Properties of Stock Option Prices

advertisement

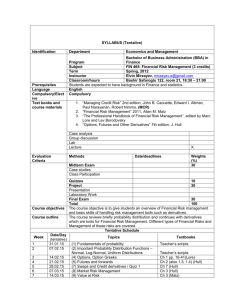

7.1 Properties of Stock Option Prices Options, Futures, and Other Derivatives, 4th edition © 1999 by John C. Hull FACTORS AFFECTING OPTION PRICES •The current stock price •The strike price •The time to expiration •The volatility of the stock price •The risk free rate •The dividend expected during the life of the option Options, Futures, and Other Derivatives, 4th edition © 1999 by John C. Hull 7.2 7.3 The owner of a EUROPEAN option can only exercise at the maturity of the option. The owner of an AMERICAN option can exercise any time before the maturity of the option Options, Futures, and Other Derivatives, 4th edition © 1999 by John C. Hull WHICH ONE IS MORE EXPENSIVE ? MARCH CALL or JULY CALL JULY 30 CALL IF IT IS AMERICAN Options, Futures, and Other Derivatives, 4th edition © 1999 by John C. Hull 7.4 7.5 TIME TO EXPIRATION American Put and call options become MORE valuable as the time to expiration increase because the holder of the option has all the exercise opportunity and time. European call and put options do not necessarily increase in value as the time to expiration increases because the owner of the option can only exercise at expiration. Options, Futures, and Other Derivatives, 4th edition © 1999 by John C. Hull 7.6 VOLATILITY It is a measure of how uncertain we are about future stock price movements. Volatility (s) = Standard deviation of the return on a stock in a length of time t Options, Futures, and Other Derivatives, 4th edition © 1999 by John C. Hull DIVIDENDS 7.7 WHAT DOES "EX DIVIDEND " MEAN ? A stock goes ex-dividend the day the company pays the dividend WHAT HAPPENS TO THE VALUE OF THE STOCK ? Stock price is reduced by the amount of the dividend at the opening HOW DOES IT AFFECT CALL & PUT ? •The value of a put option is positively related to the size of any anticipated dividend •The value of a call option is inversely related to the size of any anticipated dividend. Options, Futures, and Other Derivatives, 4th edition © 1999 by John C. Hull 7.8 Notation • c : European call • • • • • option price p : European put option price S0 : Stock price today X : Strike price T : Life of option s: Volatility of stock price • C : American Call • • • • option price P : American Put option price ST :Stock price at time T D : Present value of dividends during option’s life r : Risk-free rate for maturity T with cont comp Options, Futures, and Other Derivatives, 4th edition © 1999 by John C. Hull 7.9 UPPER AND LOWER BOUNDS FOR OPTION PRICES Can the price of a call option be worth more than the stock ? NO C S0 The stock price is an upper bound to the option price. What if that did not hold ? ARBITRAGE Options, Futures, and Other Derivatives, 4th edition © 1999 by John C. Hull 7.10 No matter how low the stock price becomes, the option (p) can never be worth more than the price of the stock (X) pX For EUROPEAN put options, we know, that at expiration (T), its value will not be worth more than X. Its value today cannot be more than the present value of X : p Xe-rT Options, Futures, and Other Derivatives, 4th edition © 1999 by John C. Hull 7.11 LOWER BOUNDS FOR EUROPEAN CALLS or THE THEORETICAL MINIMUM A lower bound for the price of a EUROPEAN call option is : S0 - -rT Xe - D Options, Futures, and Other Derivatives, 4th edition © 1999 by John C. Hull Calls: An Arbitrage Opportunity? • Suppose that c =3 T =1 X = 18 S0 = 20 r = 10% D=0 • Is there an arbitrage opportunity? Options, Futures, and Other Derivatives, 4th edition © 1999 by John C. Hull 7.12 EXAMPLE 7.13 Suppose a stock is trading at $20 (S0). The strike price (X) of the call option is $18, the risk free rate r is 10% and T = 1 year. S - Xe-rT = $3.71 The lower bound is : 0 The call option is trading at $3. An arbitrageur can buy the call and short the stock In cash flow analysis 20 - 3 = $17 invested at 10% per annum 17e0.1 = $18.79 Options, Futures, and Other Derivatives, 4th edition © 1999 by John C. Hull 7.14 $19 At expiration $17 Options, Futures, and Other Derivatives, 4th edition © 1999 by John C. Hull 7.15 STOCK IS AT $19 The arbitrageur exercises the option : $18.79 - $18.00 = $0.79 RIGHT TO BUY AT 18 Options, Futures, and Other Derivatives, 4th edition © 1999 by John C. Hull 7.16 STOCK = $17 The arbitrageur buys the stock back in the market and the short position is closed out. $18.79 - $17.00 = $1.79 Options, Futures, and Other Derivatives, 4th edition © 1999 by John C. Hull Effect of Variables on Option Pricing Variable S0 X T s r D c + – ? + + – p – +? + – + C + – + + + – P – + + + – + Options, Futures, and Other Derivatives, 4th edition © 1999 by John C. Hull 7.17 7.18 Lower Bound for European Call Option c S0 -Xe -rT Options, Futures, and Other Derivatives, 4th edition © 1999 by John C. Hull LOWER BOUNDS FOR EUROPEAN PUT OPTIONS or THE THEORETICAL MINIMUM 7.19 A lower bound for the price of a EUROPEAN put option is : -rT Xe - S0 + D Options, Futures, and Other Derivatives, 4th edition © 1999 by John C. Hull Puts: An Arbitrage Opportunity? • Suppose that p =1 T = 0.5 X = 40 S0 = 37 r =5% D =0 • Is there an arbitrage opportunity? Options, Futures, and Other Derivatives, 4th edition © 1999 by John C. Hull 7.20 EXAMPLE 7.21 Suppose a stock is trading at $37(S0). The strike price (X) of the put option is $40, the risk free rate r is 5% and T = 0.5 year. -rT The lower bound is : Th put option is trading at $1.00 Xe - S0 = $2.01 An arbitrageur can buy the put and the stock by borrowing $38 In cash flow analysis $38 borrowed at 5% per annum 38e0.5 X 0.05 = $38.96 will have to be paid back in 6 months. Options, Futures, and Other Derivatives, 4th edition © 1999 by John C. Hull 7.22 $45 At expiration $39 Options, Futures, and Other Derivatives, 4th edition © 1999 by John C. Hull 7.23 STOCK IS AT $45 The arbitrageur discards the put, sells the stock in the market and repays the loan : $45 - $38.96 = $6.04 Options, Futures, and Other Derivatives, 4th edition © 1999 by John C. Hull 7.24 STOCK IS AT $39 The arbitrageur exercises the option to sell the stock for $40, repays the loan and makes a profit of : $40 - $38.96 = $1.04 Options, Futures, and Other Derivatives, 4th edition © 1999 by John C. Hull 7.25 Lower Bound for European Put options p Xe -rT - S0 Options, Futures, and Other Derivatives, 4th edition © 1999 by John C. Hull 7.26 PUT - CALL PARITY Put-call parity is a fundamental relationship that must exist between the prices of a put option and call option if both have the same underlier, strike price and expiration date. The relationship is derived using arbitrage arguments. Options, Futures, and Other Derivatives, 4th edition © 1999 by John C. Hull 7.27 Put-Call Parity; No Dividends • Consider the following 2 portfolios: – Portfolio A: European call on a stock + PV of the strike price in cash – Portfolio B: European put on the stock + the stock • Both are worth MAX(ST , X ) at the maturity of the options • They must therefore be worth the same today – This means that c + Xe -rT = p + S0 Options, Futures, and Other Derivatives, 4th edition © 1999 by John C. Hull 7.28 Options, Futures, and Other Derivatives, 4th edition © 1999 by John C. Hull 7.29 BOTH PORTFOLIOS HAVE IDENTICAL PAYOFF PATTERNS THEY MUST HAVE THE SAME VALUE TODAY ARBITRAGE OPPORTUNITY Options, Futures, and Other Derivatives, 4th edition © 1999 by John C. Hull 7.30 PUT - CALL PARITY C+ -rt Xe = P + S0 Put-call parity is often used as a simple test of option pricing models. Any option pricing model which produces put and call prices that do not satisfy put-call parity must be rejected as unsound. Such a model will suggest trading opportunities where none exist. Options, Futures, and Other Derivatives, 4th edition © 1999 by John C. Hull 7.31 Arbitrage Opportunities • Suppose that c =3 S0 = 31 T = 0.25 r = 10% X =30 D =0 • What are the arbitrage possibilities when p = 2.25 ? p =1? Options, Futures, and Other Derivatives, 4th edition © 1999 by John C. Hull C+ A -rt Xe = P + S0 B VALUE OF PORTFOLIO "A" ? $32.26 VALUE OF PORTFOLIO "B" ? $33.25 Options, Futures, and Other Derivatives, 4th edition © 1999 by John C. Hull 7.32 7.33 BUY "A" AND SELL "B" Options, Futures, and Other Derivatives, 4th edition © 1999 by John C. Hull For p= 2.25 7.34 Portfolio B is overpriced relative to portfolio A Portf A :c + Xe-rT = $32.26 Portf B : p + S0 = $33.25 Arbitrage : buy securities in A and sell securities in B Buy the call and short the put and the stock... CASH FLOW ANALYSIS… Options, Futures, and Other Derivatives, 4th edition © 1999 by John C. Hull 7.35 Cash flow : -3 + 2.25 +31 = 30.25 (invested at 10% for 3months = 31.02) Options, Futures, and Other Derivatives, 4th edition © 1999 by John C. Hull Suppose the stock at expiration is greater than $30. Call is exercised 7.36 Suppose the stock at expiration is less than $30 Put is exercised LONG THE SHARE AT $30 Cash Flow: $31.02 - $30 = $1.02 (close out the short position Options, Futures, and Other Derivatives, 4th edition © 1999 by John C. Hull For p= 1 7.37 Portfolio A is overpriced relative to portfolio B Portf A :c + Xe-rT = $32.26 Portf B: p + S0 = $32.00 Arbitrage : buy securities in B and sell securities in A Buy the put and the stock and short the call Investment of : - $31 - $1 + $3 = -$29 (29e0.10 x 0.25 = $29.73) Options, Futures, and Other Derivatives, 4th edition © 1999 by John C. Hull Suppose the stock at expiration is greater than $30. Call is exercised 7.38 Suppose the stock at expiration is less than $30 Put is exercised SHORT THE SHARE AT $30 Cash Flow: $30.00 - $29.73 = $0.27 Options, Futures, and Other Derivatives, 4th edition © 1999 by John C. Hull 7.39 DOES PUT/CALL PARITY EXIST FOR AMERICAN TYPE OPTIONS ? NO WHY ? Because American options can be exerciced before Expiration and would not the same value today Options, Futures, and Other Derivatives, 4th edition © 1999 by John C. Hull 7.40 Early Exercise • Usually there is some chance that an American option will be exercised early • An exception is an American call on a non-dividend paying stock • This should never be exercised early Options, Futures, and Other Derivatives, 4th edition © 1999 by John C. Hull 7.41 An Extreme Situation • For an American call option: S0 = 100; T = 0.25; X = 60; D = 0 Should you exercise immediately? • What should you do if 1 You want to hold the stock for the next 3 months? 2 You do not feel that the stock is worth holding for the next 3 months? Options, Futures, and Other Derivatives, 4th edition © 1999 by John C. Hull Reasons For Not Exercising a Call Early (No Dividends ) • No income is sacrificed • We delay paying the strike price • Holding the call provides insurance against stock price falling below strike price Options, Futures, and Other Derivatives, 4th edition © 1999 by John C. Hull 7.42 7.43 Should Puts Be Exercised Early ? Are there any advantages to exercising an American put when S0 = 60; T = 0.25; r=10% X = 100; D = 0 Options, Futures, and Other Derivatives, 4th edition © 1999 by John C. Hull 7.44 The Impact of Dividends on Lower Bounds to Option Prices c S 0 D Xe p D Xe rT rT S0 Options, Futures, and Other Derivatives, 4th edition © 1999 by John C. Hull 7.45 RELATIONSHIP BETWEEN AMERICAN PUT AND CALL PRICES Put-Call parity apply for European options but can be derived to American option : S0 - X C - P S0 - Xe-rT Options, Futures, and Other Derivatives, 4th edition © 1999 by John C. Hull 7.46 EXAMPLE An American Call option with strike price (X) = $20.00 and maturity in 5 months (T) is worth $1.50. Current stock price (S0) = $19.00 and r = 10% S0 - X C - P S0 - Xe-rT 19 - 20 1.50 -P 19 - 20e-0.10 x 5/12 $1.68 P $2.50 Upper and lower bounds for price of an American put with the same strike price and expiration date as the American call are $2.50 and $1.68 Options, Futures, and Other Derivatives, 4th edition © 1999 by John C. Hull