daily cost of food

advertisement

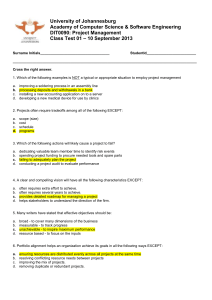

Chapter 9 Daily Food Cost Principles of Food, Beverage, and Labour Cost Controls, Second Canadian Edition Learning Objectives • 9.1 Calculate food cost and food cost percent for a single day and for all the days to date in a period. • 9.2 Prepare a daily report of food sales, food cost, and food cost percent. • 9.3 Differentiate between book inventory and actual physical inventory and identify various causes for differences between the two. • 9.4 Determine book inventory value. Principles of Food, Beverage, and Labour Cost Controls, Second Canadian Edition • 9.1a Calculate food cost percent for any single day and for all the days to date in a period. 2 • If foodservice operations were monitored from monthly cost figures alone, the length of time between monthly reports would present an obstacle. • This delay can be very costly. To avoid the delay, better organized foodservice operations calculate food cost daily. Principles of Food, Beverage, and Labour Cost Controls, Second Canadian Edition Introduction 3 • Opening inventory: the dollar value of all food on hand at the beginning of the accounting period • Purchases: the sum cost of all food purchased during the accounting period • Total Available: the sum of the beginning inventory and purchases • Closing Inventory: the dollar value of all food on hand at the end of the accounting period Principles of Food, Beverage, and Labour Cost Controls, Second Canadian Edition Important Definitions 4 Important Definitions • Employee meal cost: a labour-related, not food-related cost. Free or reduced-cost employee meals are a benefit much in the same manner as medical insurance or paid vacation. Principles of Food, Beverage, and Labour Cost Controls, Second Canadian Edition • Cost of food consumed: the actual dollar value of all food used, or consumed, by the operation 5 Determining Daily Food Cost • All foods are either directs or stores Receiving Clerk's Daily Report • Stores are charged to the food cost when issued • Determine the value of stores issued on a given day • Extends all requisitions for foods issued on that day and total Principles of Food, Beverage, and Labour Cost Controls, Second Canadian Edition • Find total directs that day, available from the 6 Determining Daily Food Cost • Determine the value of any alcoholic beverages • Determine the value for daily transfers from the kitchen to bar, promotion, etc. • Many establishments credit daily food cost for the value of employees’ meals Principles of Food, Beverage, and Labour Cost Controls, Second Canadian Edition transferred from the bar to the kitchen 7 Determining Daily Food Cost Cost of directs (from the Receiving Clerk’s Daily Report) + Cost of stores issued + Adjustments that increase daily cost* – Adjustments that decrease daily cost** = Cost of food consumed – Cost of employee meals = Daily cost of food sold *Include transfers from bar to kitchen; transfers from other units **Include transfers from the kitchen to the bar food to bar (directs), gratis to bar, steward sales, promotion expense Principles of Food, Beverage, and Labour Cost Controls, Second Canadian Edition The daily cost of food can be determined in the following way: 8 Food Cost Today and To Date • The daily food cost percent for any one day may • Directs may be purchased every other day • this will make daily food cost artificially higher on the days when directs are received • To help overcome the problem most operations calculate food cost percent to date. Principles of Food, Beverage, and Labour Cost Controls, Second Canadian Edition not be a very accurate: 9 Food Cost Today and To Date • Food cost percent to date is defined as the • It takes into account all food costs and all food sales for all days so far in the period. • To determine food cost percent to date: • divide cost to date by sales to date Principles of Food, Beverage, and Labour Cost Controls, Second Canadian Edition cumulative food cost percent for a period. 10 Simple Daily Cumulative Cost Report Adjustments Total Cost Total Sales Food Cost % Date Directs 1-Feb $254.20 Stores $ 977.30 Added to Cost $ 57.20 Subtract from Cost Today $255.30 $1,033.40 2-Feb $326.70 $ 944.10 $ 86.20 $253.40 3-Feb $262.50 $1,040.40 $ 88.60 4-Feb $256.35 $ 965.30 5-Feb $218.75 $ 944.55 To Date $1,033.40 Today $2,778.00 To Date $ 2,778.00 Today 37.199% To Date 37.199% $1,103.60 $2,137.00 $2,919.20 $ 5,697.20 37.805% 37.510% $177.80 $1,213.70 $3,350.70 $3,056.95 $ 8,754.15 39.703% 38.276% $ 120.00 $220.00 $1,121.65 $4,472.35 $3,094.20 $11,848.35 36.250% 37.747% $ 90.00 $170.00 $1,083.30 $5,555.65 $3,427.35 $15,275.70 31.608% 36.369% Principles of Food, Beverage, and Labour Cost Controls, Second Canadian Edition Simple Daily Cumulative Cost Report 11 Daily Reports • Daily reports allow management to: • Report should show: • • food cost, food sales, and food cost percent for any one specific day and for all the days to date in the period compare these figures to those for a similar period Principles of Food, Beverage, and Labour Cost Controls, Second Canadian Edition • accurately assess daily costs and sales • compare with similar periods • better assess operations and cost-control measures 12 Book vs. Actual Inventory • Compare it with the actual inventory value • Maintain daily food cost figures to establish the value of the book inventory Principles of Food, Beverage, and Labour Cost Controls, Second Canadian Edition • Determine what the value of the closing inventory should be, based on records indicating purchases and issues 13 Book vs. Actual Inventory Opening inventory (closing inventory for the preceding month) + Purchases (total stores purchases for the period, on receiving reports) = Total available (total value of stores available for use during the period) – Issues (total stores issues for the period, as listed on requisitions) = Closing book value of the stores inventory Principles of Food, Beverage, and Labour Cost Controls, Second Canadian Edition Book inventory value is determined as follows: 14 Book Inventory vs. Physical Inventory • an occasional human error in costing out requisitions • use of the most recent purchase price rather than actual purchase price in valuing the physical inventory • mismarking of actual purchase prices when that method is used • Reasons that are never acceptable include: • issuing stores without requisitions • food spoilage that must be discarded • theft of food. Principles of Food, Beverage, and Labour Cost Controls, Second Canadian Edition • The value should be identical to the value at the end of the month. • Acceptable reasons are: 15 Key Terms Principles of Food, Beverage, and Labour Cost Controls, Second Canadian Edition • Book inventory, p. 252 • Daily cost of food, p. 244 • Food cost percent to date, p. 245 16 Chapter Web Links • Silverware POS: www.silverwarepos.com Principles of Food, Beverage, and Labour Cost Controls, Second Canadian Edition • Compeat: www.compeat.com 17 Principles of Food, Beverage, and Labour Cost Controls, Second Canadian Edition Copyright 18