Comparing GDP across Countries

advertisement

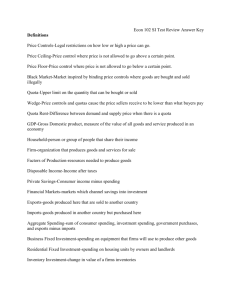

Measuring Economic Performance 01-May-15 01-Dec-14 01-Jul-14 01-Feb-14 01-Sep-13 01-Apr-13 01-Nov-12 01-Jun-12 01-Jan-12 01-Aug-11 01-Mar-11 01-Oct-10 01-May-10 01-Dec-09 01-Jul-09 01-Feb-09 01-Sep-08 01-Apr-08 01-Nov-07 01-Jun-07 01-Jan-07 01-Aug-06 01-Mar-06 01-Oct-05 01-May-05 01-Dec-04 01-Jul-04 01-Feb-04 01-Sep-03 01-Apr-03 01-Nov-02 01-Jun-02 01-Jan-02 01-Aug-01 01-Mar-01 01-Oct-00 01-May-00 01-Dec-99 Real GDP: YoY 16 14 12 10 8 6 4 2 0 Readings • Lequiller François and Derek Blades, 2006, Under standing NATIONAL ACCOUNTS, Organization for Economic Cooperation and Development, Chapter 1 and 2. Link • Bureau of Economic Analysis “Introduction to the National Income and Product Accounts” Link Value vs. Volume • Consider the sales of a hypothetical single good k (for example, k = apples). • Dollar Value of sales (called vk) is the product of the volume of goods sold (called qk) measured in the goods natural units (i.e. bushels of apples) and the dollar price per good (called pk) vk = pk * qk • Growth of value can be decomposed into growth of volume and growth in prices. (1 g ) (1 g )(1 g ) vk pk qk Economic Growth • Rate of Increase of Production. • If Qt is a measure of production, the simple net growth rate is qt qt 1 q gt qt 1 qt • Implying 1 g qt 1 q t What is Economic Growth in a world of many goods? • We need to combine the many goods produced or consumed in an economy into one measure. + + + + =? (Simple) Average Growth • If there are K goods then we could calculate the average growth rate of each type of good. g q AVERAGE g g g ... g K q1 q2 q3 qK • Problem: Taking the simple average of the growth of different types of goods may give a distorted picture of average growth, since different goods are of different importance in the economy. Weighted Average Growth • Instead we could construct a weighted average g qWGTD _ AVGE w g w g w g ... w g 1 q1 2 q2 q3 3 K where the weights add to 1. w w w ... w 1 1 2 3 K • An even weight is wk =1/K but we could adjust the weights to be indicate the importance of each good in the economy. g qWGTD _ AVGE K w g k k 1 qk K k w 1 k 1 qK Measuring the Economy • National accounts are the core statistical measure of the economy. • Accounts cover many features of the economy but organizing concept is Gross Domestic Product (GDP) All goods sold in an economy share a common unit of measure: the price at which they are sold. Sum up the value of goods Gross Domestic Product (GDP) • “GDP combines in a single figure, and with no double counting, all the output (or production) carried out by all the firms, non-profit institutions, government bodies and households in a given country during a given period, regardless of the type of goods and services produced, provided that the production takes place within the country’s economic territory.” L & B p. 15 GDP is a measure of production • Value added at production establishment i Value Addedi =Sales + inventories -raw materials, semi-processed inputs and energy costs. • GDP is the sum of VA across establishments. GDP iValue Addedi Link • Accounts are created by national statistical agencies • UN System of National Accounts is the “internationally agreed standard set of recommendations” used by most countries. • Annual data for many countries available at Link the UN Production Approach Sub-aggregates • Divide production establishments into sectors usually along the line of – Primary: Natural Resources (Agriculture, Forestry, Fishing, Mining, Quarrying) – Secondary: Goods production (Manufacturing, Construction, Utilities) – Tertiary: Intangibles Production by Sector Hong Kong Census and Statistics Other Activities (ISIC J-P) Transport, storage and communication (ISIC I) Wholesale, retail trade, restaurants and hotels (ISIC G-H) Construction (ISIC F) Added Manufacturing (ISIC D) Value Mining & Utilities Kong: Agriculture, hunting, forestry, fishing (ISIC A-B) Hong 60 50 40 30 20 10 0 2010 1970 Expenditure Approach • Purchase of Final goods by end users are divided into two categories: 1. Consumption: Household expenditure (durables, nondurables & services); government (nondurables & services) expenditure; nonprofit expenditures 2. Investment: Inventories, Fixed Investment (equipment, structures) Some Asian Expenditure Shares: 2010 People’s Republic of China 1 90 0.9 80 0.8 70 0.7 60 0.6 50 0.5 40 0.4 30 0.3 20 0.2 10 0.1 0 1 0 2 Japan 3 4 5 Republic of Korea 6 7 8 9 -10 Household consumption expenditure General government final consumption expenditure Gross fixed capital formation Changes in inventories Source: United Nations Main Aggregates Database 10 Share of Value • We could measure total value for the economy. • Divide our economy into K categories of goods indexed by k = 1,…, K. • Value of sales of good k, vk. GDP is represented as the sum of value across goods GDPt Vt v v v ... v 1 t 2 t 3 t K t • The weight of k in the economy could be defined as k v k which add up to 1 across sectors. w K V k Vt vt k 1 • Using GDP to Measure Economic Performance Growth Rates of Products and Ratios Zt X tYt X t Yt Z t X tYt (1 gtX )(1 gtY ) Z t 1 X t 1Yt 1 X t 1 Yt 1 1 gtZ 1 gtX gtY gtY gtX gtZ gtX gtY Xt Zt Xt Zt Yt Yt Z t 1 X t 1 Yt 1 Xt X t 1 Yt Yt 1 (1 gtX ) (1 gtY ) (1 gtX ) (1 gtZ )(1 gtY ) 1 gtZ gtY gtY gtZ gtZ gtX gtY Share of Value • We could measure total value for the economy. • Divide our economy into K categories of goods indexed by k = 1,…, K. • Value of sales of good k, vk. GDP is represented as the sum of value across goods GDPt Vt v v v ... v 1 t 2 t 3 t K t • The weight of k in the economy could be defined as k v k which add up to 1 across sectors. w K V Vt v k 1 k t Volume Growth • Define as a weight k t 1 w k k t 1 t 1 p q Vt 1 • By construction, the weights add up to one, so volume growth is a weighted average of the growth of production of each type of good g w g w g w g .... w g Q t 1 q1 t 1 t K 2 q2 t 1 t w g k 1 k qk t 1 t 3 q3 t 1 t K qk t 1 t Aggregate Growth • Macroeconomic aggregates such as GDP and its sub-totals are the sum of values of sales (or purchases) from different firms. Vt vi pi qi i i • We also decompose the growth of the aggregates into growth in prices (inflation) and growth in volume (output). (1 g ) (1 g )(1 g ) V t P t Q t How statistical agencies calculate volume growth. 1. Construct representative market basket of each category of goods, k. For example, if k were apples, the market basket could consist of a certain number of Red apples, Green apples, Fuji apples depending on how many of each of these are purchased. 2. Sample goods of type k at time t and at time t-1 to assess the price level of the market basket at each time period. k k pt , pt 1 Building Blocks for Volume Growth Value and Inflation Vectors k t 3. For every type of good at time t, measure v and construct an inflation vector representing the growth rate of prices. p k k p t k 1 gt pt 1 4. Convert the dollars spent on good k into their purchasing power measured at time t-1 prices. vtk k p t 1 k pt vtk k t k t 1 p p • Conceptually, if we think of value of good k as the product of price and quantity vk = pk*qk we can think of value divided by the inflation vector as the quantity of goods produced at time t measured at the value in terms of the previous period prices. k t k t k k t t k t v p q k k k k pt 1 pt 1 pt 1qt p p Volume Growth≡ g tQ 5. Sum the inflation adjusted values across the types of goods and divide by value in Q previous period 1 gt v 1 t ptk1 1 t p v 2 t pt21 2 t p v 3 t pt31 3 t p .... v K t ptK1 K t p Vt 1 K 1 gtQ k v t k 1 ptk1 ptk Vt 1 Volume Growth cont. • Conceptually, the numerator of volume growth is the sum of goods produced at time t valued at the price prevailing at time t-1 while the denominator is the sum of goods produced at time t-1 valued at the price prevailing at time t1. The yardstick of value, dollar prices in time t-1 prices, are the same in the numerator and denominator. 1 1 2 2 3 3 K K p q p q p q .... p q t 1 t t 1 t t 1 t t 1 t 1 gtQ 1 1 2 2 3 3 K K Vt 1 pt 1qt 1 pt 1qt 1 pt 1qt 1 .... pt 1qt 1 Volume Growth cont. • Conceptually, we can also think net volume growth as a weighted average of the growth rate of quantities of each type of good. p q p q p q .... p q g 1 K K Vt 1 p q p q p q .... pt 1qt 1 1 1 t 1 t 1 1 t 1 t 1 Q t 2 2 3 3 t 1 t t 1 t 2 2 3 3 t 1 t 1 t 1 t 1 K K t 1 t p q p q p q .... p q Vt 1 Vt 1 Vt 1 1 1 t 1 t 2 2 t 1 t 3 3 t 1 t K K t 1 t p q p q p q .... p q Vt 1 Vt 1 1 1 t 1 t 2 2 t 1 t 3 3 t 1 t K K t 1 t • We can rewrite the numerator as gtQ 1 1 2 2 K K 1 1 2 2 K K p q p q .... p q p q p q .... p q t 1 t t 1 t t 1 t t 1 t 1 t 1 t 1 t 1 t 1 • Collect terms Vt 1 1 1 1 2 2 2 K K K p ( q q ) p ( q q ) .... p ( q q Q t 1 t t 1 t 1 t t 1 t 1 t t 1 ) gt Vt 1 • Rewrite gtQ 1 1 2 2 K K ( q q ) q q q q pt11qt11 t 1 t 1 pt21qt21 ( t 2 t 1 ) .... ptK1qtK1 ( t K t 1 ) qt 1 qt 1 qt 1 Vt 1 • Note that g by Vt-1 . q t k (q q ) and divide through k qt 1 k t k t 1 1 1 2 2 K K 1 2 p q p q p q Q q q qK t 1 t 1 t 1 t 1 t 1 t 1 gt gt gt .... gt Vt 1 Vt 1 Vt 1 • Define as a weight k t 1 w k k t 1 t 1 p q Vt 1 • By construction, the weights add up to one, so volume growth is a weighted average of the growth of production of each type of good g w g w g w g .... w g Q t 1 q1 t 1 t 2 q2 t 1 t 3 q3 t 1 t K qk t 1 t Volume Levels • To compare the level of aggregate quantities at different points in time, total up the growth that appears in between periods. Q 1. Calculate the growth rateg t for all periods using the prices from the immediately previous periods to adjust current values. 2. Choose a reference period, ref, preferably in a recent period and set a constant price series equal to value in that period QREF VREF Chained Index 3. Define the constant price series recursively in all periods using the equation Qt (1 g ) Qt 1 Q t The relationship between the levels of the chain volume index at any two points t and t+T is the product of the growth between the two points. QREF T QREF Q Q Q Q (1 g REF ) (1 g ) (1 g ) .... (1 g 1 REF 2 REF 3 REF T ) QREF QREF T Q Q Q Q (1 g REF ) (1 g ) (1 g ) .... (1 g 1 REF 2 REF 3 REF T 1 ) Comparing GDP across Countries We want to compare output in two countries though those are measured in different currencies. Market Basket Index? • Construct an international market basket of goods produced and purchased around the world. For country j, PPPj could be the relative price of the market basket relative to price of the market basket in US$. • Problem: Judging the cost of living by the cost of the international market basket may not be fair if customers in the local market can buy the types of goods which are cheaper at home. Link • Major project to compare prices internationally implemented by the World Bank with the help of UN and national statistical agencies. • ICP has been implemented by UN Statistical Office since 1968. PPP’s 1. Divide expenditures into k = 1,..,K (in 2005, K = 155) “basic heading” categories of goods. 2. All j = 1,..J countries (in 2005, J = 146) report total expenditure in domestic currency of all k categories v . j ICP Handbook PPP’s cont. 3. Sample prices of representative goods from each category in each country. 4. Construct average of those prices (relative to “anchor” economy) for each country j basic heading type of good k . p k j p k ANC Note: Measured in # of j country Currency units per anchor country currency units. Example. If Japan = j and anchor is USA, and 1 kg. rice is 400 yen in Japan and $2 k in USA : pJPN p k ANC 200 PPP in Anchor Currency. 4. Define quantity of good of type k valued q k j v k j p k j 5. Calculate price of j’s market basket in j’s prices relative to price of j’s market basket in anchor country prices. v1j v 2j ... v Kj PPPj j: AC $ v1j 1 j p p1AC v 2j p 2 j ... v Kj p 2j 2 p AC Numerator in j currency, denominator in AC currency 2 p AC • Conceptually PPP is the cost of the goods purchased by consumers in their country relative to the cost of those same goods in anchor country terms. PPPj j: AC $ 1 p q p q ... p q p AC $ j PPP 1 ANC 1 1 j j 1 j q p 2 j 2 ANC 2 j K j q ... p 2 j K j K ANC q K j 1 2 K p p p 2 K ANC ANC w1j ANC w ... w j j 1 2 K pj pj pj ,......, wnj v nj Vj • We could also calculate relative price of anchor countries market basket. j: AC $ AC PPP 1 1 j AC 1 AC pq 1 AC p q pq p 2 j 2 ANC 2 AC q ... p q K j 2 AC ... p K AC K AC q • Index number theory suggest Fisher Ideal index (i.e. geometric average of PPPACj:AC $and PPP represent the differences in the cost of living). j: AC $ j $ j: AC $ j: AC $ PPPIntlj: AC PPP PPP $ AC j K AC 2011 Price level ratio of PPP conversion factor Country Name to market exchange rate China 0.542527 Hong Kong SAR, China 0.701644 Indonesia 0.411219 India 0.314063 Japan 1.346427 Korea, Rep. 0.771083 Lao PDR 0.307315 Myanmar 43.16115 Philippines 0.412201 Singapore 0.708778 Thailand 0.405696 PPP conversion factor (LCU per international $) 3.505536 5.461593 3606.566 15.10943 107.4543 854.5857 2467.753 234.974 17.85372 0.891484 12.37038 Large Variations in Labor per Person (www.ggdc.net) Hours per Worker 2001 Taiwan South Korea Singapore Hong Kong Japan USA EU 0 500 1,000 1,500 2,000 2,500 3,000 Variation in Labor Force Participaton Employment as a share of Population 52.00% 50.00% 48.00% 46.00% 44.00% 42.00% 40.00% 38.00% Europe U.S.A Japan Hong Kong Singapore South Korea Taiwan Pre-Industrial Revolution Source: Angus Madisson, Measuring the Chinese Economy GDP per Capita 1200 1000 1990 US$ 800 China 600 Europe 400 200 0 50AD 960AD 1280 1400 1820 Main Differences in Countries are Due to Variation in Labor Productivity GDP per Worker 50000 45000 40000 35000 30000 25000 20000 15000 10000 5000 Th ai la nd Ta iw an ng ap or e Si Ph illi pp in es al ay sia M Ko re a In do ne sia Ho ng Ko ng 0 Now, China is calculating GDP based on economic activity of each quarter to make the data "more accurate in measuring the seasonal economic activity and more sensitive in capturing information on short-term fluctuations", the NBS said. Previously, China's quarterly GDP data, in terms of value and growth rates, was derived from cumulated figures rather than economic activity of that particular quarter, the bureau said. The new methodology - in line with that of major developed countries will pave the way for China to adopt the International Monetary Fund's Special Data Dissemination Standard (SDDS) in calculating GDP, it said. Link Labor Share of Income Link Determinants of Income 1600 1400 Hours per Capita 1200 1000 800 600 400 200 0 0 20 40 60 80 GDP per Capita, 1000's of US$ 100 120 140 160 Determinants of Income 100.00 90.00 80.00 Labor Productivity 70.00 60.00 50.00 40.00 30.00 20.00 10.00 0.00 0 20,000 40,000 60,000 GDP per Capita 80,000 100,000 120,000 Productivity Catch Up: Europe Source: Groningen Growth & Development Center U.S.A % of 1950 USA % of 2003 USA Growth Rate 12.00 100.0% 33.97 100.0% 2.00% France 5.63 46.9% 37.75 111.1% 3.46% Germany 4.36 36.3% 30.01 88.3% 3.95% UK 7.49 62.4% 28.01 82.5% 2.91% Spain 2.60 21.7% 22.21 65.4% 4.94% 1990 US$, Average Output per Hour (Y/L) Productivity Catch Up: Latin America Source: Groningen Growth & Development Center 1950 U.S.A 12.00 % of 2003 USA 100.0% 33.97 % of Growth USA Rate 100.0% 2.00% Argentina 6.16 51.4% 10.57 31.1% 1.04% Brazil 2.48 20.7% 7.81 23.0% 2.21% Chili 4.66 38.9% 14.07 41.4% 2.12% Mexico 3.56 29.7% 10.24 30.1% 2.03% Productivity Catch Up: East Asia Source: Groningen Growth & Development Center 1950 % of USA 2003 % of USA Growth Rate U.S.A 12.00 100.0% 33.97 100.0% 2.00% Japan 2.30 19.2% 24.78 73.0% 4.57% 1973 % of USA 2003 % of USA Hong Kong 7.49 35.0% 22.28 65.6% 4.74% Korea 3.64 17.0% 14.25 42.0% 5.93% Singapore 6.80 31.8% 19.63 57.8% 4.61% Taiwan 20.4% 18.77 55.2% 6.33% 4.37 y1951 % of USA y2011 % of USA Argentina 2.592284 15.1% 19.29067 35.3% Australia 13.4734 1.646719 5.803535 6.578401 78.6% 9.6% 33.9% 38.4% 38.31929 9.128079 14.40455 49.28606 70.2% 16.7% 26.4% 90.2% 49.18272 90.1% 28.55739 25.5% 40.41155 12.1% 38.14028 39.8% 14.68958 52.3% 74.0% 69.8% 26.9% Singapore 34.86622 63.8% South Korea 26.84044 49.1% 39.9666 73.2% 100.0% 54.61435 100.0% Brazil Chile France Germany Hong Kong Italy Japan Mexico 4.366204 2.06587 6.828484 United Kingdom 9.541419 United States 17.14322 55.7% Labor Productivity per Hour 2014 US$ Country 1950.00 2014.00 % of USA France Germany Italy United Kingdom 8.64 6.57 8.22 12.18 43.3% 33.0% 41.2% 61.1% 63.97 63.44 50.41 49.66 % of USA 96.2% 95.4% 75.8% 74.7% Canada United States 16.07 19.94 80.6% 100.0% 51.17 66.47 77.0% 100.0% Australia New Zealand 14.15 15.59 71.0% 78.2% 53.35 39.03 80.3% 58.7% Labor Productivity per Hour 2014 US$ Economy 1950.00 2014.00 % of USA Hong Kong Japan Singapore South Korea Taiwan Argentina Brazil Chile Mexico Peru 3.29 3.24 7.81 1.74 1.48 16.5% 16.2% 39.2% 8.7% 7.4% 47.16 42.06 60.42 33.67 43.27 % of USA 71.0% 63.3% 90.9% 50.7% 65.1% 10.45 4.70 6.30 8.12 6.06 52.4% 23.6% 31.6% 40.7% 30.4% 22.21 16.94 27.38 19.89 15.27 33.4% 25.5% 41.2% 29.9% 23.0% Capital Productivity 0.7 0.6 0.5 0.4 0.3 0.2 0.1 0 Brazil France South Korea United States Midterm Exam • • • • Thursday, October 15, 2015, 2:00-4:00, LTG Location: Lecture Theater G Bring writing materials and calculator. Coverage: Material (through Tuesday, October, 13, 2015). • Semi-open book: Bring 1 A4 size piece of paper with handwritten notes on both sides. 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 1996 1995 1994 1993 1992 1991 1990 1989 1988 1987 1986 1985 1984 1983 1982 1981 1980 1979 1978 1977 1976 China Capital Productivity 50.00% 45.00% 40.00% 35.00% 30.00% 25.00%