Cost estimation and cost behaviour

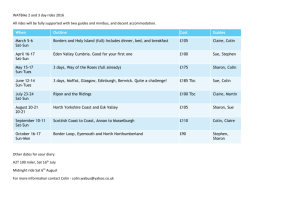

advertisement

MANAGEMENT AND COST ACCOUNTING SIXTH EDITION COLIN DRURY Management and Cost Accounting, 6th edition, ISBN 1-84480-028-8 © 2004 Colin Drury Part Six: The application of quantitative methods to management accounting Chapter Twenty-four: Cost estimation and behaviour Management and Cost Accounting, 6th edition, ISBN 1-84480-028-8 © 2000 Colin Drury © 2004 Colin Drury 24.1a General principles • A regression equation (or cost function) measures past relationships between a dependent variable (total cost)and potential independent variables (i.e.cost drivers/activity measures). • Simple regression y = a + bx Where y = Total cost a = Total fixed cost for the period b = Average unit variable cost x = Volume of activity or cost driver for the period • Multiple regression y = a + b1 x1 + b2 x2 • Resulting cost functions must make sense and be economically plausible. Management and Cost Accounting, 6th edition, ISBN 1-84480-028-8 © 2000 Colin Drury © 2004 Colin Drury 24.1b Cost estimation methods 1. Engineering methods 2. Inspection of accounts method 3. Graphical or scattergraph method 4. High-low method 5. Least squares method. Management and Cost Accounting, 6th edition, ISBN 1-84480-028-8 © 2000 Colin Drury © 2004 Colin Drury 24.2 Engineering methods • Analysis based on direct observations of physical quantities required for an activity and then converted into cost estimates. • Useful for estimating the costs of repetitive processes where input-output relationships are clearly defined. • Appropriate for estimating the costs associated with direct labour, materials and machine time. Inspection of accounts • Departmental manager and accountant inspect each item of expenditure within the accounts for a particular period and classify each item as fixed, variable or semi-variable. Management and Cost Accounting, 6th edition, ISBN 1-84480-028-8 © 2000 Colin Drury © 2004 Colin Drury 24.3 Graphical or scattergraph method • Past observations are plotted on a graph and a line of best fit is drawn. • Unit VC = Difference in cost = £720 – £560 Difference in activity 240 hours – 160 hours = £2 per hour • Y = £240 + £2x Management and Cost Accounting, 6th edition, ISBN 1-84480-028-8 © 2000 Colin Drury © 2004 Colin Drury 24.4a High – low method • Involves selecting the periods of highest and lowest activity levels and comparing changes in costs that result from the two levels. Example Lowest activity 5,000 units £22,000 Highest activity 10,000 units £32,000 Cost per unit = £10,000/5,000 units = £2 per unit Fixed costs = £22,000 – (5,000 × £2) = £12,000 • Major limitation = Reliance on two extreme observations Management and Cost Accounting, 6th edition, ISBN 1-84480-028-8 © 2000 Colin Drury © 2004 Colin Drury 24.4b Figure 24.2 High – low method. Management and Cost Accounting, 6th edition, ISBN 1-84480-028-8 © 2000 Colin Drury © 2004 Colin Drury 24.5a The least squares method Management and Cost Accounting, 6th edition, ISBN 1-84480-028-8 © 2000 Colin Drury © 2004 Colin Drury 24.5b Management and Cost Accounting, 6th edition, ISBN 1-84480-028-8 © 2000 Colin Drury © 2004 Colin Drury 24.6a Multiple regression analysis Management and Cost Accounting, 6th edition, ISBN 1-84480-028-8 © 2000 Colin Drury © 2004 Colin Drury 24.6b Multiple regression analysis contd. Management and Cost Accounting, 6th edition, ISBN 1-84480-028-8 © 2000 Colin Drury © 2004 Colin Drury 24.7 Factors to be considered when using past data to estimate cost functions • Identify the potential activity bases (i.e. cost drivers) 1. The objective is to find the cost driver that has the greatest effect on cost. • Ensure that the cost data and activity measures relate to the same period. • Some costs lag behind the associated activity measures (e.g.wages paid for the output of a previous period). • Ensure that a sufficient number of observations are obtained. • Ensure that accounting policies do not lead to distorted cost functions. • Adjust for past changes so that all data relates to the circumstances of the planning horizon. • Adjust for inflation,technological changes and observations based on abnormal situations. Management and Cost Accounting, 6th edition, ISBN 1-84480-028-8 © 2000 Colin Drury © 2004 Colin Drury 24.8 Summary 1. Select the dependent variable (y) to be predicted. 2. Select the potential cost drivers. 3. Plot the observations on a graph.* 4. Estimate the cost function. 5.Test the reliability of the cost function. *Be aware of the dangers of predicting costs outside the relevant range. Management and Cost Accounting, 6th edition, ISBN 1-84480-028-8 © 2000 Colin Drury © 2004 Colin Drury 24.9 Tests of reliability 1. Coefficient of determination (r²) See Exhibits 24A.1 (page 1059) and 24A.2 (page 1059) for the calculation of r² of 0.8861. r² of 0.8861 indicates that 88.61% of the variation in total cost is explained by variations in the activity base and the remaining 11.39% is explained by either random variation or the effect of other (omitted)variables on total cost. 2. Standard error of the estimate Gives an indication of the absolute size of the probable deviations from the line. For example, in Exhibit 24A.1 on page 1059 there is a 0.90 probability that the true cost for an activity of 180 hours will fall within the range: £2 400 1.812 (201.25) = £2 035 to £2 765 3. Standard error of the coefficient Focuses on the regression coefficient b (i.e. variable cost) In Exhibit 24A.1 there is a 0.90 probability that the true variable cost lies within the range £7.95 to £12.05. Management and Cost Accounting, 6th edition, ISBN 1-84480-028-8 © 2000 Colin Drury © 2004 Colin Drury 24.10a Management and Cost Accounting, 6th edition, ISBN 1-84480-028-8 © 2000 Colin Drury © 2004 Colin Drury 24.10b Management and Cost Accounting, 6th edition, ISBN 1-84480-028-8 © 2000 Colin Drury © 2004 Colin Drury 24.11a Mathematical method Management and Cost Accounting, 6th edition, ISBN 1-84480-028-8 © 2000 Colin Drury © 2004 Colin Drury 24.11b Mathematical method contd. Management and Cost Accounting, 6th edition, ISBN 1-84480-028-8 © 2000 Colin Drury © 2004 Colin Drury