Full cost scholarship, separate application required, early deadlines) *ACT use Composite Score **SAT use combined Math and Verbal Score www.ysu.edu/finaid Scholarship Info Online Tools Grants • Money that does not have to be paid back • Usually awarded on the basis of financial need Loans • Money students and parents borrow to help pay college expenses • Repayment usually begins after education is finished • Only borrow what is really needed • Look at loans as an investment in the future Federal College Work Study • Allows student to earn money to help pay educational costs • Federal Work-Study is need-based employment on a part-time, hourly basis • Rate of pay for such jobs is regulated by the federal minimum wage law • To qualify for Federal Work-Study, you must be enrolled, be in good academic standing, and have a demonstrated financial need. • Early deadlines. Must complete the FAFSA Sources of Financial Aid • Federal government • States • Colleges and universities • Private sources • Civic organizations and churches • Employers Federal Government • Largest source of financial aid • Aid awarded primarily on the basis of financial need • Must apply every year using the Free Application for Federal Student Aid (FAFSA) Common Federal Aid Programs • Federal Pell Grant • Federal Supplemental Educational Opportunity Grant • Federal Perkins Loan • Federal Work-Study • Subsidized and Unsubsidized Federal Student Loans (Direct Loans) • PLUS Loans States • Residency requirements • Award aid on the basis of both merit and need • Use information from the FAFSA • Deadlines vary by state (check FAFSA on the Web) Ohio College Opportunity Grant • State of Ohio need-based grant (OCOG) • 2013-2014 maximum awards (full-time enrollment) • $920 for students at most public university main campuses • $2080 for students at private, non-profit schools • $664 for students at private, for-profit schools • Students are limited to 10 semesters or 15 quarters of state, need-based grant aid (including combination of OCOG and OIG) Colleges and Universities • Award aid on the basis of both merit and need • Aid may be gift aid or self-help aid • Use information from the FAFSA and/or institutional applications • Deadlines and application requirements vary by institution • Check with each college or university Private Sources • Foundations, businesses, charitable organizations • Deadlines and application procedures vary widely • Begin researching private aid sources early Civic Organizations and Churches • Research what is available in your community • To what organizations and churches does student and family belong? • Application process usually occurs during spring of senior year • Small scholarships add up! Employers • Companies may have scholarships available to the children of employees • Companies may have educational benefits for their employees Free Application for Federal Student Aid (FAFSA) • A standard form that collects demographic and financial information about the student and family • May be filed electronically or using paper form (Available in English and Spanish) FAFSA • Information used to calculate the Expected Family Contribution or EFC -The amount of money a student and his or her family may reasonably be expected to contribute towards the cost of the student’s education for an academic year • Colleges use EFC to award financial aid!!! FAFSA • May be filed at any time during an academic year, but no earlier than the January 1st prior to the academic year for which the student requests aid • For the 2014-15 academic year, the FAFSA may be filed beginning January 1, 2014 • Most colleges set FAFSA filing deadlines YSU’s Priority Filing Date is Feb. 15th Federal Student Aid Personal Identification Number (FSA PIN) • Web site: • www.pin.ed.gov • Sign FAFSA electronically • Can request PIN before January 1, 2014 • Not required, but speeds processing • May be used by students and parents throughout aid process, including subsequent school years FAFSA on the Web • Web site: www.fafsa.gov • 2014-15 FAFSA on the Web available on January 1,2014 • FAFSA on the Web Worksheet: • Used as “pre-application” worksheet • Questions follow order of FAFSA on the Web FAFSA on the Web • Good reasons to file electronically: • Internal Revenue Service (IRS) data retrieval tool • Built-in edits to prevent costly errors • Skip-logic allows student and/or parent to skip unnecessary questions • More timely submission of original application and any necessary corrections • More detailed instructions and “help” for common questions • Ability to check application status online • Simplified application process in the future IRS Data Retrieval Tool • While completing FOTW, applicant may submit real-time requests to IRS for tax data • IRS will authenticate taxpayer’s identity • If match found, IRS sends real-time results to applicant in a new browser window • Applicant chooses whether or not to transfer data to FOTW IRS Data Retrieval Tool • Available early February 2014 for 2014-2015 processing cycle • Participation is strongly encouraged! • Could greatly reduce documents requested by financial aid office IRS Data Retrieval Tool • Some will be unable to use IRS DRT • Examples include: • Filed an amended tax return • No SSN was entered • Student or parent married but filed separately Importance of Early Tax Return Submission • Especially if you are looking to compare financial aid award packages from various schools before determining what college to attend. • Early filing could greatly reduce processing time in case student’s fafsa is selected for verification. • If selected for verification schools can no longer accept a copy of the federal tax return. Schools will need a copy of the Tax Return Transcript from the IRS. Federal Verification • Verification is a process used to check the accuracy of the information that a student has given when applying for federal financial aid. • Verification is used to ensure that the student is providing accurate information about their need for financial aid, since inaccurate information may result in the student receiving less (or more) money than he/she should. • Students selected for verification are notified on the Student Aid Report (SAR) or by the Financial Aid office. Even if the student is not selected by the government for review the school can request additional documentation to verify the accuracy of the FAFSA Federal Verification • Students will be instructed to send in specific materials to verify their status, income, asset information or other relevant documentation. • Until all verification requirements are completed no federal funds will be disbursed to the student. Helpful Tip! Secure copies of all personal and financial records (including but not limited to) IRS Tax Return Transcripts, untaxed statements, bank records, and marital documentation Making Corrections • If necessary, corrections to FAFSA data may be made by: • Using FAFSA on the Web www.fafsa.ed.gov if student has a PIN • Updating paper SAR (SAR Information Acknowledgement cannot be used to make corrections) • Submitting documentation to college’s financial aid office FAFSA on the Web Worksheet • 2014-15 FAFSA on the Web Worksheet is a 4page booklet containing • Instructions • 4 sections • Student Information • Student Dependency Status • Parent Financial Info • Student Financial Info FOTW Worksheet: Section 1 FOTW Worksheet: Section 1 FOTW Worksheet: Section 2 FOTW Worksheet: Section 3 FOTW Worksheet: Section 3 FOTW Worksheet: Section 3 FOTW Worksheet: Section 4 FOTW Worksheet: Section 4 Additional Information • College and housing information Signatures • Required • Student • One parent (dependent students) • Format • Electronic using PIN • Signature page • Paper FAFSA Frequent FAFSA Errors • Social Security Numbers • Divorced/remarried parental information • Income earned by parent/stepparents • Untaxed income • U.S. income taxes paid • Household size • Number of household members in college • Real estate and investment net worth FAFSA Processing Results Central Processing System (CPS) notifies student of FAFSA processing results by: • Paper Student Aid Report (SAR) if paper FAFSA was filed and student’s e-mail address was not provided • SAR Acknowledgement if filed FAFSA on the Web and student’s e-mail address was not provided • E-mail notification containing a direct link to student’s online SAR if student’s email was provided on paper or electronic FAFSA Student with PIN may view SAR online at www.fafsa.gov FAFSA Processing Results • Institutional Student Information Record (ISIR) sent to colleges listed on FAFSA approximately 10 to 14 days after FAFSA submitted • College reviews ISIR • May request additional documentation, such as copies of federal tax return transcripts Student Aid Report • Review data for accuracy and correct any errors • Update estimated information when actual figures become available Special Circumstances • Situations that cannot be reported on FAFSA • Change in employment status • Medical expenses not covered by insurance • Change in parent marital status • Unusual dependent care expenses • Student cannot obtain parent information • Special Circumstances must be done through a scheduled appointment with a financial aid counselor. • Verification must be completed prior to filing a special circumstance Special Circumstances • College reviews special circumstances • Request additional documentation if necessary Decisions are final and cannot be appealed to the U.S. Department of Education Questions???? Office Information Counselor Appointments Walk-in Hours Available Monday through Friday Call 330-941-3506 to schedule Monday through Friday 10:00am to 12:00pm and 2:00pm to 4:00pm Main Line 330-941-3505 Mailing Address Fax Number 330-941-1659 Youngstown State University Office Website www.ysu.edu/finaid Office of Financial Aid and Scholarships One University Plaza Office Email ysufinaid@ysu.edu Youngstown, OH 44555 Building: Meshel Hall (Room 203) Federal School Code: 003145