Foreign Investment in RMB Funds

- The Current State and Way Forward

Michael Chan

James Chen

Alan Xu

Copyright © 2010 by K&L Gates Solicitors. All rights reserved.

Outline

What are RMB funds

Why RMB funds

Key PRC legislations

Alternative fund models under the existing legal regime

The parallel fund structure

Recent developments

1

What Are RMB Funds

Key characteristics

-

RMB-denominated funds usually formed by private equities and venture

capitals

-

Formed under PRC law

-

Portfolio investment primarily in China

Two basic types of RMB funds

-

Purely domestic RMB funds (e.g., Bohai Industrial Investment Fund)

-

Foreign invested RMB funds (e.g., Blackstone Zhonghua Development

Investment Fund)

RMB funds can be managed by foreign fund managers through their

onshore affiliates

2

Why RMB Funds – from A Foreign Fund Manager’s Perspective

Current status

-

Skyrocketing number of RMB funds: 29 formed in 2007; 88 formed in 2008;

84 formed in 2009

-

Amount of funds raised: RMB25 billion raised in 2009

-

Value of deals closed: RMB20 billion closed in 2009

Voices of fund managers[1]

-

[1]

91.2% of the surveyed “believe the rise of RMB funds is an inevitable trend

and wish to prepare to set up RMB funds”

Based on the data provided by China Venture Capital Association.

3

Why RMB Funds – from A Foreign Fund Manager’s Perspective (Cont’d)

Main reasons for foreign investors to set up RMB funds

4

Why RMB Funds – from A Foreign Fund Manager’s Perspective (Cont’d)

Opportunities relating to clean technologies

-

Pursuant to the CVCA survey, RMB funds’ No. 1 target sector is —

ENVIRONMENTAL PROTECTION AND NEW ENERGY!

5

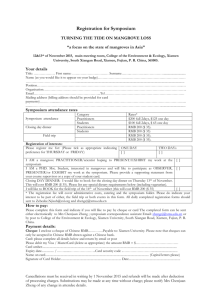

Key PRC Regulations Governing Foreign Invested RMB Funds

Stage one (pre-2003): absence of legal basis

-

No legal basis to form foreign invested RMB funds

Stage two (2003 – 2006): the inception and rise of FIVCIEs

-

Key legislation: The Regulations on the Administration of Foreign Invested

Venture Capital Enterprises (the "2003 FIVCIE Regulations")

-

An FIVCIE can take the form of an incorporated entity or a non-legal

person entity

-

Representative funds: SAIF – Tianjin VC Fund (formed in 2005; fund size:

around RMB150 million); Infinity – Suzhou VC Fund (formed in 2004, fund

size: around RMB75 million); Gobi – Tianjin HiTech (formed in 2007, fund

size: RMB150 million)

6

Key PRC Regulations Governing Foreign Invested RMB Funds (Cont’d)

Stage three (2007 – 2009): new doors opened by the Partnership Law

-

Key legislation: The PRC Partnership Law (the "2006 Partnership Law")

-

The 2006 Partnership Law made possible the establishment of a “limited

partnership” in China and introduced the concepts of “GP” and “LP”

-

Increasing number of local legislations to attract international PE/VC firms

to set up funds and fund management entities

-

Representative funds: Blackstone Zhonghua Development Investment

Fund (estimated fund size: RMB5 billion); Guosheng-CLSA Industrial

Investment Fund (estimated fund size: RMB10 billion)

Stage four (2010 onwards): foreign invested partnerships – a new world

on the horizon?

-

Key legislation: The Administrative Measures relating to the Establishment

of Partnerships in China by Foreign Enterprises or Individuals (the "2010

Foreign Invested Partnership Measures")

7

Alternative Foreign Invested RMB Fund Models under Existing Legal

Regime

Four common models for foreign investors to tap RMB funds market

-

Establishment of FIVCIEs

-

Establishment of onshore partnerships

-

Cooperation with trust companies

-

Establishment of a plain-vanilla company to make investments

8

Introduction of the FIVCIE Model

Key characteristics of the 2003 FIVCIE Regulations

-

2 to 50 investors, including at least one “Requisite Investor” (the equivalent

of GP)

-

Stringent qualification requirements of the “Requisite Investor”: at least

US$50 million already invested in the VC area; at least 3 VC professionals

and each with at least 3 years’ VC experience, etc.

-

Can take the form of an incorporated entity or a non-legal person entity

-

Minimum committed contributions (from investors) of US$10 million for the

non-legal person entity and US$5 million for the incorporated entity

9

Illustrative Chart of the FIVCIE Model

SAIF Tianjin Growth Fund (the 1st non-legal person FIVCIE)

(based on public information)

Cisco

Softbank

SAIF Partners

(requisite investor)

Offshore

Onshore

Tianjin Venture

Capital

y%

Commitment

x%

SAIF Tianjin

Advisory JV

Commitment

Fee

SAIF Tianjin

Growth Fund

(FIVCIE)

Management

Agreement

Portfolio

Companies

A

B

C

D

10

Key Facts of SAIF Tianjin Growth Fund[2]

Place of formation: Tianjin

Fund size: around RMB150 million

Investment targets: high technology enterprises

Current status: fund formed in January 2005 and already made several

investments

[2] Based on public information

.

11

Downside of the FIVCIE Model

Possible approval hurdles

-

Approvals from the Ministry of Commerce and Ministry of Science and

Technology

Investment restrictions

-

An FIVCIE’s investment is subject to foreign investment industry

restrictions

Stringent qualification requirements on the “Requisite Investor”

12

Introduction of the Domestic Partnership Model

Legislation

-

National level: 2006 Partnership Law

-

Selective local legislations:

Shanghai : The Tentative Measures for the Establishment of Foreign

Invested Equity Investment Enterprises in the Pudong

New District

Beijing

: Opinions for Promoting the Development of Equity

Investment Funds

Tianjin

: Opinions on the Registration of Private Equity Investment

Funds and Private Equity Investment Management

Enterprises

Chongqing : Opinions on Encouraging the Development of Equity

Investment Enterprises

13

Representative Benefits Offered under the Local Legislations

Reduced income tax and tax rebates

Tianjin: waiver of business tax for two years starting from

establishment

Financial subsidies

Tianjin: a one-off subsidy equal to 3% of the relevant entity’s

registered capital (capped at RMB5 million)

Chongqing: for properties purchased by the relevant entity, a one-off

subsidy of RMB1,000/square meter

Other types of benefits

Beijing: government to share its database of IPO candidate

companies

Tianjin: government to grant local residency to the staff of local

registered PE funds

14

Illustrative Chart of the Domestic Partnership Model

Blackstone Zhonghua Development Investment Fund

(based on public information)

Blackstone Group

Offshore

100%

Onshore

Payments

100%

Blackstone

Investment WFOE

(GP)

Blackstone

Advisory WFOE

Fee

Shanghai

Blackstone

Partnership

Management

Agreement

Chinese LPs

no commitment

Portfolio Companies

A

B

C

D

15

Key Facts of Blackstone Zhonghua Development Investment Fund[4]

Place of formation: Pudong New Area, Shanghai

Fund size: RMB5 billion

Investment targets: enterprises located in Shanghai and the neighboring

areas in the Yangtze River Delta

Current status: fund management company established in October 2009

and reportedly fundraising completed in July 2010

[4] Based on public information.

16

Downside of the Domestic Partnership Model

Government and judicial authorities’ lack of experience in dealing with

partnerships

-

Relatively new legislation: 2006 Partnership Law

-

Relevant agreements seldom tested in courts, so uncertainty over

the validity and enforceability of certain arrangements

Difficulties in making offshore investments

Investment restriction

-

The fund potentially regarded as a foreign invested fund due to the

GP’s foreign background

-

Accordingly the fund’s investment is subject to foreign investment

industry restrictions and may trigger onshore approval requirements

17

A Variation of the Domestic Partnership Model: the Nominee GP Structure

Foreign Investors

Offshore

Contractual arrangements

Onshore

Chinese Individual(s)

100%

Payments

100%

Chinese GP

Commitment

Fee

Advisory WFOE

Commitment

RMB Fund

Management Agreement

Chinese LPs

no commitment

Portfolio Companies

A

B

C

D

18

Recent Development on Structuring RMB Funds: the Parallel Structure

Based on the Domestic Partnership Model

Offshore structure

Offshore Fund LPs

Offshore Fund GP

Affiliate

Offshore Fund

Offshore Advisor

Offshore

control

Onshore

Investment WFOE

Affiliate

Co-investment

(GP)

Commitment

Fee

Advisory WFOE

Commitment

RMB Fund

Management Agreement

Chinese LPs

no commitment

Portfolio Companies

A

B

C

D

19

Recent Developments

Key legislations

-

The 2010 Foreign Invested Partnership Measures

-

SAIC’s implementing rules

Breakthroughs under the legislations

-

Foreign investors acting as GP and LP on the horizon

-

Possibility for a PRC individual to be a partner

-

No government approvals required

20

For more information, please contact

Michael Chan

Partner, Hong Kong

Tel: +852 2230 3581

Email: michael.chan@klgates.com

James Chen

Partner, Taipei

Tel: +886 2 2326 5155

Email: james.chen@klgates.com

Alan Xu

Foreign legal consultant, Hong Kong

Tel: +852 2230 3547

Email: alan.xu@klgates.com

21