G/C

advertisement

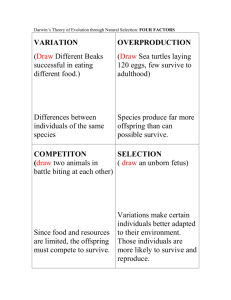

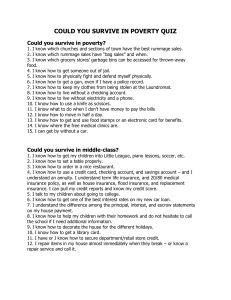

Why do Businesses need to Plan and Control? Must prepare a business plan/forward plan (set objectives) to ensure that: Meet customer needs and wants Manage costs effectively Stay competitive Contains goals: Short-term – eg increase sales locally Long-term – eg expand nationwide Check these goals against business plan regularly and take action if not achieving F/G/C 2.3 How do businesses survive? 1 Why do Businesses need to Plan and Control? Planning decisions?? product or service? how many to make? how many workers? when will I make a profit? what price? new product? size of product? how much will it cost? what materials? Successful business must meet the needs of its customers – its product/service must: be of suitable quality in the quantities required at a suitable price available to the correct consumer market which consumers want to buy F/G/C 2.3 How do businesses survive? 2 Why do Businesses need to Plan and Control? Covering Costs?? Businesses must cover costs or they will make a loss Some new businesses will aim to only cover costs or break-even (ie not make a loss) in the first few years - to get established Profit is the amount made after costs are paid. Forecasting income and costs allows businesses to make decisions and plans eg – get a loan or overdraft in a month where income is low. F/G/C 2.3 How do businesses survive? 3 What is a Budget? A plan that a business prepares for the year ahead. It is based on the objectives of the business and provided targets for the employees to achieve. shows the money that is likely to come in and how it will be spent over the coming months checks if a business can earn enough money in expected sales to pay for expected costs anticipates what lies ahead (business can take action to reduce risks, etc) G/C 2.3 How do businesses survive? 4 What is a Budget? Types of budget Cash Sales Raw materials Spreadsheet packages – useful for budgets? • Can perform calculations (formula) • Can run scenarios (what ifs?) • Can display results on charts Etc 90 80 70 60 50 East West North 40 30 20 10 0 1st Qtr 2nd 3rd Qtr 4th Qtr Qtr G/C 2.3 How do businesses survive? 5 Why prepare a Budget? Greater control over the future of the business – gives targets and reduces RISKS Weaknesses or difficulties can be anticipated before they happen Less uncertainty and fear about future Decisions can be made eg purchase asset? G/C 2.3 How do businesses survive? 6 Problems shown by the Cash Budget? Shows a problem in February: what can we do? • arrange a loan/overdraft • buy the van on Hire Purchase CASH BUDGET STATEMEN T FOR FION A'S FLOWER SH OP Januar y Febr uar y Mar ch Opening Balance £1,900 £5,500 -£1,900 Receipts Sales Paym ents Pur chases Rent Wages H eat and Light Van Closing Balance £12,500 £14,400 £14,000 £19,500 £15,200 £13,300 £5,500 £2,000 £1,100 £300 £8,000 £2,000 £1,100 £300 £10,000 £21,400 -£1,900 £9,200 £2,000 £1,100 £300 £500 £13,100 £200 £8,900 £5,500 • try to increase sales • find a cheaper supplier G/C 2.3 How do businesses survive? 7 • the point at which the sales revenue of a business equals its total (running) costs • at break-even all the running costs have been paid off by the money coming in from sales • allows you to work out how many items you need to produce and sell and cover those costs in order to break even • if you sell any units above the BEP you will therefore make a profit G/C 2.3 How do businesses survive? 8 Break-Even Analysis Fixed Costs are those costs which stay the same irrespective of how much you sell or produce (eg rent for premises, insurance premiums) Variable Costs are those costs which increase directly as sales or production increases (eg power to machines, some wages [where workers are paid according to how much they produce]) TOTAL COST = Fixed Costs + Variable Costs G/C 2.3 How do businesses survive? 9 Costs & Revenues (£) Break-even point Sales Revenue Total Costs Variable Costs Fixed Costs Quantity G/C 2.3 How do businesses survive? 10 Costs & Revenues (£) Break-even point Quantity For an explanation of the shaded areas see next slide G/C 2.3 How do businesses survive? 11 The green shaded area (to the left of BEP) shows the losses made at the appropriate levels of sales since Total Cost is greater the Sales Revenue. The blue shaded area (to the right of BEP) shows the profits made at the appropriate levels of sales since Sales Revenue is greater the Total Cost. Therefore the BE chart allows you to calculate whether a profit or loss will be made at any level of sales. G/C 2.3 How do businesses survive? 12 Market Research Reasons for Market Research Find out what is happening in the market at the moment Help predict the future – for product development Find out why sales have fallen Investigate if there is a market for a product/service C 2.3 How do businesses survive? 13 Market Research Problems with Market Research Sampling – may not reflect nations views People’s behaviour not always predictable Wording of the questions – leading? Attitude and personality of the interviewers? C 2.3 How do businesses survive? 14 FINAL ACCOUNTS Trading Account Profit and Loss Account Balance Sheet C 2.3 How do businesses survive? 15 Trading and Profit & Loss Account TRADING ACCOUNT PROFIT & LOSS ACC Gross Profit = Net Profit = difference between money from selling goods and cost of buying or making these goods gross profit less expenses (overheads), eg wages, rent, lighting C 2.3 How do businesses survive? 16 Trading and Profit & Loss Account Trading and Profit and Loss Account for years 1 and 2 less less Year 1 £000s £000s Sales 150 Cost of Goods Sold 90 ____ GROSS PROFIT Expenses Wages Selling Expenses Administration Expen NET PROFIT 16 20 14 Year 2 £000s £000s 180 110 ____ 60 50 £10 ==== 70 20 25 18 63 £7 === C 2.3 How do businesses survive? 17 BALANCE SHEET FIXED ASSETS eg premises, equipment CURRENT ASSETS eg cash, stock, debtors CURRENT LIABILITIES eg loans, creditors WORKING CAPITAL: current assets less current liabilities CAPITAL EMPLOYED: capital invested once liabilities have been deducted Shows the worth of the business on a particular date C 2.3 How do businesses survive? 18 BALANCE SHEET Balance Sheets for years 1 and 2 Year 1 Year £000s £000s £000s £000s Fixed Assets Current Assets less Current Liabilities Financed by: Capital Long Term Liabilities 150 80 20 200 100 60 £ 210 ==== 210 0 £210 ==== 60 40 £ 240 ==== 200 40 £240 ==== C 2.3 How do businesses survive? 19 ACCOUNTING RATIOS highlights liquidity problems comparisons - over years and between competitors shows how well business uses its assets C 2.3 How do businesses survive? 20 T, P & L Acc – Ratios TRADING ACCOUNT PROFIT & LOSS ACC Gross Profit Percentage Net Profit Percentage Gross Profit x 100 Sales Yr 1 = 60% Yr 2 = 45% Investigate!!! Net Profit x 100 Sales Yr 1 = 28% Yr 2 = 36% C 2.3 How do businesses survive? 21 T, P & L Acc – Ratios Rate of Stock Turnover= Cost of Goods Sold Average Stock = ???? Times Average Stock= (Opening Stock + Closing Stock)/2 A rate of 1.3 times means that stock has changed only once in a year! Rate of turnover depends on product. A fishmonger will have a rate of 300 times a year! C 2.3 How do businesses survive? 22 Balance Sheet - Ratios Working Capital Ratio (Current Ratio) Current Assets: Current Liabilities eg 2:1 Measures how easily short-terms debts can be paid off Acid Test Ratio Current Assets - Stock: Current Liabilities Stock is least liquid asset Ratio should be greater than 1 C 2.3 How do businesses survive? 23 Balance Sheet - Ratios Return on Capital Employed = net profit x 100 capital employed eg 53% This means a return of £53 for every £100 invested. C 2.3 How do businesses survive? 24 SUMMARY OF RATIOS PROFITABILITY - return on capital employed, gross profit to sales, net profit to sales LIQUIDITY - working capital ratio, acid test ratio ASSET USAGE - rate of stock turnover, asset utilisation C 2.3 How do businesses survive? 25 Use of Ratios Compare between 2 years – can see if company has improved, has new idea worked, etc. Compare between companies - you can compare 2 similar companies to see if one is better managed, better resources, etc. Compare against expected (forecast) performance C 2.3 How do businesses survive? 26