Consumer Skills

advertisement

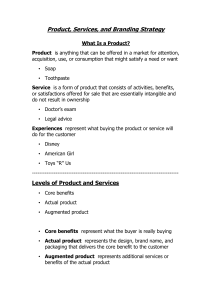

Review of Chapter 27: Money Management Money means different things to different people. For some, it’s tied to emotions. A checking account offers a safe, convenient alternative to paying in cash, but it must be used responsibly. Review of Chapter 27: Money Management Buying goods with credit allows you to have items now and pay for the later Different types of credit included credit cards, installment accounts and loans Review of Chapter 27: Money Management A financial plan outlines future spending based on income, expense and priorities. By creating a financial plan, you devise a way to manage your spending and saving Review of Chapter 27: Money Management Making a financial plan for a family can be more difficult than making an individual plan because each family member may have different values and priorities about money management Effective, usable financial plans reflect the needs, wants and resources of the family’s stage of development Review of Chapter 27: Money Management Financial danger signs: Paying only the minimum amount due on credit accounts Paying regular monthly bills with loans or savings Using credit to pay for items that are normally paid for with cash Not knowing how much your total debt is and how much interest you’re paying Depending on irregular income, such as overtime or tax refunds, to pay bills CONSUMER SKILLS Being a Good Consumer Chapter 28.1 Objectives Explain how skillful consumers judge quality price Explain what ‘comparison shopping’ means Describe impulse buying Give tips for saving money Recognize and explain different ways advertisers try to get you to buy their product Vocabulary: Consumer Bargain Unit price Comparison shopping Warranty Impulse buying Direct advertising Indirect advertising Traits of Skillful Consumers A consumer is simply a person who purchases goods and services. To be a Skillful Consumer,… Become familiar with available products, prices, and standards of quality Read and do research to learn what features to look for or avoid Use self-discipline to resist society’s message to buy more than you need What is Quality? “They just don’t make things like they used to” “I’ll never buy that brand again” If something has quality: It is well-made Works right Will last Two Consumer Advocate Groups Consumer Reports These two groups test products in laboratories and then report to readers Consumers Research Magazine This information is available at the public library internet A Fair Price To be a true bargain, you must look at four conditions: The product is one you need, want, and will use The item’s quality is suitable The product sells at a price you’re willing to pay A reliable dealer sells the item Comparison Shopping Comparison Shopping means you look at the same item in several stores to compare quality and price before you buy Tips for comparing: Know what you want (know features) Use the telephone (call around) Compare similar items Check any warranty Compare credit terms Check the return policy Warranty: A written guarantee Impulse Buying “I just couldn’t resist” Impulse buying is purchasing items without previous consideration or thought Retailers promote impulse buying in stores Check-out aisles Controlling Impulse Buying You must know what you truly need and can afford to pay Bring a shopping listhelps you focus on what you intend to buy Only take enough money to cover what you’ve planned to buy- no credit cards! Analyzing Advertising Advertising is everywhere! Television Radio Newspapers Magazines Buses Billboards Clothing Internet… Advertising Techniques Direct Advertising tries to convince you to buy a particular product by appealing directly to your values focus on glamour, health, happiness, good looks, love Indirect Advertising is more subtle celebrity association to a product, printing of company or product names on clothing A Critical Eye Learn to separate fact from fiction Recognize ‘no-promise’ promises words such as ‘can’ and ‘often’ Store raises prices then advertises ‘30% off selected items’ Conditional Watch out for belowcost sales Be careful of percentoff ads Get the whole story Fees Cost of everything else you’ll need Use Your Knowledge Max has a $.75 coupon for a brand-name toothpaste that costs $3.45 without the coupon. The house brand, which is the same size, costs $2.65. Which should he buy? Check Understanding What are two traits of a good consumer? What conditions make a purchase a bargain? What is a warranty? How can a person control impulse buying? Describe two types of advertising techniques. CONSUMER RIGHTS AND RESPONSIBILITIES Chapter 28.2 Consumers have both rights and responsibilities in the marketplace State and federal laws protect consumers’ interests, or rights At the same time, however, consumers also have responsibilities. To earn your rights as a consumer, you have to live up to your responsibilities. Consumer Rights: Consumers have 4 major rights: To safety To be informed To choose To be heard Consumer responsibilities: Be careful Be considerate shoppers who treat merchandise as carefully as if they owned it Pay for all merchandise (no shoplifting) Save sales records and receipts Follow product instructions Consumer complaints You can file a consumer complaint You can return merchandise for a refund or replacement You can write a letter of complaint Several government agencies and business organizations (like Better Business Bureau) can help Consumers can dispute thought small claims court Reflection 1. 2. Answer the following reflection questions on the back of your note sheet Many people seem to believe that happiness comes through possessions. Do you agree? Support your answer with examples. Some people admit to being “shopaholics”. When does this trait become a problem? Do you struggle with impulse buying? If yes, provide and example. If no, why do you think you can stay away from impulse buying? Should consumers be able to claim their rights if they don’t live up to their responsibilities? Explain.