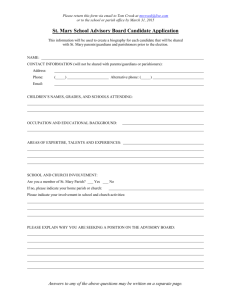

Parish Business Managers and Finance Councils

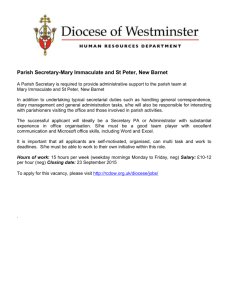

advertisement