Presentation Chapter 12

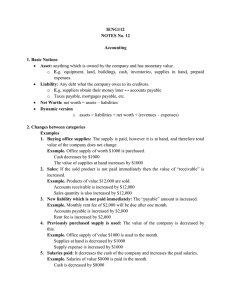

advertisement

Chapter 12 The Statement of Cash Flows FEDERAL RESERVE NOTE THE THEUNITED UNITEDSTATES STATESOF OFAMER AMERIC ICA A THIS NOTE IS LEGAL TENDER FOR ALL DEBTS, PUBLIC AND PRIVATE L70744629F 12 WASHINGTON, D.C. 12 A H 29 3 L70744629F 12 SERIES 12 1985 ONE ONE DOLLAR DOLLAR Financial Accounting, Alternate 4e by Porter and Norton 1 Cash Flows and Net Income for Four Computer Companies in 2002 (in millions) Increase (Decrease) in Cash $ 591 Dell Computer Corp. (948) IBM 6,995 Hewlitt-Packard Co. (265) Gateway, Inc. Net Income (Loss) $2,122 3,579 (903) (298) 2 Purpose of the Statement of Cash Flows Explains changes in cash over a period of time Summarizes cash inflows and outflows from: Operating Activities Investing Activities Financing Activities 3 FEDERAL RESERVE NOTE THE THE UNITED UNITED STATES STATES OF OF AMERICA AMERICA THI S NOTE I S LEGAL TENDER FOR ALL DEBTS, PUBLI C AND PRI VATE L7 074 4629 F 12 Cash Equivalents 2 3 8 9 10 H 293 5 6 7 11 12 13 14 18 19 20 2111 2212 23 13 2414 25 26 27 2818 2919 30 20 3121 4 25 15 5 26 16 6 27 17 7 28 1 2 3 8 9 10 15 4 16 5 17 6 7 22 11 23 12 24 13 14 29 18 30 19 31 20 21 25 26 27 28 1 2 3 8 9 10 15 16 17 22 23 24 29 30 31 SERI ES 12 1985 ONE ONE DOLLAR DOLLAR 4 12 L7 074 4629 F 12 1 WA SH IN G TO N , D . C. A Readily convertible to cash Little risk of price change Original maturity to investor of three months or less Examples: • Commercial paper • U.S. Treasury bills • Certain money market funds 4 Statement of Cash Flows Format inflows Cash outflows Classified by: Operating activities Investing activities Financing activities Beginning Cash + Increase or decrease in cash = = Ending Cash 5 Statement of Cash Flows Format Cash flows from operating activities: Inflows Outflows Net cash provided (used) by operating activities Cash flows from investing activities: Inflows Outflows Net cash provided (used) by investing activities Cash flows from financing activities: Inflows Outflows Net cash provided (used) by financing activities Net increase (decrease) in cash and cash equivalents Cash and cash equivalents at beginning of year Cash and cash equivalents at end of year $ xxx (xxx) $ xxx $ xxx (xxx) xxx $ xxx (xxx) xxx $ xxx xxx $ xxx from balance sheets 6 Operating Activities Incur employee salaries and wages Sell products and services Make inventory purchases Cash transactions concerned with acquiring and selling products and services Incur utility and other operating costs 7 Investing Activities Buy/Sell property, plant & equipment Cash transactions concerned with acquiring and disposing of longterm assets Purchase/Sell long-term investments Purchase/Sell intangible assets (e.g., patents, trademarks) 8 Financing Activities Sell/Repurchase stocks FEDERAL RESERVE NOTE THE THE UNITED UNITED STATES STATES OF OF AMERICA AMERICA THI S NOTE I S LEGAL TENDER FOR ALL DEBTS, PUBLI C AND PRI VATE L7 074 4629 F 12 WA SH IN G TO N , D . C. 12 A H 293 L7 074 4629 F 12 SERI ES 12 1985 ONE ONE DOLLAR DOLLAR Issue/Retire bonds Cash transactions concerned with internal and external financing of the business Borrow $/ repay loans Issue dividends 9 Categorizing Cash Flow Activities Operating Activities Investing Activities Long-Term Assets Current Income Assets Statement and Transactions Current Liabilities Financing Activities Long-Term Liabilities or Stockholders’ Equity 10 Methods to Report Cash from Operating Activities Direct Method reports major classes of cash receipts and payments Indirect Method adjusts net income to remove effect of accruals and deferrals both methods arrive at same cash from operating activities 11 Preparing the Statement of Cash Flows: Direct Method Step 1 – Set up three schedules Cash Flows from Cash Flows from Cash Flows from Operating Activities Investing Activities Financing Activities Step – 2 Determine the cash flows from operating activities by analyzing each item on the income statement, current assets and current liabilities 12 Direct Method - Operating Activities Determine cash collected from customers: Beginning accounts receivable + Sales revenue – Cash collections = Ending accounts receivable From Income Statement $ 57,000 670,000 (x) $ 63,000 From Balance Sheet Solve for x. Cash collections = $664,000 13 Schedule of Cash Flows from Operating Activities Cash receipts from: Sales on account 664,000 14 Direct Method - Operating Activities Interest Revenue: Since no Interest Receivable account exists on the balance sheet, the interest earned was received, not accrued. Gain on Sale of Machine: Not an operating cash flow 15 Schedule of Cash Flows from Operating Activities Cash receipts from: Sales on account Interest 664,000 15,000 16 Direct Method - Operating Activities Calculate cash paid to suppliers by first finding purchases: Beginning inventory + Purchases (x) – Cost of goods sold (390,000) = Ending inventory 84,000 Solve for x. $ 92,000 $ Purchases = $382,000 17 Direct Method - Operating Activities Then examine Accounts Payable to determine cash paid to suppliers: Beginning accounts payable + Purchases 382,000 – Cash payments (x) = Ending accounts payable $ 31,000 $ 38,000 Solve for x. Cash paid to suppliers = $ 375,000 18 Schedule of Cash Flows from Operating Activities Cash receipts from: Sales on account Interest Cash payments for: Inventory purchases 664,000 15,000 (375,000) 19 Direct Method - Operating Activities Salaries and wages: Beginning salaries & wages pay. $ 9,000 + Salaries & wages expense 60,000 – Cash payments to employees (x) = Ending salaries & wages pay. $ 7,000 Solve for x. Cash paid for salaries & wages = $ 62,000 20 Schedule of Cash Flows from Operating Activities Cash receipts from: Sales on account Interest Cash payments for: Inventory purchases Salaries and wages 664,000 15,000 (375,000) (62,000) 21 Direct Method - Operating Activities Depreciation expense is not a cash flow Insurance Expense and Prepaid Insurance: Beginning prepaid insurance + Cash payments for insurance – Insurance expense = Ending prepaid insurance $ 18,000 (x) (12,000) $ 12,000 Solve for x. Cash paid for insurance = $6,000 22 Schedule of Cash Flows from Operating Activities Cash receipts from: Sales on account Interest Cash payments for: Inventory purchases Salaries and wages Insurance 664,000 15,000 (375,000) (62,000) (6,000) 23 Direct Method - Operating Activities Interest Expense: Since no Interest Payable account exists on the balance sheet, the interest expensed was paid, not deferred. Income Tax Expense and Income Taxes Payable: Beginning income taxes payable + Income tax expense 50,000 – Cash payments for taxes = Ending income taxes payable $ 5,000 (x) $ 8,000 Solve for x. Cash paid for taxes = $47,000 24 Schedule of Cash Flows from Operating Activities Cash receipts from: Sales on account Interest Cash payments for: Inventory purchases Salaries and wages Insurance Interest Taxes Net cash provided by operating activities $ 664,000 15,000 (375,000) (62,000) (6,000) (15,000) (47,000) $ 174,000 25 Preparing the Statement of Cash Flows: Direct Method Step – 3 Determine the cash flows from investing activities by examining the long-term asset accounts and any additional info 26 Direct Method – Investing Activities Long-Term Investments: The net increase of $30,000 matches the additional info given on the balance sheet and required the use of cash. Land: The additional balance sheet info reveals that a note payable was issued. No cash was involved in the land transaction so it should be reported in a separate schedule instead of on the Statement of Cash Flows 27 Direct Method – Investing Activities Property and Equipment: The additional balance sheet info reveals that equipment was purchased for $75,000 and a machine was sold for $25,000. Beginning property and equip. + Acquisitions – Disposals = Ending property and equip. $280,000 75,000 (x) $320,000 Solve for x. The cost of fixed assets sold = $35,000 28 Direct Method – Investing Activities Accumulated Depreciation: Beginning accum. depreciation + Depreciation expense – Accum. depreciation on assets sold = Ending accum. depreciation $ 75,000 40,000 (x) $100,000 Solve for x. The accumulated depreciation on the assets disposed of during the year = $15,000 29 Schedule of Cash Flows from Investing Activities Cash inflows from: Sale of machine Cash outflows from: Purchase of investment Purchase of property and equip. Net cash used by investing activities $ 25,000 (30,000) (75,000) $(80,000) 30 Preparing the Statement of Cash Flows: Direct Method Step – 4 Determine the cash flows from financing activities FEDERAL RESERVE NOTE THE THE UNITED UNITED STATES STATES OF OF AMERICA AMERICA THI S NOTE I S LEGAL TENDER FOR ALL DEBTS, PUBLI C AND PRI VATE L7 074 4629 F 12 WA SH IN G TO N , D . C. 12 A H 293 L7 074 4629 F 12 SERI ES 12 1985 ONE ONE DOLLAR DOLLAR 31 Direct Method – Financing Activities Notes payable: This increase is already shown on a supplemental schedule of noncash activities. Bonds payable: Bonds with a face value of $60,000 are retired by paying $63,000. 32 Direct Method – Financing Activities Capital stock was issued for cash Retained earnings: Beginning retained earnings $ 193,000 + Net income 120,000 – Cash dividends (x) = Ending retained 246,000 Solve for x. Cash earnings paid for dividends =$ $67,000 33 Schedule of Cash Flows from Financing Activities Cash inflows from: Issuance of stock Cash outflows from: Retirement of bonds Payment of cash dividends Net cash used by financing activities $ 25,000 (63,000) (67,000) $(105,000) 34 Noncash Investing and Financing Activities Disclose important financing and investing activities which do not require cash Examples: Exchange Stock for Assets Certificate of Stock Buy Assets through Debt Financing from Supplier 35 Statement of Cash Flows Format Cash flows from operating activities: Inflows Outflows Net cash provided (used) by operating activities Cash flows from investing activities: Inflows Outflows Net cash provided (used) by investing activities Cash flows from financing activities: Inflows Outflows Only section of statement Net cash provided by financing that(used) differs in form activities between Net increase (decrease) in cash and cash equivalents direct and indirect method Cash and cash equivalents at beginning of year (net cashatflow total Cash and cash equivalents end of yearis the $ xxx (xxx) $ xxx $ xxx (xxx) xxx $ xxx (xxx) xxx $ xxx xxx $ xxx same) 36 Indirect Method Operating Activities Income Statement Conversion of accrual to cash basis Cash Flows from Operating Activities 37 Indirect Method - Operating Activities Net cash flows from operating activities: Net income Adjustments to reconcile net income: Increase in accounts receivable xx,xxx (6,000) From balance sheet: Accts. receivable, 2004 Accts. receivable, 2003 $63,000 57,000 $ 6,000 Decrease $6,000 38 Indirect Method - Operating Activities Net cash flows from operating activities: Net income Adjustments to reconcile net income: Increase in accounts receivable Gain on sale of machine Selling price of machine Book value of machine Gain on sale xx,xxx (6,000) 5,000 $25,000 20,000 $ 5,000 Increase $5,000 39 Indirect Method - Operating Activities Net cash flows from operating activities: Net income Adjustments to reconcile net income: Increase in accounts receivable Gain on sale of machine Decrease in inventory Decrease $8,000 xx,xxx ( 6,000) 5,000 8,000 From balance sheet: Inventory, 2003 $92,000 Inventory, 2004 84,000 $ 8,000 40 Indirect Method - Operating Activities Net cash flows from operating activities: Net income Adjustments to reconcile net income: Increase in accounts receivable Gain on sale of machine Decrease in inventory Increase in accounts payable Increase $7,000 xx,xxx ( 6,000) 5,000 8,000 7,000 From balance sheet: Accts. payable, 2004 $38,000 Accts. payable, 2003 31,000 $ 7,000 41 Indirect Method - Operating Activities Net cash flows from operating activities: Net income Adjustments to reconcile net income: Increase in accounts receivable Gain on sale of machine Decrease in inventory Increase in accounts payable Decrease in salaries & wages payable Salaries & wages payable, 2003 Salaries & wages payable, 2004 xx,xxx ( 6,000) 5,000 8,000 7,000 ( 2,000) $9,000 7,000 $2,000 Decrease $2,000 42 Indirect Method - Operating Activities Net cash flows from operating activities: Net income Adjustments to reconcile net income: Increase in accounts receivable Gain on sale of machine Decrease in inventory Increase in accounts payable Decrease in salaries & wages payable Decrease in prepaid insurance xx,xxx ( 6,000) 5,000 8,000 7,000 ( 2,000) 6,000 Prepaid insurance, 2003 Prepaid insurance, 2004 $18,000 12,000 $ 6,000 Decrease $6,000 43 Indirect Method - Operating Activities Net cash flows from operating activities: Net income Adjustments to reconcile net income: Increase in accounts receivable Gain on sale of machine Decrease in inventory Increase in accounts payable Decrease in salaries & wages payable Decrease in prepaid insurance Depreciation expense xx,xxx ( 6,000) 5,000 8,000 7,000 ( 2,000) 6,000 40,000 Add back noncash expense 44 Indirect Method - Operating Activities Net cash flows from operating activities: Net income Adjustments to reconcile net income: Increase in accounts receivable Gain on sale of machine Decrease in inventory Increase in accounts payable Decrease in salaries & wages payable Decrease in prepaid insurance Depreciation expense Increase in income taxes payable xx,xxx ( 6,000) 5,000 8,000 7,000 ( 2,000) 6,000 40,000 3,000 Inc. taxes payable, 2004 Inc. taxes payable, 2003 $8,000 5,000 $3,000 Increase $3,000 45 Indirect Method - Operating Activities Net cash flows from operating activities: Net income Adjustments to reconcile net income: Increase in accounts receivable Gain on sale of machine Decrease in inventory Increase in accounts payable Decrease in salaries & wages payable Decrease in prepaid insurance Increase in income taxes payable Depreciation expense Loss on retirement of bonds xx,xxx ( 6,000) ( 5,000) 8,000 7,000 ( 2,000) 6,000 3,000 40,000 3,000 Report entire outflow as a financing activity 46 FEDERAL RESERVE NOTE THE THE UNITED UNITEDSTATES STATES OF OF AMERICA AMERICA TH IS N O TE IS LEG A L TEN D ER FO RA LL D EBTS, PU BLIC A N DPRIV A TE Cash Flow Adequacy L70744629F 12 WASHINGTON, D.C. 12 A H293 L70744629F 12 SERIES 12 1985 ONE ONE DOLLAR DOLLAR Measures company’s ability to meet principal and interest obligations Creditors concerned with cash available to repay debts after company has replaced its long-term assets Cash Flow from Operating Activities - Capital Expenditures . Avg. Debt Maturing over Next Five Years 47 Appendix Accounting Tools: A Work-Sheet Approach to the Statement of Cash Flows 48 Indirect Method: Using a Work Sheet Enter account balances 49 Indirect Method: Using a Work Sheet 50 Indirect Method: Using a Work Sheet Enter net income 51 Indirect Method: Using a Work Sheet Enter noncash revenues or expenses 52 Indirect Method: Using a Work Sheet Extend current assets & current liabilities 53 Indirect Method: Using a Work Sheet Total columns 54 Indirect Method: Using a Work Sheet Determine net cash inflow (outflow) 55 End of Chapter 12 FEDERAL RESERVE NOTE THE THEUNITED UNITEDSTATES STATESOF OFAMERICA AMERICA THIS NOTE IS LEGAL TENDER FOR ALL DEBTS, PUBLIC AND PRIVATE L70744629F 12 WASHINGTON, D.C. 12 A H 293 L70744629F 12 SERIES 12 19 85 ONE ONE DOLLAR DOLLAR 56