Ekonomi Bisnis dan Manajerial

Ekonomi Bisnis dan

Manajerial

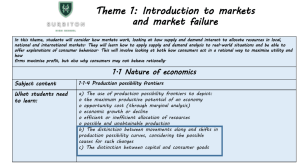

1.Mengetahui ruang lingkup mata kuliah ini

2. Mengetahui lingkungan ekonomi di dalam mana bisnis dilakukan

What is MICROECONOMICS?

MICRO:

– study of economic behavior of (relatively)

"small" units, e.g., workers, firms

Versus MACRO:

– study of economy as a whole,

– aggregate actor behavior

• Remarkable consensus on micro's underlying principles

– "laws" and tools of analysis, but vast differences in terms of what to do with the analysis.

• Micro inherently conservative (?!).

Role of Theory

Microeconomic theory evolved gradually

– 1700s & late 1800s.

– Marshall’s famous "scissors"

– Few changes to core of micro theory in many decades.

Price

Basic Supply and Demand Curves

"Theory provides means or framework for explaining complex reality”

– Simplifies/abstracts from reality

– Need not fully or precisely describe reality

S D

Quantity

Role of Theory

• Best test of 'good' theory?

– Whether it explains/predicts what it's designed to, NOT whether its assumptions are correct or reflect reality

• CAVEAT:

– Many controversies & issues here

– Can have seemingly good theory, but as result of non-modeled events or other supporting circumstances, lousy results

Positive v. Normative Analysis

Economists & others often called on to assess best policy approach.

– Positive analysis — "WHAT IS“

– Normative analysis — "WHAT SHOULD BE"

Important Distinction

– Much of micro in realm of positive analysis, dealing w/propositions that can be tested in terms of underlying logic (qualitative analysis) & empirical evidence (quantitative analysis)

Positive v. Normative Analysis

• Qualitatively determining expected effects of particular policy, based on micro theory

– Likely effects on employment, production, prices

• Quantitatively determining size of actual effects of particular policy.

– Stats./econometrics & statistical significance

• Then, go further (Steps 1 & 2). Use value judgments to decide whether or not such effects are desired — realm of normative analysis.

• Economists no better than anyone else at making these …

Value Judgments

"When analysis comes in conflict with

[strongly held] values, values trump analysis every time."

• Theda Skocpol (1997 Harvard) on 'welfare devolution’

Continuing debate on the ‘success’ of welfare reform in U.S. CEA, Bill Clinton,

Al From, Bush, others:

• Was it policy or the economy & how much of each?

J. Bishop’s 1998 & R. Blank’s 2002 analysis of impacts v. CEA’s

Welfare Reform’s ‘Success’?

Consider Blank (2002)—

Figure 3-1

Labor Force Participation Rates for Women by Marital Status and Presence of Children, 1989-2001

0.800

0.780

0.760

Single w/ no kids

0.740

0.720

Single w/ kids under 18

0.700

0.680

0.660

0.640

Married w/ kids under 18

Married w/ no kids

0.620

0.600

1989 1990 1991 1992 1993 1994

Source: Authors' tabulations of March Current Population Survey data, for

1995 1996 1997 1998 1999 2000 2001

Why POLITICAL ECONOMY?

Why not just microeconomics taught by UT’s econ tribe?

– Cheaper, easier? Why not?

– For starters, check out stark contrast in treatments by B&Z, Kuttner, Blank

& McGurn …

QUESTIONS

– Do “free markets” exist? Yes & No.

So what?

– What share of GDP produced & sold in “free markets”?

Considerations

• Influence of laws, institutions & “rules of the game”

• Effects of power & influence on market outcomes

• Issues surrounding “one-man/one vote,”

“one-dollar/one-vote”

– The Endowment Issue

• Effects of policies & policy shifts on markets & on market outcomes

Considerations

• Question: How deterministic is market analysis?

• Question: Is there ‘play’ in markets? If so, how much?

– 2001 Austin Equity Comm. & “living wage” issue; see J. Siedlecki piece, LBJ Journal

(Spring/Summer 2005 – Link to article )

• Question: Do markets sometimes fail and, if so, whats’ to be done about it?

The Imperial Market

Considerable “market worship”

• Not just among economists, but policymakers of almost all stripes

(Kuttner, ch. 2)

Theory of Second Best

• i.e., where markets have multiple

‘distortions,’ removing one to create purer market won’t necessarily improve overall outcomes.

Market Analysis: Terms &

Concepts

Market defined as —

" Area” where potential buyers & sellers of a good/service interact

"interplay of all potential buyers & sellers involved in”

Prices (to economists)

Relative (or real) prices, i.e., price relative to prices of all other goods/services at point in time.

Issue more one of dynamics, change over time...

Market Analysis: Key Actors

Buyers/consumers

– Theoretical abstraction largely ignores important market intermediaries, e.g., unions, trade associations.

‘Lost’ tribe of economists who emphasize institutions & their effects within a market economy.

– Pure market analysis insufficient, per se

Galbraith

Marshall

Market Analysis: Time

Time

• One of more important dimensions of market analysis

• S & D responses can & do vary enormously over the short- and longer-term!

Behavioral Assumptions

Critical foundation for what follows:

1. Self-interested behavior

• actors pursue own goals & objectives

2. Rational behavior

• actors weigh choices & actions and act deliberately

3. Scarce resources

• or, as a famous (non-practicing) economist put it,

"you can't always get what you want!”

Note: 1 + 2 => generally prefer more to less

Behavioral Assumptions

THUS,

• Actors must choose among available options, pursuing desires rationally with limited resources or

• "Actors make choices subject to a resource constraint"

Production Possibilities Frontier

• All possible combinations of goods/services a rational actor can attain with fixed resources

• Technology

• [What does this mean?]

Illustrate with 2 choices

• Say... research reports, R, and research proposals, P

• Might also view as Present v. Future

Research

Reports

(present)

PPF

Production Possibilities

Curve

Research Proposals

(future)

PPF

Research

Reports

(present)

A

Production Possibilities

Curve

Research Proposals

(future)

PPF

Research

Reports

(present)

Production Possibilities

Curve

A

B

Research Proposals

(future)

PPF

Research

Reports

(present)

A

B

Research Proposals

(future)

Production Possibilities

Curve

C

PPF

Research

Reports

(present)

A

B

D

Production Possibilities

Curve

C

Research Proposals

(future)

PPF

Opportunity Cost:

• Amount of one good that must be foregone to produce added unit of another

• PPF slope

• Marginal Rate of Transformation, MRT

• Defined as: ∆R / ∆P

• Think "rise over run”

PPF Questions

Q1: Why is PPF concave?

A1: Efficiency of resource use dictates that as shift resources to producing more of one, less of another, become less efficient in doing so.

Q2: Which goods combination = BEST?

A2: Don't know (yet)! Depends on "preferences" which we'll get to shortly.

PPF Questions …

Q3: Why not either devote more resources to production or improve technology to attain greater amounts of BOTH goods?

A3: Can't! In the short run, resources & technology are both FIXED .

Opportunity Cost

• Economic or opportunity cost of given action or choice comprised of both:

– EXPLICIT (or accounting) Cost

• defined typically in terms of monetary costs;

– IMPLICIT (or non-monetary) Cost

• imputed value of alternative use of resources

• “Value of resource in its best alternative use", includes both explicit (monetary) and implicit (or non-monetary) costs

– Key concept in micro & policy analysis

– Numerous applications, e.g., benefit/cost analysis

Discussion

Significance of accounting v. economic costs, in terms of:

– Education & career choices?

– The environment?

– Welfare reform and related interventions?

What of "sunk costs"?

– Already incurred, can't recoup. So, forget them.

Demand Schedules & Curves

Demand

– Schedule of prices & associated quantities of goods/services consumers willing & able to purchase. Prices Quantities

$7 2

Demand Schedule,

$6 3 for example:

$5 4

– Functionally Q

1

= a + bP

1 Etc...

Demand Schedules & Curves

Law of Demand

– The lower the price of a good or service, the larger the quantity consumers wish to purchase (demand), ceteris paribus .

• Law of D —> negative slope for D curve!

• NOTE TERMS!

Distinguish carefully between:

– ∆Qd (movement along ) versus

– ∆ in D, a shift in D Curve

– Ceteris paribus — tastes, incomes, prices of other goods. E.g. iPods...

Demand Schedules & Curves

Demand for iPods

Price

D

1

Quantity

Demand Schedules & Curves

Demand for iPods

Price

D

1

Quantity

D

2

Demand Depends On...

Incomes: Response depends very much on

TYPE of good/service!

– If “normal” good , increase in average household income, Y

• With P unchanged, leads to increased consumption of iPods

• That is, demand shifts from D

1 to D

2

– If "inferior" good , increase in Y

• With P unchanged, leads to decreased iPod consumption, again a demand shift.

Inferior Goods?

Inferior goods:

– Spam

– Texas wines

– Hamburger

– Others?

*Most goods = Normal*

Demand Depends On...

Prices of Other Goods

– Depends very much on WHICH other goods!

Examples...

– CD Prices? Sharp drop in P of CDs leads to increased consumption of CD players

• A shift out in demand, from D

1 to D

2

.

• Complements in consumption, I.e., their consumption "goes together"...

Demand Depends On...

Prices of Other Goods

• another example

– VCRs? Sharp drop in P of DVD players leads to decreased consumption of VCRs

• a shift in demand from D

2 to D

1

.

• Substitutes in consumption, alternatives for meeting same needs...

• “Either/or” goods.

Demand Depends On...

Tastes & Preferences

– Can deal with these any number of ways:

Consider introduction of new alternatives

– growth of live music venues, DATs & DAT players, iPods, "retro"

(vinyl) movement

– E.g., the Wine Industry

Supply Schedules & Curves

SUPPLY, the producer side of the market:

– schedule of prices & associated quantities producers willing & able to produce & sell at point in time.

LAW of SUPPLY:

– Higher the price, the larger the quantity producers will want to produce (supply) at any point in time, cet. par. So, positive slope!

P as "reward for production":

– As more produced, per-unit opportunity cost of production tends to increase. Higher Ps needed to elicit greater Qs.

Ceteris paribus:

– Technology/production techniques, input factor prices/availability generally. Try same e.g., iPods...

Supply Schedules & Curves

Price Supply of iPods

S

1

Quantity

Supply Schedules

Consider:

• Technology of Production

– Intro of new, more efficient production techniques (e.g. HPWO) allows producers to produce more at every P. So, supply shifts out from S

1 to S

2

• Input Supply Conditions

– Increase in labor costs—one NOT offset by productivity increases —leads to reduced supply, a shift from S

2 to S

1

.

Supply Schedules & Curves

Price Supply of iPods

S

1

S

2

Quantity

Market Equilibrium,

Disequilibrium

Equilibrium P & Q —> no forces acting to make them different!

– Static, not really dynamic.

Example?

– Try the market for Applied Microeconomics textbooks...

Price

Market Equilibrium

Applied Microeconomics

Textbook Market

S

D

Quantity

Price

Market Equilibrium

Applied Microeconomics

Textbook Market

P e

$125

S

Q e

D

Quantity

Price

P

1

$200

P e

$125

Market Equilibrium

Applied Microeconomics

Textbook Market

Surplus

S

Q

1

Q e

Q

2

D

Quantity

Market Equilibrium

Applied Microeconomics

Textbook Market

Price

P

1

$200

P e

$125

P

2

$75

S

Surplus

Shortage

Q

1

Q e

D

Q

2 Quantity

Government Interventions...

• NYC rent controls, minimum wage hikes

(1977-81, 1989, 1995)

– classic illustrations of impact of market interventions

– wage/price controls (1971-74)

Q: Are such interventions “bad”?

– Maybe, if you're a market worshiper

• Otherwise, depends upon your values & other non-market considerations ...

• Some adverse market & non-market responses —

– Non-price rationing

– Quality deterioration

– Black markets