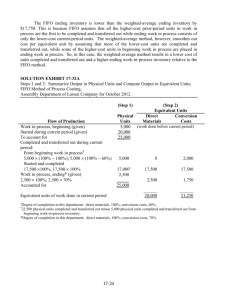

Units Completed

advertisement

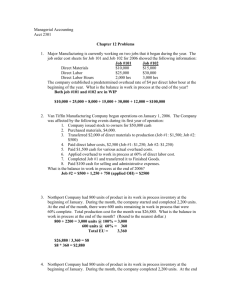

Cornerstones of Managerial Accounting 2e Chapter Six Process Costing Mowen/Hansen Copyright © 2008 Thomson South-Western, a part of the Thomson Corporation. Thomson, the Star logo, and South-Western are trademarks used herein under license. 1 Characteristics of Process Manufacturing Process costing works well whenever relatively homogeneous products pass through a series of processes and they receive similar amounts of manufacturing costs. Example industries: Chemicals Tire manufacturers Food Large manufacturing plants 2 Types of Processes Sequential processing Requires that units pass through one process before they can be worked on in later processes. In each department materials, labor, and overhead may be added. After completing one process, the partially completed goods are transferred to the next department. 3 Types of Processes Parallel processing Partially completed units can be worked on simultaneously in different processes and then brought together in a final process for completion. 4 Raw Materials Cost Flow The manufacturing cost flows are generally the same as those for a joborder system. Raw Materials Materials + purchases As raw materials are purchased, the cost of these materials flow into a raw materials account. 5 Cost Flows into Work in Process Work in Process + Materials + Direct Labor + Overhead Materials, labor and overhead flow into the Work in Process account 6 Cost Flows into Finished Goods Work in Process + Materials + Direct Labor + Overhead Finished Goods Completed Goods + Completed Goods Completed goods are transferred out of Work in Process and into Finished Goods 7 Cost Flows into Cost of Goods Sold Finished Goods + Completed Goods Cost of Goods Sold Sold Goods + Sold Goods Goods that are sold are transferred out of Finished Goods and into Cost of Goods Sold 8 Transferred-In Costs Transferred-In Costs are costs transferred from a prior process to a subsequent process. From the viewpoint of the subsequent process, transferred-in costs are a type of raw material cost. 9 Production Report Summarizes the manufacturing activity of a process department for a given period of time. Two sections: Unit Information section Cost Information section 10 Production Report Two sections: Unit Information section Units to Account For Cost Information section Units Accounted For Unit Information Section has two major subdivisions 11 Production Report Two sections: Unit Information section Cost Information section Costs to Account For Costs Accounted For Cost Information Section also has two major subdivisions 12 Production Report Computing unit cost is a key part of the production report. Unit Cost is needed to: • Compute the cost of goods transferred out of a department • Value ending work-in-process inventory This is not easy. It is difficult to define the number of units produced. 13 Equivalent Units Example Assume that Department A had the following data for October: Units in beginning work in process Units completed Units in ending work in process (25% complete) Total manufacturing costs --1,000 600 $11,500 What is the output for this department? 1000 units? 1600 units? 14 Equivalent Units Example Assume that Department A had the following data for October: Units in beginning work in process Units completed Units in ending work in process (25% complete) Total manufacturing costs --1,000 600 $11,500 If we say 1000, we ignore the ending work in process. 15 Equivalent Units Example Assume that Department A had the following data for October: Units in beginning work in process --1,000 Units completed Units in ending work in process (25% complete) Total manufacturing costs 600 $11,500 1600? Then we ignore the fact that the units in ending work in process are only partially completed 16 Equivalent Units of Output • What are equivalent units? ◦ • The total number of complete units that could have been produced given the total manufacturing effort used during the period Dilemma ◦ Some units are physically complete ∙ Called Units Completed ∙ When complete, units are transferred out ◦ Some units are not complete ∙ Remain in Work in Process ∙ Degree of completion must be determined 17 Beginning Work-In-Process Inventory • Work done on these beginning inventory units ◦ Represents prior period costs ◦ How should these costs figure into the computation of current period unit costs? • Two methods: ◦ Weighted Average Method ◦ FIFO Method 18 Weighted Average Method • Combines ◦ Beginning inventory costs ◦ Current-period costs • Calculates Unit Cost for the period ◦ • By averaging Unit cost is used to compute costs for: ◦ Goods transferred-out ◦ Goods remaining in work-in-process 19 FIFO Method Separates work and costs for the equivalent units in beginning inventory from work and costs of the equivalent units produced during the current period. Only current work and costs are used to calculate this period’s unit cost. 20 Preparing a Weighted Average Production Report Step #1 Physical Flow Analysis • Trace the physical units of production ◦ Two amounts are computed ∙ Units Started and Completed ∙ Units Started 21 Preparing a Weighted Average Production Report Step #2 Calculation of Equivalent Units • Adding together ◦ Units Completed ◦ Units in Ending Work in Process x Fraction Complete • Beginning inventory ◦ Included in the units completed ◦ Treats beginning inventory as if it was started and completed the current period 22 Preparing a Weighted Average Production Report Step #3 Computation of Unit Cost • Manufacturing Costs ÷ Equivalent Units ◦ Costs include: ∙ Prior period costs associated with beginning work in process ∙ Current period manufacturing costs 23 Preparing a Weighted Average Production Report Step #4 Valuation of Inventories • Computing cost of goods transferred out ◦ • Multiplying ∙ Unit cost (computed in step #3) ∙ Units completed (computed in step #1) Computing cost of ending work in process ◦ Multiplying ∙ Unit cost (computed in step #3) ∙ Equivalent units (computed in step #2) 24 Preparing a Weighted Average Production Report Step #5 Cost Reconciliation • Checks to see if ◦ Costs to account for ∙ Beginning Work in Process + Costs incurred during the period ◦ Equal ◦ Costs assigned to inventory ∙ Transferred Out + Ending Work In Process 25 Evaluation of the Weighted Average Method Major benefit of this method is the simplicity. Main disadvantage is reduced accuracy in computing unit costs. If greater accuracy is desired, a company should use the FIFO method to determine unit costs. 26 Nonuniform Application of Manufacturing Inputs • In the prior example ◦ • Materials, labor and overhead were applied uniformly throughout the process But often material is not added uniformly ◦ Instead it is added at the beginning and end of the process This leads to separate completion percentages for materials and conversion costs. 27 Nonuniform Application of Manufacturing Inputs Separate equivalent units, unit costs and category costs are computed for materials and conversion costs. Cornerstone 6-7 will walk us through this. 28 Multiple Departments Some departments receive partially completed goods from prior departments. Usual approach is to treat transferred-in goods as a separate material category. Cost of this material is the cost of the goods transferred out as computed in the prior department. 29