Session-IV

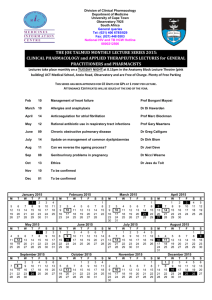

advertisement

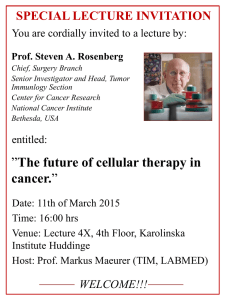

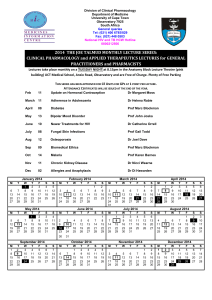

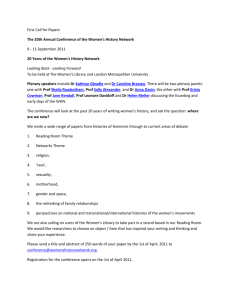

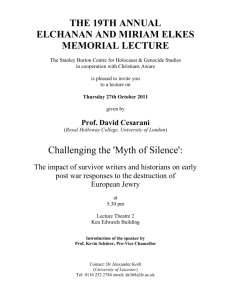

MANAGEMENT POLICY AND STRATEGY SESSION - IV Capability Analysis Prof. Sushil Department of Management Studies Indian Institute of Technology, Delhi INDIA Email: sushil@dms.iitd.ernet.in Prof.Sushil\Canada\Session-IV 1 Ingredients Critical to a Successful Strategy Be consistent with conditions in the competitive environment Strategy must . . . Place realistic requirements on the firm’s resources Be carefully executed Prof.Sushil\Canada\Session-IV 2 What is the Resource-Based View of the Firm? Firms differ in fundamental ways because each firm possesses a unique “bundle” of resources tangible and intangible assets and organizational capabilities to make use of those assets. Prof.Sushil\Canada\Session-IV 3 The Three Basic Resources Tangible assets – Easiest to identify and often found on a firm’s balance sheet – Include physical and financial assets – Examples: Production facilities, raw materials, financial resources, real estate, computers Intangible assets – Cannot be seen or touched – Often very critical in creating competitive advantage – Examples: Brand names, company reputation, company morale, patents and trademarks, accumulated experience Organizational capabilities – Involve skills - ability to combine assets, people, and processes - used to transform inputs into outputs Prof.Sushil\Canada\Session-IV 4 Examples of Different Resources Tangible Assets Intangible Assets • Hampton Inn’s • Nike’s brand name reservation system • Ford Motor’s cash reserves • 3M’s patents • Georgia Pacific’s land holdings • Virgin Airlines’ plane fleet • Coca-Cola’s Coke • Dell Computer’s reputation • Wendy’s advertising with Dave Thomas • Jack Welch as GE’s leader • IBM’s management team • Wal-Mart’s culture formula Organizational Capabilities • Dell Computer’s customer service • Wal-Mart’s purchasing and inbound logistics • Sony’s productdevelopment processes • Coke’s global distribution coordination • 3M’s innovation process Prof.Sushil\Canada\Session-IV 5 What Makes a Resource Valuable? 1. Competitive superiority: Does the resource help fulfill a customer’s need better than those of firm’s competitors? 2. Resource scarcity: Is the resource in short supply? 3. Inimitability: Is the resource easily copied or acquired? 4. Appropriability: Who actually gets the profit created by a resource? 5. Durability: How rapidly will the resource depreciate? 6. Substitutability: Are other alternatives available? Prof.Sushil\Canada\Session-IV 6 Wal-Mart’s Resource-Based Competitive Advantage Industry ave. cost - Wal-Mart cost (% of sales) Resource Tangible Store Locations 0.3 store rental space Intangible Brand reputation Employee loyalty 1.2 advertising expense 1.1 payroll expense 0.7 shrinkage expense Capabilities Inbound logistics 1.2 distribution expense Total Advantage: 4.5%* *Wal-Mart’s cost advantage as a percent of sales. Each percentage point advantage is worth $500 million in net income to Wal-Mart. Prof.Sushil\Canada\Session-IV 7 Characteristics Making Resources Difficult to Imitate Physically unique resources – Resources virtually impossible to imitate – Examples: One-of-a-kind real estate location, mineral rights, patents Path-dependent resources – Resources that must be created over time in a manner that is often expensive and difficult to accelerate – Examples: Dell Computer’s system of direct sales of customized PCs via the Internet, Coca-Cola’s brand name, Gerber Baby Food’s reputation for quality Prof.Sushil\Canada\Session-IV 8 Characteristics Making Resources Difficult to Imitate Causal ambiguity – Situations where it is difficult for competitors to understand how a firm has created its advantage – Example: Southwest Airlines’ approach • Same plane, routes, gate procedures, number of attendants • Culture of fun, family, and frugal yet focused services Economic deterrence – Involves large capital investments in capacity to provide products or services in a given market that are scale sensitive Prof.Sushil\Canada\Session-IV 9 Resource Inimitability Cannot be imitated • Patents • Unique locations Difficult to imitate• Unique assets • Brand loyalty • Employee satisfaction • Reputation for fairness Can be imitated • Capacity preemption • Economies of scale Easy to imitate • Cash • Commodities Prof.Sushil\Canada\Session-IV 10 SWOT Analysis Based on assumption an effective strategy derives from a sound “fit” between a firm’s internal resources and its external situation Opportunities A major favorable situation in a firm’s environment Threats A major unfavorable situation in a firm’s environment Strengths A resource advantage relative to competitors and the needs of markets firm serves Weaknesses A limitation or deficiency in one or more resources or competencies relative to competitors Prof.Sushil\Canada\Session-IV 11 STRATEGIC CAPABILITY ANALYSIS RESOURCE AUDIT VALUE CHAIN ANALYSIS Resource Utilization Resource Control DRAWING COMPARISONS Historical Analysis Industry Norms Best Practice ASSESSING BALANCE Product Portfolio Skills/Personality Flexibility Analysis IDENTIFICATION OF KEY ISSUES Strengths and Weaknesses Core Competencies UNDERSTANDING STRATEGIC CAPABILITY Prof.Sushil\Canada\Session-IV 12 What is Value Chain Analysis? Focuses on how a business creates customer value by examining contributions of different internal activities to that value Divides a business into sets of activities within the business – Starts with inputs a firm receives – Finishes with firm’s products or services and after-sales service to customers Allows better identification of a firm’s strengths and weaknesses since the business is viewed as a process Prof.Sushil\Canada\Session-IV 13 The Value Chain Human resource management Research, technology, and development systems Prof.Sushil\Canada\Session-IV Primary Activities Service Marketing and sales Outbound logistics Operations Procurement Inbound Logistics Suppo rt Activit ies General administration 14 Conducting a Value Chain Analysis Identify specific activities or business processes, grouping them into primary and support activities Allocate costs to each discrete activity Identify the activities that differentiate the firm Examine value chain based on firm’s mission, unique industry characteristics, and firm’s relative position in a broader value chain system Compare firm’s status to competitors Prof.Sushil\Canada\Session-IV 15 Difference Between Traditional Cost Accounting and Activity-Based Cost Accounting Traditional Cost Accounting Categories in a Purchasing Department Wages and salaries Employee benefits Supplies Travel Depreciation Other fixed charges Miscellaneous operating expenses Activity-Based Cost Accounting in Same Purchasing Department $350,000 115,000 6,500 2,400 17,000 124,000 25,520 Evaluate suppliers Process purchase orders Expedite deliveries Expedite internal process Check item quality Check deliveries against purchase orders Resolve problems Internal administration $640,150 Prof.Sushil\Canada\Session-IV $135,750 82,100 23,500 15,840 94,300 48,450 110,000 130,210 $640,150 16 Possible Factors for Assessing Sources of Differentiation in Support Activities of the Value Chain General Administration • Capability to identify new product market opportunities and potential • • • • • environmental threats Quality of strategic planning system to achieve corporate objectives Ability to obtain relatively low-cost funds for capital expenditures Level of information systems support in making strategic and routine decisions Timely, accurate management information on external environments Public image and corporate citizenship Human Resource Management • Effectiveness of procedures for recruiting, training, and promoting all • • • • • employees Appropriateness of reward systems for motivating and challenging employees A work environment minimizing absenteeism and keeping turnover low Relations with trade unions Active participation by managers and technical personnel in professional Prof.Sushil\Canada\Session-IV organizations Levels of employee motivation and job satisfaction 17 Possible Factors for Assessing Sources of Differentiation in Support Activities of the Value Chain (continued) Technology Development • Success of R&D activities in leading to product and process innovations • Quality of working relationships between R&D personnel and other • • • • departments Timeliness of technology development activities in meeting critical deadlines Quality of laboratories and other facilities Qualification and experience of laboratory technicians and scientists Ability of work environment to encourage creativity and innovation Procurement • Development of alternate sources for inputs to minimize dependence on a • • • • single supplier Procurement of raw materials (1) on a timely basis, (2) at lowest possible cost, (3) at acceptable levels of quality Procedures for procurement of plant, machinery, and buildings Development of criteria for lease-versus-purchase decisions Good, long-term relationships with reliable suppliers Prof.Sushil\Canada\Session-IV 18 Possible Factors for Assessing Sources of Differentiation in Primary Activities of the Value Chain (continued) Inbound Logistics • Soundness of material and inventory control systems • Efficiency of raw material warehousing activities Operations • Productivity of equipment compared to key competitors • Appropriate automation of production processed • Effectiveness of production control systems to improve quality and improve costs • Efficiency of plant layout and work-flow design Prof.Sushil\Canada\Session-IV Outbound Logistics • Timeliness and efficiency of delivery of finished goods and services • Efficiency of finished goods warehousing activities 19 Possible Factors for Assessing Sources of Differentiation in Primary Activities of the Value Chain (concluded) Marketing and Sales Service • Effectiveness of research to • • • • • • identify customer segments and needs Innovation in sales promotion and advertising Evaluation of alternate distribution channels Motivation and compensation of sales force Development of quality image and favorable reputation Extent of brand loyalty among customers Extent of market dominance within market segment or overall market • Means to solicit customer input for product improvements • Promptness of attention to customer complaints • Appropriateness of warranty and guarantee policies • Quality of customer education and training • Ability to provide replacement parts and repair services Prof.Sushil\Canada\Session-IV 20 RESOURCE UTILIZATION AND COMPETITIVE ADVANTAGE IDENTIFY: VALUE ACTIVITIES Assign Costs and Added Value Identify Critical Activities IDENTIFY: COST OR VALUE DRIVERS Factors w hich Determine Cost or Value of Each Activity IDENTIFY: LINKAGES Which Reduce Cost or Add Value Which Discourage Imitation Prof.Sushil\Canada\Session-IV 21 SOURCES OF COST EFFICIENCY ECONOMIES OF SCALE EXPERIENCE COST EFFICIENCY SUPPLY COST PRODUCT/ PROCESS DESIGN Prof.Sushil\Canada\Session-IV 22 Internal Analysis: Making Meaningful Comparisons 1. Comparison with past performance Perspective s to use in evaluating how a firm stacks up based on its internal capabilities 2. Stages of industry evolution 3. Benchmarking Comparison with competitors 4. Comparison with success factors in the industry Prof.Sushil\Canada\Session-IV 23 ASSESSING BALANCE OF RESOURCES Portfolio Analysis SBUs BCG, GE, Product/Market Evolution Balance of Skills/Personalities Functional Areas Team Roles Flexibility Analysis Adaptiveness to Change Openness Prof.Sushil\Canada\Session-IV 24 ANALYSING EFFECTIVENESS CLIENT REQUIREMENTS Product Attributes Service Expectations Price Sensitivity Degree of Matching ORGANISATION’ S CAPABILITY Product Features Service Performance Communication w ith Clients Prof.Sushil\Canada\Session-IV 25 FINANCIAL ANALYSIS Share Holders – Payoffs Bankers – Risk Attached to Loans Suppliers and Employees – Liquidity of Co. Managers – Performance Prof.Sushil\Canada\Session-IV 26 FINANCIAL ANALYSIS Contd…….. Financial Ratios Profitability Stock-Turnout Sales Margin Return on Equity Debt-Equity Ratio Return of Assets Net Profit Margin Asset Turnover Leverage Current Ratio Prof.Sushil\Canada\Session-IV 27 IDENTIFICATION OF KEY ISSUES SWOT Analysis Core Competencies – Who Owns? – Professional Employees How Durable? – Shorter Life Cycles – How Transferable? Raw Materials-High Brand Name/Reputation – Low – How Replicable? Threat of Imitation Prof.Sushil\Canada\Session-IV 28 Internal Factor Analysis Summary (IFAS): Maytag as Example Internal Factors Weight Rating Weighted Score Comments .15 .05 5 4 .75 .20 Quality key to success Know appliances .10 .05 .15 4 3 3 .40 .15 .45 Dedicated factories Good, but deteriorating Hoover name in cleaners Weaknesses Process-oriented R&D Distribution channels .05 .05 2 2 .10 .10 Financial position Global positioning .15 .20 2 2 .30 .40 Manufacturing facilities Total Scores .05 1.00 4 .20 3.05 Slow on new products Superstores replacing small dealers High debt load Hoover weak outside the United Kingdom and Australia Investing now Strengths Quality Maytag Culture Experienced top management Vertical integration Employee relations Hoover’s international orientation Prof.Sushil\Canada\Session-IV 29