Analyzing Bank Performance: Using the UBPR

advertisement

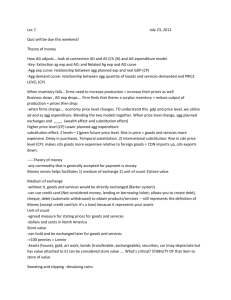

Bank Management, 6th edition. Timothy W. Koch and S. Scott MacDonald Copyright © 2006 by South-Western, a division of Thomson Learning ANALYZING BANK PERFORMANCE: USING THE UBPR Chapter 2 William Chittenden edited and updated the PowerPoint slides for this edition. Balance Sheet Assets = Liabilities + Equity Balance sheet figures are calculated at a particular point in time and thus represent stock values. Bank Assets http://www2.fdic.gov/ubpr/UbprReport/SearchEngine/Default.asp Cash and due from banks Vault cash, deposits held at the Fed and other financial institutions, and cash items in the process of collection. Investment Securities Securities held to earn interest and help meet liquidity needs. Loans The major asset, generate the greatest amount of income, exhibit the highest default risk and are relatively illiquid. Other assets Bank premises and equipment, interest receivable, prepaid expenses, other real estate owned, and customers' liability to the bank Balance Sheet (assets): PNC and Community National Bank PNC BANK, NATIONAL ASSOCIATION BALANCE SHEET ASSETS % Cha Loans: Real estate loans 1.2% Commercial loans -8.4% Individual loans -4.4% Agricultural loans 9.2% Other LN&LS in domestic off. -20.5% LN&LS in foreign off. 15.6% Gross Loans & Leases -4.6% Less: Unearned Income 8.0% Memo: Total loans -4.6% Loan & Lease loss Allowance -5.8% Net Loans & Leases -4.5% Investments: U.S. Treasury & Agency securities 90.6% Municipal securities -46.9% Foreign debt securities -100.0% All other securities 1.1% Interest bearing bank balances 16.4% Fed funds sold & resales -54.6% Trading account assets -9.1% Total Investments 8.7% Total Earning Assets Dec-03 1,000 % of Total % Cha COMMUNITY NATIONAL BANK % of Total 15,639,089 11,879,285 2,501,847 984 3,022,795 1,190,025 34,234,025 44,867 34,189,158 606,886 33,582,272 25.2% 19.2% 4.0% 0.0% 4.9% 1.9% 55.2% 0.1% 55.1% 1.0% 54.1% 20,701,904 14,707,458 3,816,861 1,545 2,999,113 1,222,904 43,449,785 44,949 43,404,836 583,915 42,820,921 28.0% 19.9% 5.2% 0.0% 4.1% 1.7% 58.9% 0.1% 58.8% 0.8% 58.0% 5,574,108 7,719 0 8,804,028 259,318 1,106,733 935,042 16,686,948 9.0% 15.9% 6,460,936 0.0% 1606.0% 131,685 0.0% 0% 0 14.2% 3.0% 9,064,146 0.4% 51.8% 393,713 1.8% 56.2% 1,728,372 1.5% 78.3% 1,667,330 26.9% 16.5% 19,446,182 8.8% 0.2% 0.0% 12.3% 0.5% 2.3% 2.3% 26.3% 81.1% 84.4% -0.5% 50,269,220 32.4% 23.8% 52.6% 57.0% -0.8% 2.8% 26.9% 0.2% 27.0% -3.8% 27.5% Dec-04 1,000 23.9% 62,267,103 % Cha Dec-03 1,000 4.0% 75,324 -5.8% 34,288 26.7% 8,454 0.0% 0 13.0% 26 0.0% 0 2.2% 118,092 0.0% 0 2.2% 118,092 6.7% 1,258 2.2% 116,834 % of Total % Cha Dec-04 1,000 % of Total 39.1% 12.9% 85,050 17.8% 12.9% 38,716 4.4% -5.2% 8,011 0.0% 0.0% 0 0.0% 284.6% 100 0.0% 0.0% 0 61.3% 11.7% 131,877 0.0% 0.0% 0 61.3% 11.7% 131,877 0.7% 28.5% 1,617 60.6% 11.5% 130,260 40.5% 18.4% 3.8% 0.0% 0.0% 0.0% 62.8% 0.0% 62.8% 0.8% 62.0% 34,937 613 0 2,104 4,428 7,000 0 49,082 18.1% 0.3% 0.0% 1.1% 2.3% 3.6% 0.0% 25.5% 24.8% 43,591 -0.5% 610 0% 0 -2.2% 2,057 -57.5% 1,881 -21.4% 5,500 0.0% 0 9.3% 53,639 20.7% 0.3% 0.0% 1.0% 0.9% 2.6% 0.0% 25.5% 20.6% 165,916 86.1% 10.8% 183,899 87.5% 73.9% -0.5% 0.0% #N/A #N/A 175.0% 0.0% 111.1% Nonint Cash & Due from banks -6.9% 2,926,330 4.7% Premises, fixed assets & capital leases 24.4% 1,039,603 1.7% Other real estate owned 21.8% 14,208 0.0% Investment in unconsolidated subs. 252.4% 17,386 0.0% Acceptances and other assets 51.8% 7,754,149 12.5% Total Assets 4.0% 62,020,896 100.0% 8.5% 3,174,493 4.3% -16.6% 13,083 6.8% -10.7% 11,682 5.6% 2.5% 1,066,028 1.4% 12.2% 5,642 2.9% 2.2% 5,768 2.7% 0.7% 14,301 0.0% -84.3% 325 0.2% -100.0% 0 0.0% -12.4% 15,223 0.0% 0.0% 0 0.0% 0.0% 0 0.0% -6.2% 7,272,017 9.9% 259.8% 7,761 4.0% 13.2% 8,783 4.2% 19.0% 73,809,165 100.0% 18.6% 192,727 100.0% 9.0% 210,132 100.0% Average Assets During Quarter 17.0% 73,391,052 6.8% 62,719,462 101.1% 99.4% 17.5% 191,480 99.4% 9.4% 209,525 99.7% Adjustments to total loans …three adjustments are made to obtain a net loan figure. 1. Leases are included in gross loans. 2. Unearned income is deducted from gross interest received. 3. Gross loans are reduced by the dollar magnitude of a bank's loan-loss reserve, which exists in recognition that some loans will not be repaid. Provisions for loan losses Recoveries Provisions for loan losses Reserve for Loan Losses Charge offs Bank investments and FASB 115 Following FASB 115 a bank, at purchase, must designate the objective behind buying investment securities as either: Held-to-maturity securities are recorded on the balance sheet at amortized cost. Trading account securities are actively bought and sold, so the bank marks the securities to market (reports them at current market value) on the balance sheet and reports all gains and losses on the income statement. Available-for-sale, all other investment securities, are recorded at market value on the balance sheet with a corresponding change to stockholders’ equity as unrealized gains and losses on securities holdings; no income statement impact . Average assets, capital and loan loss data: PNC and Community NB PNC BANK, NATIONAL ASSOCIATION Enter analysts name here SUPPLEMENTAL DATA Average Assets Domestic Banking offices Foreign Branches Number of equivalent employees Pg # 1 3 3 3 % Cha Dec-03 $ 1,000 % of Total 2.36% 60,890,137 0.59% 684 0.00% 8 -1.72% 15,147 % Cha Dec-04 $ 1,000 COMMUNITY NATIONAL BANK % of Total 14.30% 69,596,163 7.75% 737 0.00% 8 3.49% 15,675 % Cha Dec-03 $ 1,000 % of Total % Cha Dec-04 $ 1,000 % of Total 11.59% 176,531 0.00% 5 0.00% 0 -3.02% 64 13.45% 200,271 20.00% 6 0.00% 0 9.85% 71 14.19% 14,005 10.7% 6.70% 1,258 1.0% 0.00% 0 0.0% 13.53% 15,263 11.7% 13.53% 30,526 23.4% 12.72% 130,506 100.0% 9.09% 15,278 10.3% 28.54% 1,617 1.1% 0.00% 0 0.0% 10.69% 16,895 11.4% 10.69% 33,790 22.7% 14.03% 148,814 100.0% SUMMARY OF RISK BASED CAPITAL Net Tier One Net Eligible Tier Two Tier Three Deductions Total-risk-based-capital Total Risk-Weighted Assets 11A 11A 11A 11A 11A 11A -0.49% 5,134,748 9.9% -0.90% 5,088,306 8.4% -9.20% 1,566,924 3.0% 28.12% 2,007,618 3.3% 36.19% (12,269) 0.0% 408.06% (62,334) -0.1% -2.73% 6,689,403 12.9% 5.15% 7,033,591 11.5% -2.73% 13,378,806 25.8% 5.15% 14,067,181 23.1% -1.95% 51,908,044 100.0% 17.32% 60,897,630 100.0% SUMMARY OF LOAN LOSS ACCOUNT Balance at beginning of period Gross Credit Losses Memo: Loans HFS Writedown Recoveries Net Credit Losses 7 7 7 7 7 6.92% 2.40% 14.01% 11.29% 0.56% 644,475 255,377 26,060 47,453 207,924 1.8% 0.7% 0.1% 0.1% 0.6% -5.83% -36.75% -67.16% 5.05% -46.28% 606,886 161,537 8,558 49,849 111,688 1.5% 38.87% 0.4% 277.91% 0.0% 0.00% 0.1% -15.38% 0.3% 303.33% 1,179 616 0 11 605 1.0% 0.5% 0.0% 0.0% 0.5% 6.70% -57.79% 0.00% 72.73% -60.17% 1,258 260 0 19 241 1.0% 0.2% 0.0% 0.0% 0.2% Provisions for Credit Losses Other Adjustments Balance at end of period 7 7 7 -39.11% -84.91% -5.83% 176,612 (6,277) 606,886 0.5% -70.81% 0.0% -692.07% 1.7% -3.79% 51,553 37,164 583,915 0.1% 0.1% 1.5% 684 0 1,258 0.6% 0.0% 1.1% -12.28% 0.00% 28.54% 600 0 1,617 0.5% 0.0% 1.3% Average Total Loans & Leases 7 -8.74% 35,193,158 100.0% 13.55% 39,960,849 100.0% 42.50% 0.00% 6.70% 5.43% 114,953 100.0% 7.38% 123,431 100.0% NON-CURRENT LN&LS 90 days and over past due Total Nonaccrual Ln&LS Total Non-current LN&LS Ln&Ls 30-89 Days Past Due 8 8 8 8 -53.71% -21.98% -31.89% -49.74% 72,963 270,782 343,745 126,455 0.2% 0.8% 1.0% 0.4% -20.54% -47.60% -41.86% -25.05% 57,979 141,887 199,866 94,779 0.1% 0.4% 0.5% 0.2% -38.05% -42.61% -40.66% -68.98% 184 229 413 844 0.2% -100.00% 0.2% -9.17% 0.4% -49.64% 0.7% 167.89% Restructured LN&LS 90+ Days P/D Restructured LN&LS Nonaccrual 8 8 0.0% -65.1% 0 424 0.0% 0.0% 0.0% -100.0% 0 0 0.0% 0.0% 0.0% 0.0% 0 0 0.0% 0.0% Current Restructured LN&LS All other real estate owned 8 8 0.0% 21.8% 0 14,208 0.0% 0.0% 0.0% 0.7% 0 14,301 0.0% 0.0% 0.0% -84.3% 0 325 0.0% 0.3% 0 208 208 2,261 0.0% 0.2% 0.2% 1.8% 0.0% 0.0% 0 0 0.0% 0.0% 0.0% -100.0% 0 0 0.0% 0.0% Bank liabilities Demand deposits Transactions accounts that pay no interest Negotiable orders of withdrawal (NOWs) and automatic transfers from savings (ATS) accounts Pay interest set by each bank without federal restrictions Money market deposit accounts (MMDAs) Pay market rates, but a customer is limited to no more than six checks or automatic transfers each month Savings and time deposits represent the bulk of interest-bearing liabilities at banks. Bank liabilities (continued) Two general time deposits categories exist: Time deposits in excess of $100,000, labeled jumbo certificates of deposit (CDs). Small CDs, considered core deposits which tend to be stable deposits that are typically not withdrawn over short periods of time. Deposits held in foreign offices Balances issued by a bank subsidiary located outside the U.S. Purchased liabilities, (rate-sensitive borrowings): Federal Funds purchased Repos Other borrowings less than one year Core versus volatile funds Core deposits are stable deposits that are not highly interest rate-sensitive. More sensitive to the fees charged, services rendered, and location of the bank. Includes: demand deposits, NOW accounts, MMDAs, and small time deposits. Large, or volatile, borrowings are liabilities that are highly rate-sensitive. Normally issued in uninsured denominations Ability to borrow is asset quality sensitive Includes: large CDs (over 100,000), deposits in foreign offices, federal funds purchased, repurchase agreements, and other borrowings with maturities less than one year.* *The UBPR also includes brokered deposits less than $100,000 and maturing within one year in the definition of net non-core liabilities. Balance Sheet (liabilities): PNC and Community National Bank PNC BANK, NATIONAL ASSOCIATION BALANCE SHEET % Cha Dec-03 1,000 % of Total % Cha Dec-04 1,000 COMMUNITY NATIONAL BANK % of Total % Cha Dec-03 1,000 % of Total % Cha Dec-04 1,000 % of Total LIABILITIES Demand deposits All NOW & ATS Accounts Money market deposit accounts Other savings deposits Time deposits under $100M Core Deposits 2.6% 7,070,434 9.9% 1,529,861 6.8% 24,502,371 5.0% 2,055,659 -15.9% 6,242,628 2.0% 41,400,953 11.4% 2.5% 39.5% 3.3% 10.1% 66.8% 20.1% 8,488,607 8.9% 1,666,003 8.8% 26,665,024 35.4% 2,782,931 13.1% 7,063,499 12.7% 46,666,064 11.5% 2.3% 36.1% 3.8% 9.6% 63.2% 12.6% 72,500 15.5% 12,478 56.7% 46,458 7.3% 7,812 4.0% 24,469 20.7% 163,717 37.6% 6.5% 24.1% 4.1% 12.7% 84.9% 12.4% 81,514 39.7% 17,437 5.3% 48,908 26.7% 9,896 -14.4% 20,949 9.2% 178,704 38.8% 8.3% 23.3% 4.7% 10.0% 85.0% Time deposits of $100M or more Deposits held in foreign offices Total deposits -17.6% 1,775,943 71.5% 2,371,548 3.2% 45,548,444 2.9% 3.8% 73.4% 80.5% 3,205,331 26.3% 2,994,623 16.1% 52,866,018 4.3% 4.1% 71.6% 4.9% 13,572 0.0% 0 19.3% 177,289 7.0% 0.0% 92.0% 8.4% 14,714 0.0% 0 9.1% 193,418 7.0% 0.0% 92.0% Fed funds purchased & resale FHLB borrowings < 1 Yr Other borrowings inc mat < 1 yr Memo: S.T. non core funding Memo: S.T. Volatile liabilities 25.2% 898.2% 99.4% 73.5% 36.2% 0.8% 221.8% 1,606,647 1.6% -100.0% 0 3.7% 34.5% 3,046,632 11.5% 25.7% 8,936,809 11.1% 57.0% 10,853,233 2.2% 0.0% 4.1% 12.1% 14.7% 1,000 0 0 7,901 14,572 0.5% 0.0% 0.0% 4.1% 7.6% 0.2% 2.8% 6.2% 88.8% 2.2% 90.9% 0.1% 0.0% 0 4.9% 0.0% 0 6.2% -11.0% 395 89.2% 19.1% 178,684 2.6% 0.0% 0 91.7% 19.1% 178,684 0.0% 0.0% 0.2% 92.7% 0.0% 92.7% 499,232 1,000,000 2,264,921 7,111,124 6,911,644 FHLB borrowings > 1 Yr -90.0% 115,406 Other borrowings inc mat > 1 yr -2.9% 1,765,851 Acceptances & other liabilities -0.1% 3,864,388 Total Liabilities before Sub. Notes 4.6% 55,058,242 Sub. Notes & Debentures 16.2% 1,340,133 Total Liabilities 4.9% 56,398,375 All common and preferred capital Total Liabilities & Capital Memoranda: Officer, Shareholder Loans (#) Officer, Shareholder Loans ($) Non-investment ORE Loans Held for Sale Held-to Maturity Securities Available-for-Sale-Securities Total Securities All Brokered Deposits -4.1% 5,622,521 9.1% 4.0% 62,020,896 100.0% 0.0% 2 -19.4% 14,211 21.8% 14,208 -10.2% 1,378,603 #N/A 2,114 23.4% 14,383,741 23.4% 14,385,855 14.2% 1,533,123 -23.3% 88,508 105.2% 3,624,223 18.7% 4,585,994 19.5% 65,818,022 41.4% 1,895,482 20.1% 67,713,504 8.4% 6,095,661 8.3% 19.0% 73,809,165 100.0% 0.0% 50.0% 3 0.0% 58.0% 22,449 0.0% 0.7% 14,301 2.2% 20.9% 1,667,154 0.0% -100.0% 0 23.2% 8.9% 15,656,767 23.2% 8.8% 15,656,767 2.5% 49.3% 2,289,151 0.0% 0.0% 0.0% 0.1% 4.5% 12.0% 14,043 7.3% 18.6% 192,727 100.0% 0.0% -50.0% 0.0% 31.7% 0.0% -84.3% 2.3% 0.0% 0.0% 36.7% 21.2% 89.4% 21.2% 81.8% 3.1% 0.0% 1 1,852 325 0 4,073 33,581 37,654 0 0.0% 0.0% 0.0% 28.7% 7.8% 1,000 0 0 10,169 15,714 0.5% 0.0% 0.0% 4.8% 7.5% 0.0% 0 0.0% 0 31.6% 520 9.1% 194,938 0.0% 0 9.1% 194,938 0.0% 0.0% 0.2% 92.8% 0.0% 92.8% 8.2% 15,194 7.2% 9.0% 210,132 100.0% 0.0% 0.0% 1.0% 22.2% 0.2% -100.0% 0.0% 0.0% 2.1% -56.2% 17.4% 32.4% 19.5% 22.9% 0.0% 0.0% 1 2,263 0 0 1,785 44,473 46,258 0.0% 1.1% 0.0% 0.0% 0.8% 21.2% 22.0% 0 0.0% Stockholders equity Subordinated notes and debentures: Notes and bonds with maturities in excess of one year. Stockholders' equity Ownership interest in the bank. Common and preferred stock are listed at par Surplus account represents the amount of proceeds received by the bank in excess of par when it issued the stock. Retained earnings equals accumulated net income not paid out as cash dividends The income statement Interest income (II) Interest expense (IE) Interest income less interest expense equals net interest income (NII) Loan-loss provisions (PL) represent management's estimate of potential lost revenue from bad loans Noninterest income (OI) Noninterest expense (OE) noninterest expense usually exceeds noninterest income such that the difference is labeled the bank's burden Securities gains or losses (SG) Taxes Income statement (interest): PNC and Community National Bank Income Statement PNC BANK, NATIONAL ASSOCIATION Dec-03 % of Dec-04 % Cha $ 1,000 Total % Cha $ 1,000 % of Total Interest Income: Interest and fees on loans Income from lease financing Memo: Fully taxable Tax-exempt Estimated tax benefit Income on Loans & Leases (TE) -17.5% 1,730,575 -20.6% 189,910 -17.7% 1,905,782 -25.7% 14,703 -27.7% 7,347 -17.8% 1,927,832 Other security inc. (data prior to 12/31/00) 0.0% U.S. Treasury & Agency securities 48.2% Mortgage Backed Securities -0.7% Estimated tax benefit 1.0% All other securities income -15.4% Memo: Tax-Exempt Securities Income 3.7% Investment Interest Income (TE) -2.4% Interest on due from banks Interest on Fed funds sold & resales Trading account income Other interest income Total interest income (TE) Interest Expense: Int on Deposits held in foreign offices Interest on CD's over $100M Interest on All Other Deposits: All NOW & ATS Accounts Money market deposit accounts Other savings deposits Time deposits under $100M Total interest exp. on deposits 0 34,418 366,877 504 117,866 1,008 519,665 43.8% 4,835 -32.4% 18,682 216.9% 805 127.2% 39,447 -14.2% 2,511,266 % Cha COMMUNITY NATIONAL BANK Dec-03 % of Dec-04 $ 1,000 Total % Cha $ 1,000 % of Total 37.5% 4.1% 41.3% 0.3% 0.2% 41.7% 8.3% 1,875,058 -30.1% 132,839 4.6% 1,993,668 -3.2% 14,229 -22.3% 5,711 4.4% 2,013,608 38.4% 2.7% 40.8% 0.3% 0.1% 41.2% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 7,923 0 7,923 0 0 7,923 73.6% 0.0% 73.6% 0.0% 0.0% 73.6% 7.5% 0.0% 7.5% 0.0% 0.0% 7.5% 8,521 0 8,521 0 0 8,521 72.1% 0.0% 72.1% 0.0% 0.0% 72.1% 0.0% 0.7% 7.9% 0.0% 2.6% 0.0% 11.2% 0.0% 221.4% -8.1% 565.1% -31.2% 728.4% 2.4% 0 110,614 337,110 3,352 81,129 8,350 532,205 0.0% 2.3% 6.9% 0.1% 1.7% 0.2% 10.9% 0.0% -6.2% -12.6% 23.5% 28.1% 28.1% -7.4% 0 427 368 21 41 41 857 0.0% 4.0% 3.4% 0.2% 0.4% 0.4% 8.0% 0.0% 28.3% 62.8% 81.0% 80.5% 80.5% 46.9% 0 548 599 38 74 74 1,259 0.0% 4.6% 5.1% 0.3% 0.6% 0.6% 10.7% 0.1% -24.8% 3,638 0.4% 57.9% 29,503 0.0% 2455.9% 20,575 0.9% -47.2% 20,847 54.4% 4.3% 2,620,376 0.1% 0.6% 0.4% 0.4% 53.6% 164.3% -7.0% 0.0% 0.0% -0.6% 37 133 0 15 8,965 0.3% 1.2% 0.0% 0.1% 83.3% 21.6% -23.3% 0.0% 13.3% 10.9% 45 102 0 17 9,944 0.4% 0.9% 0.0% 0.1% 84.1% -14.7% -29.5% -30.5% 0.0% 0.0% 0.0% 0.0% -29.8% 17,335 67,714 369,702 0 0 0 0 454,751 0.4% 1.5% 8.0% 0.0% 0.0% 0.0% 0.0% 9.8% 144.0% 6.4% 1.8% 0.0% 0.0% 0.0% 0.0% 7.9% 42,290 72,032 376,244 0 0 0 0 490,566 0.9% 1.5% 7.7% 0.0% 0.0% 0.0% 0.0% 10.0% 0.0% -19.2% -20.5% 0.0% 0.0% 0.0% 0.0% -20.2% 0 375 1,060 0 0 0 0 1,435 0.0% 3.5% 9.8% 0.0% 0.0% 0.0% 0.0% 13.3% 0.0% 6.4% 3.6% 0.0% 0.0% 0.0% 0.0% 4.3% 0 399 1,098 0 0 0 0 1,497 0.0% 3.4% 9.3% 0.0% 0.0% 0.0% 0.0% 12.7% Interest on Fed funds purchased & resale 2.2% Interest on Trad Liab & Oth Borrowings -59.0% Interest on mortgages & leases 0.0% Interest on Sub. Notes & Debentures -17.9% Total interest expense -30.6% 13,260 26,001 0 55,449 549,461 0.3% 0.6% 0.0% 1.2% 11.9% 204.9% 429.4% 0.0% 52.1% 37.0% 40,432 137,637 0 84,340 752,975 0.8% 2.8% 0.0% 1.7% 15.4% -52.2% 0.0% 0.0% 0.0% -20.6% 11 0 0 0 1,446 0.1% 0.0% 0.0% 0.0% 13.4% 90.9% 0.0% 0.0% 0.0% 5.0% 21 0 0 0 1,518 0.2% 0.0% 0.0% 0.0% 12.8% -8.1% 1,961,805 42.5% -4.8% 1,867,401 38.2% 4.5% 7,519 69.8% 12.1% 8,426 71.3% Net interest income (TE) Income statement (noninterest): PNC and Community National Bank Income Statement PNC BANK, NATIONAL ASSOCIATION Dec-03 % of Dec-04 % Cha $ 1,000 Total % Cha $ 1,000 % of Total Noninterest Income: Fiduciary Activities Deposit service charges Trading rev, venture cap., securitize inc. Investment banking, advisory inc. Insurance commissions & fees Net servicing fees Loan & lease net gains (losses) Other net gains (losses) Other noninterest income Total noninterest income -5.4% 291,582 4.8% 422,100 61.8% 88,985 3.5% 562,482 -74.8% (660) -7.9% 35,245 -13.4% 134,969 -39.1% 10,036 10.5% 474,040 3.7% 2,018,779 6.3% 9.1% 1.9% 12.2% 0.0% 0.8% 2.9% 0.2% 10.3% 43.7% 1.6% 296,226 2.1% 431,169 -24.4% 67,267 32.7% 746,475 -1896% 11,856 45.3% 51,212 -3.0% 130,953 -88.8% 1,124 1.3% 479,982 9.8% 2,216,264 6.1% 8.8% 1.4% 15.3% 0.2% 1.0% 2.7% 0.0% 9.8% 45.4% 0.0% 16.7% 0.0% 0.0% -66.7% 0.0% -100.0% -1012.5% -31.9% -16.6% Adjusted Operating Income (TE) -2.5% 3,980,584 86.2% 2.6% 4,083,665 83.6% 5.7% 1,112,208 11.8% 352,506 0.0% 0 -4.6% 4,006 10.9% 956,533 8.6% 2,425,253 24.1% 7.6% 0.0% 0.1% 20.7% 52.5% 27.8% 1,421,341 -0.6% 350,550 0.0% 0 186.5% 11,476 3.9% 994,122 14.5% 2,777,489 Provision: Loan & Lease Losses Pretax Operating Income (TE) -39.1% 176,612 -11.5% 1,378,719 3.8% 29.8% Realized G/L Hld-to-Maturity Sec. Realized G/L Avail-for-Sale Sec. Pretax Net Operating Income (TE) 0.0% 0 12.6% 89,786 -10.4% 1,468,505 Applicable Income Taxes Current Tax Equivalent Adjustment Other Tax Equivalent Adjustments Applicable Income Taxes (TE) -13.4% -26.4% 0.0% -13.6% Net Operating Income Net Extraordinary Items Net Income Non-Interest Expenses: Personnel expense Occupancy expense Goodwill impairment Other Intangible Amortization Other Oper Exp (Incl intangibles) Total Noninterest Expenses Cash Dividends Declared Retained Earnings Memo: Net International Income Memo: Total operating income Memo: Net operating income % Cha COMMUNITY NATIONAL BANK Dec-03 % of Dec-04 $ 1,000 Total % Cha $ 1,000 0 1,070 0 0 1 0 0 (73) 590 1,588 0.0% 0.0% 9.9% 30.5% 0.0% 0.0% 0.0% 0.0% 0.0% 100.0% 0.0% 0.0% 0.0% 0.0% -0.7% -75.3% 5.5% -15.8% 14.7% 18.2% 0.1% 9,107 84.6% 29.1% 7.2% 0.0% 0.2% 20.3% 56.8% -2.4% 4.5% 0.0% 0.0% -2.8% -1.4% 4,202 1,256 0 11 2,064 7,533 39.0% 11.7% 0.0% 0.1% 19.2% 70.0% -70.8% 51,553 -9.0% 1,254,623 1.1% 25.7% 42.5% -8.9% 0.0% 1.9% 31.8% 0.0% 0 -44.5% 49,792 -11.2% 1,304,415 0.0% 1.0% 26.7% 490,376 7,851 0 498,227 10.6% 0.2% 0.0% 10.8% -22.1% 15.4% 0.0% -21.5% 381,926 9,063 0 390,989 -8.6% 970,278 21.0% -5.9% 0.0% -8.6% 0 970,278 0.0% 21.0% 87.5% -66.7% 0.0% 750,000 220,278 0 16.2% 4.8% 0.0% -6.7% 4,619,831 100.0% -2.5% 3,980,584 86.2% 0 1,396 0 0 2 0 0 (18) 497 1,877 13.1% 10,303 % of Total 0.0% 11.8% 0.0% 0.0% 0.0% 0.0% 0.0% -0.2% 4.2% 15.9% 87.2% 3.2% 2.2% 0.0% 0.0% 3.3% 3.1% 4,335 1,284 0 11 2,133 7,763 36.7% 10.9% 0.0% 0.1% 18.0% 65.7% 684 890 6.4% -12.3% 8.3% 118.0% 600 1,940 5.1% 16.4% 0.0% 110.8% 2.4% 0 215 1,105 0.0% 0.0% 2.0% -100.0% 10.3% 75.6% 0 0 1,940 0.0% 0.0% 16.4% 7.8% 0.2% 0.0% 8.0% -2.2% 23.5% 0.0% -1.1% 355 21 0 376 3.3% 0.2% 0.0% 3.5% 80.6% 81.0% 0.0% 80.6% 641 38 0 679 5.4% 0.3% 0.0% 5.7% 913,426 18.7% 4.3% 729 6.8% 73.0% 1,261 10.7% 0.0% -5.9% 0 913,426 0.0% 18.7% 0.0% 4.3% 0 729 0.0% 6.8% 0.0% 73.0% 0 1,261 0.0% 10.7% 6.7% -48.5% 0.0% 800,000 113,426 0 16.4% 2.3% 0.0% -100.0% 58.8% 0.0% 0 729 0 0.0% 6.8% 0.0% 0.0% 73.0% 0.0% 0 1,261 0 0.0% 10.7% 0.0% 5.8% 4,886,432 100.0% 2.6% 4,083,665 83.6% -2.3% 10,768 100.0% 0.1% 9,107 84.6% 9.8% 11,821 100.0% 13.1% 10,303 87.2% Interest income …the sum of interest and loan fees earned on all of a bank's assets. Interest income includes interest from: 1. 2. 3. Loans and leases Deposits held at other institutions, Investment securities 4. Taxable and municipal securities Trading account securities Noninterest income …has increased significantly and consists of fees & other revenues for services Fiduciary activities Deposit service charges Trading revenue, venture cap., securitize inc. Investment banking, advisory inc. Insurance commissions & fees Net servicing fees Loan & lease net gains (losses) Other net gains (losses) Other noninterest income Noninterest expense …composed primarily of: Personnel expense: Salaries and fringe benefits paid to bank employees Occupancy expense : Rent and depreciation on equipment and premises, and Other operating expenses: Utilities Deposit insurance premiums Noninterest expense Expenses and loan losses directly affect the balance sheet. The greater the size of loan portfolio, the greater is operating overhead and PLL. Consumer loans are usually smaller and hence more costly (non-interest) per dollar of loans. Return on equity (ROE = NI / TE) … the basic measure of stockholders’ returns ROE is composed of two parts: Return represents the returns to the assets the bank has invested in Equity on Assets (ROA = NI / TA), Multiplier (EM = TA / TE), the degree of financial leverage employed by the bank Return on assets (ROA = NI / TA) …can be decomposed into two parts: Asset Utilization (AU) → income generation Expense Ratio (ER) → expense control ROA = = AU ER (TR / TA) - (TE / TA) Where: TR = total revenue or total operating income = Int. inc. + Non-int. inc. + SG and TE = total expenses = Int. exp. + Non-int. exp. + PLL + Taxes ROA is driven by the bank’s ability to: …generate income (AU) and control expenses (ER) Income generation (AU) can be found on the UBPR (page 1) as: Int. Inc. Non. int. Inc. Sec gains (losses) AU TA TA TA Expense Control (ER) can be found on the UBPR (page 1) as: Int . Exp . Non int . Exp . PLL * ER TA TA TA Note, ER* does not include taxes. Bank Performance Model Returns to Shareholders ROE = NI / TE Interest Rate Composition (mix) Volume INCOME Fees and Serv Charge Non Interest Trust Other Return to the Bank ROA = NI / TA Rate Interest Composition (mix) Volume EXPENSES Overhead Salaries and Benefits Occupancy Degree of Leverage EM =1 / (TE / TA) Prov. for LL Taxes Other Expense ratio (ER = Exp / TA) … the ability to control expenses. Interest expense / TA Cost per liability (avg. rate paid) Int. exp. liab. (j) / $ amt. liab. (j) Composition of liabilities $ amt. of liab. (j) / TA Volume of int. bearing debt and equity Non-interest expense / TA Salaries and employee benefits / TA Occupancy expense / TA Other operating expense / TA Provisions for loan losses / TA Taxes / TA Asset utilization (AU = TR / TA): … the ability to generate income. Interest Income / TA Asset yields (avg. rate earned) Interest income asset (i) / $ amount of asset (i) Composition of assets (mix) $ amount asset (i) / TA Volume of Earning Assets Earning assets / TA Noninterest income / TA Fees and Service Charges Securities Gains (Losses) Other income Aggregate profitability measures Net interest margin NIM = NII / Earning Assets (EA) Spread Spread = (Int Inc / EA) (Int Exp / Int bear. Liab.) Earnings base EB = EA / TA Burden / TA (Noninterest Exp. - Noninterest Income) / TA Efficiency ratio Non int. Exp. / (Net int. Inc. + Non-int. Inc.) UBPR for PNC Financial ratios …PNC and Community National Bank PNC BANK, NATIONAL ASSOCIATION RISK RATIOS Pg # ROE: Net Income / Average total equity 11 ROA: Net Income / aTA 1 AU: Total Revenue / aTA 1 calc ER: Total expenses (less Taxes) / aTA 1 calc EM: aTA / Avg, Total Equity 6 calc EB: Earning Assets / aTA 6 NIM: Net interest margin (te) 1 Spread (te) 3 calc Efficiency Ratio 3 Burden / aTA 1 calc Non Interest Income / Noninterest exp. 1 calc EXPENSES: ER*: Expense ratio (Expense components) Total Interest expense / aTA 1 Memo: Interest expense / Avg. Earn assets 1 Noninterest Expenses / aTA 1 Personnel expense 3 Occupancy expense 3 Other Oper Exp (Incl intangibles) 3 Provision: Loan & Lease Losses / aTA 1 Income Taxes / aTA #N/A INCOME: AU: Asset Utilization (Income components): Interest income / aTA 1 Memo: Avg, yield on earning assets 1 Noninterest income / aTA 1 Realized security gains (losses) / aTA 1 Dec-03 CALC BANK PG 1 Dec-04 CALC BANK PG 1 COMMUNITY NATIONAL BANK Dec-03 CALC BANK PG 4 Dec-04 CALC BANK PG 4 16.90% 1.59% 7.59% 5.18% 10.59x 82.86% 3.89% 3.74% 60.93% 0.67% 83.24% 16.56% 1.59% 7.59% 5.17% 10.48x 82.60% 3.82% 3.62% 60.86% 0.66% 83.42% 14.41% 1.28% 6.45% 4.51% 11.20x 89.84% 3.51% 3.36% 57.73% 1.12% 62.03% 15.59% 1.31% 7.02% 5.15% 11.59x 82.85% 3.32% 3.15% 68.01% 0.81% 79.79% 15.26% 1.31% 7.02% 5.14% 11.47x 82.92% 3.18% 3.02% 67.97% 0.81% 79.70% 14.55% 1.31% 6.21% 4.23% 10.65x 90.08% 3.52% 3.37% 57.92% 1.16% 59.86% 5.48% 0.41% 6.10% 5.47% 13.37x 85.43% 4.95% 4.39% 82.72% 3.37% 21.08% 5.56% 0.41% 6.10% 5.48% 13.76x 86.74% 4.80% 4.25% 82.75% 3.37% 21.08% 11.56% 1.07% 6.50% 5.01% 10.85x 91.45% 4.33% 3.97% 66.06% 2.33% 29.18% 8.63% 0.63% 5.90% 4.93% 13.78x 86.83% 4.82% 4.30% 75.35% 2.94% 24.18% 8.67% 0.63% 5.91% 4.94% 13.97x 86.98% 4.74% 4.25% 75.34% 2.94% 24.23% 11.72% 1.09% 6.23% 4.73% 10.67x 91.76% 4.36% 4.04% 65.99% 2.39% 26.23% 5.18% 0.00% 0.90% 1.09% 3.98% 1.83% 0.58% 1.57% 0.29% 0.82% 5.17% 0.90% 1.07% 3.98% 1.83% 0.58% 1.58% 0.29% 0.83% 4.51% 1.29% 1.41% 2.95% 1.37% 0.38% 1.13% 0.27% 0.66% 5.15% 0.00% 1.08% 1.34% 3.99% 2.04% 0.50% 1.43% 0.07% 0.56% 5.14% 1.08% 1.28% 3.99% 2.04% 0.50% 1.44% 0.07% 0.57% 4.23% 1.20% 1.31% 2.89% 1.38% 0.36% 1.08% 0.14% 0.67% 5.47% 0.00% 0.82% 0.95% 4.27% 2.38% 0.71% 1.17% 0.39% 0.21% 5.48% 0.82% 0.92% 4.27% 2.38% 0.71% 1.18% 0.39% 0.21% 5.01% 1.50% 1.61% 3.29% 1.79% 0.48% 1.00% 0.22% 0.42% 4.93% 0.00% 0.76% 0.87% 3.88% 2.16% 0.64% 1.07% 0.30% 0.34% 4.94% 0.76% 0.85% 3.88% 2.16% 0.64% 1.07% 0.30% 0.34% 4.73% 1.31% 1.41% 3.24% 1.78% 0.47% 0.98% 0.18% 0.41% 7.59% 4.12% 4.98% 3.32% 0.15% 7.59% 4.12% 4.89% 3.32% 0.15% 6.45% 4.57% 4.98% 1.83% 0.05% 7.02% 3.77% 4.66% 3.18% 0.07% 7.02% 3.77% 4.46% 3.18% 0.07% 6.21% 4.46% 4.88% 1.73% 0.02% 6.10% 5.08% 5.91% 0.90% 0.12% 6.10% 5.08% 5.73% 0.90% 0.12% 6.50% 5.52% 5.95% 0.96% 0.02% 5.90% 4.97% 5.69% 0.94% 0.00% 5.91% 4.97% 5.59% 0.94% 0.00% 6.23% 5.37% 5.78% 0.85% 0.01% Interest expense …composition, rate and volume effects for PNC and Community National Bank PNC BANK, NATIONAL ASSOCIATION RISK RATIOS Dec-03 Pg # CALC BANK Interest Expense: Composition, Rate and Volume Effects Rate: Avg, interest cost of interest bearing liabilities 3 1.24% Memo: Interest expense / Earning assets 1 1.09% Volume: All Interest bearing debt (avg.) / aTA 1 72.73% Mix and Cost of Individual Liabilities:* Total deposits (avg.) / aTA: 6 73.72% Cost (rate): Int bearing Total deposits 3 1.20% Core deposits (avg.) / aTA 6 67.41% All other deposits (avg.) / aTA 6-calc 55.93% Trans (NOW&ATS) Accts (avg.) / aTA 6 2.40% Cost (rate): Trans (NOW&ATS) Acts 3 #N/A MMDA's and other sav. Accts (avg) / aTA 6-calc 42.29% Cost (rate): Other savs deposits* 3 #N/A Time deposits under $100M (avg.) / aTA 6 11.24% Cost (rate): All oth time dep. (CD<100M) 3 #N/A Volatile (S.T non core) liab (avg.) / aTA 10 9.85% Large CDs (inc. brokered) (avg.) / aTA 6 3.23% Cost (rate): CD's over $100M 3 3.44% Fed funds purchased & resale (avg.)/ aTA 6 0.74% Cost (rate): Fed funds pur & resale 3 2.95% Memo: All brokered deposits (avg.) / aTA 6 2.36% All common and preferred capital (avg.) / aTA 6 9.44% PG 1 Dec-04 CALC BANK PG 1 COMMUNITY NATIONAL BANK Dec-03 CALC BANK PG 4 Dec-04 CALC BANK PG 4 1.27% 1.62% 1.50% 1.44% 1.51% 1.51% 1.48% 1.98% 1.39% 1.34% 1.74% 1.07% 1.41% 1.34% 1.28% 1.31% 0.95% 0.92% 1.61% 0.87% 0.85% 1.41% 70.78% 80.81% 73.70% 74.97% 80.65% 53.76% 55.17% 75.51% 54.29% 56.69% 74.88% 73.84% 1.22% 68.16% 55.41% 2.23% 0.90% 42.15% 0.57% 11.03% 3.12% 11.47% 3.14% 3.66% 0.99% 1.10% 2.19% 9.54% 67.79% 1.39% 53.90% 42.13% 1.81% 0.60% 30.73% 0.70% 9.59% 2.41% 23.24% 9.02% 2.38% 8.16% 1.15% 2.29% 8.93% 72.45% 1.18% 64.84% 53.38% 2.35% #N/A 41.23% #N/A 9.80% #N/A 13.08% 3.67% 2.89% 1.55% 3.84% 2.81% 8.63% 72.30% 1.14% 64.29% 53.19% 2.15% 0.86% 41.28% 0.60% 9.76% 2.78% 12.11% 3.76% 2.81% 3.18% 1.37% 3.00% 8.72% 68.32% 1.25% 54.64% 43.03% 1.92% 0.62% 32.75% 0.69% 8.36% 2.03% 23.42% 8.99% 2.17% 8.00% 1.41% 2.81% 9.39% 91.72% 1.52% 84.26% 45.73% 6.55% #N/A 25.67% #N/A 13.51% #N/A 8.03% 7.46% 2.83% 0.56% 1.10% 0.00% 7.48% 91.94% 1.49% 84.50% 45.52% 6.58% 0.29% 25.71% 0.90% 13.23% 2.51% 4.10% 7.44% 2.79% 0.55% 1.10% 0.00% 7.27% 85.07% 1.90% 72.07% 54.88% 10.37% 0.63% 22.70% 1.08% 21.81% 2.80% 11.90% 12.41% 2.72% 1.05% 0.82% 0.51% 9.22% 92.02% 1.38% 85.00% 46.77% 7.43% #N/A 28.07% #N/A 11.27% #N/A 7.52% 7.02% 2.82% 0.50% 2.10% 0.00% 7.26% 91.96% 1.33% 84.90% 47.73% 7.02% 0.28% 29.57% 0.98% 11.14% 2.01% 4.84% 7.06% 2.78% 0.55% 1.75% 0.11% 7.16% 84.46% 1.66% 71.52% 53.88% 10.60% 0.59% 22.85% 1.00% 20.43% 2.43% 12.21% 12.39% 2.40% 1.07% 0.98% 0.84% 9.37% Interest income …composition, rate and volume effects for PNC and Community National Bank PNC BANK, NATIONAL ASSOCIATION RISK RATIOS Pg # Dec-03 CALC BANK PG 1 Interest Income: Composition, Rate and Volume Effects Rate: Avg, yield on aTA Memo: Avg. yield on earn. assets (rate) 1 4.98% Volume: Earn assets (avg.) / aTA 6 82.86% Non earning assets (avg.) / aTA 6-calc 17.14% Mix and Yield on Individual Assets:* Total Loans (Gross loans - unearn inc.) (avg.) / 6aTA 57.55% Yield (rate): Total Loans & Leases (te) 3 5.48% Total Investments (avg.) / aTA: 6-calc 26.33% Total investment securities (avg.) / aTA 6-calc 21.41% Yield (rate): Total invest secs. (TE) 3 3.99% Yield (rate): Total invest secs. (Book) 3 3.99% Trading account assets (avg.) / aTA 6 1.61% Dec-04 CALC BANK PG 1 COMMUNITY NATIONAL BANK Dec-03 CALC BANK PG 4 Dec-04 CALC BANK PG 4 4.89% 4.98% 4.66% 4.46% 4.88% 5.91% 5.73% 5.95% 5.69% 5.59% 5.78% 82.60% 89.84% 82.85% 82.92% 90.08% 85.43% 86.74% 91.45% 86.83% 86.98% 91.76% 17.39% 9.75% 17.15% 17.07% 9.64% 14.57% 13.27% 8.25% 13.17% 13.03% 7.93% 57.17% 5.48% 26.46% 21.90% 3.81% 3.81% 1.63% 57.69% 5.66% 26.43% 22.56% 4.18% 4.00% 0.39% 57.13% 5.04% 26.60% 22.12% 3.54% 3.52% 1.92% 57.25% 5.04% 26.52% 22.03% 3.51% 3.48% 2.09% 58.22% 5.47% 26.50% 23.03% 3.98% 3.84% 0.34% 65.76% 6.89% 20.36% 16.43% 2.94% 2.86% 0.00% 64.10% 6.89% 23.28% 14.97% 3.32% 3.24% 0.00% 66.45% 6.91% 21.82% 17.89% 4.08% 3.75% 0.00% 62.05% 6.90% 25.50% 20.83% 3.00% 2.91% 0.00% 61.33% 6.90% 26.35% 20.78% 2.92% 2.83% 0.00% 67.80% 6.58% 20.98% 17.81% 3.91% 3.61% 0.00% Fundamental risks : Credit risk Liquidity risk Market risk Operational risk Capital or solvency risk Legal risk Reputational risk Credit risk …the potential variation in net income and market value of equity resulting from nonpayment or delayed payment on loans and securities Three Question need to be addressed: 1. What has been the loss experience? 2. What amount of losses do we expect? 3. How prepared is the bank? Credit ratios to consider What has been the loss experience? Net loss to average total LN&LS Gross losses to average total LN&LS Recoveries to avg. total LN&LS Recoveries to prior period losses Net losses by type of LN&LS What amount of losses do we expect? Non-current LN&LS to total loans Total Past/Due LN&LS - including nonaccrual Non-current & restruc LN&LS / Gross LN&LS Current - Non-current & restruc/ Gr LN&LS Past due loans by loan type Credit ratios to consider (continued) How prepared are we? Provision for loan loss to: average assets and average total LN&LS LN&LS Allowance to: net losses and total LN&LS Earnings coverage of net loss Credit risk ratios : PNC and Community National RISK RATIOS Pg # Credit Risk Gross loss / Avg. tot LN&LS 7 Net loss / Avg. tot LN&LS 7 Recoveries / Avg. tot LN&LS 7 Recoveries to prior credit loss 7 90 days past due / EOP LN&LS 8A total Nonaccrual LN&LS / EOP LN&LS 8A total Noncurrent / EOP LN&LS 8A LN&LS Allowance to total LN&LS 7 LN&LS Allowance / Net losses 7 LN&LS Allowance / total nonaccural LN&LS7 Earn Coverage of net losses 7 Net Loan and lease growth rate 1 PNC BANK, NATIONAL ASSOCIATION Dec-03 Dec-04 CALC BANK PG 1 CALC BANK PG 1 0.73% 0.73% 0.53% 0.40% 0.40% 0.36% 0.59% 0.59% 0.41% 0.28% 0.28% 0.25% 0.13% 0.13% 0.12% 0.12% 0.12% 0.11% 19.0% 0.00% 19.03% 22.26% #NA 19.5% 0.00% 19.52% 23.76% #NA 0.21% 0.21% 0.13% 0.13% 0.13% 0.10% 0.79% 0.79% 0.66% 0.33% 0.33% 0.46% 1.00% 1.00% 0.83% #NA 0.46% 0.46% 0.59% #NA 1.77% 1.78% 1.44% 1.34% 1.35% 1.27% 2.9x 2.92x 4.18x 5.2x 5.23x 7.51x 1.77x 2.24x 2.73x 2.92x 4.12x 3.73x 7.44x 7.44x 10.92x 11.61x 11.61x 19.94x -4.55% 0.00% -4.55% 10.14% 27.51% 0.00% 27.51% 17.96% CALC 0.54% 0.53% 0.01% 6.7% 0.00% 0.16% 0.19% 0.35% 1.07% 2.1x 3.05x 2.57x 2.16% 0.00% COMMUNITY NATIONAL BANK Dec-03 Dec-04 BANK PG 4 CALC BANK 0.54% 0.53% 0.01% 6.75% 0.16% 0.19% 0.35% 1.07% 2.08x 5.49x 2.57x 2.16% 0.26% 0.21% 0.21% 0.21% 0.20% 0.20% 0.06% 0.02% 0.02% 29.21% 3.1% 3.08% #NA 0.00% 0.13% 0.00% 0.00% 0.47% 0.16% 0.16% 0.66% #NA 0.16% 0.16% 1.25% 1.23% 1.23% 11.89x 6.7x 6.71x 4.35x 7.77x 7.77x 23.89x 10.38x 10.38x 11.61% 11.49% 0.00% 11.49% PG 4 0.20% 0.16% 0.05% 24.53% #NA 0.10% 0.41% 0.55% #NA 1.20% 14.52x 5.63x 30.80x 14.24% Liquidity risk …the variation in net income and market value of equity caused by a bank's difficulty in obtaining cash at a reasonable cost from either the sale of assets or new borrowings Banks can acquire liquidity in two distinct ways: 1. By liquidation of assets 2. Composition of loans & investments Maturity of loans & investments Percent of loans and investments pledged as collateral By borrowing Core deposits Volatile deposits Asset quality & stockholders’ equity Liquidity risk ratios : PNC and Community National RISK RATIOS PNC BANK, NATIONAL ASSOCIATION Dec-03 Dec-04 Pg # CALC 0.00% BANK PG 1 CALC 0.00% BANK PG 1 Liquidity Risk %Total (EOP) Assets (except where noted) Total equity 11 Core deposits 10 S.T Non-core funding 10 Net loans & leases / Total Deposits 10 Net loans & leases / Core Deposits 10 Avg. Available for sale securities / aTA 6 Short-term investments 10 Pledged securities 10 9.07% 67.41% #N/A 73.73% 81.11% 21.41% #N/A #N/A 0.00% 9.07% 66.75% 11.47% 73.73% 81.11% 21.90% 2.73% 46.50% 8.95% 53.75% 23.24% 87.72% 115.16% 21.11% 6.25% 49.08% 8.26% 64.84% #N/A 81.00% 91.76% 22.12% #N/A #N/A 0.00% 8.26% 63.23% 12.11% 81.00% 91.76% 22.03% 3.02% 51.76% 9.74% 54.19% 23.42% 88.28% 116.10% 21.00% 5.23% 54.78% COMMUNITY NATIONAL BANK Dec-03 Dec-04 CALC 0.00% BANK PG 4 CALC 0.00% BANK 7.29% 84.26% #N/A 65.90% 71.36% 14.44% #N/A #N/A 0.00% 7.29% 84.95% 4.10% 65.90% 71.36% 13.39% 5.99% 29.25% 9.28% 71.85% 11.90% 78.94% 93.85% 15.88% 5.41% 40.34% 7.23% 85.00% #N/A 67.35% 72.89% 19.38% #N/A #N/A 0.00% 7.23% 85.04% 4.84% 67.35% 72.89% 19.04% 5.72% 28.49% PG 4 9.42% 71.10% 12.21% 81.42% 97.58% 15.80% 5.26% 41.20% Market risk …the risk to a financial institution’s condition resulting from adverse movements in market rates or prices Market risk arises from changes in: Interest rates Foreign exchange rates Equity, commodity and security prices Interest rate risk …the potential variability in a bank's net interest income and market value of equity due to changes in the level of market interest rates Example: $10,000 Car loan 4 year fixed-rate car loan at 8.5% 1 year CD at 4.5% Spread 4.0% But for How long? Funding GAP GAP = $RSA - $RSL, where $RSA = $ amount of assets expected to reprice in a give period of time. In this example: GAP1yr = $0 - $10,000 = - $10,000 This is a negative GAP. Foreign exchange risk … the risk to a financial institution’s condition resulting from adverse movements in foreign exchange rates Foreign exchange risk arises from changes in foreign exchange rates that affect the values of assets, liabilities, and off-balance sheet activities denominated in currencies different from the bank’s domestic (home) currency. This risk is also often found in off-balance sheet loan commitments and guarantees denominated in foreign currencies; foreign currency translation risk Equity and security price risk …change in market prices, interest rates and foreign exchange rates affect the market values of equities, fixed income securities, foreign currency holdings, and associated derivative and other offbalance sheet contracts. Large banks must conduct value-at- risk analysis to assess the risk of loss with their trading account portfolios. Operational risk …measures the cost efficiency of the bank's activities; i.e., expense control or productivity; also measures whether the bank has the proper procedures and systems in place . Typical ratios focus on: total assets per employee total personnel expense per employee Non-interest expense ratio There is no meaningful way to estimate the likelihood of fraud or other contingencies from published data. A bank’s operating risk is closely related to its operating policies and processes and whether is has adequate controls. Operational risk ratios: PNC and Community National RISK RATIOS PNC BANK, NATIONAL ASSOCIATION Dec-03 Dec-04 Pg # CALC 0.00% BANK PG 1 CALC 0.00% BANK PG 1 Operational Risk Total Assets / Number of employees 3 Personnel expense / number of employees 3 Efficiency ratio 3 COMMUNITY NATIONAL BANK Dec-03 Dec-04 CALC 0.00% BANK PG 4 CALC 0.00% BANK PG 4 $4.09 $ 4.02 $ 5.17 $4.71 $ 4.44 $ 6.09 $3.00 $ 2.75 $ 2.95 $2.98 $ 2.84 $ 3.08 73.43x 72.06x 60.48x 90.68x 85.48x 65.26x 65.46x 60.03x 48.27x 61.47x 58.58x 50.10x 60.93% 60.86% 57.73% 68.01% 67.97% 57.92% 82.72% 82.75% 66.06% 75.35% 75.34% 65.99% Capital risk … closely tied to asset quality and a bank's overall risk profile The more risk taken, the greater is the amount of capital required. Appropriate risk measures include all the risk measures discussed earlier as well as ratios measuring the ratio of: Tier 1 capital and total risk based capital to risk weighted assets Equity capital to total assets Dividend payout, and growth rate in tier 1 capital Definitions of capital Tier 1 capital is: Total common equity capital plus noncumulative preferred stock, plus minority interest in unconsolidated subsidiaries, less ineligible intangibles. Risk-weighted assets are: The total of risk-adjusted assets where the risk weights are based on four risk classes of assets. Importantly, a bank's dividend policy affects its capital risk by influencing retained earnings. Capital risk ratios : PNC and Community National RISK RATIOS PNC BANK, NATIONAL ASSOCIATION Dec-03 Dec-04 Pg # CALC 0.00% BANK PG 1 CALC 0.00% BANK PG 1 COMMUNITY NATIONAL BANK Dec-03 Dec-04 CALC 0.00% BANK PG 4 CALC 0.00% BANK Capital Risk Tier 1 Leverage Capital / Total Assets Tier 1 Capital / Risk-weighted assets Total RBC / Risk weighted Assets Equity Capital / Total Assets Dividend Payout Growth rate in total equity capital Equity growth less asset growth 11A 8.28% 8.37% 7.67% 6.89% 7.14% 7.71% 7.27% 7.31% 11A 9.91% 9.89% 11.13% 8.65% 8.36% 11.17% 10.73% 10.73% 11A 12.91% 12.89% 13.08% 11.95% 11.55% 12.98% 11.70% 11.70% 11 9.07% 9.07% 8.95% 8.26% 8.26% 9.74% 7.29% 7.29% 11 77.30% 77.30% 57.26% 87.58% 87.58% 46.73% 0.00% 0.00% 11 -4.09% -4.09% 10.34% 8.42% 8.42% 20.28% 11.99% 11.99% 11 -8.09% 0.00% -8.09% 0.59% -10.59% 0.00% -10.59% 4.55% -6.56% 0.00% -6.56% PG 4 8.97% 7.27% 7.29% 9.11% 12.64% 10.27% 10.27% 12.64% 13.80% 11.35% 11.35% 13.76% 9.28% 7.23% 7.23% 9.42% 30.77% 0.00% 0.00% 29.34% 10.99% 8.20% 8.20% 11.32% 0.41% -0.83% 0.00% -0.83% 0.28% Legal risk …the potential that unenforceable contracts, lawsuits, or adverse judgments can disrupt or otherwise negatively affect the operations or condition of the banking organization Legal risk includes: Compliance risks Strategic risks General liability issues Reputational risk Reputational risk is the potential that negative publicity regarding an institution’s business practices, whether true or not, will cause a decline in the customer base, costly litigation, or revenue reductions. Strategies for Maximizing Shareholder Wealth Asset Management Composition and Volume Liability Management Composition and Volume Management of off-balance sheet activities Net interest margin management Credit risk management Liquidity management Management of non-interest expense Securities gains/losses management Tax management CAMELS Capital Adequacy Measures bank’s ability to maintain capital commensurate with the bank’s risk Asset Quality Reflects the amount of credit risk with the loan and investment portfolios Management Quality Reflects management’s ability to identify, measure, monitor, and control risks CAMELS (continued) Earnings Reflects the quantity, trend, and quality of earnings Liquidity Reflects the sources of liquidity and funds management practices Sensitivity to market risk Reflects the degree to which changes in market prices and rates adversely affect earnings and capital CAMELS Ratings Regulators assign a rating of 1 (best) to 5 (worst) in each of the six categories and an overall composite rating 1 or 2 indicates a fundamentally sound bank 3 indicates that a bank shows some underlying weakness that should be corrected 4 or 5 indicates a problem bank Average Performance Characteristics of Banks by Business Concentration and Size ROE and ROA (up to $10 billion in assets) increases with bank size Employees per dollar of assets decreases with bank size Larger banks have lower efficiency ratios than smaller banks Smaller banks: have proportionately more core deposits and fewer volatile liabilities than larger banks have a proportionately larger earnings base than larger banks have proportionately lower charge-offs than larger banks Bank Performance Measure by Size Assets Size Number of institutions reporting % of unprofitable institutions % of institutions with earn gains Performance ratios (%) Return on equity Return on assets Pretax ROA Equity capital ratio Net interest margin Yield on earning assets Cost of funding earn assets Earning assets to total assets Efficiency ratio Burden ratio Noninterest inc to earn assets Noninterest exp to earn assets Net charge-offs to LN&LS LN&LS loss provision to assets < $100M $100M $1B $1B $10B > $10B 3,655 9.80 59.30 3,530 2.00 70.70 360 1.90 71.90 85 1.20 68.20 8.46 0.99 1.24 11.52 4.18 5.65 1.47 91.86 69.54 2.60 1.03 3.63 0.27 0.22 12.88 1.28 1.73 10.00 4.22 5.73 1.51 91.93 62.22 2.07 1.54 3.61 0.31 0.26 13.48 1.46 2.21 10.90 4.00 5.39 1.39 91.01 55.54 1.21 2.46 3.67 0.43 0.34 14.24 1.30 1.93 9.95 3.43 4.83 1.40 84.39 57.42 0.82 2.93 3.75 0.73 0.34 Trend with Size then generally then then All Commercial Banks 7,630 5.70 65.30 13.82 1.31 1.92 10.10 3.61 5.02 1.41 86.18 57.96 1.06 2.66 3.72 0.63 0.33 Bank Risk Measures by Size Assets Size Asset Quality Net charge-offs to LN&LS Loss allow to Noncurr LN&LS LN&LS provision to net charge-offs Loss allowance to LN&LS Net LN&LS to deposits Capital Ratios Core capital (leverage) ratio Tier 1 risk-based capital ratio Total risk-based capital ratio Structural Changes New Charters Banks absorbed by mergers Failed banks < $100M $100M $1B $1B $10B Trend with Size > $10B 0.27 151.5 134.2 1.44 72.67 0.31 196.2 125.7 1.39 82.11 0.43 206.0 125.5 1.47 92.82 0.73 168.0 83.0 1.53 86.68 11.31 16.83 17.93 9.47 12.85 14.06 9.36 12.34 13.92 7.23 9.11 12.07 118 102 3 2 125 0 1 30 0 1 7 0 then then All Commercial Banks 0.63 174.6 89.9 1.50 86.38 7.83 10.04 12.62 122 264 3 Performance Characteristics of Banks by Business Concentration and Size Wholesale Banks Focus on loans for the largest commercial customers and purchase substantial funds from corporate and government depositors Retail Banks Focus on consumer, small business, mortgage, and agriculture loans and obtain deposits form individuals and small businesses Profitability Measures of Banks by Business Concentration All Institu # of institutions reporting Commercial banks Savings institutions Performance ratios (%) Return on equity Return on assets Pretax ROA Equity capital ratio Net interest margin Yield on earning assets Cost of funding earn assets Earning assets to total assets Efficiency ratio Burden Noninterest inc to earn assets Noninterest exp to earn assets LN&LS loss provision to assets Credit Card Inter national 8,975 7,630 1,345 34 30 4 5 5 0 13.28 1.29 1.90 10.28 3.53 5.02 1.49 87.13 58.03 0.97 2.13 3.10 0.30 22.16 4.01 6.21 20.52 9.05 11.25 2.20 82.95 45.29 -2.15 11.18 9.03 3.96 10.35 0.76 1.09 8.05 2.50 4.02 1.52 81.47 70.16 0.75 2.51 3.26 0.25 Asset Concentration Groups CommCon – Other All Ag. Mort ercial summer spec. < Other Lending gage Lending Lending $1B <$1B 1,730 4,424 990 132 465 1,120 1,725 4,019 250 101 414 1,026 5 405 740 31 51 94 11.45 1.23 1.51 10.79 4.07 5.68 1.61 91.91 62.07 2.08 0.69 2.77 0.16 13.48 1.30 1.89 10.09 3.86 5.26 1.40 90.18 57.10 1.40 1.51 2.91 0.22 11.61 1.18 1.81 10.55 3.05 4.80 1.75 92.17 56.46 1.07 1.20 2.27 0.08 16.81 1.66 2.56 11.36 4.71 6.88 2.17 90.73 45.53 0.78 2.26 3.04 1.05 10.03 1.66 2.43 16.94 3.20 4.54 1.33 88.93 72.42 0.34 6.55 6.89 0.11 10.18 1.10 1.41 10.79 3.86 5.40 1.53 92.11 66.92 2.01 1.16 3.17 0.17 All Other > $1B 75 60 15 13.69 1.35 1.98 10.25 3.27 4.54 1.27 84.36 57.71 0.84 1.96 2.80 0.07 Risk Measures of Banks by Business Concentration All Institu Credit Card Asset Concentration Groups CommCon – Other Inter Ag. Mort ercial summer spec. < national Lending gage Lending Lending $1B Asset Quality Net charge-offs to LN&LS 0.56 4.67 0.91 0.21 0.30 0.12 Loss allow to Noncurr LN&LS 167.8 215.8 135.3 156.7 206.3 97.1 LN&LS provs. to net charge-offs 90.6 108.8 63.1 118.3 105.2 100.2 Loss allowance to LN&LS 1.34 4.27 1.74 1.43 1.30 0.53 Net LN&LS to deposits 91.69 239.79 69.91 76.64 93.90 120.82 Capital Ratios Core capital (leverage) ratio 8.12 16.64 6.05 10.37 8.29 9.10 Tier 1 risk-based capital ratio 10.76 14.59 8.38 14.71 10.14 15.36 Total risk-based capital ratio 13.19 17.34 12.03 15.82 12.18 16.86 Structural Changes New Charters 128 0 0 5 35 4 Banks absorbed by mergers 322 1 2 24 210 26 Failed institutions 4 0 0 0 3 0 SOURCE: FDIC Quarterly Banking Profile, http://www.fdic.gov/, http://www2.fdic.gov/qbp. All Other <$1B All Other > $1B 1.57 259.4 85.5 1.66 135.96 0.59 168.4 67.3 1.66 33.54 0.31 155.3 99.4 1.34 67.56 0.25 156.3 52.0 1.16 80.51 8.82 13.07 14.62 15.17 34.70 35.95 10.38 17.32 18.55 7.20 9.45 12.12 1 13 0 77 6 0 5 20 1 1 20 0 Financial Statement Manipulation Off-balance sheet activities Enron and “Special-Purpose Vehicles” Window dressing Eliminate Fed borrowing prior to financial statement reporting date Increase asset size prior to year-end Preferred stock Meets capital requirements but causes NIM, NI, ROE, and ROA to be overstated Financial Statement Manipulation (continued) Non-performing loans Banks may lend borrower funds to make payments on past due loans, understating non-performance status Allowance for loan losses Management discretion and IRS regulations may be in conflict Financial Statement Manipulation (continued) Securities gains and losses Banks often classify all investment securities as “available for sale,” overstating any true “gains or losses” Non-recurring sales of assets This type of transaction is not part of the bank’s daily activities and typically cannot be repeated; thus it overstates earnings Bank Management, 6th edition. Timothy W. Koch and S. Scott MacDonald Copyright © 2006 by South-Western, a division of Thomson Learning ANALYZING BANK PERFORMANCE: USING THE UBPR Chapter 2 William Chittenden edited and updated the PowerPoint slides for this edition.