Week 2 Section Notes

advertisement

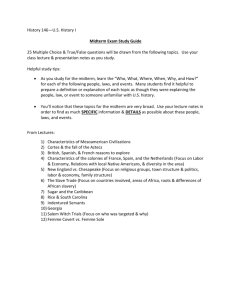

Section 3: Midterm Review EWMBA 201A Eva Vivalt September 5, 2009 Section 3 Midterm Review 1 Administrative Stuff 1. 2. 3. Prior midterms are on bspace. Mid-Term Exam is on Tuesday (9/8). Both cohorts take it then; no lecture on Monday. September 5, 2009 Section 3 Midterm Review 2 Review Topics 1. 2. 3. 4. Decision Trees Certainty Equivalence Market Analysis Questions (especially Thought Questions) September 5, 2009 Section 3 Midterm Review 3 Tips for Decision Trees 1. 2. 3. 4. Start by writing down the CHOICE and CHANCE nodes that you see in the question. Try to see relationships among nodes; which come first? Which come later or are dependent on earlier choices/chances? Make sure nodes are mutually exclusive (probabilities sum to 1). After you have a good tree, calculate EVs from right to left. September 5, 2009 Section 3 Midterm Review 4 Tips for Certainty Equivalence 1. 2. Translate word problems into two options: one with certain payout and one with risky payout (and calculate the EV of this risky payout). Observe decision maker’s choice and apply the following rules to get range of CE: 1. 2. 3. If decision maker rejects the option with the certain payout, then her CE is strictly greater than that payout; If decision maker accepts the option with the certain payout, then her CE is less than or equal to that payout. Compare CE range to EV of the risky payout to determine risk preference: 1. 2. 3. CE<EV risk averse CE=EV risk neutral CE>EV risk loving September 5, 2009 Section 3 Midterm Review 5 2005 Decision Tree Question a. Draw decision tree and calculate EV (see answer solutions). Note for future reference that EV = $1.1M. September 5, 2009 Section 3 Midterm Review 6 2005 Decision Tree Question b. If Goodwyn were risk averse, might she have made a different decision than the one you found in part a? Why or why not? First think of the intuition: Goodwyn originally took a risky option when one with a sure payoff existed. A sufficiently risk averse person (i.e.: one with a CE less than the sure payoff) would not have done this. We can also see this by considering each of Goodwyn’s choices. To solve, note that for Goodwyn to be risk averse means we need CE<EV. Now let’s break the tree into steps and see if there are any situations where the condition is violated. i. ii. Compare “run as standard story” to “don’t run story” Compare “run as cover story” to “don’t run story” September 5, 2009 Section 3 Midterm Review 7 2005 Decision Tree Question i. Compare “run as standard story” to “don’t run story” standard EV = 0.88 don’t run 0.9 Note if she picked the risky bet with EV = 0.88 (i.e. if she had rejected the safe bet with payoff 0.9) this would imply that her CE >0.9. But then CE>0.9>0.88=EV CE > EV, which we know can’t be true because she is risk averse (since she is risk averse, she must have CE<EV). So we know she will pick the safe bet (“don’t run”), and we know she will never choose “run as standard story”. September 5, 2009 Section 3 Midterm Review 8 2005 Decision Tree Question ii. Compare “run as cover story” to “don’t run story” cover don’t run EV = 1.1 0.9 First, note that if she picked the risky bet with EV = 1.1 (i.e. if she had rejected the safe bet with payoff 0.9) this would imply that her CE >0.9, but she could still have a CE<EV. For example, her CE could be 0.99. Second, note that if she picked the safe bet this would imply that her CE ≤ 0.9, and so her CE < EV. Hence, in both cases, it could be that her CE<EV, so it is unclear which one she would pick. Summarizing, from (i) we know she would never choose “run as standard story”, but from (ii) we cannot say whether she would choose “run as cover story” or “don’t run story”. September 5, 2009 Section 3 Midterm Review 9 2005 Decision Tree Question c. How much would Goodwyn pay for information? a. b. Draw a tree with information node first and calculate EV. Compare the EV of tree with info to the EV of tree in (a). cover Appointed (p= 0.4) standard don’t run 2 1 0.9 EV = 2*(0.4) + 0.9*(0.6) = 1.34 cover Not Appointed (p= 0.6) standard don’t run 0.5 0.8 0.9 Note that EV of tree with info = $1.34M, which is $240K greater than the EV of tree in (a). Hence, Goodwyn would pay up to $240K to obtain the information September 5, 2009 Section 3 Midterm Review 10 Tips for Market Analysis 1. 2. 3. 4. To find equilibrium price and quantity set Qd=Qs and use algebra to solve. For consumer surplus, recall the area of a triangle = ½ * Base * Height When aggregating a total market demand curve, remember that demand curves are only additive where they are positive. Formula for elasticity = (dQ/dp)*(p/Q) September 5, 2009 Section 3 Midterm Review 11 2006 Market Analysis Question a. What is equilibrium price and quantity? Solve by setting Qd = Qs to find that P* = $150/ton and Q* = 1800K tons. b. What is consumer surplus at Q* and P*? Recall that the area of a triangle is ½ * Base * Height. Find where demand curve intersects P axis. This occurs when Q=0, so 0 = 3000 – 8P P = $375. Height = ($375 – $150) = $225 Base = 1800K – 0 = 1800K Hence, consumer surplus = ½ * 1800K * $225 = $202,500,000. September 5, 2009 Section 3 Midterm Review 12 2006 Market Analysis Question c. We have a new demand curve; what is new equilibrium price and quantity? Step 1: Find where demand is positive: Plastics: q = 3000 – 8P for P<375 Transportation: q = 2100 – 10P for P<210 Industrial: q = 1760 – 11P for P<160 Step 2: Add demand 0 if P≥375 3000 – 8P if 210≤ P<375 (i.e.: only plastics) 5100 – 18P if 160≤P<210 (i.e.: plastics and transportation) 6860 – 29P if P<160 (i.e.: plastics, transportation and industrial) Note: the above four lines are the new “Qd” September 5, 2009 Section 3 Midterm Review 13 2006 Market Analysis Question c. We have a new demand curve; what is new equilibrium price and quantity? Step 3: Find where Qs = Qd; to do this, try different segments of Qd p,t,i: 6860 – 29P = 12P P~167, but we require P<160 p,t: 5100 – 18P = 12P P = 170, this is consistent because 160≤P<210 Plug P* = 170 back into supply (or appropriate demand) to find Q* = 2040K tons. September 5, 2009 Section 3 Midterm Review 14 2006 Market Analysis Question What is going on here? We are trying to figure out where the supply curve intersects the demand curve. 400 Supply here? 350 … or supply here? 300 Price ($) 250 p,t,i 200 p,t p 150 100 50 demand 0 0 1000 2000 3000 4000 5000 6000 7000 8000 Quantity (K tons) September 5, 2009 Section 3 Midterm Review 15 2006 Market Analysis Question d. Are plastics manufacturers better off? Compare new consumer surplus with old consumer surplus (calculated in (b)). When P=170, Qd (plastics) = 3000 – 8*170 = 1640 CS = ½*(1640K - 0)*(375-170) = $168,100K, which is less than before. Hence, they are worse off. September 5, 2009 Section 3 Midterm Review 16 Questions? September 5, 2009 Section 3 Midterm Review 17