current liabilities - Accounting and Economic

advertisement

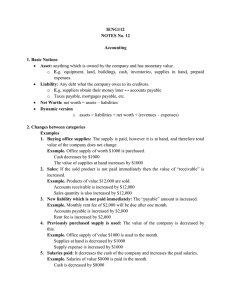

The Nature of Liabilities A. Definitions of Liabilities Liabilities are probable future sacrifices of economic benefits arising from present obligations of particular entity to transfer assets or provide services to other entities in the future as result of past transactions or events. B. Characteristics of a Liability 1) It is a present obligation that entails settlement by probable future transfer or the use of cash, goods, or services 2) It is an unavoidable obligation 3) The transaction or event creating the obligation has already occurred C. The Types of Liabilities 1) Current liablities Current liabilities are obligations which liquidation is reasonably expected to require use of existing resources properly classified as current assets, or the creation of other current liabilities or due to within shot time usually within one year. 2) Long Term Debt Long term debt are liabilities that are due to over one years. CURRENT LIABILITIES Transactions caused by current liablities are: 1. Receiving goods or services prior to make payment 2. Receiving payment prior to deliver goods or services The examples of current liablities are: 1 Account payable/trade account payable refinanced 7 Current maturities of long term debt 2 account payable refinanced 8 Short term obligatio xpected to be refinanced 3 Taxes payable 9 Dividends payable 4 Interest payable 10 Customer advances and deposits 5 Wages Payable 11 Income taxe payable 6 Notes payable ACCOUNTING FOR CURRENT LIABILITIES 1. Account payable/trade account payable Liablities emerge from merchandise purchasing for resale or The amount owed to others for goods, supplies, or services purchased on open account. Ex: Assume that on July, 10, 2008 Boys Company purchased merchandise from Trade Company Rp. 10.000.000, term 2/10,n/30, FOB Destination Transactons above record as follows; (in Rp) Date Description 2008 July 10 Merchandise Inventory Account Payable Reff. Debit Credit 10,000,000 10,000,000 2. Unearned rent Liabilities emerge from the receipt of rent in advance 3. Taxes payable The amount of taxes owed to governmental units 4. Interest payable The amount of interest owed on borrowed funds 5. Wages payable The amount owed to employees ACCOUNTING FOR CURRENT LIABILITIES 1.Account payable/trade account payable • Liablities emerge from purcahes of merchandise for resale • The amount owed to others for goods, supplies, or services purchased on open account. • Example : Assume that on July, 10, 2008 Boys Company purchase merchandise from Trade Company Rp. 10.000.000, term 2/10,n/30, FOB Destination • The entry to record is: Date 2008 July 10 Description Merchandise Inventory Account Payable Reff. Debit Credit 10,000,000 10,000,000 2. Unearned revenue - Liabilities arising from the receipt of cash in advance - Accounting treatment for unearned revenue are follows: 1. When the advance is received , Cash is debited, and current liability account identifying the source of unearne reenue credited 2. When the revenue is earned, the unearned revenue account is debited, an earned revenue account is credited - Example : Assume that on August, 10, 2008 Permata Airlines, Co sells 100 tickets at Rp. 500.000 each for flying at Oct, 25, 2008 - The entry for record the sales of tickets is: (in Rp) Date 2008 August 10 Description Cash Uneaned tickets revenue Reff. Debit Credit 50,000,000 50,000,000 • The entry to record services which completed to customers (in Rp) Date 2008 Oct 25 Description Reff. Unearned ickets revenue Ticktes revenue Debit Credit 50,000,000 50,000,000 3. Taxes Payable • The amount of taxes owed to governmental units • The tax is expressed as stated percentage of the sales price • Example : Assume that on August, 10, 2008 Regent Mart, sell merchandise Rp. 28.000.000 an sales taxes 10%. • The entry for record the sales of merchandise is: (in Rp) Date 2008 August 10 Description Cash Reff. Debit Credit 30,800,000 Sales taxes payable Sales 2,800,000 28,000,000 4. Notes Payable • Notes payable is obligation in the form of written promissory notes • It is often used instead of account payable • Example : • Well Mart, Co agrees to borrow Rp. 100.000.000 from BCA Bank. On Oct, 1, 2008, Well Mart , Co sign a Rp. 100.000.000, 12%, 4-month notes. • The entry for record the transaction is: (in Rp) Date 2008 Oct 1 Description Cash Reff. Debit Credit 100,000,000 Notes Payable 100,000,000 5. Interest payable • The amount of interest owed on borrowed funds • Example: • If Well Mart, Co must prepare financial statement Des, 31, 2008, this company should recognize interest expense that is not due to. • The adjusment entry for recording the interest expense is: (in Rp) Date 2008 Des 31 Description Interest expense Interest Payable Reff. Debit Credit 3,000,000 3,000,000 Note : calculation accrued interest Rp. 100.000.000 x 3/14 x 12% = Rp. 3.000.000 6. Current maturities of long-term debt • It is long term debt due within one year • It is not necessary to prepare an adjuting entries to recognize the current maturities of long term debt, but directly presented at balance sheets as current liablities. 7. Dividends payable • It is amount owed by company to it stockholders as a result of board director’s authorization. • It happens at the date of declaration of dividens. • Example: • On January, 25, Well Mart, Co declare to give dividen for stockholders Rp. 450.000.000 with will bepaid at Feb, 20, 2008. (in Rp) Date 2008 Jan 25 Description Retained Earning Dividen Payable Reff. Debit Credit 450,000,000 450,000,000 8. Customer advances and deposits They are deposits received from customer to guarantee performance of contrac or service or as guarantees to cover payment of expected future obligation. For example, Aqua company may receive deposits from distributors as guarantees for possible damage to company’s property – the water containers 9. Income taxes payable The company’s income taxes determine on based incomes they earned during one period and usually paid three months latter from the end period. For example, at Dec, 31, Astira,Co income taxes is not yet paid Rp. 665.000.000. The adjusment entry for record the interest expense is (in Rp) Date 2008 Dec 31 Description Income Taxes Expense Income Taxes Payable Reff. Debit Credit 665.000.000 665.000.000 10. Wages Payable • At the date of financial reporting, the company sometimes is not paid salary or wages of their employees. Instead they have been performed services for company. • The company should recognized the expenses of wages or salary that is not paid • The adjusment entry for recording the interest expense is: (in Rp) Date 2008 Dec 31 Description Wages and Salary Expense Wages and Salaries Payable Payable Reff. Debit Credit xxx xxx • In the business that has several thousand creditors or costumers that need information about the balance amount payable to each creditor or amount owed to individual costumer. • To track individual balances, the company uses a subsidiary ledger. • A subsidiary ledger is a group of account shared common characteristic (for example all costumers) • Two common subsidiary ledgers are: 1. The account receivable (or costumers’) ledger which accumulates transaction data with individual costumer. 2. The account payable (or creditors’) ledger which accumulates transaction data with individual costumer. • The general ledger account that summarizes subsidiary ledger data is called a control account. • Each general ledger control account balance must equal the composite balance of the individual accounts in the related subsidiary ledger the end of an accounting period. • Relationship of general ledger and subsidiary accounts General Ledger Subsidiary Ledgers Account Receivable Cash Customer A Customer B Account Payable Customer C Creditor X Creditor X Owner’s Capital Creditor X Relationship Beetwen Ledger Accounts Payable Subsidiary Ledger GENERAL LEDGER ANDA Date Ref 2008 Jan 10 19 Debit Credit Balance ACCOUNTs PAYABLE Date 6.000 4.000 6.000 2.000 Ref 2008 Jan 31 31 Debit Credit Balance 12.000 8.000 BANASA Date Ref Debit Credit Balance 2008 Jan 12 3.000 21 3.000 3.000 0 GIOVANI Date Ref Debit 2008 Jan 20 29 Credit 3.000 1.000 Balance 3.000 2.000 The subsidiary ledger is separate from the general ledger Accounts payable is a control account 12.000 4.000 Journalizing and Posting the General Ledger Karns Wholesale Supply General Journal Account Titles and Explanation Date 1996 May 31 Account Payable-Fabor and son Purchase returns and Allowances (Receivable credit for returned goods) GI Credit Debit Ref 25/√ 73 500 500 ACCOUNT PAYABLE SUBSIDIARY LEDGER ACCOUNT PAYABLE SUBSIDIARY LEDGER Fabor and Son Ref Debit Credit Fabor and Son Date 1996 May 14 23 26 31 PI CPI PI GI 6,900 6,900 500 Balance 6,900 ………… 8,700 8,700 8,200 Date 2008 May 31 31 31 Ref PI CPI GI Debit Credit 63,900 42,600 500 No. 25 Balance 63,900 21,300 20,800 Purchase Returns and Allowances Date 2008 May 31 Ref GI Debit Credit 500 No. 73 Balance 500 CONTINGENT LIABILITIES •Contingent liabilities is a potential liabliy that may become an actual liablity in the future •Guidelines to report contingent liabilities 1. If the contingency is probable – if it is likely to occur- and the amount can be reasonably estimated, the liability should be recorded to the account 2. If the contingency is reasonably probable – if it is could happen-then it need be disclosed only in the notes accompanying the financial statements 3. If the contingency is remote – if it is unlikely to occur – it need not be recorded or disclosed • Recording a Contingent Liability • The example of contingent liablities is product warranties . • The accounting for warranty cost is based on the matching principle whichever the estimated cost of honoring product warranty contracs should be recognizea as an expense • Assume that The Plasa Electronic, Co sells 100 washing machines at Rp. 1.500.000 for each during 2008. The selling price includes one-year warranty on parts. It is expected that 5 unit of product sold (5%) will be defective and the average warranty repair cost will be Rp. 150.000 per unit. In the period of sales, warranty contracs are honored on 3 unit with total cost Rp. 450.000. • Computation estimates warranty liablitty as follows: Number of unit sold 100 Estimated rate of defective units 5% Total estimated defectve units 5 Average warranty reapir cost Rp. 150.000 Estimated prodct warranty liability Rp. 750.000 • The adjusment entry for recording accrues warranty cost is: Date 2008 Dec 31 Description Reff. Warranty Expense Wages and Salaries Payable Estimated Wararntywarranty Liability costs) (to accrue estimated Debit Credit 750,000 750,000 • The entry for recording repair cost occurs during the year ( 3 units are repair) is: (in Rp) Date 2008 Dec 31 Description Estimated warranty Liability Repairs Parts/Wages Payable (to record honoring of 3 waranty contract on 2008 sales) Reff. Debit Credit 450,000 750,000 PRESENTATION OF CURRENT LIABILITIES STAR ROCK, CO BALANCE SHEET PER DEC, 31, 2008 Current Liabilities (in million rups) Notes Payable Account Payable Sallaries Payable Taxes Payable Interest Payable Long-term Debt due to within one year Total Current Liablities 145 231 422 356 265 1.567 2.986 LONG TERM LIABILITY • Long-term debt consists of probable future sacrifies of economic benefits emerge from present obligations that are not payable within a year or the operating cycle of the company, whichever is longer. • Long term liabilities commonly include: 1. Bonds payable • Bonds are a written promisses to pay specified sums of money at specified times • Bonds represent a promise to pay: A. A sum of money at designed maturity date, plus B. Periodic interest at a specified rate on maturity amount • The parties who interested in bondings are: 1. Bondholders (creditors/lenders) 2. Bonds issuer (debitors/borrower) 2. Mortages payable It is a loan or note that has specific assets of the company (land and buildings, for example) pledged as security for repayment 3. Pension liability It is obligation to employees under a pension plan, obligation for employees compensation in the form of pensions to be paid in the future 4. Long-term notes payable Long-term notes payable is obligation in the form of written promissory notes that are not payable within a year or the operating cycle of the company, whichever is longer. 5. Long term-lease obligation Long term-lease obligation is obligation emerges from lease property, plant or equipment that are not payable within a year or the operating cycle of the company, whichever is longer. 6. Deffered income tax liablities It is obligation emerging from different calculation of income tax, caused diferrenciation of accounting treatment between tax law with generally accepted accounting standar. That is not payable within a year or the operating cycle of the company, whichever is longer.