Properties of Stock Option Prices

advertisement

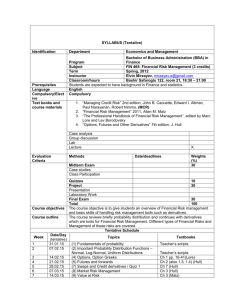

7.1 Properties of Stock Option Prices Chapter 7 Options, Futures, and Other Derivatives, 4th edition © 1999 by John C. Hull Effect of Variables on Option Pricing (Table 7.1, page 169) Variable S0 X T r D c + – ? + + – p – +? + – + C + – + + + – P – + + + – + Options, Futures, and Other Derivatives, 4th edition © 1999 by John C. Hull 7.2 7.3 Assumptions • There are no transaction costs • All trading profits are subject to the same tax rate • Borrowing and lending at the risk-free interest rate is possible Options, Futures, and Other Derivatives, 4th edition © 1999 by John C. Hull 7.4 Notation • c : European call • • • • • option price p : European put option price S0 : Stock price today X : Strike price T : Life of option : Volatility of stock price • C : American Call option • • • • price P : American Put option price ST :Stock price at time T D : Present value of dividends during option’s life r : Risk-free rate for maturity T with cont comp Options, Futures, and Other Derivatives, 4th edition © 1999 by John C. Hull 7.5 American vs European Options An American option is worth at least as much as the corresponding European option C c P p Options, Futures, and Other Derivatives, 4th edition © 1999 by John C. Hull Upper Bounds • Stock price is an upper bound to the American or European call c ≤ So and C ≤ So, if this would not hold, an easy arbitrage profit would be available by buying the stock and selling the call option. • Strike price is an upper bound to the American or European put p ≤ X and P ≤ X • For European put p Xe rT Options, Futures, and Other Derivatives, 4th edition © 1999 by John C. Hull 7.6 7.7 Lower bound • European calls on non-dividend-paying stock S o Xe rT Options, Futures, and Other Derivatives, 4th edition © 1999 by John C. Hull 7.8 Calls: An Arbitrage Opportunity? • Suppose that c =3 T =1 X = 18 S0 = 20 r = 10% D=0 • Is there an arbitrage opportunity? Options, Futures, and Other Derivatives, 4th edition © 1999 by John C. Hull 7.9 LBEurCall S 0 Xe rT 20 18e 0,1 3,71 What if the price of a European Call is c 3,00$ and arbitrageur buys the call and shorts the stock $20 $3 $17 17e 17e rT and invests on r for a year 0,1 18,79 Options, Futures, and Other Derivatives, 4th edition © 1999 by John C. Hull 7.10 If the stock price is greater than 18, arbitrageur exercises the option, closes short and makes a profit of $0,79. $18,79 $18 $0,79 If the stock price is less than 18, (for ex. 17) the stock is bought in the market and a short position is closed out with even greater profit of 1,79. $18,79 $17 $1,79 Options, Futures, and Other Derivatives, 4th edition © 1999 by John C. Hull 7.11 Portfolio A: 1 Eur Call + Xe-rT Portfolio B: 1 share of stock Cash in A is invested in r and will grow to X in time T If ST>X, c is exercised and A =ST If ST<X, c is worthless and A =X At time T portfolio A is worth max (ST, X) Options, Futures, and Other Derivatives, 4th edition © 1999 by John C. Hull 7.12 Portfolio B is worth ST at time T Portfolio A is worth at least as portfolio B at time T Hence, A must be worth at least as B today c Xe rT S0 c S 0 Xe rT Options, Futures, and Other Derivatives, 4th edition © 1999 by John C. Hull 7.13 Lower Bound for European Call Option Prices; No Dividends (Equation 7.1, page 172) Since c must be non negative i.e. c ≥ 0 c max So Xe rT ,0 Options, Futures, and Other Derivatives, 4th edition © 1999 by John C. Hull 7.14 Lower bound • European puts on non-dividend-paying stock Xe rT S0 Options, Futures, and Other Derivatives, 4th edition © 1999 by John C. Hull Puts: An Arbitrage Opportunity? • Suppose that p =1 T = 0.5 X = 40 S0 = 37 r =5% D =0 • Is there an arbitrage opportunity? Options, Futures, and Other Derivatives, 4th edition © 1999 by John C. Hull 7.15 7.16 LBEurPut Xe rT S 0 40e 0,050,5 37 2,01 What if the price of a European Put is p 1,00$ and arbitrageur borrows $38 for six months and buys a put and the stock $37 1$ $38 38e 0, 0505 at the end of six months arbitrageur will have to pay $38,96 Options, Futures, and Other Derivatives, 4th edition © 1999 by John C. Hull 7.17 If the stock price is bellow 40, arbitrageur exercises the option, Sells the stock and makes a profit of $1,04. $40,00 $38,96 $1,04 If the stock price is greater than 40, (for ex. 42) the option is discarded and the stock is sold in the market with even greater profit of 3,04. $42,00 $38,96 $3,04 Options, Futures, and Other Derivatives, 4th edition © 1999 by John C. Hull 7.18 Portfolio C: 1 Eur Put +1 share Portfolio D: cash of Xe-rT If ST<X, p is exercised at T and C =X If ST>X, p is worthless and C =ST At time T portfolio C is worth max (ST, X) Options, Futures, and Other Derivatives, 4th edition © 1999 by John C. Hull 7.19 Assuming cash is invested at r, D is worth X at T Portfolio C is worth at list as portfolio D at time T Hence, C must be worth at least as D today p S 0 Xe p Xe rT rT S0 Options, Futures, and Other Derivatives, 4th edition © 1999 by John C. Hull Lower Bound for European Put7.20 Prices; No Dividends (Equation 7.2, page 173) Since p must be non negative i.e. p ≥ 0 p max (Xe -rT - S0, 0) Options, Futures, and Other Derivatives, 4th edition © 1999 by John C. Hull 7.21 Put-Call Parity; No Dividends (Equation 7.3, page 174) • Consider the following 2 portfolios: – Portfolio A: European call on a stock + PV of the strike price in cash – Portfolio C: European put on the stock + the stock • Both are worth MAX(ST , X ) at the maturity of the options • They must therefore be worth the same today – This means that c + Xe -rT = p + S0 This relationship is known as put-call parity Options, Futures, and Other Derivatives, 4th edition © 1999 by John C. Hull 7.22 Arbitrage Opportunities • Suppose that c =3 S0 = 31 T = 0.25 r = 10% X =30 D =0 • What are the arbitrage possibilities when p = 2.25 ? p =1? Options, Futures, and Other Derivatives, 4th edition © 1999 by John C. Hull 7.23 Early Exercise • Usually there is some chance that an American option will be exercised early • An exception is an American call on a non-dividend paying stock • This should never be exercised early Options, Futures, and Other Derivatives, 4th edition © 1999 by John C. Hull 7.24 An Extreme Situation • For an American call option: S0 = 50; T = 0.083; X = 40; D = 0 Should you exercise immediately? • What should you do if 1 You want to hold the stock for the next 3 months? 2 You do not feel that the stock is worth holding for the next 3 months? Options, Futures, and Other Derivatives, 4th edition © 1999 by John C. Hull Reasons For Not Exercising a Call Early (No Dividends ) • No income is sacrificed • We delay paying the strike price • Holding the call provides insurance against stock price falling below strike price Options, Futures, and Other Derivatives, 4th edition © 1999 by John C. Hull 7.25 7.26 Should Puts Be Exercised Early ? Are there any advantages to exercising an American put when S0 = 60; T = 0.25; r=10% X = 100; D = 0 Options, Futures, and Other Derivatives, 4th edition © 1999 by John C. Hull 7.27 The Impact of Dividends on Lower Bounds to Option Prices (Equations 7.5 and 7.6, page 179) c S 0 D Xe p D Xe rT rT S0 Options, Futures, and Other Derivatives, 4th edition © 1999 by John C. Hull 7.28 Extensions of Put-Call Parity • American options; D = 0 S0 - X < C - P < S0 - Xe -rT Equation 7.4 p. 178 • European options; D > 0 c + D + Xe -rT = p + S0 Equation 7.7 p. 180 • American options; D > 0 S0 - D - X < C - P < S0 - Xe -rT Equation 7.8 p. 180 Options, Futures, and Other Derivatives, 4th edition © 1999 by John C. Hull