Follow-the-Money Methods of Crime Control: An Appraisal

advertisement

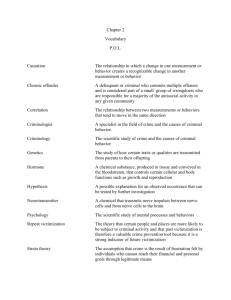

Follow-the-Money Methods of Crime Control: An Appraisal by R. T. Naylor Professor of Economics McGill University Montreal Follow-the-Money Strategy: • • • • • Makes big changes in criminal law Revolutionizes law enforcement methods Conscripts private financial sector Transforms client-institution relations Complicates international relations Follow the Money Strategy: The Basic Questions 1. 2. 3. 4. 5. What is it? Why was it adopted? How does it operate? Does it work? What kind of “collateral damage” 1.What: The U.S. Model • • • • • New crime “money laundering” New reporting requirements Facilitate freeze and forfeit “Proceeds of crime ” to the police Operates nationally and internationally Traditional Financial Investigations 1) Reactive 2) Case-by-case 3) Usually target predatory crimes 4) Seeking evidence against perpetrators 5) And/or restitution to victims Modern Financial Investigations 1) Proactive (including stings) 2) Targets criminal economy 3) Usually market-based crimes 4) Object to seize “proceeds” 5) To punish and deter 2. Why Was It Adopted? a. b. c. d. e. f. Logic of deterrence Presumed sums Danger of “cartels” Threat of infiltration View of banker Secret agendas? a. The Logic of Deterrence Taking away the money removes: - motive to commit new crimes - means to commit new crimes - capacity to infiltrate the legal economy Motives and Mores? A Changing View of Crime • Old View: Focus social context • New View: Criminal as cost-benefit calculator • Other motives ignored or downplayed: - Peer pressure - Lack of alternatives? - Pyscho-social disorders - Stupidity of certain criminal laws b. A World Awash With Criminal Money? • • • • • • • World drug trade: $500 billion per annum! US share: $100-150 billion! Laundered Money = 2-5% World GDP! Meyer Lansky’s assets: $300 million John Gotti’s annual income: $350 million! Pablo Escobar’s fortune: $2-14 billion! World GCP: $1.2 trillion! Criminal Income: What is Really Known About… • • • • • • • Amount? Trend? Distribution? % Profit? % Laundered? % Legally Invested? Impact? Existing Scientific Knowledge First Law of Crimodynamics “You do not have to take the square root of a negative sum to arrive at a perfectly imaginary number.” . c. The Criminal “Firm” (I) The Harvard MBA Model • • • • • • • Large organizations Hierarchical structures Long term planning Huge profits Profits concentrated Infiltrate legal economy Corrupt legal markets The Criminal “Firm" (II) The Rotary Club Model • • • • • • • Individuals and small groups Arms length, ad hoc relations Opportunistic Modest profits Profits widely shared Cash mainly on street Rare and usually benign infiltration d. Threat of Criminal Infiltration “The business community is so infected by drug money we can’t handle it with law enforcement tools alone.” Director, U.S. National Drug Intelligence Center “Approximativement 90% des clubs, bars et brasseries sont contrôlés par le crime organisé.” Montreal Police Study Why Criminal Money Enters the Legal Economy • • • • • • Long term security Inheritance Reducing risk to income Tax cover Supporting rackets Applying criminal methods to extract profit e. Role of the Banker Banker Police Client f. A Hidden Agenda? • A.G. Official: “The potential in this area is really unlimited. My guess is that, with adequate forfeiture laws, we could….” • Senator: “We could balance the budget?” • A.G. Official: “There clearly would be millions and hundreds of millions available” Senate Judiciary Committee 1982 3. How: Changing Relations of Banker, Client and Police: OLD NEW Client Police Police Client Banker Banker Information Flows and Client Relations Report CTR STR KYC Banker Information Client passive objective aware (conduit) reactive subjective aware (?) but (informant) uninformed proactive subjective unaware & (private eye?) uninformed The Financial Analysis Centre • • • • • Customer Bank clerk Bank manager Bank security Financial centre Bank clerk Bank manager Bank security Financial centre Tax authority Police Intelligence agency Financial Institution Vulnerability • Criminal charges - fines - suspension of charter - “death penalty” • Civil penalties - fines - forfeitures • Social fallout - flight of clients - civil suits - falling share values 4. Do New Reporting Requirements Work?: • deluge of information self-defeating • institutions in conflict of interests • premium on rumour, bias, stereotype • out of sync with modern banking The CTR Defeated by: • Evasion techniques • Sheer mass • Good business cover The STR Problems: • training of front-line staff • lack of objective standards • propensity to over-reporting • changing nature of banking -- centralized deposit processing -- spread of electronic banking KYC Rules • changing nature of banking • need to “know” - client - client’s clients - client’s client’s clients etc. • what are we supposed to know?!!!?? 5. Collateral Damage? The U.S. Model a. Regulatory infractions = crimes b. Civil forfeitures c. Seized assets to police d. Imposed on world e. Applied to “terrorist finance” a. Money Laundering as a Crime • contrived offense? - shifts focus from underlying crime - creates two classes of citizens • unnecessary offense? - use of conspiracy or aiding & abetting - expand definition of predicate offense - fiscal procedures eliminate profit b. Civil Forfeitures • taint of criminality without trial • reverses burden of proof • collateral damage to innocents • abuse of concept of instrumentality • creates professional informants c. Financing Law Enforcement from Forfeitures • community control subverted • budgets detached from logistical needs • focus shifted from violent to rich offenders • corruption encouraged d. Externalizing the U.S. Model • • • • institutional conditions differ legal traditions differ social priorities differ no proof it actually works e. Attacking Terrorist Finance? • Removes motive? - No • Removes means? - Marginal - small sums required most legal in origin the rest from petty crime • Key Asset - Determination Can’t Be Frozen in a Bank Account Follow-the-Money Methods: Another Faith-Based Initiative? • • • • • • Dubious logic Bank-client conflict Information overload Degradation of civil rights More international disputes For no proveable result