introducing pu + ca

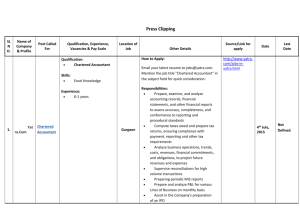

advertisement

INDIAN ACADEMY PU COLLEGE PUC Plus- A Visionary Course The accounting and finance profession is a dynamic, challenging and rewarding profession always. The Chartered Accountancy (CA) Course is a blend of theoretical education and practical training to equip a person with knowledge, skills, competency, confidence, and attitude required of a professional accountant. Specifically, a chartered accountant is specialized in accounting, finance, auditing and taxation. But all these disciplines are highly integrated to enable a chartered accountant perform a variety of finance and accounting functions. A typical chartered accountant can perform as a practicing auditor, chief accountant, chief finance manger, financial analyst, stock/commodity/forex market analyst, tax consultant, portfolio manager, finance advisor, etc. The domain of jobs for a chartered account is so vast across private sector, public sector, and government organizations like Indian Railways, India Posts, etc. There is no organization, whether it is a for-profit organization or a not-for-profit organization that can function without involvement of a chartered account either directly or indirectly. In fact, a chartered account is a family doctor to keep up the financial health of an organization. With the world becoming more and more integrated by ever-increasing cross-border trade and investments, the career options for a chartered accountant are becoming globalized. So a chartered account can place himself/herself anywhere in the world. For a student who passed +2 examinations, the Chartered Accountancy Programme has three levels namely Common Proficiency Test (CPT), Integrated Professional Competence Course (IPCC) and Final Course. The examinations are held twice a year in June and December. Following are the subjects in the entire programme of chartered accountancy. Subjects at CPT Level 1. Fundamentals of Accounting 2. Mercantile Law 3. General Economics 4. Quantitative Aptitude Subjects at IPCC Level Group I 1. Accounting 2. Law, Ethics and Communication 3. Cost Accounting and Financial Management 4. Taxation Group II 5. Advanced Accounting 6. Auditing and Assurance 7. Information Technology and Strategic Management Subjects at Final level Group I 1. Financial Reporting 2. Strategic Financial Management 3. Advanced Auditing and Professional Ethics 4. Corporate and Allied Laws Group II 5. Advanced Management Accounting 6. Information Systems Control and Audit 7. Direct Tax Laws 8. Indirect Tax Laws Indian Academy PU College offers PUC plus course for the students who seek admission in the commerce stream of PUC. It consists of regular PUC course of PU Board of Karnataka and CA-CPT. A student who joins PU plus will do all the subjects of PUC (Commerce) as usual in regular college hours. In addition, he/she would do CA-CPT outside the working hours of the college. PUC subjects are taught by the regular faculty of the college while the CA –CPT subjects are taught by faculty who are specialized in teaching the subjects of CA-CPT. The teaching hours are not less than 250 for CA-CPT subjects, spanning over two years of PUC. A student who takes admission into PUC Plus in June 2013 will appear for CA-CPT examination in June 2015. As the syllabus of PUC (Commerce) and CA-CPT are highly overlapping, it may not be difficult for a student to pass both PUC and CA-CPT. As the courses are complementary, with extra teaching and coaching, the students may aspire to score very high percentage of marks (even state ranks) in their PUC examinations as well. PUC certificate shall be in the usual format of PU Board of Karnataka state without any mention of CA-CPT.