Optimal Algorithms for k-Search with Application in Option Pricing

advertisement

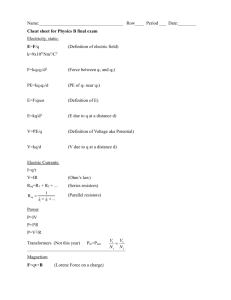

Optimal Algorithms for k-Search with Application in Option Pricing Julian Lorenz, Konstantinos Panagiotou, Angelika Steger Institute of Theoretical Computer Science, ETH Zürich 15. 05. 2007 Online Problem k-Search (1/2) 4$ 9$ 5$ 1$ k-max-search: k-min-search: Player wants to sell k units for MAX profit Player wants to buy kunits for MIN cost • Prices =(p1,…,pn) presented sequentially • Must decide immediately whether or not to buy/sell for pi • Competitive analysis: 09.10.2007 (MAX profit) (MIN cost) Julian Lorenz, jlorenz@inf.ethz.ch 2 Online Problem k-Search (2/2) Model for price sequences: M pi [m,M],arbitrary in that trading range M = m j,fluctuation ratio j > 1 Can buy/sell only one unit for each pi Length of known in advance 09.10.2007 Julian Lorenz, jlorenz@inf.ethz.ch m i 3 Related Literature El-Yaniv, Fiat, Karp, Turpin (2001): Timeseries-Search: Optimal deterministic (=1-max-search) Optimal randomized One-Way-Trading: Optimal algorithm & no improvement by randomization One-Way-Trading: Can trade arbitrary fractions for each pi Other related problems: Search problems with distributional assumption on prices Secretary problems 09.10.2007 Julian Lorenz, jlorenz@inf.ethz.ch 5 Deterministic Search Algorithms 09.10.2007 Julian Lorenz, jlorenz@inf.ethz.ch 6 Deterministic K-Search: RPP Reservation price policy (RPP) for k-max-search: Choose Process sequentially Accept incoming price if exceeds current Forced sale of remaining units at end of sequence … and analogously for k-min-search. 09.10.2007 Julian Lorenz, jlorenz@inf.ethz.ch 7 Theorem: Deterministic K-Max-Search 50 RPP with where 45 40 solution of 35 30 p i 25 20 15 i) Optimal RPP with competitive ratio 10 5 0 5 10 ii) Optimal deterministic online algorithm for k-max-search i Remarks: 1) Asymptotics: 2) “Bridging“ Timeseries-Search and One-Way-Trading 09.10.2007 Julian Lorenz, jlorenz@inf.ethz.ch 8 15 Theorem: Deterministic K-Min-Search 50 RPP with where 45 40 solution of 35 30 pi 25 20 15 i) Optimal RPP with competitive ratio 10 5 0 5 10 ii) Optimal deterministic online algorithm for k-min-search i Remarks: Asymptotics: 09.10.2007 Julian Lorenz, jlorenz@inf.ethz.ch 9 15 Randomized Search Algorithms 09.10.2007 Julian Lorenz, jlorenz@inf.ethz.ch 10 Randomized k-Max-Search Consider k=1: Optimal deterministic RPP has . Randomized algorithm EXPO: Fix base . Choose random, set RP to . Competitive ratio uniformly at (El-Yaniv et. al., 2001). We can prove: In fact, asymptotically optimal. 09.10.2007 Julian Lorenz, jlorenz@inf.ethz.ch 11 Theorem: Randomized K-Max-Search For any randomized k-max-search algorithm RALG, the competitive ratio satisfies Remarks: 1) Independent of k 2) Algorithm EXPOk achieves EXPOk: Set all k reservation prices to 3) Small k 09.10.2007 significant improvement! ( Julian Lorenz, jlorenz@inf.ethz.ch . ) 12 Theorem: Randomized K-Min-Search For any randomized k-min-search algorithm RALG, the competitive ratio satisfies Remarks: 1) Again independent of k 2) No improvement over deterministic ALG possible ! Recall CR of RPP for k-minsearch 09.10.2007 Julian Lorenz, jlorenz@inf.ethz.ch 13 Yao‘s Principle (mincost online problems) Finitely many possible inputs Set of deterministic algorithms RALG any randomized algorithm f() any fixed probability distribution on Then: With respect to f() ! Best deterministic algorithm for fixed input distribution 09.10.2007 Julian Lorenz, jlorenz@inf.ethz.ch Lower bound for best randomized algorithm 14 On the Proof of Lower Bound For k-min-search, k=1: f() uniform distribution on Essentially only two deterministic algorithms: ALG1 buys at ALG2 rejects , hoping that next quote is Similarly for arbitrary k, and for k-max-search … 09.10.2007 Julian Lorenz, jlorenz@inf.ethz.ch 15 Application To Option Pricing 09.10.2007 Julian Lorenz, jlorenz@inf.ethz.ch 16 Application: Pricing of Lookback Options Two examples of options (there are all kinds of them…): • European Call Option: right to buy shares for prespecified price at future time T from option writer • Lookback Call Option: right to buy at time T for minimum price in [0,T] (i.e. between issuance and expiry) Option price (“premium“) paid to the option writer at time of issuance. Fair Price of a Lookback Option? 09.10.2007 Julian Lorenz, jlorenz@inf.ethz.ch 17 Classical Option Pricing: Black Scholes • Model assumption for stock price evolution Geometric Brownian Motion: • No-Arbitrage and pricing by “replication“: Riskless Replication Trading algorithm (“hedging“) for option writer to meet obligation in all possible scenarios. No-Arbitrage Assumption (“efficient markets“) “Hedging cost“ must be option price. Otherwise: Arbitrage (“free lunch“). 09.10.2007 Julian Lorenz, jlorenz@inf.ethz.ch 18 Drawback of Classical Option Pricing What if Black Scholes model assumptions no good? In fact, in reality price geometric Brownian motion trading not continuous … DeMarzo, Kremer, Mansour (STOC’06): Bounds for European options using competitive trading algorithms Weaker model assumptions 09.10.2007 Julian Lorenz, jlorenz@inf.ethz.ch „Robust“ bounds for option price 19 Bound for Price of Lookback Call Hedging lookback call = buying “close to min“ in [0,T] _ Use k-min-search algorithm! _ Hedging cost = comp. ratio of k-minsearch = option price Instead of GBM assumption: • Trading range • Discrete-time trading Robust bound for option price, qualitatively and quantitatively similar to Black Scholes price V = price of lookback call on k shares Under no-arbitrage assumption 09.10.2007 Julian Lorenz, jlorenz@inf.ethz.ch 20 Thank you very much for your attention! Questions? 09.10.2007 Julian Lorenz, jlorenz@inf.ethz.ch 22