Lecture 5: Macroeconomic Model

advertisement

Lecture 5: Basics of Macroeconomics II

Dr. Rajeev Dhawan

Director

Given to the

EMBA 8400 Class

April 16, 2010

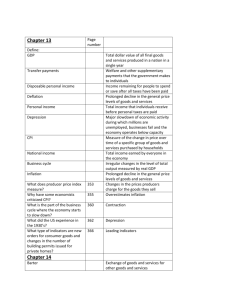

Chapter 28

Unemployment & Its Natural Rate

U.S. Unemployment, 1960-2007

12

percentage of labor force

Unemployment rate

10

8

6

4

Natural rate of

unemployment

2

0

1960 1965 1970 1975 1980 1985 1990 1995 2000 2005

Unemployment Insurance Claims

and Unemployment Rate

(%)

11

('000)

700

10

600

9

500

8

7

400

6

300

5

4

MAR JUN

2007

SEP

DEC

MAR JUN

2008

SEP

Un em pl oy m en t Ra t e (Left )

DEC

MAR JUN

2009

SEP

DEC

MAR

2010

U.I. Cl a im s (Ri gh t )

200

Unemployment Rate: U.S. vs. Georgia

(%)

12

10

8

6

4

2

1991

1994

1997

2000

2003

2006

2009

Identifying Unemployment

Natural Rate of Unemployment

– The natural rate of unemployment is unemployment

that does not go away on its own even in the long run.

– It is the amount of unemployment that the economy

normally experiences.

Cyclical Unemployment

– Cyclical unemployment refers to the year-to-year

fluctuations in unemployment around its natural rate.

– It is associated with short-term ups and downs of the

business cycle.

How Is Unemployment

Measured?

Based on the answers to the survey questions, the

Bureau of Labor Statistics (BLS) places each adult

into one of three categories:

– Employed

– Unemployed

– Not in the labor force

Labor Force

– The labor force is the total number of workers, including

both the employed and the unemployed.

– The BLS defines the labor force as the sum of the

employed and the unemployed.

Breakdown Of The Population In 2007

Employed

(146.0 million)

Adult

Population

(231.8 million)

Unemployed (7.1 million)

Not in labor force

(76.0 million)

Labor Force

(153.1 million)

Unemployment - What is it?

The unemployment rate is calculated as the

percentage of the labor force that is

unemployed.

Number unemployed

Unemployment rate =

100

Labor force

Labor Force Participation Rate

Labor force participation rate

Labor force

100

Adult population

Example

In 2001, 135.1 million people were employed and

6.7 million people were unemployed.

– Labor Force = 135.1 + 6.7 = 141.8 million

– Unemployment Rate

= (6.7 / 141.8) X 100

= 4.7 percent

– Labor Force Participation Rate =

(141.8 / 211.9) X 100 = 66.9 percent

Figure 3 Labor Force Participation

Rates for Men and Women Since 1950

Labor-Force

Rate (in percent)

90

80

Men

70

60

50

Women

40

30

20

1950 1955 1960 1965 1970 1975 1980 1985 1990 1995 2000 2005

The Labor-Market Experiences of Various

Demographic Groups (2007)

Demographic Group

Adults (ages 20 and older)

White, male

White, female

Black, male

Black, female

Teenagers (ages 16–19)

White, male

White, female

Black, male

Black, female

Unemployment

Rate

Labor-force Participation

Rate

3.7%

3.6

7.9

6.7

76.3%

60.1

71.2

64.0

15.7

12.1

33.8

25.3

44.3

44.6

29.4

31.2

This table shows the unemployment rate and the labor-force participation

rate of various groups in the U.S. population for 2007

Copyright©2004 South-Western

Questions About Unemployment

Does the Unemployment Rate Measure What We

Want It To?

How Long Are the Unemployed without Work?

Why Are There Always Some People

Unemployed?

Article: Why do Americans Work More Than Europeans?

WSJ; by: Edward Prescott

Americans aged 15-64, on a per-person basis, work

50% more than French. The French, for example,

prefer leisure more than do Americans or on the other

side of the coin, that Americans like to work more. This

is silliness !!

Germans and Americans spend the same amount time

working, but the proportion of taxable market time vs.

nontaxable home work time is different

But marginal tax rates explain virtually all of this

difference. Labor supply is not fixed. People be they

European or American, respond to taxed on their

income.

– Spanish labor supply increased by 12% in 1988

when taxes were cut

Chapter 29

The Monetary System

Money–What is it and what does it do?

Money is the set of assets in an economy that people regularly

use to buy goods and services from one another

Medium of Exchange –what sellers accept from buyers as

payment for goods and services. Eliminates inefficiencies of

barter.

Unit of Account – When there is one unit of account, like the

($) in the United States, you don't have to think in relative

terms when valuing goods and services.

Store of Value – people have the option to hold money over

time as one way of storing their assets. Money is an important

store of value, because it is the most liquid asset in the

economy

Types of Money

Commodity Money money that takes the form of a

commodity with intrinsic value.

Fiat Money money without intrinsic value that is

used as money because of government decree

How to Measure Money

Money Stock: The quantity of money circulating in the

economy

Q: Suppose you want to know the size of the U.S.

money stock. What should you count as money?

A: Currency and demand deposits, and a few other

items (detailed below) but not credit cards.

Currency - the paper bills and coins in the hands of the

public

Demand Deposits - balances in bank accounts that

depositors can access on demand by writing a check

(or by using a debit card)

Two Measures of the Money Stock for the U.S.

Economy (2007)

Billions

of Dollars

M2

$7,447

• Savings deposits

• Small time deposits

• Money market

mutual funds

• A few minor categories

($6,083 billion)

M1

$1,363

0

• Demand deposits

• Traveler’s checks

• Other checkable deposits

($605 billion)

• Currency

($759 billion)

• Everything in M1

($1,364 billion)

Continued…

Q: How is the U.S. money stock measured and reported?

A: Two most important measures – M1 and M2

M1 = Currency, Traveler's checks, Demand Deposits and Other

Checkable Deposits

Here is a breakdown of M1 for 1996:

Item$ (Billions) % of total

Currency

Traveler's Checks

Demand Deposits

Other Checkable Deposits

$1076.8

395.7

8.6

400.7

271.8

100.0%

36.7

0.8

37.2

25.3

M2 = Everything in M1 plus Savings deposits, Small Time

Deposits, Money Market Mutual Funds and a few minor

categories. M2 for 1996 was $3657.4 billion.

Banks & Money Supply

Q: How do banks operate?

A: Banks accept deposits from people. That money is in an

account until the depositor makes a withdrawal or writes a

check on their account.

Q: Do banks keep all of your money in their vault?

A: No. Our banking system is called fractional reserve

banking. Bankers understand that it is not necessary to

keep 100 percent of a depositors money on hand at all

times. As a result, bankers take some of your money and

loan it out to other people.

Continued..

Fractional reserve banking - a banking

system in which banks hold only a fraction

of deposits as reserves

Reserve ratio - the fraction of deposits that

banks hold as reserves. Minimum reserve

ratios are set by the Fed.

Money Creation with

Fractional-Reserve Banking

When a bank makes a loan from its

reserves, the money supply increases.

The money supply is affected by the amount

deposited in banks and the amount that

banks loan.

– Deposits into a bank are recorded as both assets

and liabilities.

– The fraction of total deposits that a bank has to

keep as reserves is called the reserve ratio.

– Loans become an asset to the bank.

Money Creation with FractionalReserve Banking

This T-Account shows a bank that…

– accepts deposits,

– keeps a portion

as reserves,

– and lends out

the rest.

– It assumes a

reserve ratio

of 10%.

First National Bank

Assets

Reserves

$10.00

Liabilities

Deposits

$100.00

Loans

$90.00

Total Assets

$100.00

Total Liabilities

$100.00

Money Creation with

Fractional-Reserve Banking

When one bank loans money, that money is

generally deposited into another bank.

This creates more deposits and more

reserves to be lent out.

When a bank makes a loan from its

reserves, the money supply increases.

The Money Multiplier

First National Bank

Assets

Reserves

$10.00

Liabilities

Deposits

$100.00

Loans

Second National Bank

Assets

Reserves

$9.00

Liabilities

Deposits

$90.00

Loans

$90.00

Total Assets

Total Liabilities

$100.00

$100.00

$81.00

Total Assets

$90.00

Money Supply = $190.00!

Total Liabilities

$90.00

The Money Multiplier

Suppose that the Fed requires banks to keep 10 percent of their

demand deposits on reserve.

Q: What happens when somebody brings in $100 and deposits it

in a bank?

A: The bank is required to keep $10 (10 percent) on reserve.

Q: What does the bank do with the remaining $90?

A: The bank will turn around and lend it to somebody else,

earning interest income for the bank.

Q: What did that $90 loan do to the size of the money supply?

A: The money supply increased by $90 when the loan was made.

Why? When the bank made the $90 loan, $90 in currency

reentered the money supply

Continued…

Now suppose that the person who received the $90 loan

deposits that money into their checking account.

Q: What does the bank have to do with the $90?

A: Keep 10 percent on reserve (10 percent of $90 = $9).

Q: What does the second bank do with the remaining $81?

A: They can lend that out to somebody else

Money Multiplier

Q: How far does this process of money creation go?

A: The process of bank money creation continues until there are no more

excess reserves to be lent out.

Money multiplier - the amount of money the banking system generates with

each dollar of reserves. The money multiplier is the reciprocal of the

reserve ratio:

M = 1/R

With a reserve requirement, R = 10% or 1/10,

The multiplier is 5. Therefore, the original $100 deposit will eventually

turn into $1000 of deposits.

Q: The banking system can create money, but can it also create real wealth?

A: No. Each loan has two parts. Recall that the first $90 loan generated $90 in

new money. At the same time, that $90 loan also created a new $90

liability for the person borrowing the money. The banking system cannot

create real wealth.

The Federal Reserve System

The Federal Reserve (Fed) serves as the

nation’s central bank.

– It is designed to oversee the banking system.

– It regulates the quantity of money in the

economy.

The primary elements in the Federal

Reserve System:

1) The Board of Governors

2) The Regional Federal Reserve Banks

3) The Federal Open Market Committee

The Federal Reserve System

Copyright©2003 Southwestern/Thomson Learning

The Fed’s Organization

The Federal Open Market Committee

(FOMC)

– Serves as the main policy-making organ

of the Federal Reserve System.

– Meets approximately every six weeks to

review the economy.

The Fed’s Tools of Monetary Control

The Fed has three tools in its monetary toolbox:

–

–

–

–

–

Open-market operations

Changing the reserve requirement

Changing the discount rate

NEW ALPHABET SOUP OF CREDIT PROGRAMS

BUYING T-BONDS & MBS/DEBT

The Fed’s Tools of Monetary Control

Open-Market Operations

– The Fed conducts open-market operations when it

buys government bonds from or sells government

bonds to the public:

– When the Fed buys bonds, the money supply is

increased. Here is why: The Fed pays for the bonds it

buys with money that was not currently a part of the

money supply, hence, when the Fed buys bonds it

simply increases the total amount of money in

circulation.

– When the Fed sells bonds, the money supply is

decreased. Here is why: The Fed sells bonds in the

market and receives cash in return for the bonds it

sells. Once the Fed receives the cash, this cash is

taken out of circulation – therefore, the size of the

money supply is decreased.

The Fed’s Tools of Monetary Control

Reserve Requirements

– The Fed also influences the money supply with

reserve requirements.

– Reserve requirements are regulations on the

minimum amount of reserves that banks must

hold against deposits.

Problems in Controlling the

Money Supply

The Fed must wrestle with two problems

that arise due to fractional-reserve banking.

– The Fed does not control the amount of money

that households choose to hold as deposits in

banks.

– The Fed does not control the amount of money

that bankers choose to lend.

Credit Crunch

Update

Total Commercial Paper Outstanding

($. Bil.)

2400

2200

Up 60%

2000

1800

1600

1400

Down 50%

1200

1000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

Total Consumer Credit Outstanding

($ Bil.)

2600

2550

2500

2450

2400

2350

2300

2250

JAN APR JUL OCT JAN APR JUL OCT JAN APR JUL OCT JAN APR JUL OCT JAN

2006

2007

2008

2009

2010

And You Thought HELOC Growth Was History!

(%, Y -O-Y )

50

(%)

8.4

7.8

40

7.2

6.6

30

6.0

20

5.4

4.8

10

4.2

3.6

0

3.0

-10

2.4

MAY OCT MAR AUG JAN JUN NOV APR SEP FEB JUL DEC MAY OCT MAR AUG JAN

2003

2004

2005

2006

2007

2008

2009

2010

Hom e Equ i t y (Left )

Pr im e Ra t e (Ri gh t )

Chapter 30

Money Growth and Inflation

The Classical Theory of Inflation

Inflation is an increase in the overall level of prices.

Inflation erodes purchasing power of money.

Hyperinflation is an extraordinarily high rate of

inflation.

Historical Aspects

– Over the past 60 years, prices have risen on average about

5 percent per year.

– In the 1970s prices rose by 7 percent per year.

– During the 1990s, prices rose at an average rate of 2

percent per year.

– Deflation, meaning decreasing average prices, occurred in

the U.S. in the nineteenth century.

– Hyperinflation refers to high rates of inflation such as

Germany experienced in the 1920s.

Money Supply, Money Demand

and Monetary Equilibrium

The money supply is a policy variable that is controlled by

the Fed.

– Through instruments such as open-market operations,

the Fed directly controls the quantity of money

supplied.

Money demand has several determinants, including interest

rates and the average level of prices in the economy.

People hold money because it is the medium of exchange.

– The amount of money people choose to hold depends

on the prices of goods and services.

In the long run, the overall level of prices adjusts to the

level at which the demand for money equals the supply.

Money Supply, Money Demand, and the Equilibrium

Price Level

Value of

Money, 1/P

(High)

Price

Level, P

Money supply

1

1 (Low)

3

1.33

/4

12

/

Equilibrium

value of

money

(Low)

A

2

Equilibrium

price level

14

4

/

Money

demand

(High)

0

Quantity fixed

by the Fed

Quantity of

Money

Copyright © 2004 South-Western

Figure 2 The Effects of Monetary Injection

Value of

Money, 1/P

(High)

MS1

MS2

1 (Low)

1

1. An increase

in the money

supply . . .

3

2. . . . decreases

the value of

money . . .

Price

Level, P

/4

12

/

1.33

A

2

B

14

/

3. . . . and

increases

the price

level.

4

Money

demand

(High)

(Low)

0

M1

M2

Quantity of

Money

Copyright © 2004 South-Western

The Classical Theory of

Inflation

The Quantity Theory of Money

– How the price level is determined and why it

might change over time is called the quantity

theory of money.

The quantity of money available in the economy

determines the value of money.

The primary cause of inflation is the growth in the

quantity of money.

Velocity and the Quantity Equation

The velocity of money refers to the speed at

which the typical dollar bill travels around the

economy from wallet to wallet.

V = (P Y)/M

Where: V = velocity

P = the price level

Y = the quantity of output

M = the quantity of money

Rewriting the equation gives the quantity

equation:

MV=PY

Velocity & Quantity Equation

Velocity ( V )

= Nominal GDP/ Money Supply

=(PxY)/M

Example: V

= ($10 x 100 ) / $ 50

= 20

Velocity & Quantity Equation

The quantity equation relates the quantity of

money (M) to the nominal value of output

(P Y).

The quantity equation shows that an increase in

the quantity of money in an economy must be

reflected in one of three other variables:

– the price level must rise,

– the quantity of output must rise, or

– the velocity of money must fall.

Velocity and the Quantity

Equation

The Equilibrium Price Level, Inflation Rate,

and the Quantity Theory of Money

– The velocity of money is relatively stable over

time.

– When the Fed changes the quantity of money, it

causes proportionate changes in the nominal

value of output (P Y).

– Because money is neutral, money does not

affect output.

Nominal GDP, the Quantity of Money,

and the Velocity of Money

Velocity of Money (M2)

2.2

2.1

2.0

1.9

1.8

1.7

1.6

1.5

1961

1965

1969

1973

1977

1981

1985

1989

1993

1997

2001

2005 2009

The Inflation Tax

When the government raises revenue by

printing money, it is said to levy an

inflation tax.

An inflation tax is like a tax on everyone

who holds money.

The Fisher effect refers to a one-to-one

adjustment of the nominal interest rate to

the inflation rate.

The Nominal Interest Rate and the

Inflation Rate

Costs of Inflation

1.

2.

3.

4.

Shoeleather Costs – resources wasted when inflation encourages

people to reduce their holdings of money.

Menu Costs – the costs involved in actually changing prices

around the economy.

Relative Price Variability and the Misallocation of Resources

– If firms only occasionally change their prices (like once per

year), then they have to guess at the future level of inflation. Their

prices will be too high early in the year and too low late in the

year, resulting in sales that are artificially low early in the year

and artificially high late in the year.

Inflation-Induced Tax Distortions – Taxes like capital gains and

interest income taxes are imposed on the nominal value of assets

or on interest income. From studying real versus nominal interest

rates, you know that part of the nominal interest rate exists to

compensate people for the effects of inflation. The higher is the

rate of inflation, the higher is this distortion caused by these taxes.

Continued..

5. Confusion and Inconvenience – Money, being the economy's

unit of account, is used to quote prices for goods and services

throughout the economy. Confusion and inconvenience arise as

a cost of inflation because inflation makes valuing dollars over

time difficult. Many important items in the economy are

measured over time (like the value of a firm, for instance), and

inflation creates difficulties in the valuation of assets or debts

that occur over time.

6. Arbitrary Redistributions of Wealth – "Inflation is good for

borrowers and bad for lenders" is a common phrase that rings

out in economics principles courses. Here's a personal example

for you to consider (and a personal example for your website

author as well). When you graduate from college, you will

likely owe money on student loans that you took out during

your college years. Between the time you borrowed the money

and the time when you repay the loan, you will be better off if

inflation is high.

Overhang of

Toxic Debt

Bad Luck for Streets of Buckhead

As of the 4th quarter, about 20% of $440 billion of

construction loans outstanding were more than 30

days past due, compared to 11.4% a year ago.

Banks will have their hands full in the coming

months. About $566 billion is commercial real estate

debt, the majority of which was provided by banks,

comes due in 2010 and 2011.

(Foresight Analytics)

Source: The Wall Street Journal, January 22, 2010

Atlanta’s Irrational Building Update

Two Alliance Center

Planned Opening: June 2009

Occupancy Rate: 31%

Financial Situation: project amount $116 million

Terminus 200

Planned Opening: Aug 2009

Occupancy Rate: 8.8%

Financial situation: took a $39 mm write-down

3630 Peachtree

Planned Opening: Aug 2009

Occupancy Rate: no leasing deal reported

Financial Situation: took a $50 mm write-down

Phipps Tower

Planned Opening: March 2010

Occupancy Rate: No leasing deal reported

Financial Situation: project amount $95 million

Source: The Wall Street Journal, April 22, 2009

Atlanta’s Office and Industrial Vacancy

Source: Atlanta Office Market Analysis for 2009Q4. Cushman & Wakefield

Commercial Bank Loan Charge-Off Ratio

(%)

2.5

S&Ls Crisis

2.0

1.5

1.0

0.5

0.0

1985

1987

1989

1991

1993

1995

1997

1999

2001

2003

2005

2007

2009

Meanwhile, in the Early 90’s…

Households

Labor

Large Firms

Labor

Financial Institution

Goods

Small Firms

Figure 1: Return Function of the Intermediary

p*l

pl(L)

K*

K

MPL ( high capital) > MPL (low capital)

Table: Steady state welfare calculations

Base Case

Steady state

Output

Consumption

Investment

Capital stock

K/L

Spread

Hours

Welfare cost

(DC/C)*100

(DC/Y)*100

w=0.0

1.1441

0.8419

0.3021

12.085

39.8

0.00%

0.3038

-

Experiment

w=0.006

1.1027

0.8155

0.2872

11.487

37.7

3.69%

0.3046

3.50%

2.60%

Fear of Fire Sales and the Credit Freeze

Douglas Diamond

Professor of Finance

University of Chicago

Raghuram Rajan

Professor of Finance

University of Chicago

…an “overhang” of impaired banks that may be

forced to sell soon can reduce the current price of illiquid

securities sufficiently that banks have no interest in selling. This

creates high expected returns to holding

cash for potential buyers and an aversion

to making term loans.

Source: NBER working paper #14925, April 2009

Cease & Desist Orders in Georgia

Institution

2007

2008

2009

FDIC

1

13

49

NCUA

2

0

1

OTS

1

0

3

CCANB

1

2

5

5

15

58

Total All Institutions

As of December 31th 2009, there were 309 banks in Georgia.

FDIC

NCUA

OTS

CCANB

= Federal Insurance Deposit Corporation

= National Credit Union Administration

= Office of Thrift Supervision

= Comptroller of the Currency Administrator of National Banks

Source: Georgia Bankers Association and each institution’s website.

Definition of Depression

Los A n gel es Em pl oy m en t

(%)

100

98

Aerospace Bust

Led to a Real

Estate & Jobs

Bust in Early 90s

96

94

Real Estate Recovery

was Led by Hispanic

Buyers; Hollywood

Fills in the jobs

Vacuum somewhat

92

90

88

86

1991

1993

1995

1997

1999

2001

2003

2005

2007

2009

Beverly Hills

South Central L.A.

Source: UCLA Business Forecasting Project Report,

September 1996

Case-Shiller Tiered Home Price Index

Case-Shiller Tiered Home Price Index

A t lant a

Mia m i

140

350

300

120

250

100

200

150

80

100

60

1993

1995

Low T ier

1997

1999

2001

2003

2005

2007

2009

50

High T i er

1989

1991

Low T ier

Case-Shiller Tiered Home Price Index

1993

1995

1997

1999

2001

2003

2005

2007

2009

High T i er

Case-Shiller Tiered Home Price Index

Los A n gel es

New Yor k

(%, Y -O-Y )

300

350

300

250

250

200

200

150

150

100

100

50

1989

1991

Low T ier

1993

1995

1997

High T i er

1999

2001

2003

2005

2007

2009

50

1989

1991

Low T ier

1993

1995

1997

High T i er

1999

2001

2003

2005

2007

2009

Excess Reserves of Depository Institutions

($ Bil.)

1200

1000

800

600

400

200

0

-200

AUG SEP OCT NOVDEC JAN FEBMAR APR MAY JUN JUL AUG SEP OCT NOV DEC JAN

2008

2009

2010

Inflation Outlook

(%, Y -O-Y )

6

4

2

0

-2

-4

FEB

2007

MAY

AUG

CPI In dex

NOV

FEB

2008

MAY

Cor e CPI

AUG

NOV

FEB

2009

MAY

AUG

NOV

FEB

2010

Article: Haute Con Job (PIMCO)

aka Bill Gross’s Beef With Inflation

Methodology

Bill Claims that Hedonic Pricing a.k.a. Haute Con

Job is Keeping Inflation Rate Low

Low Inflation => Higher Productivity (Calculations)

=> FED Can Keep Rates Low, Keep the Consumption

Boom, and Greenspan His Legacy!

Government Can Keep Social Security Payments Down

It Hurts Investors, Especially His TIPS Holders

Bill Says Core Inflation is Not the Real Metric of

Measuring the Cost of Living as We Still Have to

Pay for Food & Energy in Real Life!

Article: Con Job Redux (PIMCO)

by: Bill Gross

Bill claims that CPI inaccurately calculates Americans’ cost of

living.

Example: Say you buy 1 bag of gumdrops for $1 which has 100

of those. Productivity makes it 110 gumdrops but for $1.10.

Hedonic pricing says that CPI hasn’t gone up as per-capita cost

is the same (1 cent). But you have to shelve out $1.10 to get

the bag, which is an increase in cost of 10%. They must fork

out an extra dime even though they’re getting more for their

money.

We can’t buy individual pieces of memory in a computer-we

have to buy the entire package!

Inflation Outlook

(%, Y -O-Y )

6

4

2

0

-2

-4

FEB

2007

MAY

AUG

CPI In dex

NOV

FEB

2008

MAY

Cor e CPI

AUG

NOV

FEB

2009

Hou si n g

MAY

AUG

NOV

FEB

2010