partnership – introduction - e-CTLT

advertisement

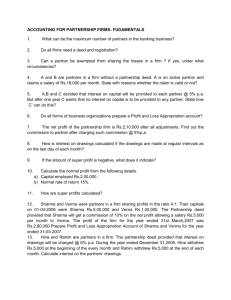

Partnership Act 1932 : Partnership Act 1932 Partnership Contract : ‘concurrent subject’( in Entry 7 of List III (Seventh Schedule to Constitution). Indian Partnership Act is a Central Act, special types of Contract Unlimited liability is the major disadvantage Partnership Firm is not a legal entity Definition of partnership : Definition of partnership “Partnership is the relation between persons who have agreed to share the profits of a business carried on by all or any one of them acting for all.” ESSENTIALS OF A PARTNERSHIP : ESSENTIALS OF A PARTNERSHIP AGREEMENT ASSOCIATION OF TWO OR MORE PERSONS SHARING OF PROFITS BUSINESS RELATION BETWEEN PARTNERS The No. of partners in a firm shall not exceed 20 partnership having more than 20 persons is illegal . When there is partnership between two firms, all the partners of each firm will be taken into account. If the partnership is between the karta or member of Hindu undivided family the members of the joint Hindu family will not be taken into account Essentials elaborated : Essentials elaborated A. agreement competent to contract. the age of majority sound mind and is not disqualified from contracting by any law to which he is subject B The following can enter into a partnership INDIVIDUAL FIRM HINDU UNDIVIDED FAMILY COMPANY TRUSTEES MUTUAL AGENCY IS THE REAL TEST - The real test of ‘partnership firm’ is ‘mutual agency’, i.e. whether a partner can bind the firm by his act, i.e. whether he can act as agent of all other partners. Persons who have entered into partnership with one another are called individually “partners” and collectively “a firm”, and the name under which their business is carried on is called the “firm name Partnership Firm is not a legal entity - It may be surprising but true that a Partnership Firm is not a legal entity. It has limited identity for purpose of tax law. As per section 4 of Indian Partnership Act, 1932, 'partnership' is the relation between persons who have agreed to share the profits of a business carried on by all or any one of them acting for all. - - Under partnership law, a partnership firm is not a legal entity, but only consists of individual partners for the time being. It is not a distinct legal entity apart from the partners constituting it Difference between partnership and Company : Difference between partnership and Company Regulating act Number of members Entity Liability Authority of members Management Transfer of Interest Audit Registration Winding Up Ownership of the property Agency shareholder not agents Contracting with the co. shareholder can do, partner cannot do with firm Ultra vires in Co., not so in Partnership Types of partnership : Types of partnership Partnership at will Particular partnership( specific venture) Kinds of Partners Active / actual / ostensible partners: must give public notice of his retirement Sleeping/ dormant partners: undisclosed principal, have voice in Mgt .not required to give PNoR Silent partners: no voice in Mgt., fully liable for P/LPartner in profits only: No voice in Mgt. only for P. now started in India, in LLP Sub partner: A partner agrees to share his P with O/S this O/S is Sub Partner Partner by estoppel /holding out/ Quasi Partner/ Nominal Partner: No agreement but the person holds out, represents himself to be a partner, becomes responsible to O/s as partner. It is not necessary that representation must be made directly to the person so giving credit. Formation Of Partnerships : Formation Of Partnerships May be formed by oral or written agreement All essential of valid contract be present Mutual rights and Obligation to be in Partnership Deed The deed to be registered Partnership Deed : Partnership Deed A partnership deed should contain the following clause Name of the parties Nature of business Duration of partnership Name of the firm Capital Share of partners in profits and losses Banking, Account firm Books of account Powers of partners Retirement and expulsion of partners Death of partner Dissolution of firm Settlement of disputes GENERAL DUTIES OF A PARTNER : GENERAL DUTIES OF A PARTNER- A. Absolute Duties carry on the business with common advantage just and faithful render true accounts to provide full information To indemnify for loss caused by fraud liable jointly and severally not to assign his interest B. Qualified duties Not to carry on business competing with the firm indemnify the firm for wilful neglect carry out the duties diligently to work without remuneration to contribute to losses Partners use firms property exclusively for the firm to account for personal profits derived RIGHTS OF THE PARTNERS : RIGHTS OF THE PARTNERS To take part in the conduct and management of the business free access to all the records To express opinion in matters connected with the business share in the profits of the business To get interest on the payment of advance To be indemnified by the firm against losses or expenses Registration of Firms : Registration of Firms not compulsory Time of registration Procedure for registration Change of particulars Effects of non registration Procedure for registration : Procedure for registration sending by post /delivering to the Registrar of Firms of the area a statement in the prescribed form and accompanied by the prescribed fee, Signed by all partners/ agents Following to be in the application: The firm name the place or principal place of business of the firm; the names of any other places where the firm carries on business; the date when each partner joined the firm; the names in full and permanent addresses of the partners; and the duration of the firm Effects of non Registration : Effects of non Registration No suit in a civil court by a partner against the firm or co partner No suit in civil court against third parties Firm or partners cannot make claim to set off other proceeding based upon a contract Registration of firms from IT is different from the above registration. For the purpose of assessment under IT separate registration with IT is required. authorities : authorities Express authority Implied authority: acts of a partner which incidental or usually done in the course of the business. In case of emergency; all acts as prudent The implied authority of a partner does not empower him to Submit a dispute relating to the business of a firm to arbitration Open a bank account in his own name Compromise or relinquish any claim of the firm Withdraw a suit or proceeding on behalf of the firm Admit any liability in a suit or proceeding against the firm Acquire immovable property on behalf of the firm Transfer immovable property belonging to the firm, or Enter into partnership on behalf of the firm Liabilities of partners to third parties : Liabilities of partners to third parties L of a partner for acts of the firm: liable jointly and severally L of firm for wrongful act of partner: firm liable to 3rd party for loss caused by partner ,the same will be borne by the partner who committed the fraud and not shared by the partners L of firm for misapplication by partners: if partner misappropriates received in repayment on account of the firm, 3rd party can make the firm liable for it PARTNERSHIP – INTRODUCTION 1. Define partnership. Accounts to section -4 of the Indian partnership act 1932, partnership is the relation between persons who have agreed to share the profits of a business carried on by all or any of them acting for all. 2. Characterstics of partnership. The essential element of a partnership are as follows . (1) There must be two or more persons to form a partnership (2) There must be an agreement .This agreement may be written oral . (3) The agreement must be conduct a business for profit. (4) There must be sharing of profit . (5) There must be a mutual agency . It is because of this mutual agency that the business may be carried by all or any of them acting for all. 3. What is partnership deed? What are its important contents ? Partnership deed is a document which contains the term of partner as agreed among the partners . In other words , the documents in writing containing various terms and condition as the relationship of the partners to each other is called the partnership deed . Contents of partnership deed :(1) Name and address of the firm . (2) Nature and place of business . (3) Commencement of business and its duration . (4) Capital of each partners . (5) Rights and duties of partners . (6) Safe custody of accounts . 4. What are the accounting provision of the Indian partnership act that will apply in the absence of any agreement between the partners ? (1) Sharing of profits and losses => profits and losses share equally. (2) Interest on capital => No interest is to be allowed. (3) Interest on drawings => No interest is to be allowed. (4) Remuneration => No remuneration is to be allowed in any partner. (5) Interest on loans => Interest @ 6% is to be allowed. 5. Basic Fixed capital Fluctuating capital 1. Change in capital It remains unchanged unless further capital is introduced or capital is withdraw. Along with fixed capital accounts , current accounts are also maintained. Fixed capital accounts of partners will always have credit balance. It fluctuates quite frequently from time to time. 2. No. of accounts 3. Balance Only capital accounts are maintained. Fluctuating capital accounts may have debit balance also. 6. List the items that may appears on the credit side of a partners fluctuating capital accounts. (1) By balance b/d down (opening balance of capital). (2) By cash A/c. (3) By interest on capital. (4) By salary A/c. (5) By profit and loss A/c. (6) By goodwill A/c. (7) By balance c/d (closing balance of capital). 7. Ujala , Jyoti and Kiran were capital are fixed of Rs. 50000, Rs. 40000 respectively, profits before interest were divided among the partners for a year ending. Particular Ujala Jyoti Kiran Total 1. Interest on capital. 6000 (cr.) 4800 (cr.) 3600 (cr.) 14400 2. Loss due to interest should be equally Total 4800 (dr.) 4800 ( dr.) 4800 ( dr.) 14400 1200 Nil 1200 ___ Kiran’s current A/c To Ujala’s current A/c 1200 1200 10. The capital’s of A,B,C stood at Rs. 20000 , Rs. 15000 and Rs. 10000 respectively. After the necessary adjustment in respect of drawings and net profit . It was discovered that interest on capital at 10% and interest on drawings Rs. 130, Rs. 90 and Rs. 50 respectively. Profit of the year already adjusted was Rs. 10000. Calculation of opening capital Particulars Closing capital Add:- Drawings Less:-profit 10000 (2:1:1 ) A 20000 1000 5000 B 15000 800 2500 C 10000 500 2500 16000 13330 8000 P&L A/c (app. A/c) To int. on capital A- 1600 Br profit 10000 BCTo net profit A 3270 B 1635 C 1635 Adjustment Int. on capital Int. on drawings Net profit Previous profit 1330 800 By int. on drawing A 130 B 90 C 50 6540 10270 A 1600 ( cr. ) 130 (dr.) 3270 5000 260 A’s cap. A/c 260 C’s cap. A/c 115 To B’s cap. A/c 270 10270 B 1330 (cr.) 90 ( dr.) 1635 2500 375 C 800 (cr.) 50 ( dr.) 1635 2500 115 375 11. Mr. Manish Vikas Tharki is a particular in a firm . He withdraws the following amts. For 1998 for personal use. DATE Jan 31 2000 March 1 3000 Sept. 1 1000 Dec. 31 500 Date Jan 31 March 01 Sep 01 Dec 31 Amt. 2000 3000 1000 500 Months 11 10 4 0 Total Product 22000 30000 4000 0 56000 Int. on drawings = 56000 X 15/100 X 1/12 = Rs. 700 P & L ( App. A/c ) Particular To P&L A/c. ( If loss can transferred from P&L A/c) Amts To salary to par. To int. on capital To net profit - Particulars By P & L By int. on drawing By net loss - Amts - Fixed Accounts Particular capital A/c To cash A - To balance C/d B - - A By balance b/d By G.R By realization By interest on capital By P&l ad B - A B - Particular current a/c A B To drawings To interest on drawings To balance c/d By interest on capital By share profit