Presentation

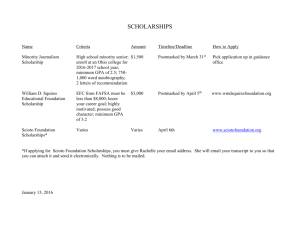

advertisement

ACT Can score a 1-36 (Average of 4 sections—Math, Science, Reading, English) No penalty for guessing SAT I Can score 200-800 on each of three sections (Critical Reading, Math, and Writing) 1 point is given for correct answers. 1/3-1/5 point is taken away for wrong answers. *Studies show that out of the students who have taken both the ACT and SAT I, 1/3 of the students score better on the ACT, 1/3 score better on the SAT, and the other 1/3 score the equivalent on both tests. Ex. 24 ACT/1170 SAT Complete all applications online, if possible. ◦ Most students waive their right to view their letters of recommendation or other information from those who contribute to the application. It’s a good idea to do this, because colleges will not view the recommendations with validity if they know that the student has had or will have access to that info. ◦ Gather letters of recommendation, resume, or any other information the application asks for and submit separately if applying online/together if applying on paper. Send your transcript to the school. (Fill out the transcript request in the guidance office) Complete the scholarship application (if separate and/or applicable). College will mail you their decision, what to do next, etc. -Mark Kantrowitz, FastWeb Very few students win a completely free ride ◦ Of students enrolled full-time at a 4-year college 0.3% get enough grants to cover the full COA 1.0% get enough grants to cover 90% or more of the COA 3.4% get enough grants to cover 75% or more of the COA 14.3% get enough grants to cover 50% or more of the COA ◦ Of students winning scholarships, more than two-thirds (69.1%) received less than $2,500 More students at 4-year colleges win scholarships ◦ 8.3% of students at 4-year colleges win scholarships ◦ 2.6% of students at 2-year colleges win scholarships -Mark Kantrowitz, FastWeb It’s a numbers game ◦ Even among talented students, who wins involves a bit of luck, not just skill ◦ To win more scholarships, apply to more scholarships, but only if you qualify You can’t win if you don’t apply ◦ One in four students never applies for financial aid It gets easier after your first 6 applications ◦ Essays can be reused and tailored to each new application Don’t miss deadlines -Mark Kantrowitz, FastWeb Prioritize your applications by deadline and the expected value of the scholarship Use a calendar and checklist to get organized Create an accomplishments resume Tailor your application to the sponsor’s goals Read and follow the instructions Make your application stand out from the crowd Ask to be nominated Practice on a copy of the application form -Mark Kantrowitz, FastWeb Ask the teacher whether she can write you a great letter of recommendation The recommendation should be relevant to the scholarship sponsor’s goal Provide the recommender with a copy of your accomplishments resume Provide the recommender with a SASE and all required forms Thank the recommender for writing the letter -Mark Kantrowitz, FastWeb Answer the essay question orally and transcribe the recording Use an outline to organize your thoughts Give examples and be specific Personalize your essay and be passionate Write about something of interest to you Talk about your impact on other people Proofread a printed copy of the essay for spelling and grammar errors -Mark Kantrowitz, FastWeb Use a professional email address, such as firstname.lastname@gmail.com Clean up the content of your Facebook account, removing inappropriate and immature material Google your name to see what shows up Make a photocopy of your application before mailing it Send the application by certified mail, return receipt requested or with delivery confirmation If rejected, ask for the reviewer comments -Mark Kantrowitz, FastWeb Scholarships in our own backyard vs. nationwide scholarships Service clubs—Rotary, Civitan, Kiwanis, American Legion, etc. Scholarships from religious organizations Money from your worker’s union Talk to your employer (student and parent) Scholarships from extracurricular activities (Boy Scouts, FBLA, Key Club, etc.) Your college financial aid office Your department of study at the college you choose. Search the newspaper for past winners of scholarships. The internet (www.fastweb.com, www.scholarships.com, etc.) Big businesses Professional associations Scholarship books Use your ethnicity or a disability Use your leadership and/or community service Contests Military Job vs. Scholarship Searching 20 hour part-time job$160=$8/hour 20 hour scholarship search$1000 scholarship=$50/hour Missing deadlines Failing to proofread the application Failing to follow directions (essay length, number of recommendations) Omitting required information Applying for an award when you don’t qualify Failing to apply for an award for which you are eligible Failing to tailor the application to the sponsor Writing a boring essay -Mark Kantrowitz, FastWeb Spout off on social media. 2. Lie on your application. 3. Neglect standardized test prep. 4. Be frivolous about grades. 5. Don’t devote time to your application essay. 6. Don’t take the admissions interview seriously. 7. Sit on your couch and do nothing. 8. Skate through your senior year after applying. 9. Use a tasteless email address. 10. Ignore deadlines. Suzanne Schaffer, http://www.parentscountdowntocollegecoach.com/201 3/11/21/top-10-ways-ruin-college-admissionschances/ 1. http://hartselle.hcs.schoolinsites.com/ --Click on Guidance for information on scholarships and on links and calendar for more information and reminders. www.alcareerinfo.org Career Planning, Scholarships/Financial Aid, and other info for students and parents. Saving for college (PACT, ESA’s, and 529 Plans) North Alabama Center for Educational Excellence— 256-350-6478 Stay organized and motivated! If you have to pay money to get money, it is probably a scam Never invest more than a postage stamp to get information about scholarships or to apply for a scholarship Nobody can guarantee that you’ll win a scholarship Do not give out personal information like bank account numbers, credit card numbers or Social Security numbers Beware of the unclaimed aid myth -Mark Kantrowitz, FastWeb College Characteristics Academics Size Atmosphere Cost Location Student Body Type Seniors could have started applying Sept 2014 100% online Will accept a weighted GPA 1st round of acceptance letters will be mailed Oct. 15. Last year the regular decision minimums in the fall were around a 24 ACT/1170 SAT and a 3.25 GPA. Some admission decisions will be deferred— this is not a denial of admission. All deferred admissions will get a final answer by Feb. 15. Writing portion of the ACT is required. Will take the highest ACT regardless of when the writing portion was taken. ACT scores must be sent from ACT and will not be accepted off of the back of the transcript. 1. 2. 3. 4. December 1st deadline—Application for admission serves as scholarship application--not separate Spirit of Auburn Scholarships Presidential—32-36 ACT (1400-1600 SAT) score and a 3.5 GPA—covers tuition for four years and a $1000 technology stipend. Founders—30-31 ACT (1330-1390 SAT) score and a 3.5 GPA—covers tuition for four years University—28-29 ACT (1250-1320 SAT) score and a 3.5 GPA --$3,000 per year for 4 years Auburn Spirit Foundation/Legacy Scholarships—26 ACT/1170 SAT and 3.5 GPA for students who are first generation college students or have a parent who is an Alumni of Auburn--$6000 over 4 years Could have started applying August Apply online or pdf version is available Writing portion of the ACT is required. Will take the highest ACT regardless of when the writing portion was taken. ACT score must be sent through ACT. Last year a 3.0 GPA and 21 ACT/1000 SAT score was generally accepted for admission Will accept a weighted GPA if printed on the transcript Some admission letters are being sent out as soon as the application is complete Capstone Scholar—3.5 GPA and a 27 ACT/1210 SAT--$3500/year for 4 years Collegiate Scholar—3.5 GPA and a 28 ACT/1250-1320 SAT--$4000/year for 4 years Foundation in Excellence—3.5 GPA and a 29 ACT/1290 SAT--$4913 or half-tuition for 4 yrs Presidential Scholar—3.5 GPA and a 30-36 ACT/1330-1600 SAT—In-state tuition for 4 years Academic Elite—Member of Univ. Fellows, 3.8 GPA and a 32-36/1400-1600 SAT—Tuition for 4 years, $8500 per year for 4 years and Ipad Generally speaking, UAB admits students with at least a 20 ACT/950 SAT and a 2.25 GPA. Presidential Scholarships, Presidential Recognition Awards, and Endowed Scholarships From $7,000 to full tuition (up to 15 credit hours per term), required fees, and on-campus housing Based on academic achievement (33-36 ACT and at least 3.0 GPA) and submission of the supplemental scholarship application sent to you if you were admitted to UAB by December 1. (Mailing begins on a rolling basis in midOctober.) These scholarships are highly competitive and limited in number. In-State Scholarships for 2014-2015 Annual Amount Required Test Score Presidential Recognition, Presidential, and Endowed Tuition and fees Scholarships (supplemental application required) 33-36 ACT Golden Excellence $7,500 30-32 ACT Collegiate Honors $5,500 27-29 ACT UAB Breakthrough $3,000 24-26 ACT UAB Academic Achievement $2,000 20-23 ACT Collegiate Honors $5,500 30-36 ACT UAB Academic Achievement Required GPA 3.5 GPA or higher 3.0-3.49 GPA $2,000 24-29 ACT Generally speaking, UAH admits students with at least a 20 ACT/970 SAT and a 2.9 GPA. However, they have a sliding scale for GPA as the ACT score goes up. Scholarships In general, admission standards are an 18 ACT score (or ranked in the top 50% of the senior class) and a 2.0 in core subject areas. Full admission starts at a 20 ACT Students with a 22 ACT are automatically qualified for scholarships. Students with a 26 ACT are automatically qualified for a full-tuition scholarship and book stipendfor up to four years. Students with a 30 ACT are automatically qualified for a full-tuition, room and board scholarship for four years. Require you to have graduated from high school for admission. An ACT score is not required for admission—However, if you score a 20 on the Math/English portions, you will not be required to take the COMPASS placement test to determine which Math/English class where you start in the fall of your Freshman year. Last year, a 27 ACT score and a 3.0 GPA was a full-tuition scholarship at Calhoun and Wallace State Many other scholarship opportunities exist at the community college level with lower ACT requirements than at 4-year colleges. Tuition rates at community colleges are cheaper than 4-year universities. Once students complete a couple of years of community college (usually around 48 hours), four-year schools offer admission and scholarships based on the GPA at the community college and not your high school GPA/ACT score. 65% of the projected jobs of the future will require a two-year technical education. 20% will require a four-year degree. 15% will require no formal training at a post-secondary school. However—65% of graduates pursue four-year degrees and 20% pursue two-year technical degrees. Healthcare Careers Process Technology Machine Tool Technology Welding Industrial Maintenance HVAC Aerospace/AviationTechnology Design/Drafting Automation/Electrical Tech Robotics Agriculture Production/Horticulture Auto Body Repair Auto Mechanics Automotive Manufacturing Technology Aviation Flight Technology Commercial Foods Commercial Sewing Diesel Mechanics Drafting and Design Technology Electronic Technology Heating and Air Conditioning Precision Machining/CNC/Tool and Die/Plastics Upholstery/Interior Refinishing Welding Auburn University—$29,000 Univ. of Alabama—$26,000 UAB—$23,000 UAH—$24,000 UNA—$19,000 Troy University—$22,000 Jacksonville State—$20,000 Calhoun Community College—$8,000 Wallace State Community College--$8,000 Go to a school you can afford. 2. Search for scholarships like crazy and take advantage of financial aid and grants if possible. 3. Generate income—Studies show that an average college student working 20 hours/week can pay for an in-state public school education. 4. Save like crazy before school and while working in the summers during school. 5. Live frugally—Sacrifice for 4 years so that you can live the next 40 uncommonly. -Rachel Cruze, @rachelcruze 1. Financial Aid A: The first step in the financial aid process is to complete the Free Application for Federal Student Aid (FAFSA) online at www.fafsa.gov. A: FAFSA completion starts the application process for Federal Pell Grants, Federal Student Loans, Federal Parent PLUS Loans, Federal Work Study, Supplemental Grants and some scholarships depending on the organization. - Even if you know you won’t qualify for a grant, you never know when you might need extra help. A: The FAFSA becomes available for the upcoming school year in January. - File as soon as your (student)/parents taxes are completed. The earlier you complete the FAFSA the more likely you are to receive additional funding that may be available. A: The earlier you complete the FAFSA the more likely you are to receive additional funding that may be available. - Some schools receive additional federal, state and/or institutional grants that have very limited funding. These grants may be given to students on a first come, first serve basis for those who qualify. A: You and your parent must have the following information: Social Security Number (can be found on your Social Security card) Driver's license (if any) 2013 Federal Income Tax Returns (if you haven't completed returns for 2013, bring 2012 federal tax returns, W-2 forms, and records of other money earned during the year): IRS PIN Number(s) IRS Form 1040, 1040A, 1040EZ, 1040Telefile, foreign tax return, or tax return for Puerto Rico, Guam, American Samoa, the U.S. Virgin Islands, the Marshall Islands, the Federated States of Micronesia. Records of untaxed income: Social Security Temporary Assistance to Needy Families , Food Stamps Welfare Veterans' benefits Current bank statements Current business and investment mortgage information, business and farm records, stock, bond, and other investment records Documentation that you are a U.S. permanent resident or other eligible noncitizen A: Federal Pell Grants, Federal Student Loans, Federal Parent PLUS Loans, Federal Perkins Loans, Federal Work Study and Supplemental Grants. - Federal Pell Grants, Federal Subsidized Student Loans, Federal Perkins Loans, Supplemental Grants and Federal Work Study aid are need based aid. - Federal Unsubsidized Student Loans and Parent PLUS Loans and are not need based aid. - Please note that all students are not eligible for need based aid. A: A Federal Pell Grant, unlike a loan, does not have to be repaid. Pell Grants are awarded usually only to undergraduate students who have not earned a bachelor's or a professional degree. (In some cases, however, a student enrolled in a post-baccalaureate teacher certification program might receive a Pell Grant.) Pell Grants are considered a foundation of federal financial aid, to which aid from other federal and nonfederal sources might be added. A: A federal student loan allows students and their parents to borrow money to help pay for college through loan programs supported by the federal government. Student loans, unlike grants and work-study, are borrowed money that must be repaid, with interest, just like car loans and home mortgages. You cannot have these loans canceled because you didn't like the education you received, didn't get a job in your field of study or because you're having financial difficulty. Loans are legal obligations, so before you take out a student loan, think about the amount you'll have to repay over the years. They usually have low interest rates and offer attractive repayment terms, benefits and options. Generally, repayment of a federal loan does not begin until after the student leaves school. Federal student loans can be used to pay school expenses such as tuition and fees, room and board, books, supplies and transportation. A: Federal Stafford Subsidized Loans provide low interest rates and are available to students who demonstrate financial need based on income and other information provided on the FAFSA. A credit check is not required to receive these loans. The federal government pays the interest on these loans until six months after the student is no longer enrolled in school at least half time. - Federal Stafford Unsubsidized Loans provide low interest rates and are available to all students regardless of financial need (although the FAFSA still must be filed). A credit check is not required to receive these loans. The student is responsible for the interest, which may be paid while the student is in school or accrued and then added to the principal balance when the student enters repayment, which occurs six months after the student is no longer enrolled in school at least half time. A: Federal Perkins Loans are made through participating schools to undergraduate, graduate and professional degree students. - Offered to students who demonstrate financial need. - Made to students enrolled full-time or parttime. - Repaid to your school. A: Federal Parent PLUS Loans are low interest loans that parents can obtain to help pay the cost of education for their children. These loans are available for parents on behalf of the student once the FAFSA has been completed and the financial aid file completed. PLUS loans require a credit check and, in some instances, an eligible cosigner. Repayment of PLUS loans begins following the final disbursement for the year. Additional paperwork may be required. A: The federal work study program is federally funded and is available to qualified students who demonstrate financial need. Students are employed on campus approximately 15 hours per week at minimum wage and are paid monthly. Funds for this program are limited and a limited number of FWSP community service opportunities are available through our office. A: The FAFSA doesn’t pay for anything, your financial aid package/award shows what funds have been offered to you. - In most cases, no, your financial aid package will not cover all of your expenses. Federal Student Aid is not designed to pay for everything. It is a supplement to help you/your parents with educational costs. A: You and your parent must each have a PIN number that will be used every year that you file a FAFSA. - It will also be used to sign your Master Promissory Note and Entrance Counseling if you accept a loan. - The PIN site is www.pin.ed.gov. A: Electronically, but you must list your school’s code on the FAFSA. - If you do not know the code, there is a drop down box for you to search for and choose your school to be added to your FAFSA. www.fsapubs.org www.fafsa.gov www.pin.ed.gov www.nslds.ed.gov www.dlservicer.ed.gov www.fsa4counselors.ed.gov www.nasfaa.org www.fastweb.com www.finaid.ucsb.edu/FAFSASimplification/index.ht ml www.studentaid.ed.gov Kenny Lopez ◦ Kenneth.lopez@hcs.k12.al.us ◦ 256-751-5616