The Accounting Cycle: Capturing Economic Events

Lecture 2

Entity Principle

A business entity is an economic unit that engages in identifiable business activities

Separate from the personal affairs of its owner

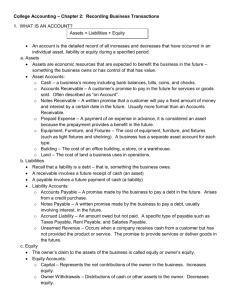

Current Assets

◦ Cash and cash equivalents

◦ Accounts receivables, trade receivables

◦ Prepaids and advances

◦ Inventory

◦ Financial assets such as trading securities, investment securities

Non-Current/Fixed Assets

◦ Property, Plant and Equipment

◦ Investment property

◦ Intangible assets (patents, trademarks, licenses, copyright, goodwill)

◦ Loans receivables

The Cost Principle

◦ The Going Concern Assumption

◦ The Objectivity Principle

◦ The Stable-Dollar Assumption

Short Term/Current Liabilities

◦ Accounts payable – Generally payable to suppliers/vendors

◦ Notes Payable – Interest bearing loan, less than a year maturity

◦ Provisions or accrued liabilities

◦ Unearned revenue

◦ Interest payable

◦ Notes Payable – Short term, interest bearing loan

Long Term/Non-Current Liabilities

◦ Debt payable/Long term loan

◦ Bonds/Debentures

◦ Notes Payable – Interest bearing loan, more than a year maturity

Increases through

◦ Investments of cash or other assets by the owner

◦ Earnings from profitable operation of the business

Decreases through

◦ Withdrawals of cash or other assets by the owner

◦ Losses from unprofitable operation of the business

Sole Proprietorship

Partnership

Corporation

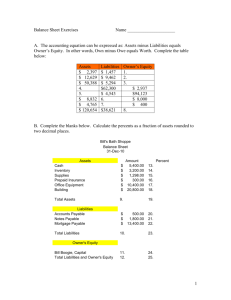

Exercise 2.3

Exercise 2.8

Assets = Liabilities + Owner’s Equity

The effects of Business Transactions

◦ Exercise 2.6

Revenues

◦ Revenue, sales

◦ Gains

◦ Investment income (e.g., interest and dividends)

Expenses

◦ Cost of Goods Sold

◦ Selling, general, and administrative expenses (‘SG&A’)

◦ Rent, utilities, salaries and advertising expenses

◦ Depreciation and amortization

◦ Interest expense

◦ Tax expense

◦ Losses

Net income is an increase in owners’ equity resulting from the profitable operation of the business

Net Income always results in the increase of

Owner’s Equity

Net Income is reported to the Owner’s Equity

Section of the Balance Sheet

The sequence of accounting procedures used to record, classify, and summarize accounting information in financial reports at regular intervals is often termed the accounting cycle

Analyzing and recording transactions via journal entries

Posting journal entries to ledger accounts

Preparing unadjusted trial balance

Preparing adjusting entries at the end of the period

Preparing adjusted trial balance

Preparing financial statements

Closing temporary accounts via closing entries

Preparing post-closing trial balance

An account is a means of accumulating in one place all the information about changes in specific financial statement items, such as a particular asset or liability e.g. Cash, Notes

Payable

Debits refer to the left side of an account, and credits refer to the right side of an account

Account

Assets

Contra Assets

Liabilities

Equity

Revenue

Expenses

Distributions

Debit (Dr.)

Increase

Decrease

Decrease

Decrease

Decrease

Increase

Increase

Credit (Cr.)

Decrease

Increase

Increase

Increase

Increase

Decrease

Decrease

The information about each business transaction is

initially recorded in an accounting

record called the journal

This information is

later transferred to the appropriate accounts in

the general ledger

The journal is a chronological (day-by-day) record of business transactions

Example

Basic characteristics of the general journal entry:

1.

2.

The name of the account debited is written first, and the dollar amount to be debited appears in the left-hand money column.

The name of the account credited appears below the account debited and is indented to the right. The dollar amount appears in the right-hand money column.

3.

A brief description of the transaction appears immediately below the journal entry.

The entire group of accounts is kept together in an accounting record called a ledger

The transactions from the journal are posted in separate accounts and are accumulated to form a ledger

Example

If the debit total exceeds the credit total, the account has a

credit balance debit balance; if the credit total exceeds the debit total, the account

has a

Debit Balances in Asset Accounts

Credit Balances in Liability and Owners’ Equity

Accounts

Every transaction is recorded by equal dollar amounts of debits and credits