LW272 MS May 14

advertisement

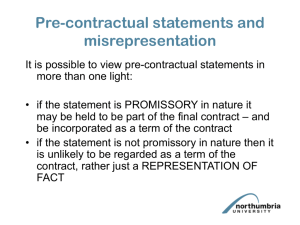

LW272: Business Law May/June 2014 Outline Solutions _______________________________ Question 1 Candidates should give a definition of misrepresentation - false statement of fact made by one party to the other party to the contract with a view to inducing the other to enter into it and actually has induced the other party to make the contract. Bisset v Wilkinson (1927), Smith v Land & House Property Corp. (1884). The statement ‘not been involved in an accident’ is a statement of fact. ‘False’ includes statements that become false after they are made, With v O’Flanagan (1936), Spice Girls Ltd v Aprilla World Service BV (2002). The statement must induce the other party to enter into the contract. Paul informs Jamal that he would not have bought the plane if it had been involved in an accident. There is a cause of action even if the deceived party could have discovered the truth, Attwood v Small (1838), Museprime Properties Ltd v Adhill (1990). Candidates should consider whether the statement is fraudulent, negligent or innocent and the effect of the Misrepresentation Act 1967. Remedies available to Paul depend upon the type of misrepresentation. A fraudulent misrepresentation is a statement which the maker knows to be false or is reckless as to whether it is true or false. If this is the case then Paul will be entitled to damages in the tort of deceit and to rescind the contract. Smith and New Court Securities Ltd v Scrimgeour Vickers Ltd (1996). A negligent misrepresentation is one the maker believes to be true but does not have reasonable grounds for that belief, and under the Misrepresentation Act 1967 will be entitled to damages s2(1) MRA 1967 and/or rescission s2(2) MRA 1967 (this section allows the court to award damages instead of rescission if it is more equitable in the circumstances). From the facts of the scenario it would appear to be negligent. An innocent misrepresentation is one the maker believes to be true and has reasonable grounds for that belief – remedy is recession or damages s2(2) MRA 1967 Under the MRA 1967 it is up to the party who made the misrepresentation to show that it was innocent – unlikely that Jamal can show he had reasonable grounds to belief the statement was still true as he had forgotten about the accident. Question 2 (a) Logistics Ltd has entered into a supply contract with Headmistresses and therefore in refusing to deliver the products Logistics Ltd is breaching the terms of the supply contract. They seem to be seeking to rely on the snowfall and slow delivery as events which are frustrating the contract. Students should define frustration e.g. Frustration of a contract takes place where a contract is impossible for one or more of the parties to carry out their duties under the contract because of some unforeseen and uncontrollable event. If a contract is frustrated it is not breached. However a contract is not frustrated just because it becomes more onerous to carry out, which is the case here (Davis Contractors v Fareham UDC (1956)) or Tsakiroglou v Noblee Thorl GmbH (1962)) (b) These clauses are restraint of trade clauses which are imposed on Mandy in her employment contract. Students should define restraint of trade (“ROT”) clauses e.g. these restraint of trade clauses seek to restrict Mandy’s right to work / do business wherever and with whoever she chooses. ROT clauses prima facie void unless reasonable. Page 1 of 4 LW212: Business Law (MS) (May/June 2014) Students should consider each of the clauses in turn to consider whether reasonable Clause 1: Business interest being protected - Distinction must be drawn between trade secrets and skills acquired during term of employment. Cutting of hair:Mandy’s haircutting skills are not a business interest which can be legitimately restricted Morris (Herbert) Ltd v Saxelby (1916). Provision of beauty products also not a business interest which can be legitimately restricted as restraints must be no more than reasonable. Headmistresses did not sell beauty products therefore it cannot seek to restrict Mandy selling in the future. Length of time: 2 years – fine. Location: UK – fine. Clause 2: Business interest being protected – the recipe to Lavendye is a trade secret therefore can be protected (Forster & Sons Ltd v Suggett (1918)) Length of time – ok; Location - fine. Mandy is bound by the second clause but not by the first. Consequently Mandy can set up a business selling foot creams in Hove. Question 3 (a) Implied into all contracts for the sale of goods is the seller has the right to sell the goods section12. Where goods are sold by description, section 13 implies a term that the goods will match the description. Where goods are sold by sample, section 15 implies a term that the goods will match the sample, and be free from any defect of quality not apparent on reasonable examination of the sample. (b) The sale of the carpet for is a sale by sample and description. Boris relied on the sample as showing what colour the carpet would be. The bulk of the carpet when it was delivered is in breach of section 15 of the SGA 1979 in that the sample was dark red/black but the carpet delivered is bright red/brown. This is not a defect which would be apparent on examination of the sample and there is therefore a breach. The term implied by section 15 is a condition and Boris can therefore reject the carpet and claim a full refund of the price.The100% wool is a description. Goods can be rejected for an incorrect description even though they are not defective in any other way Arcos v Ronaasen (1933). However in non-consumer s15A sales the buyer cannot reject the goods where the breach is so slight it would be unreasonable. As Boris is acting in the course of a business the sale is not a consumer sale and therefore s15A will apply- Boris may not be able to reject the goods. (c) Forged painting: Section 13 implies a term that the goods will match the description Where a buyer does not know of the description, or does not rely on it, the sale cannot be described as a sale by description. Therefore if a buyer with expert knowledge buys goods from a seller who is not an expert the buyer is not able to rely on the seller’s description: Harlingdon & Leinster Enterprises Ltd v Christopher Hull Fine Art Ltd (1991). Southbies had the painting examined by their own expert. Boris would argue that Southbies relied on their own judgement, and not on the description he gave of the painting as “believing” it to be by Van Goes, and Southbies would not succeed in a claim for a breach of the condition implied by section 13 SGA 1979.Stolen painting: Section 12 Implied into all contracts for the sale of goods is the seller has the right to sell the goods section12. The seller will break this term if it transpires the goods are stolen because the seller will not have good title. Rowland v Divall (1923). Page 2 of 4 LW212: Business Law (MS) (May/June 2014) Question 4 (A) Katie and Joseph have both lost money as a result of investments which resulted from the advice of Walter. No indication of contract between either K or J and Walter therefore K and J should be considering misstatement claim. Walter does not know for sure that the investment is a poor one therefore likely to be negligent misstatement. Must show W owed K / J duty of care. No established duty of care for all accountants to everyone for pure economic loss so consider Caparo, Hedley Byrne v Heller – is there “special relationship” between W and K / J? Loss of money foreseeable to K / J as result of advice? Yes for each Proximity / Special relationship between Walter and K / J? Did W know that his statement would be communicated to K / J (yes);was advice given specifically in connection with identifiable transaction (yes) did W reasonably anticipate that K / J would rely on statement without seeking further advice (Katie - yes. J – no- has no direct r’ship with W). Fair, just and reasonable to impose DOC? Yes in context of Katie. No in context of Joseph as no direct relationship Conclusion: Katie can bring negligent misstatement claim with likelihood of success. Joseph cannot as no special relationship. (B) Applying the terminology of the Data Protection Act 1998 (“DPA”), Bubblebelief is the data processor, the contact names and addresses of the branding consultants are personal data, the consultants are the data subjects, and the act of collecting and holding the data is processing. The first data protection principle provides that personal data must be handled fairly and llawfully by the data controller (BubbleBelief). Students should give 2 examples of how this could be done – e.g. by providing the name of the data controller (BubbleBelief); setting out how BubbleBelief intends to use or process the data; BB should also handle the personal data only in ways the consultants would reasonably expect; students may suggest that BB request branding consultants’ consent for future use of such data or that BB can keep and use the info for performance of contract (or for BB’s legitimate interests). Question 5 1. Use of Kate Bush’s album Is there a work? Yes, this is a musical work and literary work Is it fixed? Yes, recorded Is it original? Yes, Kate Bush wrote the lyrics/music Expired? No, Kate Bush is still alive. Has the album been infringed? Yes, Debbie copied a single Has a substantial part been infringed? Yes, Debbie copied a whole single and it was of substantial quality as it was the song released as a single Spelling Goldberg v BBC Publications Ltd What type of infringement? Performing or playing work in public. No defences Remedies – Kate Bush could sue Debbie for © infringement. Likely to require injunction to stop further adverts being run. 2. Use of sections of Hardy’s novel Literary work / fixed / original however copyright has expired as Hardy died more than one hundred years ago and under CDPA copyright for a literary work is 70 years after death of author. (c) Eleanor can use the music for her education under the statutory defence of “fair dealing” under CDPA 88. Page 3 of 4 LW212: Business Law (MS) (May/June 2014) Question 6 a) It established that a correctly registered company possesses a legal identity separated from its shareholders by the ‘veil of incorporation’. Due to the company’s separate legal personality, the courts have often been unwilling to ‘lift the veil’ and find out what the directors actually did in running the business (what decisions were taken, and by whom and so on). Whilst the veil is effective, it has been ‘raised’ by the courts where it has been deemed relevant. The courts have been notoriously unwilling to establish clear rules as to when the veil will be lifted. However, the company must not be established to commit some fraud (Jones v Lipman) or to attempt to circumvent contractual agreements or the veil will be lifted to identify the true nature of the undertaking (for example a ‘sham’ company). b) As one of the directors of the company, Joe has clearly breached a number of director’s duties under the common law rules and may also be in breach of some of the general duties imposed by the Companies Act 2006. The general directors’ duties under the 2006 Act replace the old common law rules but are to be interpreted by reference to the old rules (s 170). In particular, Joe may have breached s 174, which requires a director to exercise reasonable care, skill and diligence. It seems unlikely that a court would view Joe’s actions as reasonable. There may be evidence of a conflict of interest on the part of Joe S175 + S177 (a duty to declare an interest) may have been breached. There is no mention of him making any financial gain from Eric’s appointment, but this does not detract from his poor judgment which has had such a serious effect and resulted in the death of an innocent customer. S.172 may also have been breached – a duty to promote the success of the company. Page 4 of 4 LW212: Business Law (MS) (May/June 2014)