Bank Reconciliation

advertisement

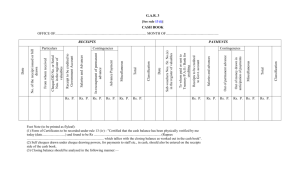

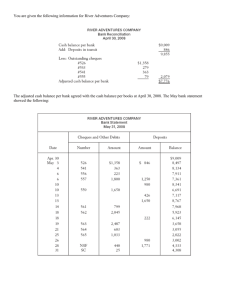

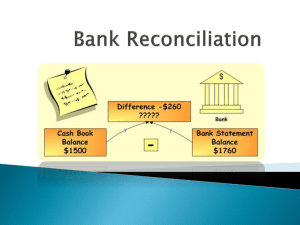

Introduction to bank reconciliation Spot the differences Bank Reconciliation A bank reconciliation is the process of matching the balances in the business records to the bank records. The goal is to find the differences between the two (business records vs bank records) and making changes to the business records as appropriate. Q: Why do business do bank reconciliation? Why do bank reconciliation? • Identify any errors committed by the business or the bank (rare). • Helps the business identify the actual amount of cash available to spend. • Without bank reconciliation you expose your business to risk. Risk of people stealing from your account. Why do bank reconciliation? • The bank reconciliation may also show any undue delay in the clearance of cheques. • A balanced bank reconciliation provides confidence in the accuracy of the business records. Bank Records: Bank Statement Business Records: Compare Find the differences • Cash receipts journal • Cash payment journal • Cash at bank account Tick each entry that appears in both sets of records And circle the entries do not appear in both set of records Entries found in the bank records but missing in the business records should be added to the business records Prepare a cash balance summary Prepare a bank reconciliation statement. What information does the bank statement What is a bank statement? provide? A bank statement is a document that is issued by a bank once a month to its customers. • The beginning cash balance in the account • + The deposited cheques and cash • - Cash withdrawn from the account • - Cheques paid out • + Interest earned on the account • - Bank charges against the account • = Ending cash balance in the account 1) The business owner (Mr. A) makes a cash sale of $200 and deposit the cash into the bank (NAB). • What is the double entry for the business? DR Cash $200, CR Sales $200 • What is the double entry for the bank? DR Cash $200, CR Bank statement (deposit) $200 The $200 the bank received is not from sales, but an obligation/liability to return the $200 to the business owner on demand. Bank Interest earned Bank automatically add interest to the account. When you open an account at a bank, the bank will pay you to keep your money at their bank. Bank charges Bank automatically deducts charges from the account. Examples • Monthly bank service charge - cost of maintaining an account. • Bank charges a fee when a cheque is returned for insufficient funds. • Bank charges a fee on an overdraft account. 2) Mr. A’s bank (NAB) deducts a bank charge of $6. • What is the double entry for the business? DR Bank charges $6, CR Cash $6 • What is the double entry for the bank? DR Bank statement $6, CR Bank service charge revenue $6 When bank charges Mr. A $6, the bank earns $6. Bank Statement Date XXX XXX XXX XXX Description Balance b/f Cash Sales Bank interest earned Monthly bank service charge DR CR Balance 200.00 5.00 6.00 √ √ 0 200.00 CR 205.00 CR 199.00 CR Missing in cash receipts journal Cash receipts journal (DR) Date xxx Particulars Cash sales Rec no. Debtors Cash sales xx Sundries 200.00 Bank 200.00 200.00 Cash payments journal (CR) Date xxx Particulars Chq no. Creditors Monthly bank service charge Cash Purchase Sundries 5.00 Bank 5.00 5.00 Mr. A made an error √ Bank reconciliation & Reconciling Items Reconciling Items • • • • • • Unrecorded deposits Unpresented cheques Business errors and Bank errors (rare) Bank Transfer /EFT Bank Interest earned Bank charges Case Study Bella needs to buy a beautiful prom dress for the prom night. Mr John Brown is a fantastic tailor and he owns a neighbourhood dress shop. Bella decides to purchase a custom made dress which cost her $700. Unrecorded deposits Bella gave John a cheque of $700. John entered this transaction into his cash receipts journal. At the end of the day, he deposited the cheque into his bank account. John’s bank did not have a chance to process the cheque; and the bank statement has already been prepared. Unrecorded deposits Receipts that have been recorded in the cash receipts journal and taken to the bank at the end of the day; but at that time the bank statement has been prepared; and the bank have not processed those receipts. Unpresented cheques John ordered some silk cloth from Jay Enterprise to make Bella’s prom dress. He wrote a cheque of $200 to Jay Enterprise and sent it by mail. He entered this transaction into his cash payments journal. John’s bank statement has already been prepared, but the cheque has not been presented for payment at the bank. Unpresented cheques Cheques that have been written, sent and recorded in the cash payments journal; but at that time the bank statement has been prepared; and the cheques have not been presented for payment at the bank. Bank Statement Date 01/04/2012 04/04/2012 05/04/2012 09/04/2012 11/04/2012 15/04/2012 16/04/2012 17/04/2012 17/04/2012 18/04/2012 20/04/2012 23/04/2012 26/04/2012 30/04/2012 30/04/2012 Particulars Debits Credits Balance brought forward C/c 2,300.00 276 1,200.00 C/c 500.00 277 2,800.00 Monthly service charge 10.00 Interest 6.00 278 1,500.00 Fee - overdrawn account 30.00 C/c 200.00 C/c 2,400.00 C/c 200.00 279 2,000.00 Returned Cheque - Nancy 200.00 Fee - returned cheque 25.00 Balance 2,565.00 CR 4,865.00 CR 3,665.00 CR 4,165.00 CR 1,365.00 CR 1,355.00 CR 1,361.00 CR 139.00 DR 169.00 DR 31.00 CR 2,431.00 CR 2,631.00 CR 631.00 CR 431.00 CR 406.00 CR C/c = Cash and Cheques deposited Cash receipts journal (DR) Date Particulars 3/04/2012 Angel Bridal Shop 8/04/2012 Wendy 17/04/2012 Nancy 19/04/2012 Kelly Fashion 22/04/2012 Sewing equipment 30/04/2012 Bella Rec no. 128 CRR 129 130 CRR 131 Debtors 2,300.00 Sundries 500.00 200.00 2,400.00 200.00 700.00 5,600.00 CRR = Cash register roll - money received over the counter. Cash sales 500.00 200.00 Bank 2,300.00 500.00 200.00 2,400.00 200.00 700.00 6,300.00 Bank Statement Date 01/04/2012 04/04/2012 05/04/2012 09/04/2012 11/04/2012 15/04/2012 16/04/2012 17/04/2012 17/04/2012 18/04/2012 20/04/2012 23/04/2012 26/04/2012 30/04/2012 30/04/2012 Particulars Debits Credits Balance brought forward C/c 2,300.00 276 1,200.00 C/c 500.00 277 2,800.00 Monthly service charge 10.00 Interest 6.00 278 1,500.00 Fee - overdrawn account 30.00 C/c 200.00 C/c 2,400.00 C/c 200.00 279 2,000.00 Returned Cheque - Nancy 200.00 Fee - returned cheque 25.00 Balance 2,565.00 CR 4,865.00 CR 3,665.00 CR 4,165.00 CR 1,365.00 CR 1,355.00 CR 1,361.00 CR 139.00 DR 169.00 DR 31.00 CR 2,431.00 CR 2,631.00 CR 631.00 CR 431.00 CR 406.00 CR C/c = Cash and Cheques deposited Cash payments journal (CR) Date Particulars 4/04/2012 Rent 10/04/2012 Sewing machine 16/04/2012 Natalie - employee 25/04/2012 AB Fabric Pty Ltd 30/04/2012 Jay Enterprise Chq no. 276 277 278 279 280 Creditors Cash Purchases Wages 2,800.00 1,500.00 2,000.00 200.00 2,200.00 2,800.00 1,500.00 Rent Sundries Bank 1,200.00 1,200.00 2,800.00 1,500.00 2,000.00 200.00 1,200.00 7,700.00 Bank Statement Date 01/04/2012 04/04/2012 05/04/2012 09/04/2012 11/04/2012 15/04/2012 16/04/2012 17/04/2012 17/04/2012 18/04/2012 20/04/2012 23/04/2012 26/04/2012 30/04/2012 30/04/2012 Particulars Debits Balance brought forward C/c 276 1,200.00 C/c 277 2,800.00 Monthly service charge 10.00 Interest 278 1,500.00 Fee - overdrawn account 30.00 C/c C/c C/c 279 2,000.00 Returned Cheque - Nancy 200.00 Fee - returned cheque 25.00 Credits 2,300.00 √ 500.00 √ 6.00 200.00 √ 2,400.00 √ 200.00 √ Balance 2,565.00 CR 4,865.00 CR 3,665.00 CR 4,165.00 CR 1,365.00 CR 1,355.00 CR 1,361.00 CR 139.00 DR 169.00 DR 31.00 CR 2,431.00 CR 2,631.00 CR 631.00 CR 431.00 CR 406.00 CR C/c = Cash and Cheques deposited Cash receipts journal (DR) Date Particulars 3/04/2012 Angel Bridal Shop 8/04/2012 Wendy 17/04/2012 Nancy 19/04/2012 Kelly Fashion 22/04/2012 Sewing equipment 30/04/2012 Bella CRR = Cash register roll - money received over the counter. Rec no. 128 CRR 129 130 CRR 131 Debtors Cash sales Sundries 2,300.00 500.00 200.00 2,400.00 200.00 700.00 5,600.00 500.00 200.00 Bank 2,300.00 500.00 200.00 2,400.00 200.00 700.00 6,300.00 √ √ √ √ √ Bank Statement Date 01/04/2012 04/04/2012 05/04/2012 09/04/2012 11/04/2012 15/04/2012 16/04/2012 17/04/2012 17/04/2012 18/04/2012 20/04/2012 23/04/2012 26/04/2012 30/04/2012 30/04/2012 Particulars Debits Balance brought forward C/c 276 1,200.00 C/c 277 2,800.00 Monthly service charge 10.00 Interest 278 1,500.00 Fee - overdrawn account 30.00 C/c C/c C/c 279 2,000.00 Returned Cheque - Nancy 200.00 Fee - returned cheque 25.00 Credits 2,300.00 √ √ 500.00 √ √ 6.00 √ 200.00 √ 2,400.00 √ 200.00 √ √ Balance 2,565.00 CR 4,865.00 CR 3,665.00 CR 4,165.00 CR 1,365.00 CR 1,355.00 CR 1,361.00 CR 139.00 DR 169.00 DR 31.00 CR 2,431.00 CR 2,631.00 CR 631.00 CR 431.00 CR 406.00 CR C/c = Cash and Cheques deposited Cash payments journal (CR) Date Particulars 4/04/2012 Rent 10/04/2012 Sewing machine 16/04/2012 Natalie - employee 25/04/2012 AB Fabric Pty Ltd 30/04/2012 Jay Enterprise Chq no. Creditors Cash Purchase 276 277 2,800.00 278 279 2,000.00 280 200.00 2,200.00 2,800.00 Wages Rent Sundries 1,200.00 1,500.00 1,500.00 1,200.00 - Bank 1,200.00 2,800.00 1,500.00 2,000.00 200.00 7,700.00 √ √ √ √ Cash receipts journal (DR) Date Particulars Rec no. Debtors Cash sales Sundries Bank 3/04/2012 Angel a Bridal Shop 2,300.00 As you add transaction, put a128 tick 2,300.00 beside it in the bank 8/04/2012 Wendy CRR 500.00 500.00 statement, cash receipts journal and cash payments journal. 16/04/2012 Interest 6.00 It 6.00 17/04/2012 Nancy 200.00 indicates that the those missing129entries have been recorded. 200.00 19/04/2012 Kelly Fashion 130 2,400.00 2,400.00 22/04/2012 Sewing equipment CRR 200.00 200.00 30/04/2012 Bella 131 700.00 700.00 30/04/2012 Returned Cheque - Nancy (200.00) (200.00) 5,400.00 500.00 206.00 6,106.00 √ √ √ √ √ √ √ Cash payments journal (CR) Date Particulars 4/04/2012 Rent 10/04/2012 Sewing machine 15/04/2012 Monthly Service charge 16/04/2012 Natalie - employee 17/04/2012 Fee - overdrawn account 25/04/2012 AB Fabric Pty Ltd 30/04/2012 Jay Enterprise 30/04/2012 Fee - returned cheque Chq no. Creditors Cash Purchases 276 277 2,800.00 Wages Rent Sundries 1,200.00 10.00 278 1,500.00 30.00 279 280 2,000.00 200.00 2,200.00 2,800.00 1,500.00 1,200.00 25.00 65.00 Bank 1,200.00 2,800.00 10.00 1,500.00 30.00 2,000.00 200.00 25.00 7,765.00 √ √ √ √ √ √ √ Cash balance summary as at 30 April 2012 Opening balance $ 2,565.00 Add cash receipts 6,106.00 Less cash payments 7,765.00 Closing balance Opening balance from bank statement Total from cash receipts journal Total from cash payments journal 906.00 MATCH Bank reconciliation statement as at 30 April 2012 Balance as per bank statement $ 406.00 Closing balance from bank CR statement Add Unrecorded deposit 700.00 Item circle/ highlight from cash receipts journal Less Unpresented cheques 200.00 Item circle/ highlight from cash payments journal Balance as per business cash records 906.00 CR