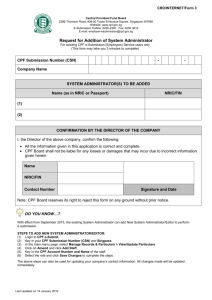

Capital Project Fund Accounting

advertisement

Capital Projects Fund Accounting WASBO Annual Conference 2006 Presented by Christie Hazlett, OSPI, Supervisor School District and ESD Accounting Capital Projects Fund A Governmental type fund. It is used to account for the acquisition of financial resources to be used for construction of major capital facilities (other than those financed by proprietary funds and trust funds). GASB Cod. Sec 1100.103a[3]. Capital Projects Fund School Districts in the state of Washington have two funds considered Capital Project funds. Can you name them? Capital Projects Fund Transportation Vehicle Fund How is the CPF financed? Generally from proceeds of the sale of bonds. Voter approved bond issues – proposition must include a description of the projects for which the money is being raised. RCW 28A.530.010 authorizes School Districts to issue bonds for certain capital projects. The acquisition of school buses is not a capital project; therefore, bonds issued pursuant to this RCW cannot be used to acquire school buses. State matching revenues. Special Levies. What is the focus of CPF Accounting? Modified Accrual Basis (except cash basis districts). Earned, measurable, and available (same for all governmental fund types). Accrual basis – Earned and measurable only. Sources and uses available resources. Amounts are recorded as revenues or other financing sources when they are both measurable and available. What are the allowable expenditures in the CPF? Revenue source: Sale of Bonds. Restricted to sites and buildings as authorized by law or as necessary or proper to carry out the function of a school district. Improvement of energy efficiency and installation of energy systems and components. Structural changes and additions to buildings and sites. The purchase of initial equipment as defined in this section is also allowable. What are the allowable expenditures in the CPF? Revenue Source: Special Levies. Same purposes as bond proceeds. Major renovations of buildings. Renovation and rehabilitation of playfields. Costs associated with implementing technology systems, facilities and projects, including acquiring hardware, licensing software, and on-line applications and training related to the installation of the foregoing. Additional major items of equipment and furniture (RCW 28A.320.330). The resolution approved by the voters authorizing the special levy must include the purpose of raising the moneys. What are the allowable expenditures in the CPF? Revenue Source: Investment earnings. Investment earnings from bond proceeds and the proceeds from special levies are restricted to the same purposes. The purchase of initial equipment is also allowable. What are the allowable expenditures in the CPF? Revenue Source: Insurance Proceeds. Insurance proceeds that represent reimbursement for loss of a building and contents shall be deposited to the CPF. Insurance proceeds for business interruption insurance shall be credited to the general fund. Expenditures for the replacement of the building and contents shall be expended from the CPF. What are the allowable expenditures in the CPF? Revenue Source: State Apportionment. State apportionment may be used for the same purposes as special levies and bond proceeds. Revenue Source: Sale of Real Property. The sale of real property may be used for any legal purpose of the CPF. What are the allowable expenditures in the CPF? Revenue Source: Lease, Sale, or Rental of Surplus Property. Expenditures necessary to transact the sale of real estate or the lease, sale, and/or rental of surplus property are charged to the CPF. Include attorney fees, sales commissions, and appraisal fees. What are Capital Outlay Expenditures? Those expenditures which result in the acquisition of capital assets or additions to capital assets: Land Existing buildings Improvement to grounds Construction of buildings Additions to buildings Remodeling Initial equipment What Other Items are considered Capital Outlay in the CPF? Facilities to house students during the construction or remodeling of a school building. Legal fees for capital projects. Election costs upon passage of the levy. Failed levy election costs are charged to the GF, however, the CPF may reimburse the GF for these expenditures if the levy passes at a later time within the same fiscal period. Are repair charges charged to the CPF? Typically no. Repairs for building structures that do not add to existing facilities are recorded in the GF. Rule of thumb, if changes involve roof, structure, or walls the expenditure would be recorded to the CPF as remodeling. Capital Projects Fund Expenditures Type Codes See Handout Capital Projects Fund Expenditures What type code would you use for expenditures to pave the parking lot? 12 - Improvements Capital Projects Fund Expenditures The school district has incurred election costs for the bond/levy election. The election was successful. Can the CPF pay for the election costs? Yes What expenditure type code would be appropriate? 63 ~~~ Capital Projects Fund Expenditures The school district is going to hire a construction manager to oversee the construction of a new building. Can the costs associated with hiring the construction manager or management company be charged to the CPF? Yes What expenditure type code should be used? 21 Capital Projects Fund Expenditures Is it ok to pay the rent for another facility from the CPF if you have to relocate students for a remodeling project? Yes What expenditure type code do you use? 22 CPF Expenditure Object Codes The only difference in the classification of objects of expenditures between the CPF and the General Fund are the following definitions: Object 5 Supplies, Instructional Resources, and Noncapitalized Items. Object 9 All Other Capital Outlay. CPF Expenditure Object Codes Object 5 Supplies, Instructional Resources, and Noncapitalized Items. Only initial expenditures for new buildings for the purchase of nonconsumable library, text, and reference books are allowable in the CPF. Items of a consumable nature are not allowed in the CPF (i.e. workbooks). CPF Expenditure Object Codes Object 9 All Other Capital Outlay. Since all expenditures of the Capital Projects Fund are of a capital outlay nature, Object 9 is labeled All Other Capital Outlay in the CPF. CPF Expenditure Source/Use Codes As we discussed earlier, school districts receive and use resources that have restrictions or conditions attached. When revenues are received, the school district must account for amounts received and expended for that purpose. The source/use code provides a common coding classification for both restricted– use revenues and expenditures. CPF Expenditure Source/Use Codes A one-digit source/use code should be assigned as follows: 0 – Unrestricted and undesignated. 1 – Derived from the sale of bonds and investment proceeds and used for the purposes expressed in the bond proposition. 2 – Received from capital project levies and used per levy propositions. 3 – Received from state agencies and used for funded projects. 4 – Received from federal agencies and used for federal portions of individual grants. CPF Expenditure Source/Use Codes 5 – Other sources and uses not described above. 9 – Amounts to be distributed. This is an intermediate code for use during the fiscal year and does not have a balance at budget preparation time or when year-end reports are issued. CPF Expenditure Source/Use Codes Revenues and Other Financing Sources that are not restricted in their use should be coded with source/use code “0”. For example, state apportionment revenues (Revenue 3100) that have been redirected from the General Fund to the Capital Projects Fund are not restricted and should be accounted for by using the “0” source/use code. If the district puts restrictions on these resources, then source/use code “3” should be used. Reservation of Fund Balance Using Source/Use Codes Establishing reservations of fund balance is done by closing Account 960 Revenues and Account 965 Other Financing Sources to the reserve accounts listed below through the use of the source/use code. To set up reservations of fund balance, the third digit in the revenue or other financing source account number must match the third digit in the reserve account section of the balance sheet. Reservation of Fund Balance Using Source/Use Codes Closing expenditures that were expended on the restricted use reduces the restriction on Capital Projects Fund resources. So the account 530 Expenditures that were restricted are closed to the general ledger reserve accounts representing that restriction. Reservation of Fund Balance Using Source/Use Codes The applicable general ledger reserve accounts are: 861 – Reserve of Bond Proceeds 862 – Reserve of Levy Proceeds 863 – Reserve of State Proceeds 864 – Reserve of Federal Proceeds 865 – Reserve of Other Proceeds 869 – Reserve for Undistributed Proceeds Reservation of Fund Balance Using Source/Use Codes The portion of G/L 960 Revenues and G/L 965 Other Financing Sources representing unrestricted resources should use source/use code “0” and must be closed to 890 Unreserved, Undesignated, Fund Balance. Examples include redirected state apportionment and revenue from the lease of real property. Reservation of Fund Balance Using Source/Use Codes The following are general guidelines in determining which reserve account to use: Investment earnings have the same expenditure restrictions as do the underlying resources generating the revenue. Assume that the most restrictive resources were expended first. Example Journal Entries See Handout