1 Making Sense of the Current International Financial and Economic

advertisement

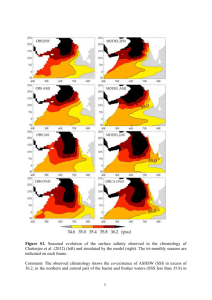

Making Sense of the Current International Financial and Economic Turmoil Srikanta Chatterjee Professor on International Economics Department of Economics and Finance Massey University Palmerston North New Zealand 1 Srikanta Chatterjee Abstract The global economy, after a prolonged period of economic growth and low inflation, appears to be ‘heating up’ in recent months, leading to the fear that the international financial architecture, built up since the Asian Financial Crisis of the late 1990s, is on the verge of collapsing. The United States economy and currency, widely accepted as the major props on which the economy of the rest of the world has come to depend, are showing signs of systemic weakness and vulnerability. This essay analyses the background to the current financial problems facing the global economy, and prognosticates its immediate future prospects. It also investigates the problems a well-functioning international monetary system must resolve for its long term stability, and how the problems might be addressed in a globally coordinated fashion. The roles of the two Asian giant economies, India and China, and of the economies rich in some strategic resources, such as petroleum and other forms of energy reserves, in meeting the current global economic challenges are examined in the context of seeking a workable solution to the financial and economic problems. 2 Srikanta Chatterjee Research Motivations To understand 3 What has been happening in the international financial arena and in the real sectors of many economies that is worrying Why the financial system has turned unstable and vulnerable What needs to be done to restore stability and confidence to the system Srikanta Chatterjee The Crux Of The Current International Financial Problem Plenty of money sloshing about in the system, but not enough confidence that they will all retain their values. The factors and forces behind the phenomenon 4 Lack of balance between savings and investments, globally – the US spends the savings of countries like China, Japan and others with external surpluses – Why and how? Srikanta Chatterjee The Factors And Forces Behind The Phenomenon (Contd.) 5 The US, the largest economy in the world has emerged as a net debtor nation since the mid 1980s. More than 50% of its government debt is held by foreigners who have been lending so that the Americans can keep spending, including on imports, in excess of their incomes. This shows up as the USA’s current account deficit, currently around 6% of its GDP. For long a net investment-creditor nation internationally, the US has emerged as a net investment-debtor nation. The value of the US’s total foreign investment of $12 trillion compares with the total investment of other nations in the US of $15 trillion (2007 figures). Srikanta Chatterjee The Factors And Forces Behind The Phenomenon (Contd.) 6 US’s debt service costs more than the returns on its foreign investments. These imbalances affect the dollar exchange rate, both upwards when foreigners buy more dollars than they sell- and downwards (such as more recently) – when they sell more. They - the lenders and the borrowers, however, are all in it together, and the lenders cannot afford to do anything ‘drastic’, like getting out of the increasingly volatile US dollar in a hurry! They will lose more than their proverbial shirts, if they did! Srikanta Chatterjee A Relatively Recent Historical Perspective on the Current Financial Turmoil 7 After the era of ‘stagflation’ that gripped much of the global economy from the first oil shock of the early 1970s to the early 1990s came the more comfortable era of low inflation, moderate growth in the developed world, and the rise of the two Asian Giants, China and India. The Asian Giants, together with the Asian Tigers, kept supplying the world market with ever cheaper consumer goods through the 1990s; this helped the developed economies achieve stable prices that lowered their inflationary expectations which, in turn, generated economic and employment growth and improved living standards. Brazil and Russia have joined this set of fast-growing, dynamic, economies more recently. Srikanta Chatterjee A Relatively Recent Historical Perspective on the Current Financial Turmoil (Contd.) 8 In addition, China emerged as an aggressive exporter on the back of a steadily declining yuan (it fell from US$1:1.5 in 1980 to 1:8.62 1994), and low real wages. These ever- increasing external surpluses needed safe havens, and the US external deficits provided a perfect fit! This is a practice that Japan too had found effective, and for a long time. The Asian Financial Crisis of the late 1990s was sharp enough in its immediate impact, but passed through soon enough to resume the favorable trend outlined above. Several other safe havens such as Australia and New Zealand attracted the ‘spare cash’ of (mainly) the Japanese investors who borrowed at low interest rates in Japan and acquired (mainly) short term assets such as government bonds (‘carry trade’) in high interest economies, pushing the exchange rates of these countries up. Srikanta Chatterjee Some Proximate Causes of the Financial Turmoil: Enter the spoil-sport in the form the Sub-prime Mortgage Crisis 9 While the financial imbalances have long been in the making, some events of more recent origin help precipitate the current crisis. Cheap and plentiful supply of (largely) foreign-sourced capital encouraged banks and other institutional lenders to finance ‘profligate’ spending, including spending on real estate. This contributed to the residential houseprice boom in many countries since the mid 1990s, accelerating in the period 2000- 2006. In turn, this encouraged house-buyers and real estate investors/speculators to take more risks and over-leverage themselves in the expectation of ever-rising house prices to keep them solvent and, eventually, make them rich(er). Srikanta Chatterjee Some Proximate Causes of the Financial Turmoil: Enter the spoil-sport in the form the Sub-prime Mortgage Crisis (Contd.) 10 New financial instruments came to emerge to take advantage of the ‘cheap’ money by lending it to the otherwise non-creditworthy borrowers to enable them to acquire real estate. The hidden costs of such loans soon began to catch up with many of these buyers, and many started to default. The real estate boom slowed at first, and then prices started to decline, while interest rates started to rise in line with the perceived increased risks of lending. Many (reputable) financial institutions had acquired these high-yield, securitized, ‘structured financial assets’, without always caring to check out their original asset-backing, which in most cases was linked to mortgage lending, often to sub-prime borrowers. These high-risk loans were bundled and repackaged with prime-quality loans to make them attractive, often with not only the knowledge of the credit rating agencies, but with their involvement in the packaging! Srikanta Chatterjee Some Proximate Causes of the Financial Turmoil: Enter the spoil-sport in the form the Sub-prime Mortgage Crisis (Contd.) The size of the sub prime loans is estimated to be around $2 trillion, and potential losses of up to $400 billion which are high, but considered to be bearable. The real reason for the panic in the market is that the hyperleveraged outstandings of all credit derivatives is thought to be of the order of $50 trillion, based on a 100:1 leverage in the typical instance to create new capital which extends far beyond ‘prudential limits’ of responsible banking. While the sub-prime phenomenon is mainly an American one, it is proving to be contagious, as many European banks also got involved in the game of re-packaging the sub-prime assets, and they too are suffering in the form of asset write-downs and defaulting debts. 11 Srikanta Chatterjee The Routes to Correction The Real Sector 12 The real sector consequences of the financial turmoil threaten to cause the US economy to go into recession which, in turn, will have a dampening effect on the world economy over the next few years. The recession will make Americans spend less, thus helping to improve the trade balance; the decline in the dollar will help export growth, and boost the trade balance. The effect of a 10% fall in house prices has already taken the equivalent of 14% of US GDP from household wealth; the US Treasury Secretary has estimated a drop of about 25% over 2007 and 2008. The wealth effect on consumption will help the correction process. Srikanta Chatterjee 13 Srikanta Chatterjee The Routes to Correction (Contd.) The adverse effect on the global economy will be cushioned however by the strength of the two Asian Giants, China and India which together account for over 25% of world GDP growth, and over one-half of the GDP growth of the low and middle-income countries. Russia and Brazil too, both with oil resources, are becoming stronger influences in the global economy. The Financial Sector 14 The old-fashioned goal of having an international financial system that has adequate liquidity, inspires confidence or credibility in its operations, and has the means to adjust to changed circumstances is still relevant, if achievable only through international coordination and collaboration. Srikanta Chatterjee The Routes to Correction (Contd.) 15 The credit crunch that has gripped the entire commercial banking sector of the OECD, is being mitigated by both the US FD and the British and European Central Banks pumping liquidity into the system. Sovereign Wealth Funds (SWFs) from developing countries, many with commodity boom surpluses, are being channeled into the private banking sectors to boost their liquidity. Abu Dhabi Investment Authority and Kuwait Investment Authority have invested almost $50 billion to provide liquidity and recapitalize major international banks like UBS, Citigroup, Merrill Lynch, Morgan Stanley and, and alas, even Bear Stearns! Srikanta Chatterjee The Routes to Correction (Contd.) 16 All these will help restore the international financial market to its functional best, in time. But just how long it will take to get to normality is anybody’s guess. J. K Galbraith expressed the depressing prediction in his grimly funny book A Short History of Financial Euphoria that money did not permit many innovations as, at the end of the day, there must be some real asset to secure it, however much it may be packaged and sliced to make it look attractive! Srikanta Chatterjee 17 Srikanta Chatterjee Thank You 18 Srikanta Chatterjee