Tuition Revenue Distribution - Office of Planning & Budgeting

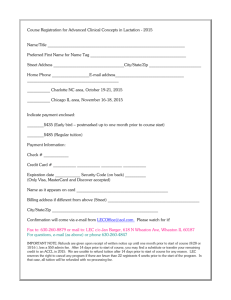

advertisement

An Intro to the Distribution of Tuition Revenue to Schools & Colleges under ABB Outline What is the tuition revenue distributed under ABB? What are the basics of the distribution process? What are the nuances of the distribution process and what – as a result – are changes that units might wish to have made to ABB? Where do the data used in ABB calculations come from? Can they be found in UW Profiles? Can they be obtained by unit administrators by querying the Enterprise Data Warehouse (EDW)? How does the ABB process fit in with the annual budget process? Tuition Revenue Only net operating fee revenue is distributed to schools/colleges 2014-15 Full-Time Resident Undergraduate Charges: Operating Fee Building Fee Total Tuition S&A Fee Tech Fee IMA Bond Fee Facilities Renovation Fee U-PASS Total Fees Total Tuition & Fees $10,740 $565 $11,305 $390 $123 $96 $252 $228 $1,089 $12,394 Only net operating fee revenue is distributed to schools/colleges We distribute the amount of revenue that is actually collected - net operating fee revenue. In order to achieve a given level of enrollment and a student body with particular characteristics (e.g., an economically diverse student population), institutions “discount” tuition. This discounting is the main source of the difference between the total amount of tuition charged and the total amount collected. Only net operating fee revenue is distributed to schools/colleges Net operating fee revenue is calculated by subtracting several types of “financial aid” from the total amount of tuition charged: Tuition waived (foregone revenue) TA/RA waivers (about ¾ of total waivers) Veteran’s waivers Pool of need/merit waivers Revenue used for financial aid Legislatively mandated 4% “set-aside” “Additional aid” pools - RUG, NonResUG (Purple/Gold Scholarships) Only 70% of net operating fee revenue is distributed to schools/colleges 30% of net operating fee revenue (the ABB “tax”) is retained centrally. These funds are used for such things as: Utilities, grounds, maintenance Central services (e.g. libraries, police) Strategic investments (Provost Reinvestment Fund) Distribution Basics To determine the amount to be distributed, we first “pool” net operating fee revenue by tuition groups: > > > > > > > > > > Undergrad Grad Tier I Grad Tier II Grad Tier III CoEnv Grad Educ Grad MSW Public Health Grad MPH Engineering Masters > > > > > > > > > M Public Admin MBA Law (JD) Law (Other Grad) Nursing Grad PharmD Medicine (MD) Dentistry (DDS) Dentistry Grad Then we distribute 70% of each pool according to the ABB distribution rules Undergrads 60% based on SCH 40% based on degrees Grad/Professional 20% based on SCH 80% based on major enrollments Only SCH and major enrollment for students who are charged tuition are included This means that fee-based activity is excluded Also means that students with an “exemption” are excluded What does it mean to distribute tuition revenue based on SCH? We pool the total number of SCH (student credit hours) taken by students in each tuition group. Using this information, we calculate the percentage of all SCH taken by students in a tuition group for which each school/college is responsible. The portion of the revenue pool to be distributed by SCH is distributed according to those percentages. The school/college that is responsible for the SCH in a course section is not determined on the basis of which faculty member teaches the section. Instead it is determined on the basis of a “mapping” of curricula to departments (and thus to schools/colleges). (e.g. ACCTG – Foster, MATH to A&S, BIOENG – SOM & CoEng) …based on major enrollments or degree majors? We distribute 40% of undergraduate resident tuition based on degree majors. We distribute 80% of graduate/professional tuition on the basis of major enrollments. We begin by finding out all the majors in which students in each tuition group are enrolled, or all the majors associated with each bachelor’s degree earned. We sum the total number of degree majors or major enrollments. Using this information, we calculate the percentage of major enrollments or degree majors for which each school/college is responsible. For this, we use a mapping” of majors to departments (and thus to schools/colleges). ABB Nuances ABB Nuances There are a number of details in the ABB tuition distribution process that are not straightforward. When ABB was created, there were a number of decisions that needed to be made in order for calculations to be made. When the effect of specific changes was assessed, in most cases, a choice one way or another had only minimal effects in most cases. In some instances, the ultimate decision about how/whether to change things is an academic rather than budgetary choice. Faculty subcommittees have been charged with addressing four issues (three related to tuition revenue). Nuances – net tuition TA/RA waivers Revenue is lost to the units in which students enroll (either on the basis of their major or on the basis of courses taken) The unit appointing a TA/RA may not be the unit in which they enroll. There are certain schools/colleges where this happens frequently (The Graduate School council has been asked to look at this issue.) Nuances – net tuition Summer quarter Tuition revenue from summer quarter is not currently included in ABB tuition revenue calculations. SCH and enrollments from summer quarter are not included in the tuition distribution calculations. It is assumed (given the way in which the baseline ABB “supplement” was calculated) that units receive revenue for summer quarter through the supplement. This means, however, that we don’t have the same incentives for growing summer quarter instruction as we do for growing instruction in autumn, winter, and spring quarters. (The Faculty Council on Teaching and Learning has been asked to look at this issue.) Nuances – exemptions Students who are UW employees, state employees, or senior citizens may enroll in up to six credits on a “space available basis” without paying tuition. Following the initial ABB guidelines, any student with such an exemption is excluded from ABB calculations. But…. Students pay tuition if enrolled for > 6 credits. We have no way of determining those enrollments where the use of the exemption has been approved. In fact, some exclusions to the exemption have now been created, but they cannot be identified in our data. Nuances – distribution by SCH A curriculum may be mapped to more than one unit (e.g. bioengineering) If a particular curriculum is attributed to two units, the associated SCH will be counted twice. If it is attributed to three units, they will be counted three times. Undergraduate SCH AA 120 C SCI 120 EE ME 120 120 BIOEN 120 Total 600 CoE 120 CoE 120 CoE 120 CoE 120 CoE 120 SoM 120 Total 720 CoE 83.3% SoM 16.7% Nuances – distribution by SCH Course sections may be offered “jointly”. In the case of “official” joint courses, one course is identified as the “responsible” course e.g., ENV H 461 is offered jointly with CEE 490, and CEE 490 is the responsible course, so all credits are attributed to Engineering In the case of “ad hoc” joint courses, a course section may be offered jointly without being designated as an official joint offering. In such an instance, credits are attributed to unit based on how each student enrolls in the course. (The Faculty Council on Academic standards has been asked to look at the issues of joint courses.) Nuances – distribution by degree major A given student may graduate with more than one degree (e.g., B.A. and B.S.), and each degree may be associated with more than one major. Each major may be mapped to more than one unit. Suppose five undergraduates graduate: Student 1 BA Student 2 BA BS Student 3 BS Student 4 BA Student 5 BS English Philosophy Math Physics Elect Eng History BioEng A&S Engr Med 1 1 1 1 1 1 1 1 We have: • 5 students • 6 degrees • 7 different majors • 8 “degree majors” • • • 62.5% to A&S 25% to Engineering 12.5% to Med Nuances – distribution by major enrollments A given student enroll in more than one program simultaneously. So if a particular tuition group has a large proportion of students with multiple program enrollments, the revenue pool for that group may end up being diluted. MBA: 98% of majors and SCH are attributable to Foster. MPH: Only 70% of majors and 76% of SCH are attributable to SPH. As with degrees, it is also the case that a given major may be attributed to more than one school/college. (The Faculty Council on Academic standards has been asked to look at the issue of double/concurrent majors.) Nuances - campuses To date, tuition revenue generated by UW Bothell and UW Tacoma has gone to those campuses, with ABB distribution rules applying only to UW Seattle. This means that course-taking on the UW Seattle campus by UW Bothell and UW Tacoma students is not included in the SCH distribution. It also means that course-taking on the UW Bothell or UW Tacoma campuses by UW Seattle students is not included in the SCH distribution. So, what happens when, for example, there is a joint program between School of Pharmacy and Bothell’s MBA program? Data for ABB Key Data Issues – How are ABB data sourced? ABB was built on the Planning and Budgeting Database (PNBDB) rather than the Enterprise Data Warehouse (EDW) because the relevant data elements didn’t exist in EDW. Requirements Census day snapshots of enrollments and course registrations. Mapping of curricula, majors, and degrees to fin orgs. Good news! Currently OPB and EDA are working to move functionality from PNBDB into EDW. In the meantime, anyone who wishes can get access to PNBDB and ABB queries. Bad news: For now, you cannot get the numbers out of EDW or UW Profiles. ABB calculations and the annual budget process Although calculations are done in Spring, the “process” starts in Fall Each Fall, schools and colleges prepare for annual budget discussions with the Provost. In that process, they are asked to provide: Recommendations for tuition rates for their programs Information about whether they wish to create a new tuition category Any expected substantial changes in enrollment in their graduate/professional programs. Calculation of true-up As of spring census day (let’s use Spring 2015 as example), the final tuition revenue estimate for 2014-15 is calculated. The final distribution for 2014-15 is calculated using: Actual SCH from 2014-15 Actual major enrollments from 2014-15 Degree majors from 2013-14 The true-up to each unit is the difference between the final ABB distribution of revenue for 2014-15 and the projected distribution of 2014-15 revenue from the prior spring. Calculation of incremental revenue for coming fiscal year To calculate the incremental revenue for the coming year (2015-16 in our example), we must begin with a projection of the revenue pool for the coming year. For that, we assume: Tuition rates proposed/approved for next year, and Enrollments expected for the coming year. Undergraduates: We use an enrollment projection model. Graduate/Professional: Informed by unit responses about expected changes in grad/professional programs. To calculate the distribution of revenue, we assume the percentage distribution of SCH and major enrollments from 2014-15 and degree majors from 2013-14.