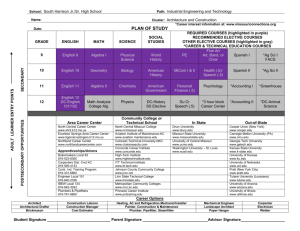

management and cost accounting

advertisement

MANAGEMENT AND COST ACCOUNTING SIXTH EDITION COLIN DRURY Management and Cost Accounting, 6th edition, ISBN 1-84480-028-8 © 2000 Colin Drury © 2004 Colin Drury Part Five: Cost management and strategic management accounting Chapter Twenty-three: Strategic management accounting Management and Cost Accounting, 6th edition, ISBN 1-84480-028-8 © 2000 Colin Drury © 2004 Colin Drury 23.1 What is strategic management accounting (SMA) • The provision of information to support strategic decisions in organizations (Innes,1998). • Review of literature by Lord (1996) identified the following strands: 1. 2. 3. Extension from internal focus of management accounting (MA) to include external information about competitors. The relationship between the strategic position chosen by the firm and the expected emphasis on MA. Gaining competitive advantage through exploiting linkages in the value chain. • Target costing is also identified as falling within the domain of SMA. • Strategic role of MA emphasized in formulating and supporting the overall strategy of an organization by developing an integrated framework of performance measurement. Management and Cost Accounting, 6th edition, ISBN 1-84480-028-8 © 2000 Colin Drury © 2004 Colin Drury 23.2a External information about competitors • MA should help firm evaluate its competitive position relative to the rest of the industry. • Managers require information that indicates by whom and by how much they are gaining or being beaten. Management and Cost Accounting, 6th edition, ISBN 1-84480-028-8 © 2000 Colin Drury © 2004 Colin Drury 23.2b Accounting in relation to strategic positioning • Advocates that firms should place more emphasis on particular techniques depending upon the strategic position they adopt. • Evidence to suggest that: 1. 2. 3. Business units following a defender strategy place a greater emphasis on the use of financial measures for rewarding managers. Non-financial measures for determining executives’ bonuses increases with the extent to which firms follow prospector strategies. Businesses following a build strategy rely more on non-financial measures of performance for determining managers’ bonuses. • Advocated that defenders (Miles and Snow) and business units pursuing a low cost strategy (Porter) should adopt results measures that emphasize cost reductions and budget achievement. • Business units competing on the basis of differentiation (Porter) or those prospecting new markets should require more information than a cost leader about new product innovations, design cycle times and research and development. Management and Cost Accounting, 6th edition, ISBN 1-84480-028-8 © 2000 Colin Drury © 2004 Colin Drury 23.3 Gaining competitive advantage through exploiting linkages in the value chain • Focuses on each link in the chain from the customer’s perspective. • Claimed that traditional management accounting starts too late and finishes too soon in terms of the value chain. • Porter advocates identifying the value chain and operation of cost drivers of competitors in order to understand relative competitiveness. Management and Cost Accounting, 6th edition, ISBN 1-84480-028-8 © 2000 Colin Drury © 2004 Colin Drury 23.4 The balanced scorecard • Traditionally MA focused mainly on financial performance measures. • Greater emphasis now being given to incorporating non-financial measures into the formal reporting system. • Result was a proliferation of performance measures. • To integrate financial and non-financial measures the Balanced Scorecard (BSC) emerged. • BSC seeks to link performance measures to an organization’s strategy — Should be used to clarify, communicate and manage strategy. Management and Cost Accounting, 6th edition, ISBN 1-84480-028-8 © 2000 Colin Drury © 2004 Colin Drury 23.5 • BSC Advocates looking at the business from four different perspectives by seeking to provide answers to the following four basic questions: 1. 2. 3. 4. How do customers see us? (customer perspective) What must we excel at? (internal business process perspective) Can we continue to improve and create value? (learning and growth perspective) How do we look to shareholders? (financial perspective) • To implement the BSC the major objectives for each of the 4 perspectives should be articulated and these objectives should be translated into specific performance measures. • A critical assumption of BSC is that each performance measure is part of a cause-andeffect relationship. • The BSC consists of two types of performance measures: 1. 2. Lagging measures Leading measures Management and Cost Accounting, 6th edition, ISBN 1-84480-028-8 © 2000 Colin Drury © 2004 Colin Drury 23.6 Figure 23.1 The Balanced Scorecard (Source: Kaplan and Norton, 1996b) Management and Cost Accounting, 6th edition, ISBN 1-84480-028-8 © 2000 Colin Drury © 2004 Colin Drury 23.7a The financial perspective • Typical measures include ROI, RI and EVA TM • Besides targets for the above, other objectives include revenue growth, cost reduction and asset utilization. • Argued by some that by focusing on other perspectives, financial measures will take care of themselves. The customer perspective • Typical generic measures include: 1. Market share 2. Customer retention and loyalty 3. Customer acquisition 4. Customer satisfaction 5. Customer profitability Management and Cost Accounting, 6th edition, ISBN 1-84480-028-8 © 2000 Colin Drury © 2004 Colin Drury 23.7b The internal business perspective • Critical internal processes for which the organization must excel (e.g.innovation, operation and post-service sales processes). • Typical innovation measures include: 1. Percentage of sales from new products. 2. New product introduction versus competitors. 3. Product development break-even time. • Typical operation process measures include: 1. Cycle time 2. Quality 3. Activity and process costs • Post-sales service processes: 1. Develop appropriate time,quality and process measurements. Management and Cost Accounting, 6th edition, ISBN 1-84480-028-8 © 2000 Colin Drury © 2004 Colin Drury 23.8 The learning and growth perspective • Focuses on the infrastructure that the business must build to create longterm growth and improvement. • Three principal categories identified: 1. Employee capabilities 2. Information system capabilities 3. Motivation,empowerment and alignment Management and Cost Accounting, 6th edition, ISBN 1-84480-028-8 © 2000 Colin Drury © 2004 Colin Drury