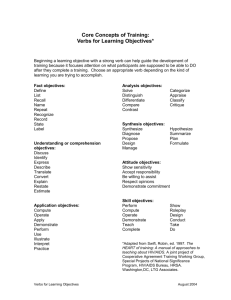

Purpose: How to do budget analysis

Funding Public Health Care:

Constitutional constraints and budgetary processes

Alison Hickey

AIDS Budget Unit, Idasa

10 February, 2004

Handouts:

Idasa Budget Guide and Dictionary

Budgeting for HIV/AIDS in South Africa

Where is HIV/AIDS in the Budget?: Survey of 2003 provincial social sector budgets

Alison Hickey ~ AIDS Budget Unit, Idasa ~ 10 February 2004 1

Purpose of today’s presentation:

Give you a clear picture of what Constitution says on public funding for health care, and how, in practice, budgets for health care are allocated at all levels of government

Outline:

1. How govt raises funds and divides money between natl, provincial and local govt

2. Basics of the government budget process

Alison Hickey ~ AIDS Budget Unit, Idasa ~ 10 February 2004 2

1.

The Constitution says which sphere of government can levy or collect which types of taxes.

National Revenue Fund where all money received by natl govt must be paid.

Income tax, VAT, corporate tax, customs duties

Provincial revenue: 4% own revenue, 96% from national government

Flat-rate surcharges on some natl taxes.

Main types of provincial own revenue: road traffic fees, hospital fees, gambling levies

Local government revenue: 83% own revenue, 17% transfers

Property rates, utility fees (e.g. electricity)

Alison Hickey ~ AIDS Budget Unit, Idasa ~ 10 February 2004 3

2. The Constitution also assigns specific powers and functions to each sphere of government.

Education (at all levels excluding tertiary), health services and welfare services are listed as concurrent functions of natl and provincial govt.

They are shared responsibilities, with national determining policy and provinces responsible for delivery.

Social spending over 80% of provincial budgets

Education:40% Health: 24% Welfare:19%

Local govt primarily concerned with delivery of basic services including water, sanitation, electricity, and refuse collection

Municipal health services undergoing changes with recent

National Health Act.

Alison Hickey ~ AIDS Budget Unit, Idasa ~ 10 February 2004 4

3. According to the Constitution, Section 227 (1):

Local government and each province is entitled to an equitable share of revenue raised nationally to enable it to provide basic services and perform the functions allocated to it;

May receive other allocations from national government revenue, either conditionally or unconditionally

Alison Hickey ~ AIDS Budget Unit, Idasa ~ 10 February 2004 5

4. Parliament must pass an annual act called the

“Division of Revenue” which tells how nationally-raised revenue will be shared between 3 spheres of government.

Section 214 (1)

Top slice (debt service, contingency reserves)

Vertical split (executive/political decision)

Excluding top slice:

39% national

57% provincial

4% local government

Horizontal split between provinces (determined by formula)

Horizontal split between municipalities (determined by formula)

Alison Hickey ~ AIDS Budget Unit, Idasa ~ 10 February 2004 6

5. National government sends money to the provinces in two different ways.

1. Equitable share grant

• Grant to each province unconditionally. Provinces free to distribute funds between departments according to their own budget processes.

• Technical formula to divide funds based on relative need. Biased towards poorer provinces.

2. Conditional grants (earmarked funds from national to provinces)

Funds added to the Equitable Share for HIV/AIDS is a special case.

Alison Hickey ~ AIDS Budget Unit, Idasa ~ 10 February 2004 7

Local government revenue?

• National govt provides an Equitable Share grant to each municipality.

(nearly 50% of natl transfers to LG)

•

–

–

Major conditional grants to municipalities (administered by DPLG)

Municipal Systems Improvement Grant (collection capacity-building and restructuring grants; administered by DPLG)

Municipal Infrastructure Grant (amalgamation of number of capital grants e.g. water, public works, electrification, transport)

Alison Hickey ~ AIDS Budget Unit, Idasa ~ 10 February 2004 8

Four stages of the budget process:

1. Drafting phase

2. Legislative phase

3. Implementation

(financial year begins 1 April)

4. Auditing

3 year rolling budget

Medium Term Expenditure Framework

Parallel national and provincial budget processes

Alison Hickey ~ AIDS Budget Unit, Idasa ~ 10 February 2004 9

The steps in drafting the budget

1. Executive determines medium-term spending priorities.

(April-Sept)

2. Natl and prov depts prepare MTEF budget submissions.

(April-Aug)

3. Macroeconomic and fiscal framework and DOR debated between July and August. Budget Council makes final recommendation on DOR between provinces in Sept. DOR approved by Cabinet.

Alison Hickey ~ AIDS Budget Unit, Idasa ~ 10 February 2004 10

Steps in drafting the budget, cont.

4. MTEC hearings held between Natl Treasury and separate departments.

(Sept-Oct)

5. Medium Term Budget Policy Statement

Adjustments Estimate

Division of Revenue Bill introduced into

Parliament

(Nov)

Alison Hickey ~ AIDS Budget Unit, Idasa ~ 10 February 2004 11

Steps in drafting the budget, cont.

6. Minister of Finance presents budget in Parliament on

Budget Day. Also Division of Revenue Bill.

(18 Feb 2004)

7. Provincial budgets tabled in provincial legislatures.

(Feb-March)

Alison Hickey ~ AIDS Budget Unit, Idasa ~ 10 February 2004 12

Can Parliament amend the budget?

Section 77 of Constitution gives Parliament power to amend money bills.

Constitution says an act of Parliament must provide for a procedure to amend money bills in Parliament. This legislation yet to be passed.

Civil society organisations interested in stronger amendment powers for

Parliament.

National Treasury and Parliament currently working on amendment powers legislation.

For now, theoretically:

Parliament cannot make changes but could vote down the entire budget.

Parliament can amend the DOR Bill.

Alison Hickey ~ AIDS Budget Unit, Idasa ~ 10 February 2004 13

* With respect to HIV/AIDS treatment and care, critical area to watch is provincial budgets—not national.

R million (nominal)

1800

1600

1400

1200

1000

800

600

400

200

0

Allocations for HIV/AIDS from provinces' own budgets

Health HIV/AIDS cgs including

ARV funds

2002/3

181.942

210.209

2003/4

356.458

333.556

2004/5

433.406

781.612

2005/6

501.288

1135.108

Alison Hickey ~ AIDS Budget Unit, Idasa ~ 10 February 2004 14

Appendices

Alison Hickey ~ AIDS Budget Unit, Idasa ~ 10 February 2004 15

The important budget documents

written by National Treasury & available from Government Printer.

• Medium Term Budget Policy Statement (MTBPS) November

Budget estimates for current budget year and two following years.

Includes macroeconomic projections, amount going to provinces, main policy choices

• Intergovernmental Fiscal Review (IGFR) October

Analysis of provincial expenditure by sector (health, education, welfare)

Also covers municipal budgets and capital investment in local government

Alison Hickey ~ AIDS Budget Unit, Idasa ~ 10 February 2004 16

Important budget documents cont.

Available on national Budget Day from government printer:

• Estimates of National Expenditure

• Budget Review

• Budget Speech by the Minister of Finance

Alison Hickey ~ AIDS Budget Unit, Idasa ~ 10 February 2004 17

Provincial shares of total ARV conditional grant funds

over medium term (R1.932 billion),

(2004/5 thru 2006/7)

KwaZulu-Natal

28%

Limpopo

10%

Mpumalanga

10%

Northern Cape

1%

Gauteng

15%

North West

11%

Free State

7%

Eastern Cape

15%

Alison Hickey ~ AIDS Budget Unit, Idasa ~ 10 February 2004

Western Cape

3%

18

ARV earmarked allocations by province, real terms

300

250

200

150

100

2004/5

2005/6

2006/7

50

0

E as te rn

C ap e

Fr ee

S ta te ng

G au te

K w aZu lu

-N at al

Li m po po

M pu m al an ga

N or th er n

C

Alison Hickey ~ AIDS Budget Unit, Idasa ~ 10 February 2004 ap e

N or th

W es t

W es te rn

C ap e

19

1,600

1,400

1,200

1,000

800

600

400

200

0

2003/4

HIV/AIDS health conditional grant funds to provinces (real terms)

2004/5 2005/6

Alison Hickey ~ AIDS Budget Unit, Idasa ~ 10 February 2004

2006/7

ARV conditional grant funds

Other

HIV/AIDS conditional grant funds

(excluding

ARV)

20

1. What share of the national budget is allocated for health?

Abuja Declaration 2001—15% target

South Africa public health expenditure

R billion 2000/1 2001/2 2002/3 2003/4 2004/5 2005/6

Consolidated expenditure

Consolidated provincial and national health expenditure

245.6

270.4

27.2

29.6

310.2

34.9

351.3

380.8

415.0

39.1

42.5

45.7

As percent 11.1% 11.0% 11.3% 11.1% 11.2% 11.0%

Source: National Treasury, 2003 and 2002 Budget Review.

Alison Hickey ~ AIDS Budget Unit, Idasa ~ 10 February 2004 21

2. How much is specifically targeted for HIV/AIDS interventions?

R billion 2001/2 2002/3 2003/4 2004/5 2005/6

Idasa estimate:HIV/AIDS targeted allocations in national budget

(excludes hidden/indirect) 0.349

1.004

1.952

2.950

3.568

Nominal % increase in

HIV/AIDS allocations

As percent of consolidated expenditure

Source: National Treasury, 2003 and 2002 Budget Review.

187.7%

0.1% 0.3%

94.4%

0.6%

51.1%

0.8%

20.9%

0.9%

Alison Hickey ~ AIDS Budget Unit, Idasa ~ 10 February 2004 22

Public health & HIV/AIDS budget allocations and proportions in real terms

Prelim.

Total public health expenditure

Audited Outcome

2001/02

in SA

Rev. Est.

Voted MTEF MTEF

Prioritization of Health and HIV/AIDS Expenditure

2000/01 2002/03 2003/04 2004/05 2005/06

(Nat+Prov+CG)

R million, real terms 31,967 33,834 34,026 35,731 36,902 37,660

Total Public Health Expenditure as

Proportion of GDP

Total public health expenditure as a share of total expenditure

Total provincial health expenditure as a share of total provincial expenditure

Total HIV/AIDS targeted allocations

R billion

Nominal % Increase in HIV/AIDS allocations

2.96%

11.56%

24.02%

0.214

3.03%

11.60%

24.27%

0.349

63.1%

3.04%

11.66%

22.40%

1.004

187.7%

3.07%

11.35%

22.37%

1.952

94.4%

3.06%

11.33%

22.16%

2.950

51.1%

3.01%

11.16%

21.72%

3.568

20.9%

Total HIV/AIDS targeted allocations as a share of total health expenditure 0.79% 1.18% 2.87%

HIV/AIDS as percent of consolidated

Alison Hickey ~ AIDS Budget Unit, Idasa ~ 10 February 2004 expenditure 0.1% 0.1% 0.3%

5.00%

0.6%

6.93%

0.8%

23

7.81%

0.9%

South Africa: Improved spending records on

HIV/AIDS conditional grants by sector

2000/1 2001/2 2002/3

100.0%

90.0%

86.5%

82.9% 82.2% 81.3%

92.7%

85.0%

80.0% 74.5%

66.1%

70.0%

60.0%

59.5%

50.0%

40.0%

30.0%

20.0%

10.0%

0.0%

22.3%

Education sector Health sector

35.6%

Social Development

36.5%

Total HIV/AIDS

South Africa: Aggregate actual expenditure of

HIV/AIDS conditional grant funds by sector

(includes funds rolled over from previous year)

450

400

350

300

250

200

150

100

50

0

R 136 m

R 6 m

R 45 m

Education

R 204 m

2000/1

2001/2

2002/3

R 385 m

R 109 m

R 51 m

R 10 m

R 14 m

R 2 m

R 46 m

Health Social Development

Alison Hickey ~ AIDS Budget Unit, Idasa ~ 10 February 2004

R 18 m

TOTAL

25

Funds for HIV/AIDS in 2003/4 national budget.

Total: R 1.952bn

Transfers to

NGOs for

HIV/AIDS and TB

2%

Funds for SANAC,

SAAVI, Lifeline and Lovelife

5%

Earmarked grants to provinces for

PMTCT, VCT, home-based care

18%

Natl HIV/AIDS

Directorate

9%

Funds to provinces for

HIV/AIDS treatment and care

57%

Lifeskills education

Alison Hickey ~ AIDS Budget Unit, Idasa ~ 10 February 2004

6%

Community based care and support

3%

26

Roles and responsibilities of health departments

National

Responsibilities of different spheres of government

Provincial Local

Determining health policies

Legislation

Implementation of national policies

Provision of services including

Primary Health Care

(PHC) - shared with local government

PHC - shared with provincial government

Monitoring implementation

Alison Hickey ~ AIDS Budget Unit, Idasa ~ 10 February 2004 27

Budget Implications of Division of Roles and

Responsibilities i.r.o. of Health

Total National health expenditure in 2003/04

= 8.4 billion

National health expenditure excl. transfers in 2003/0

= 602 million

Projected consolidated total provincial health expenditure in

2003/04 = 36.6 billion

Consolidated Health conditional grants to provinces amount to 7.4 billion

Alison Hickey ~ AIDS Budget Unit, Idasa ~ 10 February 2004 28

Budget Implications of Division of Roles and

Responsibilities i.r.o. of Health

• 93.3% of natl DoH budget is transfers, mainly to provincial departments (conditional grants)

• 88% of natl health expenditure goes to provinces as cgs

National health expenditure is less than 2% of consolidated provincial and national health expenditure

• 98+% is spent on service delivery in the provinces (through conditional grants and equitable share allocations).

• Cgs about 20% of consolidated provincial health expenditure

Alison Hickey ~ AIDS Budget Unit, Idasa ~ 10 February 2004 29

How does budget analysis fit in the oversight role of committees?

Policy Budget

Structures and institutions for implementation

Service

Delivery

Impact of programme or policy budget inputs: funds, resources budget outputs: medicine, vaccinations, HIV tests budget outcomes: improved child health

Alison Hickey ~ AIDS Budget Unit, Idasa ~ 10 February 2004

Indicators?

How do we measure inputs, outputs and outcomes?

30

National Budget

National / Provincial budget

National

Vote 16. Health

Departmental budgets

Programme budgets

National

Vote 16. Health

Programme 2: Strategic Health Programmes

Divided into separate line-items

National

Vote 16. Health

Programme 2: Strategic Health Programmes

Sub-Programme 2.1: District Health Systems

Alison Hickey ~ AIDS Budget Unit, Idasa ~ 10 February 2004 31

Examples of health policy developments impacting on budget allocations

• PHC: Need for new and upgraded clinics => Infrastructure

Conditional Grants

•PHC: Negotiations around the division of responsibility around

PHC => Transfer payments

•Nutrition Programme: Adoption of PSNP Review recommendations => Integrated Nutrition Programme

Conditional Grant

•Hospital Services: Infrastructure backlogs => Hospital

Revitalisation Grant

•Hospital Services: management improvement => Hospital

Management and Quality Improvement Grant

Alison Hickey ~ AIDS Budget Unit, Idasa ~ 10 February 2004 32

Examples of key health policy developments impacting on budget allocations

•Personnel: distribution and scarcity of health personnel => provincial health budgets: personnel item

•Non-personnel inputs: increased prices of medical equipment and consumables => provincial health budgets: machinery and equipment item, stores and livestock item

•Legislation: Mental Health Care Act => provincial budgets: specialised hospitals sub-programme

•Legislation: New National Health Bill => Act => implications for national, provincial and local government responsibilities and budgets

•Free medical care for people with disabilities => provincial health budgets

•Other???

Alison Hickey ~ AIDS Budget Unit, Idasa ~ 10 February 2004 33