Instructions for Annual State-Owned and Leased Facility Data Request

advertisement

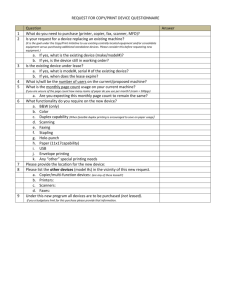

STATE OF FLORIDA DEPARTMENT OF MANAGEMENT SERVICES Annual State-Owned and Leased Facility Data Request Due June 30, 2012 Table of Contents Agency State-Owned and Leased Facility Data Validation Guidance ......................................................................2 Overview.................................................................................................................................................................2 Florida State Owned Lands and Records Information System (FL-SOLARIS)..........................................................2 Owned Facility Data................................................................................................................................................3 Leased Facility Data ................................................................................................................................................4 Appendix A – Extracting Lease Data from FL-SOLARIS .............................................................................................6 Appendix B – Agency Co-location Plans ....................................................................................................................8 Agency Co-location Plan Template.........................................................................................................................8 Appendix C – Current Vacancies in DMS Managed Facilities ................................................................................ 11 Appendix D – Current Market Rate by County ...................................................................................................... 12 Appendix E – State-Owned Facility Terms ............................................................................................................. 13 Appendix F – Leased Facility Terms........................................................................................................................ 19 1|Page Agency State-Owned and Leased Facility Data Validation Guidance Overview Florida Statute requires agencies annually submit the following information with supporting data related to owned and leased space: New/validated data for state-owned and state-occupied facilities (section 216.0152, Florida Statutes) The identification of disposition candidates (subsection 216.0153(3), Florida Statutes) Agency space needs and consolidation plans for leased facilities (paragraph 255.249(3)(d), Florida Statutes). Data Required New/validated information for all state-owned facilities to include: U.S. Postal Service (USPS) Address Map Location Revenue Fields Disposition Candidates New/validated information for all state-occupied (leased) facilities to include: All leases active as of June 30, 2012 Agency Co-location Plan Business Case Analysis Where / How Updated FL-SOLARIS System Deadline By June 30, Annually Facility Type Owned FL-SOLARIS System, Supplemental Data Provided by DMS, and CoLocation Plan Business Case Analysis By June 30, Annually Leased The validation and submission of each agency’s data is important because the data provided is used to prepare summary and planning reports for the Governor and Legislature, including the Master Leasing Report (in accordance with subsection 255.249(3), Florida Statutes), the Strategic Five Year Leasing Plan, the State Facilities Inventory, and an annual Inventory Disposition Report. The information and Co-location Plan will be used to assess, approve, or deny future requested lease actions. Florida State Owned Lands and Records Information System (FL-SOLARIS) Section 216.0153, Florida Statutes, directed the Department of Environmental Protection (DEP) to create a comprehensive state-owned real property system. As such, the Florida State Owned Lands and Records Information System (FL-SOLARIS) was developed. This system is comprised of two modules: the Facilities Inventory Tracking System (FITS) and the Lands Information Tracking System (LITS). This year agencies will use the FITS module in FL-SOLARIS to report and review state-owned and state-occupied facility data. The current version of the FL-SOLARIS FITS User Manual and other information on FITS, including these instructions, are available on the Department of Management Services (DMS) State Facilities Inventory Tracking website at: http://www.dms.myflorida.com/business_operations/real_estate_development_management/facilities_manag ement/state_facilities_inventory_tracking The FITS User Guide can be downloaded directly from the following URL: http://www.dms.myflorida.com/content/download/84321/480711/version/1/file/FITS_UserGuide-v3+0.pdf Data Validation Guidance 2|Page Owned Facility Data Each agency’s owned facility data has been loaded into the FITS module of FL-SOLARIS; however, each agency will have to complete several steps in order to mark each field as validated. Reporting for Fiscal Year 2011-12 All agencies with state-owned facilities must validate and/or correct all data by June 30, 2012. Included in the data fields for each facility is a new mapping component, where agencies will validate or correct the facility’s USPS address and map location. Agencies will also need to verify all revenue amounts. Please refer to the FLSOLARIS User Manual for more information on how to complete these steps. For terminology on owned facility data, refer to Appendix E of this document. Any new or missing facilities must be added to the system to complete the data capture. New facility data will also need to include the entry of revenue information, validation of the USPA address, and the map location. Section 14 – Working with Facilities of the FL-SOLARIS FITS User Manual, on pages 56-63, has more information on adding a new facility. Subsequent Year Reporting On July 1 of each year, certain data fields in FITS will automatically reset. These fields capture more dynamic data that changes annually and agencies will be required to re-enter information in these fields each year. All other data recorded for the facilities will carry forward unchanged from one year to the next. Below is a listing of the FL-SOLARIS FITS fields that will reset to default or zero values annually: 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. Location FTE * Space that is Leased from the Facility Total Revenue Generated from Leases Total Square Footage Leased from the Facility Parking Revenue * Utility Costs Operating Costs Taxroll Structure Value Taxroll Land Value Debt Amount * The fields above marked with an asterisk are the mandatory fields and will not allow you to complete the record without entering a value. Identification of Disposition Candidates Agencies will identify candidates for disposition through FL-SOLARIS. FL-SOLARIS Account Mangers will indicate all candidates in the Facility Action section by setting the dropdown field to “Candidate for Disposition:” For more information on how to edit facility information, refer to pages 64 – 69 of the FL-SOLARIS FITS User Manual under Section 14 – Working with Facilities. Data Validation Guidance 3|Page Leased Facility Data Active Leases as of June 30, 2012 Section 216.0152, Florida Statutes, directs agencies to annually validate existing lease data and provide any new information that pertains to state-owned or state-occupied (leased) facilities. To facilitate this process for leases, DEP has incorporated data export capability into the FITS module of FL-SOLARIS. Agency FL-SOLARIS Account Managers can access and download all active leases; however, agencies may have additional leases that are not currently active but will be by June 30, 2012. DMS will provide the future-dated lease information separately for your review. Agency leasing liaison personnel should contact their agency’s FLSOLARIS Account Manager to obtain access to the system, as well as the ability to extract data through a view only role. If you do not know your agency’s FL-SOLARIS Account Manager, please contact Ron Falkey at DMS by phone at (850) 488-3158 or by e-mail at ron.falkey@dms.myflorida.com. Agencies should review the data for each lease. Any changes should be entered correctly into the cell, and the cell should be marked by changing the cell fill color to yellow. The completed spreadsheet with all highlighted changes should be e-mailed to your DMS lease liaison for comparison with data on file. For more information on how to download and validate lease information, please see Appendix A of this document. Agency Space Needs and Co-location Plans As required by paragraph 255.249(3)(b), Florida Statutes, DMS develops and implements a strategic leasing plan. The strategic leasing plan forecasts space needs for all state agencies and identifies opportunities for reducing costs through consolidation, relocation, reconfiguration, capital investments, and the building or acquisition of state owned space. Statute directs each state agency, by June 30 of each year, to “annually provide to the department all information regarding agency programs affecting the needs for or use of space by that agency, reviews of lease expiration schedules for each geographic area, active and planned full-time equivalent data, business case analyses related to consolidation plans by an agency (Annual Co-location Plan), a telecommuting program, and current occupancy and relocation costs, including the cost of furnishings, fixtures and equipment, data and communications.” Each agency’s submission must provide: clear analysis of the current and future status of your leasing portfolio; the anticipated timing of events to facilitate the co-location recommendation; an outline of all financial costs associated with the recommendation; justification as to why the recommendation is in the best interest of the state; and statute, rules, and regulations that prevent the consolidation of agency programs into the same space. Agencies will review all lease information by geographic market (county) for leases expiring in the next 48 months (July 1, 2012 through June 30, 2016) or later if it applies to the lease strategy or co-location plan for that region/county. All agency co-location plans should give consideration to the agency’s strategies as outlined in its Long Range Program Plan (LRPP), any Capital Improvement Program (CIP) requests, and any relevant Legislative Budget Requests (LBR). Leasing and co-location strategies should also give consideration to any changes in the following: an agency’s service delivery model (example: moving to web-based service delivery); clientele, stakeholders, and general public expectations and traffic; Data Validation Guidance 4|Page staffing levels (including FTE, OPS or contracted staff) at current and future anticipated levels; telecommuting or alternative work program participation; historical basis for site and size selection; and other program changes that impact the need for owned or leased space. Since the data gathering, report drafting, and market analysis may exceed current agency resources, agencies are encouraged to utilize the services of the state’s three contracted tenant brokers to meet this requirement, should assistance be needed. DMS has provided a co-location plan template that outlines key areas of information to be included in your submission and to help with the data gathering and analysis. Please see Appendix B of this document for instructions on completing the Co-location Plan Template. Data Validation Guidance 5|Page STATE OF FLORIDA DEPARTMENT OF MANAGEMENT SERVICES Annual State-Owned and Leased Facility Data Request Due June 30, 2012 Appendix A – Extracting Lease Data from FL-SOLARIS For more information on how to download lease information, please see the FL-SOLARIS FITS User Manual Section V, “Extracting Data from FL-SOLARIS (FITS),” starting on page 96. FL-SOLARIS Account Managers will need to provide the lease data extract for validation. To begin, login to FLSOLARIS and navigate to the “Extract Data” module. Setting Criteria for the Data Extract: 1. Select the “Subset of Data” radio button 2. Change the “Select Data Category” to “Facility Lease” 3. Click “Submit” Selecting Lease Columns to Include in Extract: 4. Check the “Select All” box 5. Scroll to bottom and click “Next” 2 1 3 4 (Scroll to bottom) 5 To extract your agency’s lease data: 6. Select your agency’s name 7. Click “Extract” 6 7 Save the data file: 8. Select “Save” (Remember where you save the file!) Navigate to where the file was saved and open it. A full file should have columns “A” through “BC.” (Please note: not all columns will need to be validated.) Appendix A 8 6|Page Please Note: Many columns include information that is either system generated or will be used in future enhancements. For example, columns AK through AQ cover facility amenities and columns AR through BA are for services included in the rent and currently are shown as unknown, or “U.” The information for these fields will be populated in a future system enhancement and do not need be validated during this year’s exercise. For a full list of fields that do not require validation please see below. The following crosswalk will help you navigate which columns to validate: A B Lease Source Lease Id System Generated C Internal Agency Facility Id Validate if Applicable Validate N E F G H I J FL-SOLARIS Facility # Facility Name Last Upload Date Lessee Agency Division Number Division Name Bureau Validate SKIP – Future Use Column SKIP – Future Use Column SKIP – Future Use Column System Generated K L Facility Address 1 Facility Address 2 Facility State Facility City Facility Zip Code Validate Validate Validate Validate Validate X M D Validate if Applicable O P System Generated Q R S T U V W Facility County Facility Country Lease Start Date Lease End Date Square Footage Rate Per Sq Ft Month Rent Annual Rent Validate Validate Validate Validate Validate Validate Validate Validate Z Lessor Address 2 AA AB AC AD AE AF AG Lessor Name Y Lessor Address 1 Lessor City Lessor State Lessor Zip Code Lessor Country Lessor County Lease Options Validate Validate Validate Validate Validate Validate Validate Validate Validate AJ AK AL Legal Description Parking Structure/Garage Parking Lot SKIP – Future Use Column SKIP – Future Use Column SKIP – Future Use Column AM Show / Locker Room AN AO AP Exercise / Fitness Child Care SKIP – Future Use Column SKIP – Future Use Column SKIP – Future Use Column Predominant Space Type AH Number of Parking Space AI FTE Validate SKIP – Future Use Column Validate AR AS AT Food Services AQ Dining / Break Room Janitorial Energy Utilities Other Utilities SKIP – Future Use Column SKIP – Future Use Column SKIP – Future Use Column SKIP – Future Use Column SKIP – Future Use Column AU AV AW AX AY AZ BA BB BC Grounds Keeping Building Maintenance Telecom/Data Connectivity Parking Tenant Required Changes/Improvements Others Other Service Description Last Update Date Extracted Date SKIP – Future Use Column SKIP – Future Use Column SKIP – Future Use Column SKIP – Future Use Column SKIP – Future Use Column System Generated System Generated SKIP – Future Use Column SKIP – Future Use Column Appendix A 7|Page STATE OF FLORIDA DEPARTMENT OF MANAGEMENT SERVICES Annual State-Owned and Leased Facility Data Request Due June 30, 2012 Appendix B – Agency Co-location Plans Agency Co-location Plan Template The Agency Co-location Plan will assess all leases expiring in the next 48 months (between July 1, 2012 and June 30, 2016 or later if applicable) by county. The data source for analysis can be downloaded from FL-SOLARIS (see Appendix A). Executed leases that have not reached their start date will be sent separately by DMS to the agency. The Co-location Plan Template consists of three parts: County Summary, Co-location Business Case Analysis, and Co-location Cost-Benefit Analysis. The development of the Co-location Business Case Analysis may take considerable time if an agency has many active leases in a single county or when business operations are changing. Agencies are encouraged to maximize their resources by utilizing the services of the state’s three contracted tenant brokers to assist in meeting the deadline of June 30, 2012. County Summary The purpose of the County Summary is to show all agency leases within a particular county, identify co-location candidates, and group the leases together by future co-located site. The County Summary sheet should be completed for all counties, regardless of the number of leases. If the county has only one lease, agencies should indicate if this single lease could be co-located with an adjoining county and include all other information for this one lease on the summary sheet. Leases that can be co-located together should be indicated by a group number. For example in the data below: Lease numbers 6400174, 9646205, and 6400277 would be included in co-location (CL) group 1. Lease numbers 6400323 and 9648417 are grouped together in CL group 2. Lease numbers 9646206 and 6400374 would not be candidates for co-location. Lease Source Private Public Public Private Public Private Private Lease ID 6400174 9646206 9646205 6400323 9648417 6400374 6400277 CL Yes No Yes Yes Yes No Yes CL Grouping 1 N/A 1 2 2 N/A 1 Each group of co-location candidates will require a Co-location Business Case Analysis (a word document) to be completed (including the “N/A” candidates). Appendix B 8|Page Co-location Business Case Analysis The purpose of the Co-location Business Case Analysis is to build the justification for or against the co-location of the identified lease groupings. The analysis should include the agency’s vision, strategies, and how the proposal helps to meet business objectives. The analysis is comprised of four sections: overview, future environment, current environment, and co-location recommendation. Overview Include in this section a brief summary of your analysis and the recommendation being made for the group of leases included with this business case. Future Environment & Anticipated Needs – Where We Are Going For this section, consider future workforce, client, and operational changes when evaluating the future needs of your agency’s lease portfolio. Excellent sources of information would be the agency’s Long Rang Program Plan, Legislative Budget Request, and Capital Improvements Plan. If your agency owns buildings, these buildings should be assessed for current and future available space as a potential option to receive co-location candidates. Current Environment – Where We Are In this section, include the historical drivers for the decision to lease the current space, client and stakeholder expectations, traffic volume, and the program’s current business needs, in addition to a clear explanation of how and why programs and divisions can or cannot share space. Co-location Recommendation The business case analysis is meant to provide substantive information to support the agency recommendation on whether to co-locate or to not co-locate this group of leases. The recommendation section should identify the leases included in this analysis, include the assessment of state-owned space availability (whether owned by the agency or managed by DMS), and, if co-location is the recommendation, describe what actions will be needed to synchronize the timing of events to make co-location possible. Co-location Cost-Benefit Analysis A Co-location Cost-Benefit Analysis will need to be provided for each group of co-location candidates. The purpose of this worksheet is to help agencies assess the anticipated costs and/or savings associated with the recommendation being made. The top section of the worksheet is where all current lease data will be entered. In order to normalize rent costs, agencies will enter the current rent rate and indicate whether the rate is full service, no service (space only), or includes either janitorial or custodial services. If janitorial or custodial is not included in the rate, agencies will need to enter an amount per square foot for those services in order to bring the annual rent amount up to a full-service amount (entered into “Full Service Annual Rent YR 1”). Agencies will need to forecast future full-service rent amounts for the future years two through five for each current lease listed. If the lease expires prior to the end of year five, agencies will estimate the rent as though they would stay in that location. In the current operation costs section, provide annualized expenditures for business processes in that location, including amounts agencies currently pay for the following: Appendix B 9|Page Special equipment – lab equipment, delivery vehicles, mass production printers, etc. Data – wired and wireless network services Communication (Com) – phones and other communication services Office equipment – copiers, postage meters, faxes, scanners, etc. Other – security services and other items specific to your core business process The Co-location Options section captures the anticipated costs for the recommended co-located site. Agencies will include the revised (co-located) square footage, FTE, anticipated rate, and their projection of a procurement date. For reference, average market rates by county are shown in the attached Appendix D. For the anticipated rate, agencies can utilize the average market rates shown in Appendix D, or substitute a different rate based on their knowledge of the particular market and circumstances of the co-location scenario. If a different rate is substituted, it should be noted with an explanation in the assumptions section. Either way, the anticipated rate must include build-out or tenant improvement (TI) costs. For this section, agencies will again normalize the rent rate to ensure that it is captured at a full-service amount. If the anticipated rate is not full-service, agencies will select what the rate does/does not include and capture the supplemental costs for janitorial and/or utilities bringing it to full-service. This will ensure that the co-location option is fiscally represented in the same capacity as the current leases above. Co-located operation costs should show the same services (if needed) as the current leases above, but at a revised cost estimate. For example, three leased office sites may house three copiers each for a total of nine copiers. At the co-located site, the number of copiers can be reduced from nine to five because of space efficiencies and the ability to now share copiers. The co-located copier costs should show the reduced amount. Agencies will have to make some assumptions in order to forecast future year costs including anticipated rent rates and utility escalations. The assumptions may include rent rate components such as anticipated market, utilities, janitorial, or build out costs per square foot, or may include cost assumptions associated with operations. See Appendix D for a listing of current market rates by county. It is crucial that agencies itemize all assumptions made for both the current and co-located leases. Relocation costs will be incurred when executing the proposed co-location plan and are summarized in this section for furnishings, fixtures and equipment, data and communications, and other. The totals for this section will be included in the calculation for the first year cost change in the Cost Benefit Summary section. The key analysis pieces for the co-location recommendation are calculated for agencies in the SF Analysis and Cost Benefit Summary sections. This section calculated the anticipated savings based on the data entered in the current, co-located recommendation, and operation costs sections. The savings are limited within the template to a five-year window, but may reach beyond that timeframe for longer leases. Agencies will use this section to help support the fiscal benefit to the state of their recommendation. Appendix B 10 | P a g e STATE OF FLORIDA DEPARTMENT OF MANAGEMENT SERVICES Annual State-Owned and Leased Facility Data Request Due June 30, 2012 Appendix C – Current Vacancies in DMS Managed Facilities Building Capitol Collins Easley Elliot Holland New Records Pepper CCOC Sadowski CCOC 4040 CCOC 4050 CCOC 4070 Alachua RSC Benton Daytona Beach RSC FDLE Jacksonville Ft. Myers RSC Gore Grizzle Hurston Jacksonville RSC North Broward Peterson Rohde S. Trammel County Leon Leon Leon Leon Leon Leon Leon Leon Leon Leon Leon Alachua St. Lucie Volusia Duval Lee Broward Pinellas Orange Duval Broward Polk Dade Hillsborough Square Feet 2,526 8,919 393 4,362 19,922 12,946 12,679 33,155 2,868 5,330 27,589 1,896 7,307 3,791 109 7,282 2,794 35,507 50,901 3,841 540 9,146 354 27,049 Notes Backfill project in works Conditioned storage *Vacancy list is as of 4/12/12. Lease actions may be pending. Appendix C 11 | P a g e STATE OF FLORIDA DEPARTMENT OF MANAGEMENT SERVICES Annual State-Owned and Leased Facility Data Request Due June 30, 2012 Appendix D – Current Market Rate by County Current average market rates by county are listed below. The rates obtained from our FACT database are marked with an asterisk (*) and contain a Tenant Improvement (TI) component. The average market rates obtained from CoStar (those not marked with an *) do not include a TI component. Seven counties do not have sufficient data from either source to determine an average market rate and are indicated accordingly. Please contact your DMS leasing agent in the event you are preparing a co-location plan in one of those counties. Also, for leases located in core/downtown business areas of metropolitan municipalities, it would be appropriate to add a 10-percent premium to the applicable county rate. County Average Market Rate County Average Market Rate County Average Market Rate Alachua $16.74 Hardee* $18.26 Okeechobee* $19.11 Baker* $15.59 Hendry* $19.29 Orange $19.47 Bay $16.60 Hernando $13.94 Osceola $13.41 Bradford* $20.01 Highlands* $18.52 Palm Beach $23.16 Brevard $13.86 Hillsborough $21.61 Pasco $14.64 Broward $23.00 Holmes* $13.16 Pinellas $17.27 Calhoun Null Data/Contact DMS Indian River $20.99 Polk $16.95 Charlotte $13.54 Jackson $15.62 Putnam* $18.17 Citrus $14.29 Jefferson* $22.27 Santa Rosa $14.05 Clay $14.63 Lafayette Null Data/Contact DMS Sarasota $16.87 Collier $18.45 Lake $12.91 Seminole $18.73 Columbia $15.21 Lee $13.15 St. Johns $20.79 Desoto* $16.74 Leon $17.90 St. Lucie $16.88 Dixie* $18.40 Levy $10.60 Sumter* $14.17 Duval $17.23 Liberty Suwannee* $18.56 Escambia $16.19 Madison* $17.24 Taylor* $11.38 Flagler $21.36 Manatee $16.68 Union Null Data/Contact DMS Franklin Null Data/Contact DMS Marion $12.43 Volusia $14.97 Gadsden* $11.90 Martin $16.25 Wakulla* $15.67 Gilchrist $15.75 Miami-Dade $29.82 Walton* $19.68 Glades Null Data/Contact DMS Monroe $25.93 Washington Gulf* $19.48 Nassau $22.51 Hamilton* $19.47 Okaloosa $17.44 Appendix D Null Data/Contact DMS Null Data/Contact DMS 12 | P a g e STATE OF FLORIDA DEPARTMENT OF MANAGEMENT SERVICES Annual State-Owned and Leased Facility Data Request Due June 30, 2012 Appendix E – State-Owned Facility Terms Term Address (Physical) Address (USPS Verified Physical) Agency Comments Campus New or Changed in 2012? Specific Reference in User Guide Unchanged Pages 57 - 70 New Pages 57 - 70 New Page 61 Unchanged Page 38 Pages 83 - 93 Brief Description The physical address of the facility, not necessarily the mailing address or address of the owning agency. When there is not a U.S. Postal Service-recognized address for the facility, the 911 address should be used. The system requires the user to validate the physical address of the facility against the USPS database. This helps increase the quality of the data provided, and is used by the system to help locate the facility within the system’s GIS location validation component. Agency comments are a free form for additional information pertaining to the facility. Please include any additional information that would add value to the analysis of the facility asset. The file can accept up to 2,500 characters. The Campus field is optional and should be considered as virtual constructs to establish a logical grouping of facilities. Campuses can best be used to simplify the reporting of costs, values and FTEs that might be shared or allocated across all the facilities on a “campus” by can be attributed to the “Campus Administration Building” and shared across all the campus buildings/facilities. Conservation Unchanged Conservation indicates if the facility is located on conservation land, as determined by the managing agency. This is a yes/no radio button field. Built Year Unchanged The year the facility was completed. Debt Amount Unchanged Debt amount is the outstanding debt on the facility. If there is no outstanding debt, please input 0 (zero). Deed, Covenant or Other Restrictions Unchanged This is two fields. The first is a yes/no radio button that indicates if there any known, existing condition that could interfere or serve as an obstacle in the resale of the real property. If you select yes to the “Deed, Covenant or Other Restrictions” field, then you will use the second text box field to (as its label indicates) “Briefly Describe Restrictions”. The text box will accept up to 2,500 charters and should be used to record a short but meaningful description of the known limited to deed or covenant (such as: deed reversions, zoning restrictions, historic designations, right of ways, covenant restrictions, etc.) Appendix E 13 | P a g e Deficiency Unchanged Page 71 Deficiencies are a list of needed capital improvement projects (roof replacement, HVAC equipment, lighting, etc.) at the facility. In the “Deficiency Category” drop-down menu, please select the category that best fits the description of the proposed deficiency. These categories are provided in the LBR template agencies use to submit their proposed capital improvement projects to the legislature. In the “Funds Now Appropriated” drop-down menu, please select “yes” if the project is currently funded by the legislature, and please select “no” if the project has not been funded by the legislature. Please list the estimated total cost of the deficiency project in the “Estimated Cost” cell. In the “Brief Description” category, please give a description of the capital improvement project. An example would be, “Replace 10th floor Air Handler Unit.” You need not include projects estimated to cost less than $5,000. Facility Name Unchanged Pages 38 & 39 Facility refers to the name of the building, structure, or building system, not including transportation facilities of the state transportation system. The Facility Name may be up to 200 characters in length. Each facility must have a name, even if it is something basic and descriptive like ‘Shed’. Per section 216.0152, F.S., there is no minimum threshold for reporting facility information. One rule of thumb is if the facility has a roof, and is not adjoined to another facility, it should be recorded in FL-SOLARIS. FL-SOLARIS ID Gross Square Feet Changed Unchanged In 2011 this term was listed as “Facility ID Number,” but it was replaced by this field as a unique identifier for each facility in the FL-SOLARIS and it is system generated. Gross Square Feet is the footprint of the facility. It encompasses all the area within the outside walls, excluding awnings or canopies. This is a required field, and the system will not allow you to save edits to the record with entering a value. Historic Significance Unchanged Historic Significance indicates if the facility has historic significance or a historic designation as determined by the Department of State or the National Register of Historic Places. This is a yes/no radio button field. Location FTEs Unchanged This is to record the Full Time Equivalent (FTE) positions at the location, and will include state employees, contractors, and Other Personal Services (OPS), assigned to the facility. This is a required field, and the system will not allow you to save edits to the record with entering a value. Additionally, this field contains data that is expected to change from year to year. The system will annually reset it to a blank or null value. If the facility is an educational facility, please leave this space blank. A method for determining student utilization will be developed in the future. Appendix E 14 | P a g e Operating Costs Unchanged The operating costs are all the known costs to maintain and operate the facility. The operating costs can be either contractual services, in-house staff costs, or a mixture of both. If an agency has a contract with a private management company to provide all operating cost services, please provide the total annual cost for this contract. If operating costs are calculated at a regional or agency-wide level, please provide the individual facility’s proportionate share of the operating costs, by determining its percentage of the total gross square feet of the region or agency. All costs should be listed as annual costs. Operating costs are defined by the following six categories: 1. Facility Security - includes either contractual services or in-house staff and supply costs to provide facility security. 2. Landscaping - includes all costs to maintain the facility’s grounds, including staffing and supplies. 3. Janitorial - includes all custodial costs, including staffing and supplies. 4. Maintenance and Repairs - includes all minor repair and upkeep costs. Examples include small paint jobs, carpet upgrades, minor envelope repairs, etc. Please do not include major capital improvement projects, such as chillers, boilers, etc. These should be recorded within the “Deficiencies” tab. 5. Facility Insurance - annual cost paid to DFS Risk Management to insure the facility. 6. Facility Manager or Facility Management Company - annual contractual or inhouse costs of a facility manager’s salary, benefits and supplies. This is a required field, and the system will not allow you to save edits to the record with entering a value. Operating costs should be listed as a total of the six operating cost categories. While operating costs typically include utility costs, please do not include them in this field. Utility costs are recorded in the “Utility Cost” field. Parking Revenue Unchanged Parking Revenues is the annual total revenue generated by parking contracts with tenants or other private entities. This is a required field, and the system will not allow you to save edits to the record with entering a value. Predominant Space Type Appendix E Changed Page 175 Additionally, this field contains data that is expected to change from year to year. The system will annually reset it to a blank or null value. Eight additional space types have been added to those that were available in the 2011 data collection. This is the predominate use of the facility. If the facility has more than one space type, please list the other space types in the "Agency Comments" section, and please list the percentage(s) of the total gross square feet of the other space type(s) in relation to the campus as a whole. If the facility has more than one space type, please list the other space types in the "Agency Comments" section, and please list the percentage(s) of the total gross square feet of the other space type(s) in relation to the campus as a whole. 1. Agricultural: Includes barns, farmhouses, etc. 2. Data Center: 24-hour energy intensive IT or server space 3. Educational: Universities, Community Colleges, Schools, etc. 4. Office: Interior space used for commercial office purposes 5. Penal: Direct care, custody, or control of prisoners 6. Residential: Dorms or houses for wards or employees of the state (not correctional) 7. Labs: Includes clinics, science labs, and hospitals 8. Conditioned Storage: Air conditioned or climate controlled storage facility 15 | P a g e 9. Taxroll Assessment Year Taxroll ID Unchanged Taxroll Land Value Unchanged Taxroll Structure Value Unchanged Appendix E Unchanged Unconditioned Storage: A storage facility that does not have air or climate conditioning services 10. Unenclosed structure: Pavilion, farmers market 11. Utility: Grounds or maintenance sheds, generator sheds, etc. 12. NOC: Not otherwise classified 13. Armory: A weapons/ordinance maintenance and storage facility. This can also be a building that is the headquarters and drill center of a military unit. 14. Food Services: A facility/space used for the preparation and delivery of food/dining services. 15. Medical Care: Facility/space for interviewing, examining, consulting and counseling individuals on mental or physical health issues 16. Museum/Exhibits: A building, facility, or institution devoted to the acquisition, conservation, study, exhibition, and educational interpretation of objects having scientific, historical, or artistic value. 17. Recreational: A facility designed to provide users with a venue for spending spare time and intended to promote relaxation and enjoyment. A state park would be an example of a recreational facility. 18. Workshop: A facility where manual or light industrial work, that is the focus of the facilities tenants, is conducted. 19. Conference Center: These are specialized spaces/facilities that are not included within an organizations office square footage tally. A Conference Center is designed and built primarily to host conferences, exhibitions, large meetings, seminars, training sessions, etc. A conference center often also includes some related office spaces/facilities/service. 20. Gym/Exercise/Sports Venue: This is a facility designed to meet specific needs as a gymnasium or sports arena that is a dedicated or multi-purpose facility for sports and/or non-sporting events. It can be a covered or open air stadium, such as a large structure dedicated to sports or entertainments. This could include a baseball or football stadium, an amphitheater, a field house where athletes prepare for or engage in sporting games. Tax roll assessment refers to the date the local property appraiser assessed the facility. Tax roll ID is the property tax ID number, which can be found on the local property appraiser’s website. This is the unique number that each property appraiser assigns to the land parcel, where each state-owned facility is located. Tax roll land value is the assessed value of the parcel of land underneath the facility. Some property appraisers separate the assessed values of the facility from the land value. If the values are separated, please input the land value here. If not, please leave the cell blank. Tax roll structure value is the assessed value of the facility, which can be found on the local county property appraiser's website. Sometimes the property appraisers separate the assessed value of the land and the facility. If only one value is provided for the land and facility, please provide the total assessed value into the "Tax roll Structure Value." If an assessed value is not provided by the property appraisers, please leave the cell blank. 16 | P a g e Title Entity Unchanged The Title Entity is the owning agency of the facility, as designated in the county property tax rolls. If the facility is owned outright by the agency, please select "Agency-Owned" in the drop-down menu. If the facility is owned by the Board of Trustees, please select "Board of Trustees" in the drop down menu. If the facility is owned by a different government agency from the occupying agency, and the occupying agency has full maintenance and operational control of the facility, please select "Government Lease" in the drop-down menu. If an agency is leasing space in a state-owned facility from another government entity, but does not have full operation and maintenance responsibility of the facility, please do not report this facility. In order to limit the double counting of facilities, only report facilities for which your agency either has ownership or has 100% management responsibility. If the owning or managing agency is leasing space to a tenant in a state-owned facility, please provide the lease information in the "Space that is Leased from the Facility” section. This is a required field, and the system will not allow you to save edits to the record with entering a value. Total Number of Leases Recorded for this facility Changed Page 61 In the 2011 data collection, this had been the “Number of Subleases”. It is one of several related fields within the grouping of facility information called “Space that is Leased from the Facility”. When a portion of a facility, over which an agency has full operation control and/or ownership, is leased to any other tenant this field is used to record the number of lease contracts the owning or managing agency has with these tenants. If you enter a Total Number of Leases Recorded for this Facility greater than zero, the system enables the Total Revenue Generated From Leases, Total Square Footage Leased from the Facility, and Tenant List fields for data entry. Parking contracts are not considered leases, but if there is a parking contract with another agency or private entity tenant at the facility, please list the annual parking revenue in the “Parking Revenue” field. Unused Land New Total Utility Costs Unchanged Unused land refers to any portion of the land that could be subdivided and sold to another entity. If the facility has any unused land, please select “yes,” if not, please select “no.” Utility Costs is the total annual utility cost for the facility. The utility costs include: 1. Electricity 2. Natural Gas 3. Domestic Water 4. Sewer 5. Irrigation 6. Diesel 7. Propane 8. Any other known utility cost at the facility The utility cost should be reported as one sum total of all the above listed costs. If the facility is part of a campus, and costs are not individually metered at each facility, please provide the facility’s proportionate share of the utility cost, by determining its percentage of the total gross square feet of the campus. Total Revenue Generated From Leases Appendix E Changed This is a numeric field to record the total annual revenues generated by the lease(s) for some portion of the facility. In the 2011 data collection this field was labeled “Sublease Revenue”. 17 | P a g e Total Square Footage Leased from the Facility Tenant List Changed New For agencies that are leasing some portion of their facilities to a tenant, you will list those tenants in this test box. In the 2011 data collection, agencies were asked to list all tenants within the “Agency Comments” field. Vacant Workstations New This is a new optional field for the 2012 data collection cycle. Agencies that have underutilized office space within a facility will enter the amount available. The space does not need to be an actual workstation, but may be vacant office space (in which case it would be reported under the Smart Space standard of one workstation for each 180 square feet of vacant office space). Appendix E This is a numeric field to record the total square footage of the facility that is leased out to tenants. In the 2011 data collection this field was labeled “Sublease SF”. 18 | P a g e STATE OF FLORIDA DEPARTMENT OF MANAGEMENT SERVICES Annual State-Owned and Leased Facility Data Request Due June 30, 2012 Appendix F – Leased Facility Terms Term Annual Rent Definition Fields shaded in gray do not require updated information Dollar cost for the current fiscal year for rent for leased space. Bureau This field will be used in future system enhancements. Division Name This field will be used in future system enhancements. Division Number This field will be used in future system enhancements. Extracted Date System generated field showing the date and time of data extraction from FL-SOLARIS by user. Physical address of the leased facility to include street address, city, zip code, county, and country. Name of the facility. Facility refers to the name of the building, structure, or building system, not including transportation facilities of the state transportation system. Not all facilities will have a name. System generated field providing a unique identifier to each facility record. Facility Address 1 & 2, City, State, Zip Code, County, Country Facility Name FL-SOLARIS Facility ID # FTE (Full-Time Equivalent) Internal Agency Facility ID Location FTE’s represents the number of full-time equivalent positions, including state employees, contractors, and Other Personal Services (OPS), assigned to the property, if applicable. Unique identifier assigned by the agency for the facility. Last Update Date System generated field showing when the record was last modified. Last Upload Date Lease End Date System generated field showing when the record was last received by FLSOLARIS from DMS. Date when the lease ends. Lease ID Lease number on file with DMS. Lease Options Lease Start Date Remaining renewal options included in the lease agreement. If N/A, will be listed as "NONE." System generated. This field should contain one of the following fields: Private, Public, or Government (Others) - DMS Date lease started. Legal Description This field will be used in future system enhancements. Lessee Agency Agency name on lease considered responsible for rent payments. Lessor Address 1 & 2, City, State, Zip Code, Country, County Lessor Name Street address, city, zip code, county, and country where Lessor is located. Month Rent Dollar cost per month of rent for leased space. Number of Parking Spaces This field will be used in future system enhancements. Predominant Space Type Space Type is the predominate use of the facility. If the facility has more than one space type, please list the other space types in the "Agency Comments" section, and please list the percentage(s) of the total gross square feet of the other space type(s) in relation to the campus as a whole. Lease Source Appendix F Name of the entity responsible for providing the leased space. 19 | P a g e Rate Per Sq Ft Square Footage 1. Agricultural - Includes barns, farmhouses, etc. 2. Data Center - 24-hour energy intensive IT or server space 3. Educational - Universities, Community Colleges, Schools, etc. 4. Office - All space that can be defined by commercial office purposes 5. Penal - Direct care, custody, or control of prisoners 6. Residential - dorms or houses for wards of the state (not correctional) 7. Labs - Includes clinics, science labs, and hospitals 8. Conditioned Storage 9. Unconditioned Storage 10. Unenclosed structure - pavilion, farmers market 11. Utility - grounds or maintenance sheds, generator sheds, etc. 12. NOC - Not otherwise classified Dollar rate per square foot of leased space. Total number of square feet used to calculate annual rent amount. Complimentary square footage should not be included in this amount. Future System Enhancement Fields Amenities Parking Lot Child Care Dining/Break Room Exercise/Fitness Room These fields will be used in future system enhancements. Food Services Parking Structure/Garage Shower/Locker Room Janitorial Building Maintenance Services Provided Energy Utilities Grounds Keeping Other Service Description Other Utilities These fields will be used in future system enhancements. Others Parking Telecom/Data Connectivity Tenant Required Changes/Improvements Appendix F 20 | P a g e