Mann pensions discussion

advertisement

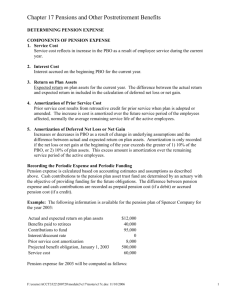

Recognition of Pension Expense and Other Changes in Plan Assets and Obligations (FASB ASC 715; previously issued as SFAS 87, 158) 1. SFAS 158 radically changed how defined benefit pension plans are recognized on an entity’s balance sheet. SFAS 158 requires an entity to recognize on its balance sheet the full overfunded or underfunded status of its defined benefit pension plans. The overfunded or underfunded status is the difference between the fair value of the plan assets and the projected benefit obligation. Thus, from a balance sheet standpoint, the requirements of SFAS 158 are a significant step in the direction of requiring an entity to recognize defined benefit pension plans on a fair value basis. 2. From an income statement standpoint, however, SFAS 158 did not change the way in which pension expense is measured and recognized. Nature and Composition of Pension Expense 3. Pension expense represents the amount of pension expense recognized during a period under current GAAP. That expense is made up of five components that either increase or decrease the amount of pension expense recognized during the period. These components are: Service cost: The portion of pension expense that represents an estimate of the increase in pension benefits payable (specifically, the increase in the projected benefit obligation) as a result of employee services rendered during the current period. Interest cost: The portion of pension expense that represents the increase in the projected benefit obligation as a result of the passage of time. The fact that at the end of the year the payment of the pension benefits is closer in time that it was at the beginning of the year causes the present value of the pension benefit obligation to increase. The interest cost component causes an increase in pension expense. Return on plan assets: An increase in the plan assets (for example, from dividends received and increases in the fair value of investments held by the plan) causes the net cost of the pension plan to the employer to be less than it otherwise would be. The amount recognized in the current period as a reduction of pension expense is the estimated return on plan assets, not the actual return (i.e., not the actual dividends, etc. received and actual changes in the fair value of the plan assets). The estimated return on plan assets that is credited to pension expense during the period is calculated by multiplying the expected rate of return times the fair value of the plan assets at the beginning of the period. The actual return, which may be different than the estimated return, is recognized as a component of other comprehensive income, as will be demonstrated later. (See also the discussion of “gain or loss recognition” immediately below.) Gain or loss recognition: The unrealized gains and losses associated with changes in the fair value of the plan assets and with changes in the projected benefit obligation are recognized as components of other comprehensive income. In certain cases, however, GAAP may require the recognition of a portion of these gains and losses as a component of pension expense. The recognition of a gain would decrease pension expense, whereas the recognition of a loss would increase pension expense. The amount of the gain or loss included in pension expense would also be reflected as a reduction of the remaining unrecognized gain or loss included in accumulated other comprehensive income. Prior service cost amortization: When plan amendments are made, additional benefits are sometimes applied retroactively to employees for services rendered in prior years. This increase in the benefits to be paid to employees represents a cost to the employer. GAAP requires that this cost be recognized as a component of pension expense over the remaining service years of the affected employees. GAAP requires that the unrecognized prior service cost be recognized as a component of other comprehensive income. The amortization of the unrecognized prior service cost is recognized as an increase in pension expense and as a reduction of the unrecognized amount remaining in accumulated other comprehensive income. 4. In addition to these five components of pension expense, a component representing the amortization of a transition asset or obligation may be encountered. The transition asset or obligation is the unrecognized asset or obligation stemming from the initial application of SFAS 87, Employers’ Accounting for Pensions. Originally, the transition asset or obligation represented the overfunded or underfunded balance of the pension plan at the time that SFAS 87 was initially adopted, adjusted for any prepaid or accrued pension cost at that time. SFAS 87 required that transition asset or liability to be amortized over the remaining service of employees expected to receive benefits under the plan. GAAP requires that any remaining unrecognized transition asset or obligation be recognized an adjustment of accumulated other comprehensive income. For example, a remaining transition obligation would be recognized for balance sheet purposes as a credit to the projected benefit obligation and a debit to accumulated other comprehensive income. Any subsequent amortization of the transition obligation would be recognized by debiting pension expense and crediting other comprehensive income. 5. The measurement and recognition of pension expense and the accounting for other changes in pension assets and obligations of a defined benefit pension plan are demonstrated in the following paragraphs. Micro Company Facts – 20X4 6. Micro Company adopted a defined benefit plan for its employees effective January 1, 20X1. At January 1, 20X4, the current year, the plan assets and the projected benefit obligation each showed a balance of $10,000. Micro Company had no unrecognized gains or losses, prior service costs, or transition asset or obligation as of January 1, 20X4. The changes in the plan assets (PA) and projected benefit obligation (PBO) during 20X4 were as follows: (a) Balance 1/1/X4 (b) Contributions by Micro to the plan (c) Benefits paid by the plan to retirees (d) Service cost (e) Interest cost (10% of 1/1/X4 PBO) (f) 12/31/X4 balances if no further changes (g) Unrealized gain (losses) associated with plan assets (h) Unrealized (gains) losses associated with PBO ( i ) 12/31/X4 balances PA $10,000 2,000 (1,100) $10,900 8,000 $18,900 PBO $10,000 (1,100) 5,000 1,000 $14,900 0 $14,900 7. Micro Company is the sponsor of this pension plan. The pension fund is actually under the control of a separate entity, a funding agency. It is a separate legal and accounting entity. The funding agency receives payments from Micro Company, invests the fund assets, and makes pension benefit payments to Micro’s employees. The funding agency has a separate set of books and accounts for the plan under current GAAP for the plan itself. 8. The entries demonstrated below are those of Micro Company, the sponsor of the plan. Even though the individual assets and liabilities of the plan will appear on the funding agency’s books, since GAAP requires Micro Company to recognize on its balance sheet the overfunded or underfunded balance of its pension plan, it will prove convenient if Micro Company maintains a Plan Assets account and a Projected Benefit Obligation (PBO) account on its own books to reflect the balances and summary changes in these two accounts. Under this approach, Micro Company would record a summary entry for each type of change in either the Plan Asset account or the Projected Benefit Obligation account. The overfunded or underfunded amount to be reported on Micro Company’s balance sheet can easily be determined as the difference between the Plan Asset account and the Projected Benefit Obligation account. 9. 10. Except for contributions by Micro Company to the plan (item b in 06) and benefits paid by the plan to employees (item c), each change in the Plan Assets account or the Projected Benefits Obligation account must be either (1) included in pension expense or (2) recognized in other comprehensive income (i.e., remain unrecognized for net income purposes but recognized for other comprehensive income and balance sheet purposes). Micro Company’s entries in 20X4 are: 1. Plan assets Cash (To record the contributions Micro made to the plan in 20X4 – see item b) 2,000 2. PBO 1,100 2,000 Plan assets (To record the benefit payments made by the funding agency to Micro’s retirees during the period – see item c) 11. 3. Plan assets Other comprehensive income (unrecognized gains/losses) (To recognize the increase in plan assets resulting from unrealized gains on the plan assets during 20X4 – see item g) 8,000 4. Other comprehensive income (unrecognized gains/losses) Pension expense (To recognize the estimated return on assets based on a 12% estimated return rate and the plan assets balance at 1/1/X4) 1,200 5. Pension expense PBO (To recognize the service cost component of pension expense – see item d) 5,000 6. Pension expense PBO (To recognize the interest cost component of pension expense – see item e) 1,000 1,200 5,000 1,000 $5,000 1,000 (1,200) $4,800 Some might prefer to recognize pension expense as one entry. In that case, entries 4, 5, and 6 could be combined as follows: Pension expense Other comprehensive income (unrecognized gains/losses) PBO 13. 8,000 Micro Company’s pension expense for 20X4 can be summarized as follows: Service cost (entry 5) Interest cost (entry 6) Expected return on assets (entry 4) Net pension expense 12. 1,100 4,800 1,200 6,000 Note that the actual return on assets during the year (i.e., the increase in the plan assets from dividends and interest on investments held by the plan and increases or decreases in the fair value of the plan assets) is recognized in other comprehensive income (entry 3), whereas the amount credited to pension expense is based on a calculated amount based on an estimated rate applied to the plan asset balance at the beginning of the current period. Entries 3 and 4 of course could be combined as follows: Plan assets Pension expense Other comprehensive income (unrecognized gains/losses) 8,000 1,200 6,800 They are shown as separate entries in 10 above to emphasize that they are separate determinations. Entry 3 reflects the actual return on plan assets during the current period, whereas entry 4 reflects the return that is included in the determination of pensions expense during the current period but is based on an expected rate of return rather than on the actual return. 14, The entries in 10 resulted in a net credit to other comprehensive income (unrecognized gains/losses with respect to the determination of net income) of $6,800. Thus, as of 1/1/X5, accumulated other comprehensive income (a balance sheet account) has a credit balance of $6,800 reflecting the net unrealized gains that have been recognized for balance sheet purposes but have not yet been recognized for income statement purposes; that is, they have not yet been included in the determination of pension expense. 15. In 20X4 there were no unrealized gains or losses associated with the projected benefit obligation (PBO). Such unrealized gains or losses could occur, however, from events such as a change in an actuarial assumption that could cause the PBO to change. If such unrealized gains or losses did occur, they would be recognized in other comprehensive income just as are unrealized gains or losses associated with plan assets. 16. As reflected in 06, the fair value of the plan assets and the projected benefit obligation at 12/31/X4 are as follows: Plan assets (fair value) Projected benefit obligation (PBO) Excess of Plan assets over PBO $18,900 14,900 $ 4,000 GAAP requires that Micro Company recognized this excess as an asset in its 12/31/X4 balance sheet. The entire amount ($4,000) must be reported as a noncurrent asset. No part of an overfunded pension plan may be classified as current. If the PBO had exceeded the plan assets, the difference would have been reported as a liability. In that case, the amount that would be reported as a current liability would be the amount by which the actuarial present value of benefits included in the benefit obligation payable in the next 12 months (or operating cycle, if longer) exceeds the fair value of the plan assets. Thus, in Micro Company’s case, if the pension plan had been underfunded rather than overfunded, the “current portion” would have to be larger than $18,900 for any of the underfunded balance to be reported as a current liability. Any remaining part of the underfunded balance would be reported as a noncurrent liability. 17. In addition, Micro Company will report a $6,800 credit balance in its accumulated other comprehensive income in the equity section of its 12/31/X4 balance sheet. In summary, Micro Company’s defined benefit pension plan will be reported in its 12/31/X4 balance sheet as follows: Noncurrent assets: Excess of fair value of plan assets over benefit obligations $4,000 Stockholders’ equity: Accumulated other comprehensive income (unrecognized gains/losses) $6,800 Micro Company Facts – 20X5 18. In 20X5 Micro Company amended its pension plan by increasing the amount of pension benefit that would be paid for each year of service. As a result, annual service cost will increase in the future. However, Micro Company also decided to apply this higher benefit rate retroactive to January 1, 20X1. Micro Company determined that the present value at January 1, 20X5 of this retroactive application of the higher benefit rate is $12,000. This $12,000 unrecognized prior service cost will be amortized over the estimated remaining service period of 8 years. 19. The changes in the plan assets and the projected benefit obligation during 20X5 were as follows: (a) (b) (c) (d) (e) (f) (g) (h) (i) 20. Balance 1/1/X5 (See 06 12/31/X4 balances) Contributions by Micro to the plan Benefits paid by the plan to retirees Service cost Interest cost (10% of ($14,900 1/1/X5 PBO + $12,000 increase in PBO 1/1/X5 due to increase in unrecognized prior service cost)) Unrecognized prior service cost 12/31/X5 balances if no further changes Unrealized gains (losses) 12/31/X5 actual balances PA $18,900 2,500 (1,400) $20,000 15,000 $35,000 PBO $14,900 (1,400) 6,000 2,690 12,000 $34,190 0 $34,190 Micro Company’s entries in 20X5 are: 1. Plan assets Cash (To record the contributions Micro made to the plan in 20X5 – see item b in 19) 2,500 2. PBO 1,400 2,500 Plan assets (To record the benefit payments made by the funding agency to Micro’s retirees during the period – see item c). 3. Plan assets Other comprehensive income (unrecognized gains/losses) (To recognize the increase in plan assets resulting from unrealized gains on the plan assets during 20X5 – see item h) 4. Other comprehensive income (unrecognized gains/losses) Pension expense (To recognize the estimated return on assets based on a 12% estimated return rate and the $18,900 plan assets balance at 1/1/X5) 5. Other comprehensive income (unrecognized gains/losses) Pension expense (to recognize “excess” gains/losses per the corridor) 6. Other comprehensive income – unrecognized PSC PBO (To recognize the increase in PBO at 1/1/X5 due to the unrecognized prior service cost – see item f) 1,400 15,000 15,000 2,268 2,268 614 614 12,000 12,000 21. 7. Pension expense Other comprehensive income – unrecognized PSC (To recognize the amortization of prior service cost in 20X5 – see item f) 1,500 8. Pension expense PBO (To recognize the service cost component of pension expense – see item d) 6,000 9. Pension expense PBO (To recognize the interest cost component of pension expense – see item e) [10% of ($14,900 PBO at 1/1/X5 + $12,000 increase in PBO 1/1/X5 due to increase in prior service cost)] 2,690 1,500 6,000 2,690 As explained in 14, the remaining unrecognized gain/loss at 12/31/X4 (and thus at 1/1/X5) was a net unrecognized gain of $6,800, resulting in a $6,800 credit balance in the Accumulated Other Comprehensive Income (unrecognized gains/losses) account. Current GAAP indicates that unrecognized gains/losses remaining at the beginning of the year do not have to be included in the determination of pension expense as long as those unrecognized gains/losses are not “too large.” Corridor for Unrecognized Gains/Losses 22. To prevent the accumulated other comprehensive income related to unrealized gains and losses from getting “too large,” GAAP utilizes a corridor approach. Under this approach, the accumulated other comprehensive income (AOCI) related to unrealized gains and losses does not have to amortized (i.e., included in the determination of pension expense) as long as the balance in that particular AOCI does not exceed the larger of the beginning of year balances in the projected benefit obligation or the market-related value of the plan assets. (The marketrelated value of plan assets can be either fair market value or a calculated value that recognizes changes in fair value in a systematic and rational manner over not more than five years. The market-related value of plan assets is herein assumed to be the same as fair value.) If it does exceed this limit, the excess must be amortized over the average remaining service period of active employees who are expected to receive benefits under the plan. 23. Thus, Micro Company must determine if its AOCI balance at 1/1/X5 related to unrealized gains/losses is “too large.” Micro Company computes the limit (corridor) as follows: A. 10 % of market-related value of plan assets (fair value) at 1/1/X5: (10% of $18,900) $1,890 B. 10% of projected benefit obligation (PBO) at 1/1/X5: (10% of $14,900) $1,490 The greater of A or B above is A, $1,890. 24. Since Micro Company’s AOCI related to unrecognized gains/losses at 1/1/X5, $6,800, is larger than $1,890, the excess must be amortized. The amortization amount is determined as follows: Unrecognized gains/losses at 1/1/X5: Credit balance in AOCI related to gains/losses Corridor (limit) at 1/1/X5 (See 23.) Excess Amortization period (8 years - estimated remaining service period of those expected to participate in the plan Amortization for 20X5 $6,800 1,890 4,910 ÷ 8 $ 614 25. Since the AOCI related to unrecognized gains/losses has a credit balance at 1/1/X5, there is an unrecognized net gain (as opposed to an unrecognized net loss). Therefore, the amortization will result in a decrease in pension expense. The amortization is reflected in entry 5 in 20. 26. Micro Company’s pension expense for 20X5 can be summarized as follows: Service cost (entry 8) Interest cost (entry 9) Expected return on assets (entry 4) Amortization of prior service cost (entry 7) Amortization of unrecognized gain/loss (entry 5) Net pension expense 27. If one prefers to recognize pension expense as one entry, it may be recorded as follows: Pension expense Other comprehensive income (unrecognized gains/losses) [$2,268 + $614} PBO Other comprehensive income (unrecognized PSC) 28. 29. $6,000 2,690 (2,268) 1,500 (614) $7,308 7,308 2,882 8,690 1,500 The AOCI related to unrecognized gains/losses that will be reported on Micro Company’s 12/31/X5 balance sheet is determined as follows: Dr. (Cr.) Balance 1/1/X5 (See 21.) $(6,800) Unrealized gain/loss occurring in 20X5 (See item h in 19.) (15,000) Expected return on assets recognized in pension expense in 20X5 (See entry 4 in 20.) 2,268 Amortization of unrecognized gain/loss in 20X5 (See entry 5 in 20.) 614 Balance 12/31/X5 $(18,918) Micro Company will also report on its 12/31/X5 balance sheet the AOCI related to the unrecognized prior service cost, computed as shown below: Balance 1/1/X5 Increase 1/1/X5 resulting from plan amendment Amortization of prior service cost in 20X5 Balance 12/31/X5 Dr. (Cr.) $0 12,000 (1,500) $10,500 30. As reflected in 19, the fair value of the plan assets and the projected benefit obligation at 12/31/X5 are as follows: Plan assets (fair value) Projected benefit obligation (PBO) Excess of Plan assets over PBO $35,000 34,190 $ 810 Micro Company will report this $810 excess as an asset (noncurrent asset) in its 12/31/X5 balance sheet. 31. Thus, Micro Company’s 12/31/X5 balance sheet will report the following items related to its defined benefit pension plan: Noncurrent assets: Excess of fair value of plan assets over benefit obligations $810 Stockholders’ equity: Accumulated other comprehensive income related to unrecognized pension gains Accumulated other comprehensive income related to unrecognized prior service costs of pension plan 18,918 (10,500) 32. As the entries for Micro Company for 20X4 and 20X5 show, except for contributions by Micro Company to the plan and benefits paid by the plan to employees, each change in the Plan Assets account or the Projected Benefits Obligation account must be either (a) included in pension expense or (b) recognized in other comprehensive income (i.e., remain unrecognized for net income purposes but recognized for other comprehensive income and balance sheet purposes). 33. In summary, except for contributions and benefits paid, the changes in the plan assets and/or projected benefit obligation fall into three categories: 1. Changes due to unrecognized gains and losses (e.g., increases in plan assets from dividends, interest, etc. received and increases in the fair value of plan assets and changes in the projected benefit obligation due to events other than the payment of pension benefits to employees) 2. Changes due to prior service cost 3. Changes associated with a transition asset or obligation 34. In all three categories, the initial event or occurrence is reflected as a change in the plan asset/PBO with an offsetting change in other comprehensive income. The subsequent allocation or amortization of that category’s unrecognized amount is recognized as an increase or decrease in pension expense and an offsetting change in other comprehensive income (AOCI from a balance sheet standpoint). That is, the item (category) initially is recognized for other comprehensive and balance sheet purposes but not for net income purposes; that it, it is not initially included in the determination of pension expense. 35. For example, increases in plan assets resulting from actual returns (increases from dividends, interest, etc. received and increases in the fair value of the plan assets) and the inclusion of those unrecognized gains are recorded as follows: Plan assets Other comprehensive income (unrecognized gains/losses) (Recognition of actual return on plan assets) XXX XXX 36. 37. Other comprehensive income (unrecognized gains/losses) Pension expense (Recognition of expected return on plan assets) XXX Other comprehensive income (unrecognized gains/losses) Pension expense (Recognition of amortization of unrecognized net gains) XXX XXX XXX The changes and entries related to prior service costs are: Other comprehensive income (unrecognized PSC) PBO (Recognition initially of the total prior service cost) XXX Pension expense Other comprehensive income (unrecognized PSC) (Recognition of amortization of prior service cost) XXX XXX XXX FASB ASC 715 requires that any remaining unrecognized transition asset or obligation (remaining from the initial application of SFAS 87) should be recognized at the time FASB ASC 715 is adopted by including it in other comprehensive income (AOCI from a balance sheet standpoint). Thus, the following entry would be made for an existing unrecognized transition obligation: Other comprehensive income (unrecognized transition obligation) PBO (Recognize unrecognized transition obligation when SFAS 158 is adopted) XXX XXX The unrecognized transition obligation would then be amortized over the remaining estimated service period as follows: Pension expense Other comprehensive income (unrecognized transition obligation) XXX XXX