Ch09-ICB

advertisement

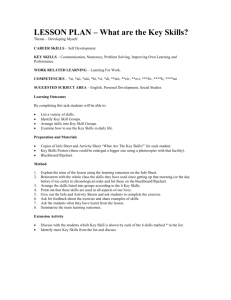

Corporations: A Contemporary Approach Chapter 9 Numeracy for Corporate Lawyers Peter Breugel, The PageElder, 1 ”The Blind Leading the Blind”of(1568) 52 Questions about Widget, Inc – • Should we buy? Is business solid? Any problems? • How much should we pay? What’s company’s value? • Given problems, any protections we should get? Corporations: A Contemporary Approach Chapter 9 Numeracy for Corporate Lawyers Page 2 of 52 Module IV – Corporate Finance Chapter 9 Numeracy for Corporate Lawyers Bar exam Corporate practice Law profession Citizen of world Corporations: A Contemporary Approach • Financial accounting – Fundamental formula – Accounting statements: Balance sheet, income statement, cash flow statement – Accounting statement analysis Workshop 1 • Business valuation – – – – Future vs. present value Accounting value vs. market value Income vs. cash flow Discounted cash flow Workshop 2 Chapter 9 Numeracy for Corporate Lawyers Page 3 of 52 Accounting basics Corporations: A Contemporary Approach Chapter 9 Numeracy for Corporate Lawyers Page 4 of 52 “Cookie jar” business You go into business, buying and selling items from your cookie jar. To keep track of your money-making efforts you keep accounts. Fundamental equation: Assets = Liabilities + Equity Accounting entries – – – – ID accounting event Value event Record event Disclose event Financial statements – Balance sheet – Income statement – Cash flow statement Corporations: A Contemporary Approach Chapter 9 Numeracy for Corporate Lawyers Page 5 of 52 Accounting entries Assets = Liabilities + Equity Put $12 in cookie jar $12 $0 $12 Borrow $10 from Mom (put in IOU) $22 $10 $12 Buy two felt-tip pens for $2 each $22 $10 $12 Buy $5 scissors on credit $27 $15 $12 Sell one of the felt-tip pens for $3 $28 $15 $13 Repay the $5 scissors debt $23 $10 $13 Pay $2 rent for using the jar $21 $10 $11 Take our $5 to go to movies $16 $10 $6 Corporations: A Contemporary Approach Chapter 9 Numeracy for Corporate Lawyers Page 6 of 52 Where do financial statements come from? Balance sheet (assets = liabilities + equity) Assets = Liabilities + Equity Put $12 in cookie jar $12 $0 $12 Borrow $10 from Mom (put in IOU) $22 $10 $12 Buy two $2 felt-tip pens $22 $10 $12 Buy $5 scissors on credit $27 $15 $12 Sell one of the felt-tip pens for $3 $28 $15 $13 Repay the $5 scissors debt $23 $10 $13 Pay $2 rent for using the jar $21 $10 $11 Take our $5 to go to movies $16 $10 $6 Income statement (sales – expenses = net income) Cash flow statement (cash at beginning – cash out + cash in = cash balance) Corporations: A Contemporary Approach Chapter 9 Numeracy for Corporate Lawyers Page 7 of 52 Balance sheet (assets = liabilities + equity) Corporations: A Contemporary Approach Chapter 9 Numeracy for Corporate Lawyers Page 8 of 52 What if market price of scissors goes up? or down? Assets Cash Pens Scissors Balance sheet (at end of Day 1) What if you don’t show the IOU to Mom? Total assets Liabilities $9 IOU (Mom) $2 Credit (scissors) $5 Total liabilities Equity Mine Total equity $16 ?? Total Liabilities + Equity Corporations: A Contemporary Approach Chapter 9 Numeracy for Corporate Lawyers $10 $0 $10 $6 $6 $16 ?? Page 9 of 52 Income statement (sales – expenses = net income) Corporations: A Contemporary Approach Chapter 9 Numeracy for Corporate Lawyers Page 10 of 52 Income statement (Day 1) Net sales What if you treat jar as “asset” not “expense”? $3 Operating expenses Cost of goods sold $2 Rent (jar) $2 Selling/adm expenses $0 Total operating expenses $4 Operating income ($1) Interest expense (Mom/scissors) $0 Income taxes $0 Net income ($1) Dividends paid Corporations: A Contemporary Approach $5 Chapter 9 Numeracy for Corporate Lawyers Page 11 of 52 Statement of cash flows (cash at beginning – cash out + cash in = cash balance) Corporations: A Contemporary Approach Chapter 9 Numeracy for Corporate Lawyers Page 12 of 52 Is the “cookie jar” business healthy? sustainable? Cash flow statement (Day 1) Operating activities Net income Decrease (increase) inventories Total operating activities Investing activities -- Financing activities Increase (decrease) short-term debt Increase (decrease) long-term debt Investment by owner Distribution to owner Total financing activities Increase (decrease) cash position Corporations: A Contemporary Approach ($1) ($7) ($8) Chapter 9 Numeracy for Corporate Lawyers $0 $10 $12 ($5) $17 $9 Page 13 of 52 Corporations: A Contemporary Approach Page 14 of 52 Balance sheet - terms Corporations: A Contemporary Approach Chapter 9 Numeracy for Corporate Lawyers Page 15 of 52 How is “inventory” valued? Avg cost / FIFO / LIFO? Balance sheet Assets Current assets Cash Accts receivable Inventories Prepaid expenses (as of date) What does it mean to “write off” a loss? Liabilities Current liabilities Accounts payable Notes payable Accrued expenses payable Long term liabilities Fixed assets Land Buildings Machinery Office equipment Less accumulated depreciation Owner’s equity Common stock Paid-in capital Retained earnings Intangible assets Corporations: A Contemporary Approach Chapter 9 Numeracy for Corporate Lawyers Page 16 of 52 Balance sheet analysis Liquidity analysis – can Widget pay its current debts? Check “current ratio” Debt analysis – can Widget take on new debt? Check “debt-equity ratio” Equity analysis – does Widget have value to its owners? Check “book value” Corporations: A Contemporary Approach Chapter 9 Numeracy for Corporate Lawyers Page 17 of 52 Liquidity analysis Balance sheet Assets Liabilities Current assets Current liabilities Cash Accts receivable Inventories Prepaid expenses Accounts payable Notes payable Accrued expenses payable Long term liabilities Fixed assets Land Buildings Machinery Office equipment Less accumulated depreciation Intangible assets Corporations: A Contemporary Approach Owner’s equity Current Ratio Current Assets divided by Current Liabilities Common stock Paid-in capital Retained earnings FY 2 = 1.62 FY 1 = 1.29 Chapter 9 Numeracy for Corporate Lawyers Page 18 of 52 Debt analysis Balance Sheet Assets Liabilities Current assets Current liabilities Cash Accts receivable Inventories Debt/Equity Ratio debt PrepaidLong-term expenses divided by Equity Accounts payable Notes payable Accrued expenses payable Long term liabilities Fixed assets Land FY 2 = 1.32 FY 1 = 1.79 Buildings Machinery Office equipment Less accumulated depreciation Owner’s equity Common stock Paid-in capital Retained earnings Intangible assets Corporations: A Contemporary Approach Chapter 9 Numeracy for Corporate Lawyers Page 19 of 52 Equity analysis Balance Sheet Assets Current assets Cash Accts receivable Inventories Prepaid expenses Liabilities Current liabilities Accounts payable Notes payable Accrued expenses payable Long term liabilities Fixed assets Book value Land Assets Owner’s equity Buildings minus Common stock Liabilities Machinery Paid-in capital Office equipment Retained earnings Less accumulatedFY 2 = $1,510,000 depreciation FY 1 = $1,120,000 Intangible assets Corporations: A Contemporary Approach Chapter 9 Numeracy for Corporate Lawyers Page 20 of 52 Income statement - terms Is Widget, Inc profitable? • • • • Corporations: A Contemporary Approach Net income EBITDA Operating margin Return on equity Chapter 9 Numeracy for Corporate Lawyers Page 21 of 52 Income statement analysis Net sales Operating expenses Cost of goods sold Depreciation Selling and administrative expenses Research and development Operating income Widget net income (after expenses, depreciation, Interest, taxes) FY 2: $390,000 FY 1: $254,000 FY 0: $226,000 Interest expense Income before taxes Income taxes Special income Net Income Corporations: A Contemporary Approach Chapter 9 Numeracy for Corporate Lawyers Page 22 of 52 Income statement analysis Net sales Operating expenses Cost of goods sold Depreciation Selling and administrative expenses Research and development Operating income Interest expense Widget EBITDA (Earnings before Interest, taxes, depreciation, amortization) FY 2: $1,170,000 FY 1: $1,005,000 FY 0: $923,000 Income before taxes Income taxes Special income Net Income Corporations: A Contemporary Approach Chapter 9 Numeracy for Corporate Lawyers Page 23 of 52 Income statement analysis Net sales Operating expenses Cost of goods sold Depreciation Selling and administrative expenses Research and development Operating income Widget operating margin (net sales minus operating expenses, divided by net sales) FY 2 = 920/7500 = 12.3% FY 1 = 765/7000 = 10.9% FY 0 = 723/6800 = 10.6% Interest expense Income before taxes Income taxes Net Income Corporations: A Contemporary Approach Chapter 9 Numeracy for Corporate Lawyers Page 24 of 52 Compare income statement / balance sheet Widget return on equity (ROI) (net income divided by stockholders' equity as of prior year) FY 2 = 390/1120 = 34.8% FY1 = ?? Corporations: A Contemporary Approach Chapter 9 Numeracy for Corporate Lawyers Page 25 of 52 Cash flow analysis Is Widget healthy? • Cash flow • Changes in accts Corporations: A Contemporary Approach Chapter 9 Numeracy for Corporate Lawyers Page 26 of 52 Cash flow analysis From Operating Activities • Net income • Decrease (increase) in accts receivable • Decrease (increase) in inventories • Decrease (Increase) in prepaid expenses • Increase (Decrease) in accounts payable • Increase (Decrease) in accrued expenses payable • Depreciation From Investing Activities • Sales (Purchases) of machinery • Sales (Purchases) of office equipment From Financing Activities • Increase (Decrease) in short-term borrowings • Increase (Decrease) in long-term borrowings Increase (Decrease) in Cash Position Corporations: A Contemporary Approach Chapter 9 Numeracy for Corporate Lawyers What happened? FY 2 ($175,000) FY 1 $16,000 Page 27 of 52 Cash flow analysis From Operating Activities • Net income • Decrease (increase) in accts receivable • Decrease (increase) in inventories • Decrease (Increase) in prepaid expenses • Increase (Decrease) in accounts payable • Increase (Decrease) in accrued exp payable • Depreciation FY 2 $390,000 ($235,000) ($205,000) ($5,000) $75,000 $15,000 $250,000 FY 1 $254,000 ($34,000) ($28,000) ($3,000) $25,000 $7,000 $240,000 From investing Activities • Sales (Purchases) of machinery ($65,000) ($378,000) Why did accounts receivable increase by $201,000? Corporations: A Contemporary Approach Chapter 9 Numeracy for Corporate Lawyers Page 28 of 52 Cash flow analysis From Operating Activities • Net income • Decrease (increase) in accts receivable • Decrease (increase) in inventories • Decrease (Increase) in prepaid expenses • Increase (Decrease) in accounts payable • Increase (Decrease) in accrued exp payable • Depreciation FY 2 $390,000 ($235,000) ($205,000) ($5,000) $75,000 $15,000 $250,000 FY 1 $254,000 ($34,000) ($28,000) ($3,000) $25,000 $7,000 $240,000 From investing Activities • Sales (Purchases) of machinery ($65,000) ($378,000) Why did inventories increase by $177,000? Corporations: A Contemporary Approach Chapter 9 Numeracy for Corporate Lawyers Page 29 of 52 Cash flow analysis From Operating Activities • Net income • Decrease (increase) in accts receivable • Decrease (increase) in inventories • Decrease (Increase) in prepaid expenses • Increase (Decrease) in accounts payable • Increase (Decrease) in accrued exp payable • Depreciation FY 2 $390,000 ($235,000) ($205,000) ($5,000) $75,000 $15,000 $250,000 FY 1 $254,000 ($34,000) ($28,000) ($3,000) $25,000 $7,000 $240,000 From investing Activities • Sales (Purchases) of machinery ($65,000) ($378,000) Why did machinery purchases decrease by $313,000? Corporations: A Contemporary Approach Chapter 9 Numeracy for Corporate Lawyers Page 30 of 52 Group hypos [click here] Corporations: A Contemporary Approach Chapter 9 Numeracy for Corporate Lawyers Page 31 of 52 Module IV – Corporate Finance Chapter 9 Numeracy for Corporate Lawyers Bar exam Corporate practice Law profession Citizen of world Corporations: A Contemporary Approach • Financial accounting – Fundamental formula – Accounting statements: Balance sheet, income statement, cash flow statement – Accounting statement analysis Workshop 1 • Business valuation – – – – Future vs. present value Accounting value vs. market value Income vs. cash flow Discounted cash flow Workshop 2 Chapter 9 Numeracy for Corporate Lawyers Page 32 of 52 Corporations: A Contemporary Approach Chapter 9 Numeracy for Corporate Lawyers Page 33 of 52 What is the value of $1,000? Which would you prefer – $800 today or $1,000 in three years? Corporations: A Contemporary Approach Chapter 9 Numeracy for Corporate Lawyers Page 34 of 52 Time value of money Invest $800 Year 1 Year 2 Year 3 10% $80.00 $88.00 $96.80 Balance $880.00 $968.00 $1,064.80 $800 * (1+ .10)3 = $1064.80 Corporations: A Contemporary Approach Chapter 9 Numeracy for Corporate Lawyers Page 35 of 52 Time value of money Invest $800 Year 1 Year 2 Year 3 5% $40.00 $42.00 $44.10 Balance $840.00 $882.00 $926.10 $800 * (1+ .05)3 = $926.10 Corporations: A Contemporary Approach Chapter 9 Numeracy for Corporate Lawyers Page 36 of 52 Future value FV = PV * (1+ i)n FV 7 PV 0 Corporations: A Contemporary Approach 1 2 3 4 5 Chapter 9 Numeracy for Corporate Lawyers 6 Page 37 of 52 You are offered $1,000 in three years from now. What is its present value? Why is this called “discounting”? Corporations: A Contemporary Approach Chapter 9 Numeracy for Corporate Lawyers Page 38 of 52 Discounting to present value Discount $1,000 Year 3 Year 2 Year 1 End of year 20% $1,000 $833 $694 $167 $139 $115 Start of year (divide by 1.20) $833 $694 $579 $1,000 / (1+ .20)3 = $579 Corporations: A Contemporary Approach Chapter 9 Numeracy for Corporate Lawyers Page 39 of 52 Present value PV = FV / (1+ i)n FV 7 6 5 Corporations: A Contemporary Approach 4 3 2 Chapter 9 Numeracy for Corporate Lawyers 1 0 PV Page 40 of 52 Pop Quiz [answers] 1. You put $10,000 in the bank at 3.6% annual interest. How much will you have after 20 years? What about 7.2% in 10 years? 3. You consider buying a vineyard that has annual cash flow of $300,000. It’s risk is similar to that of an apple orchard (discount 20%). Value the vineyard. 2. You are a superstar at your law firm. You are promised an $85,000 bonus if you stay at the firm for 5 years. How much is it worth now? (Law firm’s borrowing rate is 12%.) 4. You look at another vineyard. It has cash flow this year of $250,000, but its cash flows have been increasing each year by 7.5%. Assume a higher discount rate of 25%. Value the vineyard. Corporations: A Contemporary Approach Chapter 9 Numeracy for Corporate Lawyers Page 41 of 52 Business valuation “Accounting is twodimensional; valuation is threedimensional” Corporations: A Contemporary Approach Chapter 9 Numeracy for Corporate Lawyers Page 42 of 52 “Old Man and Apple Tree” Consider the following valuations: • • • • • • • • Corporations: A Contemporary Approach Salvage Current production Future production Market price Book value Comparables (ratio) Capitalization of earnings Discounted cash flow Chapter 9 Numeracy for Corporate Lawyers Page 43 of 52 “Old Man and Apple Tree” The old man figures he’ll have cash flows from the tree of $50 for 5 years, then $40 for 10 years. And then sell the tree as firewood for $50. What is the present value of cash flows? Corporations: A Contemporary Approach Chapter 9 Numeracy for Corporate Lawyers Page 44 of 52 Value of Apple Tree Present Value Year Cash flow 5% 8% 15% 25% 1 50.00 47.62 46.30 43.48 40.00 2 50.00 45.35 42.87 37.81 32.00 3 50.00 43.19 39.69 32.88 25.60 4 50.00 41.14 36.75 28.59 20.48 5 50.00 39.18 34.03 24.86 16.38 6 40.00 29.85 25.21 17.29 10.49 7 40.00 28.43 23.34 15.04 8.39 8 40.00 27.07 21.61 13.08 6.71 9 40.00 25.78 20.01 11.37 5.37 10 40.00 24.56 18.53 9.89 4.29 11 40.00 23.39 17.16 8.60 3.44 12 40.00 22.27 15.88 7.48 2.75 13 40.00 21.21 14.71 6.50 2.20 14 40.00 20.20 13.62 5.65 1.76 15 40.00 19.24 12.61 4.92 1.41 Salvage 50.00 24.05 15.76 6.14 1.76 Total 482.58 398.15 273.71 183.27 Corporations: A Contemporary Approach Chapter 9 Numeracy for Corporate Lawyers Page 45 of 52 Time value of “perpetuity” Discount rate (i) 3% Capitalization multiplier (1/i) 33.3 Mathematically 5% 20 8% 12.5 PV = Pymt / i PV = Pymt * (1/i) 10% 10 15% 6.7 25% 4 40% 2.5 Corporations: A Contemporary Approach *** Suppose a business earns $10,000 per year, with a DR = 15%. It’s PV = $66,666 Chapter 9 Numeracy for Corporate Lawyers Page 46 of 52 Time value of “growing perpetuity” What if somebody offers you $10 each year – growing at 3%, forever! How much do you pay for it, assuming an 8% discount rate? Mathematically (Gordon-Shapiro model) PV = Pymt1 / (d – g) $10 * 1.03 / (.08 - .03) = $10.30 / .05 = $206 ________________ approximately PV = Pymt / (d – g) Corporations: A Contemporary Approach Chapter 9 Numeracy for Corporate Lawyers Page 47 of 52 End of Lecture (group work in class) Corporations: A Contemporary Approach Chapter 9 Numeracy for Corporate Lawyers Page 48 of 52 Valuation of Widget, Inc. (for whom are we doing the valuation?) Corporations: A Contemporary Approach Chapter 9 Numeracy for Corporate Lawyers Page 49 of 52 Valuation methods: • Asset value • Market comparables • Income – Earnings • P/E multiplier • Cap multiplier – Discounted cash flow • Perpetuity • Spreadsheet Corporations: A Contemporary Approach Chapter 9 Numeracy for Corporate Lawyers Page 50 of 52 Assets method (Adjusted book value) Balance Sheet Assets Liabilities [adjusted – some up, some down] [already reflects payout amount] $3,750,000 $5,260,000 [$5,660,000] Equity $1,510,000 [$1,910,000] Corporations: A Contemporary Approach Chapter 9 Numeracy for Corporate Lawyers Page 51 of 52 Market methods (Comparable) Similar companies EBITDA = $10,000,000 Sales price = 23,000,000 Multiplier = 2.3 Widget Inc EBITDA = $1,170,000 Price = 2,691,000 Corporations: A Contemporary Approach Chapter 9 Numeracy for Corporate Lawyers Page 52 of 52 Income methods (Earnings) Earnings P/E multiplier: Earnings * P/E = $390,000 * 4 = $1,560,000 Cap multiplier: Earnings * Cap = $390,000 * (1 / 30%) = $390,000 * 3.33 = $1,300,000 Corporations: A Contemporary Approach Chapter 9 Numeracy for Corporate Lawyers Page 53 of 52 Income methods Discounted cash flow (Cash Flow) Net income $390,000 Depreciation $250,000 Accts rec’ble ($130,000) Inventory ($ 80,000) Bonuses $120,000 Normalized (CF) $500,000 Discount rate Growth rate Capitalization rate 30% 5% 25% (discount minus growth) DCF Corporations: A Contemporary Approach Chapter 9 Numeracy for Corporate Lawyers $2,000,000 Page 54 of 52 What is Widget, Inc. worth? Valuation methods: • Asset value $1.9 million • Market $2.7 million • Earnings $1.5 million • Discounted cash flow $2.00 million Ah, let’s say $2.0 million Corporations: A Contemporary Approach Chapter 9 Numeracy for Corporate Lawyers Page 55 of 52 The end Corporations: A Contemporary Approach Chapter 9 Numeracy for Corporate Lawyers Page 56 of 52 Module IV – Corporate Finance Chapter 9 Numeracy for Corporate Lawyers Bar exam Corporate practice Law profession Citizen of world Corporations: A Contemporary Approach • Financial accounting Day 1 Day 2 Day 3 Day 4 – Fundamental formula – Accounting statements: Balance sheet, income statement, cash flow statement – Financial statement analysis • Business valuation – – – – Future vs. present value Accounting value vs. market value Income vs. cash flow Discounted cash flow Chapter 9 Numeracy for Corporate Lawyers Page 57 of 52